Small Deals Placed In Primary As Secondary Market Sells Off

December 08 2011 - 6:05PM

Dow Jones News

Just a few small deals hit the corporate bond market Thursday

following a heavy slate of supply in the first three days of the

week. Bonds in the secondary market sold off abruptly as hopes of a

nicely wrapped European resolution package unraveled.

New product among investment-grade debt totaled $1.3 billion

Thursday, following nearly $20 billion from Monday to

Wednesday.

Syndicate managers are now debating whether the corporate bond

pipeline is shut down for 2012 or if Friday and the next week will

see more issuers try their luck.

One syndicate source said investors aren't engaged near the end

of the year so issuers try to avoid it, but this week has been

surprisingly active with investors continuing to demand paper and

issuers wanting to get deals done before something potentially

blows up in Europe.

"You take a risk that investors aren't engaged at this time of

the year and weigh that against a stable backdrop in a market that

has a propensity to be volatile," he said. "If you have a few of

people being hopeful and everybody is on board, why not take the

chance and issue?"

The three sizable issuers that did brave the market Thursday

upsized their deals.

Florida Power & Light Co., a subsidiary of NextEra Energy

Inc. (NEE), sold $600 million of 4.125% coupon, 30-year

first-mortgage bonds at a price to yield of 4.139%, or a spread of

115 basis points over Treasurys. The deal was just $400 million

when it was announced, and pricing improved from earlier guidance

levels.

IDEX Corp. (IEX) sold $350 million of 4.2% coupon, 10-year notes

at a spread to Treasurys of 225 basis points. The deal was

originally for $300 million.

First Niagara Financial Group Inc. (FNFG) sold $350 million of

subordinated notes bearing an interest rate of 7.25% and due in 10

years. The bonds were sold at par to yield 528 basis points over

Treasurys. It was originally reported at $300 million.

The argument that issuance will shut down early received a major

boost in the afternoon as spreads in the secondary market widened:

Markit's CDX North America Investment-Grade Index, a benchmark

gauge of the U.S. corporate-bond market, deteriorated 6.3 points on

the day for a loss of 5.3%.

The culprit was a broad sentiment shift as rumors of a European

Central Bank purchase program were promptly replaced by ECB

President Mario Draghi denying the headlines.

"We've seen this six or seven times in the last few months," a

corporate bond trader said. "An anonymous source gets us hoping,

and then an official rains on the parade."

Bonds seeing heavy losses included 10-year paper issued by

Goldman Sachs Group Inc. (GS), Transocean Inc. (RIG) and Bank of

America Merrill Lynch (BAC). Their spread to Treasurys jumped 20,

28 and 36 basis points, respectively, according to MarketAxess.

Total trading volume surpassed $12.2 billion, according to

MarketAxess at 5:20 p.m EST. The monthly average in November was

less than $10 billion.

-By Patrick McGee, Dow Jones Newswires; 212-416-2382;

patrick.mcgee@dowjones.com

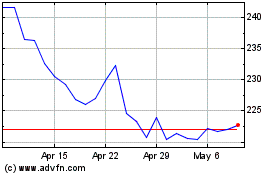

IDEX (NYSE:IEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

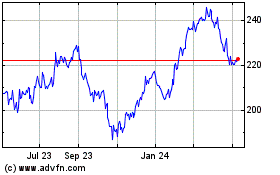

IDEX (NYSE:IEX)

Historical Stock Chart

From Apr 2023 to Apr 2024