Mysterious Filing Outlines Potential IDT Takeover Proposal

April 12 2016 - 7:20PM

Dow Jones News

Chip maker Integrated Device Technology was the subject of a

mysterious regulatory filing Tuesday, submitted by individuals

claiming to own a chunk of the company and looking to buy the rest

of it at a steep premium.

The filing said it was submitted by a group of seven investors,

six Chinese and one Pakistani, led by Liblin Sun. It listed

ownership amounts that represent 5% of shares outstanding, with

Liblin Sun said to own 4.4%. The filing included a takeover

proposal valuing IDT at $32 a share, or $4.32 billion—a 65% premium

to where the stock closed Monday. The stock hasn't traded near that

level since 2001.

Immediately following news of the filing, IDT's stock jumped as

much as 23%. Amid speculation that the filing might not be genuine,

the stock pared its gain to close up 5% at $20.22.

Both the San Jose, Calif., company and the Securities and

Exchange Commission declined to comment on the filing. Attempts to

reach individuals named on the filing didn't result in confirmation

of a takeover offer.

BlackRock and Vanguard, the two biggest investors in IDT, also

declined to comment.

Before Tuesday, the consortium had never made a filing with the

SEC on IDT or on any other company. A second filing followed the

first, amending the purported holding of a purported investor by

the name of Neuman Aly. The amendment stated Mr. Aly, the

Pakistani, had sold 185,000 call options on Tuesday for a total of

$477,740.

"It certainly is sketchy," said Wedbush Securities analyst Betsy

Van Hees, who called the filing one of the most unique she has ever

seen. "There are a lot of things that are very odd and don't add up

and make sense," she said, such as the fact that the reported

address of Mr. Aly appears to be a dilapidated building in

Portland, Ore., and that the initial filing listed his purported

options stake as common stock. Owners of common stock have voting

rights, whereas those with options don't. "A lawyer wouldn't get

that wrong," said Ms. Van Hees.

The SEC previously has said it is examining whether it should

make changes to its public securities filing system, known as

Edgar, following a spate of fake filings that have included a bogus

takeover offer for Avon Products Inc. in June and fraudulent

filings in September claiming that Berkshire Hathaway Co. owned at

least 10% stakes in both Kraft Heinz Co. and Phillips 66.

Fraudulent filings underscore a weakness in the filing system.

It is possible to set up a fake account and make fraudulent filings

directly to a legitimate firm's cache of disclosures. To make

filings, one only needs to provide Edgar with a street address and

a document signed by a notary, according to an Edgar user's manual

published by the SEC. The manual warns that intentionally making

false filings is a federal crime.

Companies make thousands of SEC filings a day, most of them

routine. Third parties such as shareholders and insiders are

allowed to file directly to a company's Edgar feed, a system set up

to promote maximum disclosure.

If the takeover offer for IDT turns out to be valid, Ms. Van

Hees said it is unlikely to be approved by IDT's board, given

regulatory hurdles that make sealing deals with Chinese investors

more difficult. For example, Ms. Van Hees pointed out that

Fairchild Semiconductor International Inc., the subject of a

bidding war between rival ON Semiconductor Corp. and a Chinese

investor group, ultimately opted to tie up with ON despite a lower

bid price.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

April 12, 2016 19:05 ET (23:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

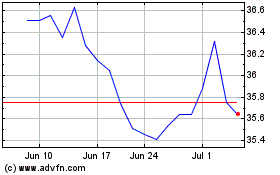

IDT (NYSE:IDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

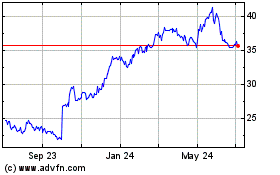

IDT (NYSE:IDT)

Historical Stock Chart

From Apr 2023 to Apr 2024