Ford Cuts Outlook for Finance Arm

November 17 2016 - 3:50PM

Dow Jones News

Ford Motor Co. cut earnings expectations for its finance arm

next year, the latest sign that falling used-car prices are hurting

automotive businesses.

The Dearborn, Mich., auto maker cut Ford Credit's 2017 pretax

profit forecast by $300 million to $1.5 billion amid sliding

auction values on used vehicles, finance chief Bob Shanks told

analysts Thursday.

The used-car values continued falling through September as

vehicles coming off leases flooded back to dealerships. Ford

previously had said it expected its financing arm to earn roughly

the same amount as this year. Mr. Shanks said falling used-car

prices are spreading beyond small cars and crossovers, both

suffering sales slumps amid lower gasoline prices, and now also

affecting larger pickup trucks and sport utilities.

The revised forecast further clouded Ford's financial outlook,

though the auto maker reaffirmed expectations to earn $10.2 billion

in adjusted pretax profits in 2016. Ford in September had lowered

full-year profit expectations by $600 million to account for its

recalling vehicles with faulty door latches.

Last week, rental-car firm Hertz Global Holdings Inc. last week

reported lower third-quarter profits and cut financial projections

amid concerns over falling used-car prices, raising broader

concerns for auto makers and dealers already struggling to match

last year's auto sales record.

Car companies are bracing for a significant influx of used cars

in good condition coming off lease, which could further erode

new-car sales by giving shoppers cheaper alternatives. Leased

vehicles accounted for about 30% of all cars sold in the U.S.

through October, according to J.D. Power.

Unlike vehicles purchased by a buyer using a loan or cash,

leased cars are owned by the finance company—often controlled by an

auto maker—during the term of a lease, which is typically three

years. Pricing is set on the expected value of the vehicle at the

end of the term, but auto makers often subsidize the deal to lower

the monthly payment.

"As an industry, we have to recognize what's happening with all

these vehicles that are coming off lease in the next few years,"

said Mr. Shanks of Ford.

Ford's financing arm is one of the company's most profitable

units and has been growing steadily as the auto industry recovered.

But Ford Credit's operating profit fell 21% in the second quarter,

driven by an increase in auto-loan defaults and deepening losses on

off-lease cars resold at auction for lower values than projected.

Ford Credit results improved in the third quarter but Mr. Shanks

warned the decline in auction values has been sharper than

expected.

GM Financial, the financing arm for Ford rival General Motors

Co., is less exposed to declining used-car prices as it only began

leasing vehicles last year.

This latest cut to Ford Credit's guidance, meanwhile, comes as

the Dearborn, Mich., car maker struggles to keep its profit

momentum going after posting record pretax results in 2015. Ford's

third-quarter profits tumbled 56% compared with the same period in

2015, hurt by hefty recall expenses, weaker U.S. sales and higher

launch costs related to the rollout of a new heavy-duty truck.

Ford expects profits will continue to shrink through next year

due to heavy investment in partnerships and acquisitions related to

its expansion into transportation services.

Write to Christina Rogers at christina.rogers@wsj.com

(END) Dow Jones Newswires

November 17, 2016 15:35 ET (20:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

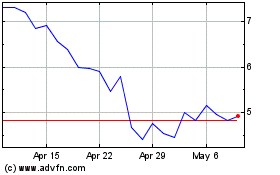

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

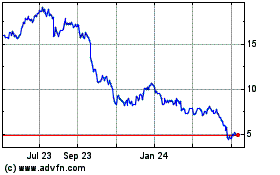

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024