UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) September 30, 2015 (September 30, 2015)

HERTZ GLOBAL HOLDINGS, INC.

THE HERTZ CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | | |

DELAWARE | | 001-33139 | | 20-3530539 |

DELAWARE | | 001-07541 | | 13-1938568 |

(State of incorporation) | | (Commission File Number) | | (I.R.S Employer Identification No.) |

| | | | |

| | 999 Vanderbilt Beach Road, 3rd Floor | | |

| | Naples, Florida 34108 | | |

| | 999 Vanderbilt Beach Road, 3rd Floor | | |

| | Naples, Florida 34108 | | |

| | (Address of principal executive offices, including zip code) | | |

| | | | |

| | (239) 552-5800 | | |

| | (239) 552-5800 | | |

| | (Registrant’s telephone number, including area code) | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 8.01 OTHER EVENTS.

On September 30, 2015, Hertz Global Holdings, Inc., the parent company of The Hertz Corporation (“Hertz”), issued a press release announcing the pricing of $636.3 million in aggregate principal amount of medium term rental car asset backed notes (the “ABS Offering”) by Hertz’s subsidiary, Hertz Vehicle Financing II LP.

The full text of the press release with respect to the ABS Offering is filed herewith as Exhibit 99.1 and is incorporated by reference in this Item 8.01.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits. The following exhibit is filed as part of this report:

Exhibit 99.1 Press Release dated September 30, 2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, each registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| HERTZ GLOBAL HOLDINGS, INC. THE HERTZ CORPORATION |

| (Registrant) |

| | |

| | |

| By: | /s/ Thomas C. Kennedy |

| Name: | Thomas C. Kennedy |

| Title: | Senior Executive Vice President and

Chief Financial Officer |

Date: September 30, 2015

exhibit 99.1

FOR IMMEDIATE RELEASE

HERTZ ANNOUNCES PRICING OF PRIVATE OFFERING OF $636 MILLION

MEDIUM TERM RENTAL CAR ASSET BACKED NOTES

ESTERO, FL, September 30, 2015 - Hertz Global Holdings, Inc. (NYSE: HTZ) (“Hertz Global” or the “Company”) today announced that Hertz Vehicle Financing II LP ("HVF II"), a wholly owned special purpose subsidiary of the Company, priced $636.3 million in aggregate principal amount of Series 2015-2 Rental Car Asset Backed Notes, Class A, Class B, Class C and Class D (the “Series 2015-2 Notes”) and Series 2015-3 Rental Car Asset Backed Notes, Class A, Class B, Class C and Class D (the “Series 2015-3 Notes” and, together with the Series 2015-2 Notes, the “Notes”). The Company utilizes the HVF II securitization platform to finance its U.S. rental car fleet.

The expected maturities of the Series 2015-2 Notes and the Series 2015-3 Notes are September 2018 and September 2020, respectively. The Series 2015-2 Notes are comprised of approximately $189.5 million aggregate principal amount of 2.02% Rental Car Asset Backed Notes, Class A, $46.2 million aggregate principal amount of 2.96% Rental Car Asset Backed Notes, Class B, $14.3 million aggregate principal amount of 3.95% Rental Car Asset Backed Notes, Class C and $15.1 million aggregate principal amount of 4.93% Rental Car Asset Backed Notes, Class D. The Series 2015-3 Notes are comprised of approximately $265.3 million aggregate principal amount of 2.67% Rental Car Asset Backed Notes, Class A, $64.7 million aggregate principal amount of 3.71% Rental Car Asset Backed Notes, Class B, $20.0 million aggregate principal amount of 4.44% Rental Car Asset Backed Notes, Class C and $21.2 million aggregate principal amount of 5.33% Rental Car Asset Backed Notes, Class D. The Class B Notes of each series are subordinated to the Class A Notes of such series. The Class C Notes of each series are subordinated to the Class A Notes and the Class B Notes of such series. The Class D Notes of each series are subordinated to the Class A Notes, the Class B Notes and the Class C Notes of such series. The Class D Notes will be retained by HVF II or conveyed to an affiliate of HVF II.

The net proceeds from the sale of the Notes are expected to be used (i) to repay a portion of the outstanding principal amount of HVF II’s Series 2013-A Variable Funding Notes and HVF II’s Series 2014-A Variable Funding Notes and (ii) to make loans to Hertz Vehicle Financing LLC, a wholly owned special purpose subsidiary of the Company. The offering is expected to close on October 7, 2015, subject to customary closing conditions.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any of the Notes or any other securities, nor will there be any sale of the Notes or any other securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction. The Notes will be sold in reliance on an exemption from the registration requirements provided by Rule 144A under the Securities Act of 1933 (the “Securities Act”) and, solely in the case of the Class A Notes, the Class B Notes and the Class C Notes, to investors outside the United States pursuant to Regulation S under the Securities Act. None of the Notes will be registered under the Securities Act or the securities laws of any state or other jurisdiction, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and the securities laws of any applicable state or other jurisdiction.

About Hertz Global

Hertz Global operates the Hertz, Dollar, Thrifty and Firefly car rental brands in more than 10,300 corporate and licensee locations throughout approximately 150 countries in North America, Europe, Latin America, Asia, Australia, Africa, the Middle East and New Zealand. Hertz Global is the largest worldwide airport general use car rental company with more than 1,600 airport locations in the U.S. and more than 1,300 airport locations internationally. Product and service initiatives such as Hertz Gold Plus Rewards, NeverLost®, Carfirmations, Mobile Wi-Fi and unique vehicles offered through the Adrenaline, Dream, Green and Prestige Collections set Hertz Global apart from the competition. Additionally, Hertz Global owns the vehicle leasing and fleet management leader Donlen Corporation, operates the Hertz 24/7 hourly car rental business in international markets and sells vehicles through its Rent2Buy program. The Company also owns Hertz Equipment Rental Corporation (“HERC”), one of the largest equipment rental businesses with more than 350 locations worldwide offering a diverse line of equipment and tools for rent and sale. HERC primarily serves the construction, industrial, oil, gas, entertainment and government sectors. For more information about Hertz Global, visit: www.hertz.com.

Cautionary Note Concerning Forward Looking Statements

Certain statements contained in this release include “forward-looking statements.” Forward-looking statements include information concerning the Company's liquidity and its possible or assumed future results of operations, including descriptions of its business strategies. These statements often include words such as "believe," "expect," "project," "potential," "anticipate," "intend," " plan," "estimate," "seek," "will," "may," "would," "should," "could," "forecasts" or similar expressions. These statements are based on certain assumptions that the Company has made in light of its experience in the industry as well as its perceptions of historical trends, current conditions, expected future developments and other factors it believes are appropriate in these circumstances. The Company believes these judgments are reasonable, but you should understand that these statements are not guarantees of performance or results, and the Company's actual results could differ materially from those expressed in the forward-looking statements due to a variety of important factors, both positive and negative, that may be revised or supplemented in subsequent reports on Forms 10-K, 10-Q and 8-K.

Among other items, such factors could include: the effect of the restatement of our previously issued financial results for the years ended December 31, 2012 and 2013 and any claims, investigations or proceedings arising as a result; our ability to remediate the material weaknesses in our internal controls over financial reporting; levels of travel demand, particularly with respect to airline passenger traffic in the United States and in global markets; the effect of our proposed separation of our equipment rental business and ability to obtain the expected benefits of any related transaction; significant changes in the competitive environment, including as a result of industry consolidation, and the effect of competition in our markets on rental volume and pricing, including on our pricing policies or use of incentives; occurrences that disrupt rental activity during our peak periods; our ability to achieve and maintain cost savings and efficiencies and realize opportunities to increase productivity and profitability; an increase in our fleet costs as a result of an increase in the cost of new vehicles and/or a decrease in the price at which we dispose of used vehicles either in the used vehicle market or under repurchase or guaranteed depreciation programs; our ability to accurately estimate future levels of rental activity and adjust the size and mix of our fleet accordingly; our ability to maintain sufficient liquidity and the availability to us of additional or continued sources of financing for our revenue earning equipment and to refinance our existing indebtedness; our ability to integrate the car rental operations of Dollar Thrifty and realize operational efficiencies from the acquisition; our ability to maintain access to third-party distribution channels, including current or favorable prices, commission structures and transaction volumes; the operational and profitability impact of the divestitures that we agreed to undertake in order to secure regulatory

approval for the acquisition of Dollar Thrifty; an increase in our fleet costs or disruption to our rental activity, particularly during our peak periods, due to safety recalls by the manufacturers of our vehicles and equipment; a major disruption in our communication or centralized information networks; financial instability of the manufacturers of our vehicles and equipment, which could impact their ability to perform under agreements with us and/or their willingness or ability to make cars available to us or the car rental industry on commercially reasonable terms; any impact on us from the actions of our franchisees, dealers and independent contractors; our ability to maintain profitability during adverse economic cycles and unfavorable external events (including war, terrorist acts, natural disasters and epidemic disease); shortages of fuel and increases or volatility in fuel costs; our ability to successfully integrate acquisitions and complete dispositions; our ability to maintain favorable brand recognition; costs and risks associated with litigation and investigations; risks related to our indebtedness, including our substantial amount of debt, our ability to incur substantially more debt and increases in interest rates or in our borrowing margins; our ability to meet the financial and other covenants contained in our Senior Credit Facilities, our outstanding unsecured Senior Notes and certain asset-backed and asset-based arrangements; changes in accounting principles, or their application or interpretation, and our ability to make accurate estimates and the assumptions underlying the estimates, which could have an effect on earnings; changes in the existing, or the adoption of new laws, regulations, policies or other activities of governments, agencies and similar organizations where such actions may affect our operations, the cost thereof or applicable tax rates; changes to our senior management team; the effect of tangible and intangible asset impairment charges; our exposure to uninsured claims in excess of historical levels; fluctuations in interest rates and commodity prices; and our exposure to fluctuations in foreign exchange rates. Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts:

Investor Relations:

Hertz

Leslie Hunziker

(239) 552-5700

lhunziker@hertz.com

Media:

Hertz Media Relations

(239) 598-6300

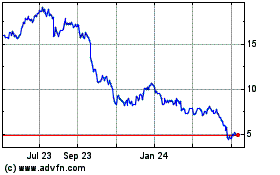

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

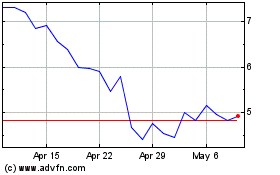

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024