Icahn Snaps Up Falling Hertz Shares -- 2nd Update

November 08 2016 - 6:59PM

Dow Jones News

By Mike Colias, David Benoit and Anne Steele

Investor Carl Icahn more than doubled his stake in Hertz Global

Holdings Inc. on Tuesday, the same day the rental-car firm's stock

plunged in the wake of disappointing financial results and a

lowered annual outlook.

The activist investor swooped in to purchase 15 million shares,

boosting his ownership in the car-rental company to more than a

third. Hertz shares at one point earlier in the day had fallen

50%.

Hertz shares closed down 23% to $27.70 Tuesday in regular

trading on the New York Stock Exchange, after the company reported

financial results Monday that raised broader concerns about the

potential for falling used-car prices to hurt the new-car business.

The stock is down 51% this year.

Mr. Icahn wasn't immediately available for comment. Hertz has

faced pressure from Mr. Icahn since 2014, and three of his

employees currently hold board seats.

The Estero, Fla.-based car-rental firm blamed steep drops in the

value of its smaller cars for the earnings miss, which was 57%

below Wall Street expectations.

Hertz's third-quarter profit fell to $42 million from $237

million a year earlier, the company reported late Monday. Excluding

certain items, per-share adjusted profit was $1.58, well below

analysts' expectations of $2.75.

Hertz, which owns Dollar and Thrifty rental brands, also cut its

financial guidance for the year, triggering analyst downgrades.

Hertz's weak results might signal headwinds for auto makers and

dealers already struggling to repeat last year's car-sales record.

The availability of cheaper used cars damps demand for new

vehicles, and could force car companies and dealers to dangle

bigger discounts to keep new-vehicle inventory from collecting

dust. Those discounts can dent profits. Declining used-car values

also can increase car companies' expenses on new-car leases.

Auto makers in recent months have been offering bigger

incentives and cheaper loans to keep shoppers engaged.

Passenger-car sales are off 8% through October while sales of

pickups, SUVs and vans rose 8% and are on track for a record high,

according to researcher Autodata Corp.

Chief Executive John Tague blamed Hertz's financial results

largely on deeper-than-expected depreciation on small and midsize

vehicles and warned of further drops in the fourth quarter. Sales

of sedans and coupes, long a staple for U.S. car shoppers, are

falling sharply as cheap gasoline prices send consumers flocking to

pickup trucks and sport-utility vehicles.

Mr. Icahn played a key role in hiring Mr. Tague to helm Hertz in

2014, pushing back against suggestions from other activist

investors. Mr. Icahn continued padding his stake after Mr. Tague's

hiring and remains a shareholder in the company's spinoff,

equipment-rental business Herc Holdings Inc.

Hertz's latest quarterly results "will make people increasingly

cautious" about the impact of lower used-car prices on new-vehicle

sales and leasing, Evercore ISI analyst Arndt Ellinghorst wrote in

a research note.

Still, some analysts suggested Hertz's struggles weren't

signaling a broader warning for the auto industry. Falling

residuals for small and midsize sedans have long been anticipated,

and Hertz suffered more from higher costs and lower rental volumes,

several analysts said. Rival Avis Budget Group Inc. last week

reported better-than-expected vehicle depreciation and posted

third-quarter financial results that beat analysts'

expectations.

Hertz has struggled to turn around operations after accounting

errors forced it to adjust years of financial results. In addition

to an equipment-rental separation that gave it a much-needed cash

infusion to pay down debt, Hertz has been aggressively cutting

expenses, targeting $350 million in cost cuts for the year.

Barclays analyst Brian Johnson said that deeper depreciation

accounted for only about 20% of Hertz's profit shortfall versus

expectations. The size of the profit shortfall and slashed guidance

suggests "there are likely some ongoing execution issues," he said

in a research note. "This management team may now face questions

around credibility," Mr. Johnson added.

"An abysmal quarter. That's all we can say about this release,"

Wells Fargo analyst Richard Kwas said in a research note on Hertz's

third-quarter results. While a negative guidance revision was

expected, "the adjustment was dramatic."

Write to Mike Colias at Mike.Colias@wsj.com, David Benoit at

david.benoit@wsj.com and Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

November 08, 2016 18:44 ET (23:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

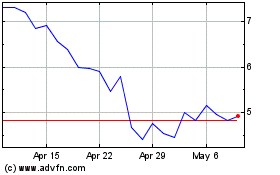

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

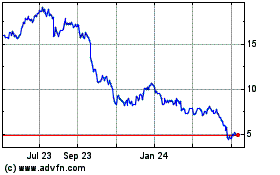

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024