UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________________________________________

FORM 10-K/A

Amendment No. 1

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015 |

OR |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-33139

HERTZ GLOBAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or other jurisdiction of incorporation or organization) | | 20-3530539 (I.R.S. Employer Identification Number) |

8501 Williams Road

Estero, Florida 33928

(239) 301-7000 (Address, including Zip Code, and telephone number,

including area code, of registrant's principal executive offices) |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | | Name of each exchange on which registered |

Common Stock, Par Value $0.01 per share | | New York Stock Exchange |

| | |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | |

Large accelerated filer | x | Accelerated filer | o | Non-accelerated filer | o | Smaller reporting company | o |

| | | | (Do not check if a smaller

reporting company) | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2015, the last business day of the registrant's most recently completed second fiscal quarter, based on the closing price of the stock on the New York Stock Exchange on such date was $8.3 billion.

Indicate the number of shares outstanding as of the latest practicable date.

|

| | | |

Class | | Shares Outstanding at | February 22, 2016 |

Common Stock, par value $0.01 per share | | 423,919,780 |

Documents incorporated by reference:

Portions of the Registrant's Proxy Statement for its 2016 Annual Meeting of Stockholders are incorporated by reference into Part III.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

|

| | |

| | Page |

EXPLANATORY NOTE | |

| | |

ITEM 9A. | | |

| | |

ITEM 15. | | |

| |

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

We are filing this Amendment No. 1 to our Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the U.S. Securities and Exchange Commission on February 29, 2016, or the "Original Filing." The sole purpose of this Amendment No. 1 is to correct a clerical error in Item 9A, "Controls and Procedures” that was included in the Original Filing. In particular, the version of Item 9A included in the Original Filing listed the estimates for the allowance for uncollectible amounts receivable for renter obligations related to damaged vehicles, and accrued unbilled revenue within the section “Accounting Estimates” under the heading “Remediation of Prior Material Weaknesses.” Because the internal controls with respect to these matters are not remediated, the estimates for the allowance for uncollectible amounts receivable for renter obligations related to damaged vehicles, and accrued unbilled revenue should not have been listed under that heading. We have refiled Item 9A in its entirety. We have made no other changes to the Original Filing other than the deletion of those matters noted above.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

PART II

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Our senior management has evaluated the effectiveness of the design and operation of our disclosure controls and procedures (as defined under Exchange Act Rules 13a-15(e) and 15d-15(e)) as of the end of the period covered by this Annual Report on Form 10-K. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that as of December 31, 2015, due to the identification of material weaknesses in our internal control over financial reporting, as further described below, our disclosure controls and procedures were not effective to provide reasonable assurance that the information required to be disclosed by us in the reports that we file or submit under the Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms, and that such information is accumulated and communicated to management as appropriate to allow timely decisions regarding required disclosure.

Management’s Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f).

Internal control over financial reporting has inherent limitations. Internal control over financial reporting is a process that involves human diligence and compliance and is subject to lapses in judgment and breakdowns resulting from human failures. Internal control over financial reporting also can be circumvented by collusion or improper management override. Because of such limitations, there is a risk that material misstatements will not be prevented or detected on a timely basis by internal control over financial reporting. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk.

Management, including our Chief Executive Officer and our Chief Financial Officer, assessed the effectiveness of our internal control over financial reporting as of December 31, 2015. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control - Integrated Framework (2013). Based on this assessment, management has concluded that we did not maintain effective internal control over financial reporting as of December 31, 2015, due to the fact that certain material weaknesses previously identified in the 2014 Form 10-K filing on July 16, 2015 continue to exist at December 31, 2015, as discussed below.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

Control Environment

We did not maintain an effective control environment primarily attributable to the following identified material weaknesses:

| |

• | We did not have a sufficient complement of personnel with an appropriate level of knowledge, experience, and training commensurate with our financial reporting requirements to ensure proper selection and application of GAAP in certain circumstances. |

| |

• | We did not design effective controls over the non-fleet procurement process, which was exacerbated by the lack of training of field personnel as part of our Oracle ERP system implementation during 2013. |

These material weaknesses in the control environment resulted in certain instances of inappropriate accounting decisions and in inappropriate accounting methodologies and contributed to the following additional material weaknesses:

| |

• | We did not design and maintain effective controls over certain accounting estimates. Specifically, we did not design and maintain controls over the effective review of the models, assumptions, and data used in developing |

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

estimates or changes made to assumptions and data, including those related to reserve estimates associated with allowances for uncollectible amounts receivable for renter obligations for damaged vehicles.

| |

• | We did not design and maintain effective controls over the review, approval, and documentation of manual journal entries. |

Risk Assessment

We did not effectively design controls in response to the risks of material misstatement. This material weakness contributed to the following additional material weaknesses:

| |

• | We did not design effective controls over certain business processes including our period-end financial reporting process. This includes the identification and execution of controls over the preparation, analysis, and review of significant account reconciliations and closing adjustments required to assess the appropriateness of certain account balances at period end. |

Monitoring

We did not design and maintain effective monitoring controls related to the design and operational effectiveness of our internal controls. Specifically, we did not maintain personnel and systems within the internal audit function that were sufficient to ensure the adequate monitoring of control activities.

One or more of the foregoing control deficiencies contributed to the previously reported restatement of our financial statements for the years 2012 and 2013, each of the quarters of 2013 and the second quarter of 2015, including misstatements of direct operating expenses, accounts payable, accrued liabilities, allowance for doubtful accounts, prepaid expenses and other assets, depreciation of vehicles sold through retail car sales locations, and non-fleet property and equipment and the related accumulated depreciation and also resulted in audit adjustments to the Company's consolidated financial statements for 2015. Additionally, the foregoing control deficiencies could result in material misstatements of the consolidated financial statements that would not be prevented or detected. Accordingly, our management has determined these control deficiencies constitute material weaknesses.

The effectiveness of our internal control over financial reporting as of December 31, 2015 has been audited by PricewaterhouseCoopers LLP, an independent registered certified public accounting firm, as stated in their report, which appears in this Annual Report on Form 10-K.

Remediation of Prior Material Weaknesses

Control Environment

Management Tone

We have taken actions to remediate the material weakness associated with an inappropriate tone at the top including (i) the previously disclosed changes in our personnel with respect to the company’s senior management, (ii) the previously disclosed personnel changes in the financial reporting and accounting function in order to ensure we have personnel with an appropriate level of knowledge, experience, and training to effect appropriate tone at the top, (iii) the augmentation of these personnel with qualified consulting resources to ensure we have sufficient staffing to meet our regulatory obligations, (iv) the reinforcement of adherence to established internal controls and Company policies and procedures through formal communications, town hall meetings and employee trainings, (v) the establishment of procedures for ensuring clear reporting structures, reporting lines, and decisional authority responsibilities in the organization and enhancement of communications with our operational departments, accounting, Board and Audit Committee, (vi) new trainings administered and monitored by the Compliance Committee, (vii) the development of a new enterprise risk assessment process to refine the company’s risk assessment, (viii) the enhancement of the annual Sarbanes-Oxley risk assessment, and (ix) the enhancement of the Company’s Disclosure Committee process.

Accounting Estimates

We have taken actions to remediate the material weakness associated with information technology expenditure accounting estimates, including (i) identifying, implementing and documenting controls over appropriate accounting methodologies, data, and assumptions for information technology expenditures, (ii) held trainings with accounting staff

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

in the first quarter of 2015 to ensure there is a thorough understanding of the underlying methodologies implemented, (iii) established policies and procedures for the approval and implementation of new or modified accounting methodologies, and (iv) hired accounting personnel with an appropriate level of knowledge and experience to execute the underlying accounting methodologies.

Reporting structure, reporting lines and decisional authority responsibilities

We have taken actions to remediate the material weakness associated with a lack of established clear reporting structures, reporting lines, and decisional authority responsibilities in the organization including (i) hiring additional accounting and finance personnel in order to ensure that we have personnel commensurate with the size and complexity of the organization, (ii) establishing a more formalized reporting structure to conform to the new executive team, reporting lines to the proper departments, and decisional authority responsibilities within the organization to the appropriate individuals accomplished through the realignment of financial reporting, technical accounting and regional controllers, (iii) enhanced and executed more frequent trainings related to the reporting structure, reporting lines, and decisional authority responsibilities, including trainings on required internal technical accounting consultations and proposed changes to internal controls, (iv) requiring regular internal communications (e.g., quarterly closing meetings) and consultations (e.g., policy changes) in accordance with the reporting structure and reporting lines and (v) reflecting changes to the operational, financial and administrative functions within the Company’s human resources and performance management systems.

GAAP Policies and Procedures

We have taken actions to remediate the material weakness associated with ineffective controls over our policies and procedures over GAAP, as well as the review, approval, and documentation related to the application of GAAP. Specifically, management implemented revisions to the Company’s GAAP policies and procedures. In order to ensure that the policies were understood and interpreted appropriately, management verified the relevant Hertz resources were trained on these policies and procedures during the second quarter of 2015 and is continuing the training on an ongoing basis, as needed.

Information and Communication

We have taken actions to remediate the material weakness associated with the ineffective process for internal communication between the accounting and other departments within the business including (i) changes to the design and reporting structure of the financial reporting and accounting function, (ii) the review and execution of formal mechanisms for communicating across departments including enhanced monthly performance reviews with operational departments, (iii) the establishment of formal technical accounting, accounting policy, methodology and reporting consultation protocols through trainings and the issuance of guidance on required internal technical accounting consultations and a formalized tracking system for technical accounting matters. In addition we formalized processes over proposed changes to internal controls.

Remediation Efforts and Status of Remaining Material Weaknesses

We have taken certain remediation steps to address the material weaknesses referenced above that continue to remain as of December 31, 2015, and to improve our control over financial reporting. If not remediated these deficiencies could result in further material misstatements to our consolidated financial statements. The Company and the Board take the control and integrity of the Company’s financial statements seriously and believe that the remediation steps described below are essential to maintaining a strong internal controls environment.

We have identified and implemented, and continue to identify and implement, actions to improve the effectiveness of our internal control over financial reporting, including plans to enhance our resources and training with respect to financial reporting and disclosure responsibilities and to review such actions with the Audit Committee.

In addition, we have taken, and continue to take, the actions described below to remediate the identified material weaknesses. As we continue to evaluate and work to improve our internal controls over financial reporting, our senior management may determine to take additional measures to address control deficiencies or determine to modify the remediation efforts described in this section. Until the remediation efforts discussed in this section, including any additional remediation efforts that our senior management identifies as necessary, are completed, the material weaknesses described above will continue to exist.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

Control Environment

Complement of Personnel

| |

• | To address the material weakness associated with a lack of personnel with sufficient training, knowledge and experience commensurate with our financial reporting requirements, we have continued to hire personnel during 2015 with the appropriate experience, certification, education, and training for all of the key positions in the financial reporting and accounting function and in some cases have created new positions. Consequently, the employees involved in the accounting and financial reporting functions in which misstatements were identified are no longer involved in the accounting or financial reporting functions. In addition, we have taken appropriate remedial actions with respect to certain employees, including termination, reassignments, reprimands, increased supervision, training, and imposition of financial penalties in the form of compensation adjustments. The Company has also taken steps to address the lack of training with respect to the Company’s non-fleet procurement process, which was exacerbated by the lack of training of field personnel as part of our Oracle enterprise resource planning ("ERP") system implementation during 2013. The Company instituted standing monthly training on how to requisition goods and services in the ERP system for new hires as well as an update training for existing users. The Company also provides additional training on an as-needed basis. In order to consider this material weakness to be fully remediated, we believe additional time is needed to demonstrate sustainability as it relates to our revised controls. |

Non-Fleet Procurement

| |

• | To address the material weakness over the non-fleet procurement process, we have strengthened processes and controls for manual accruals and journal entries. In addition, we have enhanced the accrual methodology and controls to ensure completeness over our non-fleet procurement liabilities. We have also improved our controls over vendor approval and set up, maintaining support over payables transactions and ensuring appropriate approvals for payables transactions. Further, as part of our finance transformation initiatives, we will continue to evaluate people, systems and processes related to non-fleet procurement. |

Accounting Estimates

| |

• | To address the material weakness associated with controls over certain accounting estimates, we have taken steps to improve our design and maintenance of effective controls for accounting estimates, including (i) where necessary, we have identified, implemented and documented controls over appropriate accounting methodologies, data, and assumptions for certain accounts, including reserve estimates associated with allowances for uncollectible amounts receivable for renter obligations for damaged vehicles and accrued unbilled revenue, (ii) held trainings with accounting staff in the first quarter of 2015 to ensure there is a thorough understanding of the underlying methodologies implemented, (iii) established policies and procedures for the approval and implementation of new or modified accounting methodologies, (iv) hired accounting personnel with an appropriate level of knowledge and experience to execute the underlying accounting methodologies and (v) established policies and procedures for the review, approval and application of appropriate GAAP for transactions and accounting methodology changes. We are continuing to implement controls over the completeness and accuracy of data and assumptions. In order to consider this material weakness fully remediated, we believe additional time is needed to demonstrate sustainability as it relates to the revised controls. |

Journal Entries

| |

• | To address the material weakness associated with controls over journal entries, we have enhanced and reinforced procedures to ensure that manual journal entries recorded in our financial records are properly prepared, supported by adequate documentation, and independently reviewed and approved. In order to consider this material weakness fully remediated, we believe additional time is needed to demonstrate sustainability as it relates to the revised controls. |

Risk Assessment

| |

• | To address the material weakness associated with controls in response to the risk of material misstatement, we are establishing mechanisms to identify, evaluate, and monitor risks to financial reporting throughout the organization to remediate our material weakness in the risk assessment process. We are updating our global |

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

risk assessment. We have implemented new procedures and enhanced controls governing our internal management-led Disclosure Committee, sub-certification, and external reporting processes associated with the review and approval of the content of our SEC filings. In order to consider this material weakness fully remediated, we believe additional time is needed to demonstrate sustainability as it relates to the revised controls.

| |

• | To address the material weakness associated with controls over account reconciliations and other transaction level controls, we have designed, and where appropriate enhanced, controls over the preparation, analysis and review of transactions and the execution of balance sheet and significant account reconciliations. In addition, we have reinforced existing policies and procedure and enacted policy and procedures changes, where necessary, to better define requirements for effective and timely reconciliations of balance sheet and significant accounts, including independent review. We have also implemented a training program specific to the review and preparation of account reconciliations. Lastly, we have implemented transaction controls that address the design deficiencies previously identified. In order to consider this material weakness fully remediated, we believe additional time is needed to demonstrate sustainability as it relates to the revised controls. |

Monitoring

We have taken actions to address the material weakness associated with controls over monitoring, including (i) the hiring in 2015 of a new Senior Vice President and Chief Audit Executive, with global responsibilities, (ii) the continued hiring of additional resources with an appropriate level of knowledge and expertise, (iii) the supplementation of these personnel with qualified consulting resources to ensure an adequate level of staff, (iv) the reorganization of the internal audit function and (v) enhancements to the Company’s risk assessment process, and (vi) the reporting of operational and financial assessments to senior management and the Audit Committee. During 2015, the internal audit and Sarbanes-Oxley compliance teams enhanced (i) our processes associated with the scoping and identification of processes and key controls, (ii) the documentation of these processes and (iii) our testing procedures to promote the consistency and accuracy of conclusions, deliverables and disclosures associated with SOX compliance. In order to consider this material weakness to be fully remediated, we believe additional time is needed to demonstrate sustainability as it relates to our remediation plans.

Changes in Internal Control over Financial Reporting

Our remediation efforts were ongoing during the three months ended December 31, 2015. The following remediation steps are among the measures taken by the Company during the quarter:

Control Environment

Complement of Personnel

| |

• | Completed account reconciliation and internal controls training for our accounting personnel. |

| |

• | Targeted training of field personnel in our non-fleet procurement process which includes the related Oracle ERP functionality. |

Monitoring Activities

Internal Audit

| |

• | Executed interim and certain year end procedures related to internal controls and operational audits. |

There were no other material changes in our internal control over financial reporting that occurred during the quarter ended December 31, 2015 that materially affected, or that are reasonably likely to materially affect, our internal control over financial reporting.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

3. Exhibits

The following exhibits are filed as a part of this Amendment No. 1:

|

| |

31.1 | Certification of Chief Executive Officer pursuant to Rule 13a-14(a)/15d-14(a). |

31.2 | Certification of Chief Financial Officer pursuant to Rule 13a-14(a)/15d-14(a).

|

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

SIGNATURE

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in Lee County, Florida on the 4th day of March, 2016.

|

| | |

| HERTZ GLOBAL HOLDINGS, INC. (Registrant) |

| By: | /s/ THOMAS C. KENNEDY |

| Name: | Thomas C. Kennedy |

| Title: | Senior Executive Vice President and Chief Financial Officer |

EXHIBIT 31.1

CERTIFICATION OF CHIEF EXECUTIVE OFFICER

PURSUANT TO RULE 13a-14(a)/15d-14(a)

I, John P. Tague, certify that:

| |

1. | I have reviewed this Annual Report on Form 10-K/A for the year ended December 31, 2015 of Hertz Global Holdings, Inc.; |

| |

2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| |

3. | The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15(d)-15(f)) for the registrant and have: |

| |

a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

c) | Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

d) | Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and |

| |

4. | The registrant's other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): |

| |

a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and |

| |

b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. |

Date: March 4, 2016

|

| | |

| By: | /s/ JOHN P. TAGUE |

| | John P. Tague

Chief Executive Officer and Director |

EXHIBIT 31.2

CERTIFICATION OF CHIEF FINANCIAL OFFICER

PURSUANT TO RULE 13a-14(a)/15d-14(a)

I, Thomas C. Kennedy, certify that:

| |

1. | I have reviewed this Annual Report on Form 10-K/A for the year ended December 31, 2015 of Hertz Global Holdings, Inc.; |

| |

2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| |

3. | The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15(d)-15(f)) for the registrant and have: |

| |

a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

c) | Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

d) | Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and |

| |

4. | The registrant's other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): |

| |

a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and |

| |

b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. |

Date: March 4, 2016

|

| | |

| By: | /s/ THOMAS C. KENNEDY |

| | Thomas C. Kennedy

Senior Executive Vice President and Chief Financial Officer |

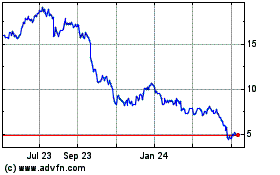

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

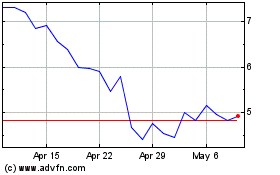

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024