Current Report Filing (8-k)

November 17 2015 - 6:48AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) November 17, 2015 (November 17, 2015)

HERTZ GLOBAL HOLDINGS, INC.

THE HERTZ CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

Delaware |

|

001-33139

001-07541 |

|

20-3530539

13-1938568 |

|

(State of Incorporation) |

|

(Commission File Number) |

|

(I.R.S Employer Identification No.) |

999 Vanderbilt Beach Road, 3rd Floor

Naples, Florida 34108

999 Vanderbilt Beach Road, 3rd Floor

Naples, Florida 34108

(Address of principal executive offices,

including zip code)

(239) 552-5800

(239) 552-5800

(Registrant’s telephone number,

including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01 REGULATION FD DISCLOSURE

On November 17, 2015, John P. Tague, Chief Executive Officer of Hertz Global Holdings, Inc. (“Hertz Holdings”) and The Hertz Corporation (together with Hertz Holdings, the “Company”), and other members of senior management will present an overview of the Company’s strategies, operations and financial results to participants at the Company’s 2015 Investor Day meeting (the “Meeting”) in New York City.

A copy of the presentation to be made at the Meeting (the “Presentation”) is attached hereto as Exhibit 99.1 and incorporated by reference herein. The Presentation will be broadcast live to the public via the Investor Relations section of the Company’s website at IR.hertz.com. Financial information in the Presentation includes certain non-GAAP financial measures. Reconciliations of such non-GAAP financial measures to the comparable measures calculated and presented in accordance with GAAP are contained in the supplemental schedules presented in Exhibits 99.1 and 99.2 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 9, 2015, which are incorporated by reference herein.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements contained in this report, and in related comments by the Company’s management, include “forward-looking statements.” Forward-looking statements include information concerning the Company’s liquidity and its possible or assumed future results of operations, including descriptions of its business strategies. These statements often include words such as “believe,” “expect,” “project,” “potential,” “anticipate,” “intend,” “plan,” “estimate,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecasts” or similar expressions. These statements are based on certain assumptions that the Company has made in light of its experience in the industry as well as its perceptions of historical trends, current conditions, expected future developments and other factors it believes are appropriate in these circumstances. The Company believes these judgments are reasonable, but you should understand that these statements are not guarantees of performance or results, and the Company’s actual results could differ materially from those expressed in the forward-looking statements due to a variety of important factors, both positive and negative, that may be revised or supplemented in subsequent reports on Forms 10-K, 10-Q and 8-K. Among other items, such factors could include: any claims, investigations or proceedings arising as a result of the restatement of our previously issued financial results; our ability to remediate the material weaknesses in our internal controls over financial reporting; levels of travel demand, particularly with respect to airline passenger traffic in the United States and in global markets; the effect of our proposed separation of our equipment rental business and ability to obtain the expected benefits of any related transaction; significant changes in the competitive environment, including as a result of industry consolidation, and the effect of competition in our markets on rental volume and pricing, including on our pricing policies or use of incentives; occurrences that disrupt rental activity during our peak periods; our ability to achieve and maintain cost savings and efficiencies and realize opportunities to increase productivity and profitability; an increase in our fleet costs as a result of an increase in the cost of new vehicles and/or a decrease in the price at which we dispose of used vehicles either in the used vehicle market or under repurchase or guaranteed depreciation programs; our ability to accurately estimate future levels of rental activity and adjust the size and mix of our fleet accordingly; our ability to maintain sufficient liquidity and the availability to us of additional or continued sources of financing for our revenue earning equipment and to refinance our existing indebtedness; our ability to integrate the car rental operations of Dollar Thrifty and realize operational efficiencies from the acquisition; our ability to maintain access to third-party distribution channels, including current or favorable prices, commission structures and transaction volumes; the operational and profitability impact of the divestitures that we agreed to undertake in order to secure regulatory approval for the acquisition of Dollar Thrifty; an increase in our fleet costs or disruption to our rental activity, particularly during our peak periods, due to safety recalls by the manufacturers of our vehicles and equipment; a major disruption in our communication or centralized information networks; financial instability of the manufacturers of our vehicles and equipment, which could impact their ability to perform under agreements with us and/or their willingness or ability to make cars available to us or the car rental industry on commercially reasonable terms; any impact on us from the actions of our franchisees,

2

dealers and independent contractors; our ability to maintain profitability during adverse economic cycles and unfavorable external events (including war, terrorist acts, natural disasters and epidemic disease); shortages of fuel and increases or volatility in fuel costs; our ability to successfully integrate acquisitions and complete dispositions; our ability to maintain favorable brand recognition; costs and risks associated with litigation and investigations; risks related to our indebtedness, including our substantial amount of debt, our ability to incur substantially more debt and increases in interest rates or in our borrowing margins; our ability to meet the financial and other covenants contained in our Senior Credit Facilities, our outstanding unsecured Senior Notes and certain asset-backed and asset-based arrangements; changes in accounting principles, or their application or interpretation, and our ability to make accurate estimates and the assumptions underlying the estimates, which could have an effect on earnings; changes in the existing, or the adoption of new laws, regulations, policies or other activities of governments, agencies and similar organizations where such actions may affect our operations, the cost thereof or applicable tax rates; changes to our senior management team; the effect of tangible and intangible asset impairment charges; our exposure to uninsured claims in excess of historical levels; fluctuations in interest rates and commodity prices; and our exposure to fluctuations in foreign exchange rates.

Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

|

Exhibit |

|

Description |

|

|

|

|

|

99.1 |

|

Investor Day Presentation |

Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

HERTZ GLOBAL HOLDINGS, INC.

THE HERTZ CORPORATION |

|

|

|

(Registrant) |

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Thomas C. Kennedy |

|

|

|

Name: |

Thomas C. Kennedy |

|

|

|

Title: |

Senior Executive Vice President and Chief Financial Officer |

Date: November 17, 2015

4

Exhibit 99.1

ACHIEVING FULL POTENTIAL 2015 Investor Day November 17, 2015 HERTZ GLOBAL 1

Forward-Looking Statements the 1995. of performance. looking, "opportunity", events. our cause expectations. December or realized. new otherwise. on above. HERTZ GLOBAL 2 We cannot assure you that the assumptions under any of the forward-looking statements will prove accurate that any projections will be We expect that there will be differences between projected and actual results. These forward-looking statements speak only as of the date of this presentation, and we do not undertake any obligation to update or revise any forward-looking statements, whether as a result of information, future events or We caution prospective purchasers not to place undue reliance forward-looking statements. All forward-looking statements attributable to us are expressly qualified in their entirety by the cautionary statements contained herein and in our annual report described above. Forward-looking statements are based on the then-current expectations, forecasts and assumptions of management and involve risks and uncertainties, some of which are outside of our control, that could actual outcomes and results to differ materially from current For some of the factors that could cause such differences, please see the sections of our annual report on Form 10-K for the year ended 31, 2014 entitled "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements." Copies of this report are available from the Securities and Exchange Commission, on our website or through our Investor Relations department. Certain statements contained in this presentation are "forward-looking statements" within the meaning of Private Securities Litigation Reform Act of These statements give our current expectations or forecasts future events and our future performance and do not relate directly to historical or current events or our historical or current Most of these statements contain words that identify them as forward such as "anticipate", "estimate", "expect", "project", "intend", "plan", "believe", "seek", "will", "may", "target" or other words that relate to future events, as opposed to past or current events.

Disclosure on Financials in Presentation the The Company has four reportable segments as follows: • U.S. Car Rental - rental of cars, crossovers and light trucks, as well as ancillary products and services, in the United States; • International Car Rental -rental of cars, crossovers and light trucks, as well as ancillary products and services, internationally; internationally. services together with other business activities, such as its claim management services. len Hertz Global is defined as the Company excluding HERC and includes Hertz Global RAC, Donlen and Corporate Amounts shown in this presentation, unless otherwise indicated, are for Hertz Global. HERTZ GLOBAL 3 Hertz Global RAC is defined as the combination of the U.S. Car Rental and International Car Rental segments, excluding Don and HERC and including Corporate. The Company's equipment rental operations are conducted by its subsidiary, Hertz Equipment Rental Corporation together with other various wholly owned international subsidiaries (collectively, HERC). In addition to the above reportable segments, the Company has corporate operations ("Corporate") which includes general corporate assets and expenses and certain interest expense (including net interest on corporate debt). • All Other Operations-includes the Company's Donlen operating segment which provides fleet leasing and management • Worldwide Equipment Rental - rental of industrial, construction, material handling and other equipment in the U.S. and Hertz Global Holdings, Inc. (HGH) is the ultimate parent company of the Hertz Corporation (THC) (and collectively, Company). GAAP and non-GAAP profitability metrics for THC, the wholly owned operating subsidiary, are materially the same as those for HGH.

---• Hertz Global in Numbers HERTZ GLOBAL 4 All numbers for Global RAC Business Ranked Loyalty program by FlyerTalk (4 years in a row) Locations worldwide #1 ~10K ~150 ~660K 10M+ ~40M+ Vehicles Monthly website visits Miles per day HERTZ GLOBAL 4

---• Agenda for today's discussion Topic Time slot Speaker 10:30 AM - 10:45 AM Break 12:30 PM - 01:00 PM Break HERTZ GLOBAL 5 John Tague Closing 02:00 PM - 02:15 PM Lunch and Q&A 01:00 PM - 02:00 PM Tom Kennedy Path to Full Potential and 2016 Preliminary Guidance 11:45 AM - 12:30 PM Jeff Foland Earning Customer Preference and Delivering Revenue Growth 10:45 AM - 11:45 AM Alex Marren Leading Cost & Quality: Operational Excellence 10:15 AM - 10:30 AM Tom Kennedy Leading Cost & Quality: Fleet Management and Overhead 09:45 AM - 10:15 AM Tyler Best Winning with Technology 09:15 AM - 09:45 AM John Tague Achieving Full Potential 08:30 AM - 09:15 AM Registration 08:00 AM - 08:30 AM

HERTZ GLOBAL 6 Stabilizing the foundation in 2015 2015 has been a year of transition We have stabilized the foundation We are building a track record of enhanced execution which is starting to show in our results We have built a committed and experienced top team, combining industry veterans with fresh external talent We have an unprecedented opportunity for margin expansion

Tyler Best EVP and Chief Information Officer Jeff Foland Senior EVP and Chief Revenue Officer Tom Kennedy Senior EVP and Chief Financial Officer Alex Marren EVP North America Operations Tom Sabatino Senior EVP, Chief Administrative Officer and General Counsel Michel Taride Group President, Rent A Car International Eliana Zem EVP and Chief Human Resources Officer HERTZ GLOBAL 7 1Senior officers are those with position of Senior Vice President and above More than 2/3 of senior officers1 have rental car experiance

Financial restatement Headquarters relocation IT systems upgrade HERC spin-off Integration II Restatement completed and remediation on going Started upgrade of the entire IT infrastructure, systems and applications HQ relocation completed 11/1 Completed Dollar Thrifty systems integration Spin-off on track to be completed by mid-2016 HERTZ GLOBAL 8 On track On track We are on track to complete a number of commitments critical to stabilizing the foundation of our business...and our long term future

---• In addition to our foundational commitments, the team has delivered successful initiatives to drive performance in 2015 M o:O HERTZ GLOBAL 9 Completed $262M share buy-back out of $1B authorized, and improved leverage ratios Generating favorable early returns on ancillary revenue and products Right sized the fleet while completing major fleet refresh Achieved Q3:15 YTD 27% YoY International Adjusted Corporate EBITDA margin improvement Restored US RAC Adjusted Corporate EBITDA margins to competitive levels

Today's Full Potential discussion is focused on global RAC excluding HERC We are now turning our attention to Full Potential HERTZ GLOBAL 10 Executing the Stabilizing the Achieving Full Potential 2018-2020 Foundation in 2015 Plan in 2016

How we defined our aspiration for Full Potential HERTZ GLOBAL Full Potential GROUND UP Based on a rigorous process of identifying and evaluating initiatives that we plan to execute Broad based assessment involving comprehensive identification of opportunities by leaders throughout the business Stress-tested against achievability, execution risk and timing to realize

---We expect to see continued margin growth in our core business in Hertz Global Adjusted Corporate EBITDA margin, % 1 16%-18% 12% 10% 7% 2014 2015 mid point est. 2016 mid point est. 2017 Full Potential (3-5 years) HERTZ GLOBAL 12 1 Bars not drawn to scale 2015 and 2016 as we drive toward Full Potential

---Pathway to low end of Full Potential range achieves 16% Adjusted Corporate risk Total Adjusted Corporate Adjusted Corporate EBITDA growth discounted for growth opportunity1 EBITDA cost inflation, fleet interest and 25% execution risk ADJUSTMENT FOR COST INFLATION, FLEET INTEREST AND 25% EXECUTION RISK Adj. Corp. EBITDA margin 16% HERTZ GLOBAL 13 1 Includes reduction for $100M of investments EBITDA margin after discounting for cost inflation and 25% execution

We are mindful of the risks in achieving the Full Potential plan - and are building in appropriate headroom and pursuing mitigating actions Competitive Risk: Destructive competitive pricing, irresponsible actionscapacity behavior, alternative mode competition Response: Path to best cost, best quality mitigates risk - Company that rents cars best winsCompetitive • Risk: Destructive competitive pricing, irresponsible actions capacity behavior, alternative mode competition Response: Path to best cost, best quality mitigates risk - Company that rents cars best wins 16-18% Execution risks Assumes 75% capture of identified Full Potential initiatives to achieve low end of range Continue to identify new opportunities in out years Fleet and non-fleet inflation Risk: Fleet and non-fleet cost inflation Response: Inflation risks are not company specific, but affect the whole industry, and have historically been passed on through rate uplift Mitigation: We have built in headroom to account for inflation in our risk discounted Adjusted Corporate EBITDA margin Full Potential risk discounted Adjusted Corporate EBITDA margin of Economic downturn Risk: Timing of the business correction cycle Mitigation: Plan is built to achieve performance range through a full cycle HERTZ GLOBAL 14

We are periodically reviewing the developing impact of ride sharing on our business and the broader car rental industry Potential viewpoints: Significant disruption Unable to keep pace with technology and customer preference shifts Car rental offering becomes less relevant New possibilities Millions will not have cars - creating new fleet supply opportunities Car Rental Industry Revenue Growth On Airport and Airline Passenger Growth Percent, Q2:14- 01:15 Car rental industry revenue growth Airline passenger growth HERTZ GLOBAL 15 Ride sharing will be one part of the solution - we will develop relevant products

---• Full Potential is achievable • within :f. •• industry HERTZ GLOBAL 16 Improved dynamics could provide opportunity to perform above the range Low end of the range achievable with reasonable realization of initiatives within our control Focused on initiatives we can execute vs. aspirations around industry conduct It's our control We have the Right team Team with proven expertise implementing these types of changes Combination of fresh talent and deeply experienced industry leaders It's within our control Focused on initiatives we can execute vs. aspirations around industry conduct Low end of the range achievable with reasonable realization of initiatives within our control Improved industry dynamics could provide opportunity to perform above the range 16.1$1: We have a proven potential We are proving our capability for execution and realizing potential No company specific constraints to improved margins 2015 is an early demonstration of execution capabilities

---• Our Full Potential is built around three pillars HERTZ GLOBAL 17 US Hertz Local Edition, and International markets Global RAC focus with elements tailored to US airport, Win customer preference and loyalty through clearly defined and positioned brands supported by consistent, well-tailored and differentiated service model Winning with 1 technology Deliver on technology and systems that enhance customer experience and reduce cost Drive excellence in core revenue performance by reinvigorating go to market execution and targeting growth opportunities in enhanced products and services Earning Customer Preference and Delivering Revenue Growth Drive cost position and service quality to industry leadership through operational excellence

Hertz. DltLLAR HEATZGLOBAL 118 WINNING WITH TECHNOLOGY Tyler Best HERTZ GLOBAL 18

---• Demonstrated meaningful progress on technology priorities in 2015 - --------.------------- ------------STARTING POINT (12/31/14) TODAY (11/17/15) Dollar Thrifty Integration 25 months in without integrated systems Brands now on one system $420M in spend Dated equipment and quality challenges resulting in service disruption Cost Management $45M cost reduction while enhancing service levels Stability Brought in new leadership team with category experience Invested to stabilize core function systems HERTZ GLOBAL 19

Cloud-based HERTZ GLOBAL 20 i Built on a foundation of security Setting the stage for future capabilities Local language and currencies Scalable Ready for future growth Integrated Single source of truth flowing to all supporting systems Flexible Adaptability to meet new customer and business needs Micro services modularity Agile Cloud-based Built on a foundation of security Global

HERTZ GLOBAL 21 Delivering next-generation benefits Automation creating consistency and efficiency Cost effectiveness with managed transition Speed and flexibility with cloud based platform Customer centric design and systems Mobile first product offering A B C D E

HERTZ GLOBAL 22 Speed and flexibility enable rapid response to market changes Adaptability to change ... requires new capabilities... ... to enable rapid response Competitors’ pricing Customer demand Operational excellence Nimble: frequent and fast updates Responsive: Reduced time to market of new functionalities Predictive: Integration of rate engine, fleet operations, and yield management Intelligent market based pricing Better matching of fleet and customers Enhanced demand forcasting

CUSTOMER Transition from car centric to customer centric design Touchless, personalized customer experience Preferences Booking behavior Buying patterns Book Personalized offers CHECK-IN Self-service ARRIVAL Right car, right options EXIT Get in and go RENT On-the-go rental extension RETURN Paperless HERTZ GLOBAL 23

Mobile First HERTZ GLOBAL 24 Enablement of new products 100% credit card capture enabling shopping cart buy: Reservation flexibility New products Additional options Bunding Split Billing

Automation driving consistency and efficiency Automation technologies enabled by the new platform ... ... potentially allowing significant cost savings and customer benefits Check-in Exit Return Mobile Damage detection Qr code scanner / RFID Telematics / Transponders Streamline process, reduce touchpoints, offer choice of pathways Customer convenience, choice and speed Reduce workload and activities required at exit Reduce customer waits at exit gate Reduce workload and activities at car return Faster customer returns Potential saving on damage collection rates HERTZ GLOBAL 25

Redesigning IT spending across the three main levers will drive a further $150M savings opportunity $420M $45M achieved in 2015 $375M $275M $225M $100M reduction in 2016 $50M additional opportunity Does not include $50M annual investment 2014 2015 est. 2016 est. Full Potential Levers to Capture Vendor contract renewals Demand management of IT services Decommissioning legacy systems $150M Full Potential opportunity HERTZ GLOBAL 26

Development of new technology platform will evolve over next 36 months Future Platform - Project Roadmap 2015 2016 2017 2018 Phase 1 - Customer Interface and Payments Phase 2 - Fleet, Counter, Personalization Phase 3 - Rates and Reservation Finance Systems Modernization CRM HERTZ GLOBAL 27

We will deliver We are building on momentum from early wins We are confident in the roadmap going forward We have the right team and partners HERTZ GLOBAL 28

Leading Cost and Quality Tom Kennedy and Alex Marren HERTZ GLOBAL 29

Scope of the three primary functions for leading on cost and quality Adjusted Corporate EBITDA growth 1 Fleet Management Support and Other DOE Operational Excellence Total $200-250M $400-450M $200-250M $800-950M Increase fleet efficiency, reduce cycle time Improve efficiency through process and automation Have right people, in right place, at right time - leading to reduced cost and increased quality total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks HERTZ GLOBAL 30

Scope of the three primary functions for leading on cost and quality Adjusted Corporate EBITDA growth’ Fleet Management Increase fleet efficiency, reduce cycle time $200-250M Support and $200-250M Have right people, in right place, at right time - leading to reduced cost and increased quality Improve efficiency through process and automation $400-450M Other DOE 1 1 Operational Excellence $800-950M Total 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks HERTZ GLOBAL 31

Fleet initiatives expected to drive $200-250M in Full Potential opportunity Better utilized fleet $70-80M improve demand forecasting and capacity planning Smarter fleet mix management $60-70M Enhance analytical approach and decision-making optimal supply chain $20-30M Improve transportation and logistics Fleet procurement $20-30M Strengthen OEM partnerships Fleet sales and organization $30-40M Further increase sales through alternative remarketing channels Total $200-250M Amounts shown reflect total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks HERTZ GLOBAL 32

2015 Global RAC fleet scope and scale1 procurement and Distribution car sales 660K Global RAC vehicles 310K+ Total non-program sales $11.9B Capital Expenditure on Fleet 220K+ Total program returns $2.5B Annual Fleet Depreciation ~140K Dealer direct sales 12+ OEM Partners 78 Retail Outlets $1.2B Other Fleet-related costs ~850+ Remarketing Staff2 1 Forecasted full year 2015 2 Total remarketing staff for all channels HERTZ GLOBAL 33

Major US Fleet Transformation completed in 2015 Completed US RAC Fleet Refresh On track for 380K new vehicles added in 2015 calender year 4 point NPS improvement Reduced 2H of 2015 vechicle maintenance by $40M YoY Improved Supply Chain Managemenr estimated to drive $70M in Value Over 25% decrease in average time to sale for non-program cars Projected to reduce turn back cycle time of program cars by more than 25% YoY Expected to reduce out-of-service levels by 10% YoY Increased Profitability from Alternative Remarketing Channels On track for 60,000 retail sales in 2015 growing net channel benefit to over $1,200 per unit Dealer Direct sales grew over 50%, with over $200 per unit net benefit Improved Efficiency in 2015 Q3 efficiency 83% vs. 80% in Q3 2014: 80bps YoY improvement due to better capacity and demand planning alignment 26% reduction in out-of-service levels 22% reduction in car sales inventory HERTZ GLOBAL 34

Better capacity and demand planning will drive higher fleet efficiency SOURCES OF VALUE Improve capacity management Lower out-of-service levels Improve supply chain efficiency Reduce car sales inventory Cost reduction opportunity from fleet efficiency improvement Reducing fleet size and saving fleet depreciation ~$7.-800M1 Full Potential Opportunity US RAC Fleet Efficiency 80.5 81.92 77-78 82+ Hertz ’12 DTG ’12 2015 est. Demand and Capacity Alignment Out of Service Car Sales Inventory Full Potential 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks 2 Dollar Thrifty Group (DTG) Fleet Efficiency is based on average fleet efficiency from 2007-2011 HERTZ GLOBAL 35

Smarter fleet mix management will unlock $60-70M potential savings opportunity Real-time fleet optimization Opportunistic fleet sales Optimize vehicle lifecycle holding costs vs. depreciation rates Create enhanced program and non-program car purchase model ~$60-70M1 Full Potential Opportunity Smarter fleet mix management Changing the way we manage the fleet 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks HERTZ GLOBAL 36

Continued focus on cycle time and cost of in-fleeting and de-fleeting has $20-30M additional savings potential De-fleeting In-fleeting Reallocation Decrease average time to sale Minimize ownership prior to rent Improve new car delivery timing model to better forecast fleet supply Improve decision making and analytical capability to move cars across locations Transportation Management System (TMS) to reduce transport costs Pre-selling to dealers while the cars are still rentable fleet Elimination of wasteful staging steps Improve operational execution (e.g. dedicated resources for turnback process) 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks ~$20-30M1 Full Potential opportunity HERTZ GLOBAL 37

There is $20-30M of opportunity through buying efficiencies Hertz Leverage earlier in program year buys Increase spot transactions 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks OEM ~$20-30M1 Full Potential opportunity HERTZ GLOBAL 38

Growing US car rental alternative channels and empowering the sales team are key to bringing $30-40M in increased channel benefit Continued growth in alternative channels Total retail sales by calendar year 40% retail growth since 2014 50% dealer direct growth since 2014 Empowering sales team and network Sales productivity increase 15% Optimize store performance 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks HERTZ GLOBAL ~$30-40M1 Full Potential Opportunity 39

Scope of the three primary functions for leading on cost and quality Adjusted Corporate EBITDA growth 1 Fleet Management Support and Other DOE Operational Excellence Total $200-250M $400-450M $200-250M $800-950M Increase fleet efficiency reduce cycle time Improve efficiency through process and automation Have right people, in right place, at right time - leading to reduced cost and increased quality Flee reduce cycle time Increase fleet of $200-250M 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks HERTZ GLOBAL 40

Additional $400-450M Full Potential opportunity exists across corporate support functions and other DOEs $150M $50-70M $110-120M $50-55M $40-55M $400-450M Restructure IT spend Streamline finance organization Leverage strategic sourcing Optimize distribution channels Manage other DOE and overhead Implement rigor around demand management, contract renewals and product line optimization Standardize processes and automation; reduce costs and increase quality Leverage new sourcing talent to achieve a systematic approach to demand management and sourcing Improve distribution costs and enhanced mix of lower cost channels Achieve cost efficiency in damage collection and other corporate overhead Total $400-450M Total does not include $50M annual IT investment Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks HERTZ GLOBAL 41

Equipping finance team with the right tools and focusing on core capability has $50-70M value capture opportunity Where We Are Full Potential Opportunity to modernize our support and finance function Legacy shared services and financial support environment High labor content due to inefficient processes Contemporize current financial systems to best practices Reduce total cost of ownership Improve capability and quality 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks ~$50-70M1 Full Potential Opportunity HERTZ GLOBAL 42

Key strategic sourcing levers to achieve $110-120M in global savings opportunity Vendor management Demand management Compliance management Purchasing process redesign Enhanced total cost of ownership strategy Operations parts Logistics Transporters Corporate Services Marketing Legal Other 3rd party vendors 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks ~$110-120M 1 Full Potential Opportunity HERTZ GLOBAL 43

Optimize channels Key focus areas: Channel mix shift Investment allocation System fees management Form of payment optimization Technology and demand management to enhance direct to consumer distribution channels 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks ~$50-55M 1 Full Potential Opportunity HERTZ GLOBAL 44

Manage other Direct Operating and Overhead Expenses Other DOE Comprehensive damage program to reduce costs including initiatives for: Prevention Detection Billing Collection Overhead Expenses Management of administrative costs through: Technology adoption Spans of control Vendor management Demand optimization 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks ~$40-55M 1 Full Potential Opportunity HERTZ GLOBAL 45

Scope of the three primary functions for leading on cost and quality Adjusted Corporate EBITDA growth1 Fleet Management Support and Other DOE Operational Excellence Total $200-250M $400-450M $200-250M $800-950M Have right people, in right place, at right time - leading to reduced cost and increased quality 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks Increase fleet efficiency, reduce cycle time Improve efficiency through process and automation HERTZ GLOBAL 46

Achieving operational excellence means: PROCESS PEOPLE CORE VALUES Customer Service Revenue Generation Cost Efficiency PERFORMANCE Drivers of Value A clean, safe car; an experience that’s fast and courteous - for every customer, every car - delivering value to our customers, employees and shareholders Drivers of HERTZ GLOBAL 47

We are focused on every customer touch point to drive value Industry Labor and fleet intensive 24 hour service with large footprint Multiple touch points and complexity Opportunity Deploy industry leading data mining, tools, and performance tracking to improve processes, giving value and time back to the customer Rental cycle of a car Customer Customer Transporter Transporter COUNTER/PICK-UP EXIT GATE RETURN MAINTENANCE SERVICE HERTZ GLOBAL 48

Reaching our Full Potential requires going further, and demands that we address core challenges across our operations Today Future Road to Success High variability in processes, many manual Standardized, centralized, and automated systems Ad hoc tracking of productivity measures Optimized workforce utilization with high visibility Multiple touch points required for customers Streamlined customer journey Smarter resource scheduling Workforce redesign Leveraging tools and technology HERTZ GLOBAL 49

we have key levers to address these challenges and unlock $200-250m in cost efficiencies and drive best-in-class service for our customers adjusted corporate EBITDA growth1 smarter resource scheduling workforce redesign leveraging tools and technology $25-30m $110-130m $65-90m standardize and centralize systems improve staffing to demand clear / consistent performance standards optimize workforce redesign for flexibility streamline customer journey with mobile platform fleet telematics, automated processes 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks $200-250m1 full potential opportunity HERTZ GLOBAL 50

Centralized and analytical approach to workforce scheduling means fewer hours with better coverage sources of value centralize field scheduling and tailor to unique facility constraints and forecasted hourly demand updated real-time by each location management fewer hours, better customer coverage more shift bids, easier to administer shift-optimized staffing closely follows demand fewer hours and lower costs 1Total 2018-2020 adjusted corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks $25-30M1 full potential opportunity Better coverage and better service HERTZ GLOBAL 51

workforce redesign post integration, streamlining our org structure deploy flex job structures (e.g., part time, temp, vacation time, flex time/leave) Implementing enhanced standard work tools (e.g., Fuel island tracking system) optimal work flow and flexibility clear and consistent performance standards 1 Total 2018-2020 adjusted corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks $110-130M1 Full Potential Opportunity HERTZ GLOBAL 52

Full potential means executing in a technology enabled world more customer facing more moblie more efficient streamline customer journey with advanced mobile platform, fleet telematics and digitized frontline processes $65-90M1 full potential opportunity HERTZ GLOBAL 53

We are applying proven best practices and technology to achieve operational excellence and our Full Potential Cost of Service Automated and faster process Consistent and accurate handling Lower cost per transaction Quality of Service Better car availability Consistent customer experience Faster rental process Enhanced choice Committed Teams Ability to attract and retain best talent Recognition for performance Tools and training for our frontline and leaders Streamlined customer experience Enabled operations team prepared to succeed HERTZ GLOBAL 54

How we will measure our performance and success against this plan Customer Satisfaction (NPS) Non-Fleet Cost Efficiency Asset Management Clean and Safe Speed of Service Courteous and Friendly Ease of Service Service Recovery DOE as % of Revenue Labor Cost Per Transaction Fleet Efficiency Out of Service Time Lifecycle Supply Chain Management HERTZ GLOBAL 55

BREAK HERTZ GLOBAL 56

EARNING CUSTOMER PREFERENCE AND DELIVERING REVENUE GROWTH Jeff Foland HERTZ GLOBAL 57

Overview of Hertz Global RAC revenue Revenue By Geography 1 Revenue By Type Of Location 1 Revenue By Customer Segment 1 28% 72% 28% 72% 31% 29% 20% 20% Published (encl. high yield) Contracted Rates 2 Unpublished Discount High Yield $8.6B+ Hertz Global Rental Car Revenues 3 1 Full year mix extrapolated from third quarter 2015 results 2 Contracted rates include corporate, government, and insurance replacement 3 Revenue for last twelve months ending 9/30/15, excluding other operaions and HERC HERTZ GLOBAL 58

Considerable revenue upside within our reach and control Revenue Growth1 Adjusted Corporate EBITDA growth2 Strengthen Core Revenue Grow Ancillary Revenue Total Market3: $580M New4: $100 M $680M Market 3: $200M New4: $60M $260M Revenue Management execution Go-to-Market execution Merchandising excellence Digital enablement New offerings $485M $335M $1,165M $595M Foundation of earned Customer Preference and loyalty Brands Experience Execution Total does not include $50M annual marketing investment 1 Total 2018-2020 Revenue improvement opportunity before investments and before discounting for execution and other risks 2 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks 3 Market growth based on GDP growth (FactSet) 4 New growth incorporates growth beyond the market HERTZ GLOBAL 59

Customer preference matters in the rental car industry Weekly price for midsize car rentals by brand$ / week Customers clearly show willingness to pay more for some brands even though car products are similar 1 July weekly rental rates for Midsize car type HERTZ GLOBAL 60

Preference is driven by a number of factors beyond price and vehicle, and is increasingly transparent in today’s digital world Drivers of customer preference have become more transparent which is particularly important for many customers Vehicle Price Service Speed Ease Quality of support Friendliness Ancillary offering Brand Perception Engagement/Loyalty Seamless, friendly efficient staff and top notch cars and sports SUV’s. Easy in and out Tremendous customer service with a personal touch. I always trust Hertz for my rental car needs. Their gold service is second to none! >70% of Hertz customers rent once a year (or less)1 1 Hertz brand only for customers renting from airport locations ERTZ GLOBAL 61

core drivers of preference are known, and will create the foundation across all brands get the basics right (tablestakes) drivers of customers satisfaction differentiate (memorable experiences) 80% speed of service “No line waits here” courteous and friendly “we take care of you” clean and safe “every car, every time” Ease of service “fast and customized for me” service recovery “understands and solves my issues” 20% truly exceptional service and recognition Source: customer satisfaction survey of hertz brand customers at airport locations between 9/2014 and 10/2015 hertz global 62

From where we are today, there is clear opportunity to strengthen preference across our brands jd power, overall customer satisfaction index premium brands value brands source: 2015 north America rental car satisfaction study, jd power hertz global 63

we are committed to re-energizing our portfolio of rental car brands Hertz Global premium smart value Experiential value deep value hertz global 64

we will recharge our PREMIUM brand... The leading top tier car rental brand offering permium services that redefine the industry Driven to succeed Bold, confident and refined influential and well-connected shphisticated but not elitist Anticipatory service HERTZ GLOBAL 65

We will deliver a reimagined SMART VALUE brand The smart go-to choice for the disverning value seeker with elevated expectations Do more, the smart way Smart, efficient and practical Consistently easy Streamlined to give you what you value most: time HERTZ GLOBAL 66

We will deliver a reimagined EXPERIENTIAL VALUE brand Go-to value brand for vacationers, tourists and those who seee life as the ultimate adventure Enjou the journey Dare to do things differently Flexibility to adapt, freedom to explore Right vehicle, right adventure Unforgettable moments HERTZ GLOBAL 67

Wewill deliver a reimagined DEEP VALUE brand Providing everything the shopper is seeking with a focus on low price Get the deal and go straightforward, easy set and managed expectations Easy ein that comes with getting the deal With the appropriate associated LOW COST structure HERTZ GLOBAL 68

And we will deliver a reimagined LOCAL EDITION brand Everything you expect from Hertz, closer to home Your mobility needs solved Part of your community In markets where it matters most to you HERTZ GLOBAL 69

We will address all aspects of the experience system with segmented offerings across and within brands Vehicle type and Quality Engagement (digital, social) Service Experience tone and Personality Facilities Loyalty Program gold Plus Rewards HERTZ GLOBAL 70

Our work is well underway, with significant rollout starting in 2016 2015 Improve delivery against the basics 2016 Deliver exceptional service and recognition Hertz Dollar Thrifty Firefly Hertz Local Edition Car quality refresh Improved delivery of basics Performance measures launched Premium services piloted Wave 1 Newly positioned brands rolled out via communications, refreshed facilities, and loyalty program features Increased share of voice through direct and indirect channels via integrated campaign Enhancements in customer engagement throughout the journey social media CRM focused on complete customer care Authentic “surprise and delight” moments that are individualized and relevant Exceptional customer amenities tailored for premium and value brands HERTZ GLOBAL 71

We will keep score with internal and external performance measures External Measures Internal Measures 3rd party rankings Customer social reviews Committed to brand leadership in each category and improving all performance measures Net Promoter Score Detailed satisfaction drivers (e.g., speed, service) HERTZ GLOBAL 72

summary - earning customer preference is foundational to our revenue efforts customer preference drives leveraged results customer needs are diverse, as will be our brands leadership is achievable we will measure and be transparent about progress hertz global 73

Strengthen core revenue Revenue Growth 1 Adjusted Corporate EBITDA growth 2 Strengthen Core Revenue Market 3 : $580M New4 : $100M Market3: $200M New 4 : $60M $680M $260M Revenue Management execution Go-to-Market execution Grow Ancillary Revenue $485M $335M Merchandising excellence Digital enablement New offerings Total $1,165M $595M Foundation of earned Customer Preference and loyalty Brands Experience Execution Total does not include $50M annual marketing investmnet 1 Total 2018-2020 Revenue improvement opportunity before investments and before discounting for execution and other risks 2 Total 2018*2020 Adjusted Corporate EBITDA improvement opportunity before investments, inflation, fleet interest and before discounting for execution and other risks 3 Market growth based on GDP growth (Factset) 4 New growth incorporates growth beyond the market HERTZ GLOBAL 74

Against the backdrop of today's industry reality, there is opportunity within our control to drive core revenue Industry Backdrop Pricing strategy in largely a function of competitive rate canvassing and automated matching Difficult to stimulate on-airport demand Relatively few periods where demand approaches capacity levels, allowing true revenue management techniques Little evidence of pricing segmentaion Revenue Management Drive toward a better model of revenue management through upskilled people, systems and pricing science Go-To-Market Reshape how we target and penetrate attractive markets through smarter selling, technology and segmented offerings HERTZ GLOBAL 75

Revenue Management Excellence - the path from where we are to where we need to be is known PEOPLE AND ROLES New staff Refocused roles Intense development PERFORMANCE VISIBILITY From limited and untimely to comprehensive and real-time IT AND SYSTEMS From fragmented, unstable and basic to consolidated, fast and next generation STRATEGY AND PROCESS From simple price matching and ad-hoc to disciplined, systematic and more state-of-the-art approach FLEET AND OPERATIONS From overly ad-hoc process to precise matching of supply, demand, inventory, yield We have taken steps to address shortcomings and to lay the foundation for work to come HERTZ GLOBAL 76

Go-To-Market Excellence - profitable growth achieved through sharpened actions and investments MIX MANAGEMENT Better compete and win in high yield customer segments CONTRACTED BUSINESS Stabilize share, improve coverage, better allocate investments GLOBAL NETWORK LEVERAGE More pull-through and leverage across global borders DIRECT CHANNEL SHIFT Increase direct channel penetration OFF-AIRPORT OPTIMIZATION Distinct go-to-market strategy deployment HERTZ GLOBAL 77

The next frontier of industry potential will be reached when... Typical Yield Curve Progression Yield curves increase as booking period progresses (rate “fences”) Spoiled inventory is greatly reduced Contracted business transacts at rates that float with market prices Tight linkage exists between industry supply and demand Car Rentals Airlines Hotels HERTZ GLOBAL 78

Grow Ancillary Revenue Revenue Growth1 Strengthen Core Revenue Market3: 580M New4: $100M $680M $485M $1,165M Adjusted Corporate EBITDA growth2 Market3: 200M New4: $60M $260M $335M $595M Revenue Management execution Go-to-Market execution Merchandising excellence Digital enablement New offerings Foundation of earned Customer Preference and loyalty Brands Experience Execution Total does not include $50M annual marketing investment 1 Total 2018-2020 Revenue improvement opportunity before investments and before discounting for execution and other risks 2 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before investments inflation, fleet interest and before discounting for execution and other risks 3 Market growth based on GDP growth (FactSet) 4 New growth incorporates growth beyond the market HERTZ GLOBAL 79

Today, Hertz drives ancillary revenue through an assortment of options to customize the rental car experience... PEACE OF MIND Coverage Child Seats CONVENIENCE Fuel Express Toll ENHANCEMENTS Upgrades GPS Satellite Radio In-Car Entertainment HERTZ GLOBAL 80

and most sales are driven through our agents at the rental counter Approximate 2014 Ancillary Revenue By Channel Phone Kiosk Online Mobile Counter HERTZ GLOBAL 81

There are several foundational enablers to ancillary revenue growth Upfront payment collection Split billing CRM enhancements + targeted marketing Effective shopping cart displays Improved digital channels Increased automation CURRENT PRODUCTS CHOICE OFFERINGS FLEXIBILITY OPTIONS MERCHANDISING CAPABILITIES HERTZ GLOBAL 82

We will roll out new capabilities to better target, present, and price offers REAL TIME CRM AUTOMATION SPECIALLY TAILORED PRODUCT BUNDLES ENHANCED SHOPPING CART FUNCTIONALITY SUBSCRIPTIONS TARGETED OFFERS THROUGHOUT CUSTOMER JOURNEY FUEL OPTION DYNAMIC PRICING Business Traveler Family/Leisure HERTZ GLOBAL 83

Improved upgrade merchandising is example of how growth will be achieved BETTER UPGRADE MONETIZATION DIGITAL ENABLEMENT LARGE OPPORTUNITY 60% Percent of upgrades provided to those that paid or are entitled 1 out of 7 Buy through digital channels today +$100M In annual revenue Increase monetization rate Increase digital conversion Unlock significant upside HERTZ GLOBAL 84

And dynamic pricing of products and bundles will help fuel growth Enhanced capabilities will allow us to price our products more dynamically Inventory Status Seasonality Day of Week Loyalty Tier Customer Segment Individual Customer Behavior Market Dynamics HERTZ GLOBAL 85

In summary, significant revenue opportunity ahead Customer preference and loyalty are foundational to revenue efforts Path to core revenue execution excellence is clear Ancillary opportunity significant, and largely within our direct reach and control Systems and consumer facing digital are key to unlocking value Behaviors for industry Full Potential realization are known, will drive down that path HERTZ GLOBAL 86

PATH TO FULL POTENTIAL Tom Kennedy HERTZ GLOBAL 87

Bringing it all together Full Potential is built on initiatives along three pillars: Winning with Technology, Leading Cost and Quality and Earning Customer Preference & Delivering Revenue Growth Based on where we are today, the plan has sufficient headroom such that - after accounting for inflation, investments and execution risks - our Full Potential Adjusted Corporate EBITDA margin is expected to reach 16-18% HERTZ GLOBAL 88

Recap of Full Potential Opportunity Key Levers Hertz Global Adjusted Corporate EBITDA impact1, $M Revenue Market growth Additional core revenue Grow ancillary Costs2 Fleet Other DOE / SG&A Operational excellence Investments Unconstrained Opportunity 200 60 335 225 425 225 100 1,370 595 impact from revenue 875 impact from cost 1 Total 2018-2020 Adjusted Corporate EBITDA improvement opportunity before inflation, fleet interest and before discounting for execution and other risks 2 Cost reduction numbers are the mid-point of the range for Full Potential impact HERTZ GLOBAL 89

As with any plan there are inflationary pressures and execution risks Hertz Global Adjusted Corporate EBITDA impact, $M Unconstrained Opportunity 1,370 Cost inflation and Fleet interest 300 Execution risk (10% - 25%) 150 - 370 2018-2020 Adjusted Corporate EBITDA Impact 700 - 920 Cost inflation sources: Bureau of Labor Statistics, International Monetary Fund HERTZ GLOBAL 90

Pathway to the low end of Full Potential range achieves 16% EBITDA margin within 3-5 years assuming cost inflation and 25% execution risk Hertz Global Adjusted Corporate EBITDA, $M Hertz Global Adjusted Corporate EBITDA, % 2015 Adjusted Corporate EBITDA est. 875 - 925 Revenue Opportunity 595 Cost and Quality 875 Investments 100 Unconstrained Full Potential Adjusted Corporate EBITDA opportunity 2,245 - 2,295 Cost Inflation and Fleet Interest 300 Execution Risk (10% - 25%) 150-370 Risk Discounted Full Potential Adjusted Corporate EBITDA 1,575 - 1,845 Cost reduction numbers are the mid-point of the range for Full Potential Adjusted Corporate EBITDA impact Cost inflation sources: Bureau of Labor Statistics, International Monetary Fund 10% est. range mid-point 22% 16% 18% HERTZ GLOBAL 91

How will we measure our progress towards our 16-18% Full Potential objectives? Key Stakeholders Customer Employee Investor/Creditor Key Metrics Net Promoter Score External/Social Media Employee Satisfaction Surveys Turnover Employer of Choice Adjusted Corporate EBITDA Margin Unit Revenue - Revenue per available car day DOE and SG&A as % of revenue Free Cash Flow Liquidity and Leverage Total Shareholder Return HERTZ GLOBAL 92

2016 PRELIMINARY GUIDANCE Tom Kennedy HERTZ GLOBAL 93

2016 Preliminary Guidance - Key Assumptions Revenue U.S. industry assumed to grow with current GDP consensus forecast1 of approximately 2.7% Company growth expected at 2.5% to 3.5% Show steady improvement in current pricing Costs Deliver $100 million remaining of original $300 million cost savings Deliver an additional $250 million of initiatives in 2016 US RAC monthly unit fleet depreciation increases approximately 7%; fleet interest based on forward curves Modest other inflationary growth assumed US RAC fleet efficiency improves with easier comparison in 1st half of 2016, with lower absolute fleet growth than industry growth Investments of -$100 million in customer service, marketing, and IT 1 Source: FactSet HERTZ GLOBAL 94

FY:16 Preliminary Financial Guidance Adjusted Corporate EBITDA CONSOLIDATED HGH, $M HERC, $M CONSOLIDATED HERTZ GLOBAL, $M US RAC depreciation per unit per month, $ US RAC fleet capacity growth, % Net consolidated non-fleet capex, $M US car rental revenue growth FY:16 GUIDANCE 1,700 - 1,800 625 - 675 1,075 - 1,125 290 - 300 (0.5%) - 0.5% 250 - 275 2.5% - 3.5% 2016 first year towards Full Potential Continued progress in cost reduction As we did for 2015, we are providing guidance on a full year basis HERTZ GLOBAL 95

Adjusted Corporate EBITDA is forecasted to reach $1,075 - 1,125M in 2016 Hertz Global Adjusted Corporate EBITDA, $M Key Levers Adjusted Corporate EBITDA Margin Revenue growth includes $100M from core revenue and $50M from ancillary revenue Cost efficiencies comprising $100M capture of 2015 initiatives and $250M of new initiatives from the following areas: - $75M fleet efficiency and other fleet costs - $175M other DOE and SG&A Investment in IT, marketing, and service level Headwinds from increase in fleet depreciation / interest and other 2015 Adjusted Corporate EBITDA - Guidance $875M - $925M Revenue $150M Cost $350M Investment ($100M) Headwinds ($200M) 2016 Adjusted Corporate EBITDA - Preliminary Guidance $1,075 - $1,125M 12% est. range mid-point point 10% est. range mid- HERTZ GLOBAL 96

2016 preliminary guidance is achievable We have a fleet that is the right size, in the right condition We have completed the integration of Dollar Thrifty systems We are on track to exit 2015 with $300M in run rate cost efficiencies We have improved revenue management systems and processes We have a stable and talented senior leadership team Within control Well underway with many initiatives already delivering HERTZ GLOBAL 97

BREAK HERTZ GLOBAL 98

LUNCH Q&A HERTZ GLOBAL 99

CLOSING John Tague HERTZ GLOBAL 100

The team has delivered successful initiatives to drive performance in 2015 Restored US RAC Adjusted Corporate EBITDA margins to competitive levels Achieved Q3:15 YTD 27% YoY International Adjusted Corporate EBITDA margin improvement Delivering $200M in cost efficiencies in 2015, and on track to exit 2015 with over $300M in run rate Right sized the fleet while completing major fleet refresh Improved customer satisfaction by 4 points YoY Generating favorable early returns on ancillary revenue and products Completed $262M share buy-back out of $1B authorized, and improved leverage ratios HERTZ GLOBAL 101

Full Potential is real, it is within our control - and this is the right team to deliver Winning with Technology Leading Cost and Quality Earning Customer Preference and Delivering Revenue Growth HERTZ GLOBAL 102

Adjusted Corporate EBITDA Net income before net interest expense, income taxes, depreciation (which includes revenue earning equipment lease charges) and amortization as adjusted for car rental fleet interest, car rental fleet depreciation, car rental debt-related charges, and for certain other charges such as non-cash stock-based employee compensation restructuring and restructuring related costs; equipment rental spin-off costs; impairments and asset write-downs; acquisition costs, integration costs, relocation costs and other extraordinary, unusual or non-recurring items. Adjusted Corporate EBITDA Margin The ratio of Adjusted Corporate EBITDA to total revenues. HERTZ GLOBAL 103

Adjusted Corporate EBITDA and Adjusted Corporate EBITDA Margin are non-GAAP measures within the meaning of Regulation G. In conformity with Regulation G, information for HGH on a segment basis required to accompany the disclosures of non-GAAP financial measure, including a reconciliation of the non-GAAP measures discussed in this presentation to the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles in the United States, appears within the supplemental schedules that have been filed with the Securities and Exchange Commission and are available on the Company's website at http://ir.hertz.com/events-presentations Because of the forward-looking nature of the Hertz Global Adjusted Corporate EBITDA and Adjusted Corporate EBITDA Margin forecast, specific quantifications of the amounts that would be required to reconcile a pre-tax income forecast are not available. The Company believes that there is a degree of volatility with respect to certain of the GAAP measures, primarily related to fair value accounting for financial assets (which includes derivative financial instruments), income tax reporting and certain adjustments made to arrive at the relevant non-GAAP measures, which preclude from providing accurate forecast of GAAP to non-GAAP reconciliations. Based on the above, the Company believes that providing estimates of the amounts that would be required to reconcile the range of the non-GAAP Adjusted Corporate EBITDA and Adjusted Corporate EBITDA Margin for Hertz Global would imply a degree of precision that would be confusing or misleading to investors for the reasons identified above. HERTZ GLOBAL 104

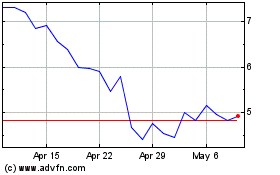

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

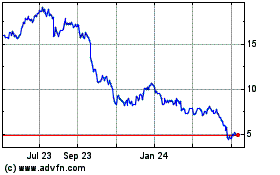

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024