Hovnanian Enterprises, Inc. (NYSE:HOV), a leading national

homebuilder, and GSO Capital Partners LP ("GSO"), the credit arm of

Blackstone (NYSE:BX), announced today a $175 million increase to

their land banking arrangement.

Funds managed by GSO expect to acquire a portfolio of land

parcels from Hovnanian and option finished lots on a monthly

takedown basis back to Hovnanian. As of November 30, 2015, GSO has

closed on one land parcel totaling 186 lots with total acquisition

and future development costs of $24.2 million. GSO and Hovnanian

have also entered into a non-binding letter of intent to land bank

a portfolio of assets totaling approximately $95 million of land

acquisition and future development costs with the expectation to

close prior to December 31, 2015.

Over the next six months, GSO and Hovnanian will jointly

evaluate other land banking opportunities totaling up to an

additional $55 million in acquisition and development costs.

"GSO has been a great land banking partner for us since the

summer of 2012 and we are excited about the opportunity to expand

our land banking arrangement with them," said Ara Hovnanian,

Chairman of the Board of Directors, President and Chief Executive

Officer of Hovnanian Enterprises, Inc. "This increase in our land

banking arrangement with GSO provides our Company with additional

liquidity. Simultaneously, we maintain control of the land

parcels by entering into an option agreement for finished lots

on a just-in-time basis."

Ryan Mollett, Managing Director of GSO, said, "We couldn't be

more pleased with our land banking relationship with Hovnanian.

This is a compelling strategic and financial transaction for both

of our companies and we look forward to continuing to work with

Hovnanian."

ABOUT HOVNANIAN ENTERPRISES®, INC.:

Hovnanian Enterprises, Inc., founded in 1959 by Kevork S.

Hovnanian, is headquartered in Red Bank, New Jersey. The Company is

one of the nation's largest homebuilders with operations in

Arizona, California, Delaware, Florida, Georgia, Illinois,

Maryland, Minnesota, New Jersey, North Carolina, Ohio,

Pennsylvania, South Carolina, Texas, Virginia, Washington, D.C. and

West Virginia. The Company's homes are marketed and sold under the

trade names K. Hovnanian® Homes®, Brighton Homes® and Parkwood

Builders. As the developer of K. Hovnanian's® Four Seasons

communities, the Company is also one of the nation's largest

builders of active adult homes.

Additional information on Hovnanian Enterprises, Inc., including

a summary investment profile and the Company's 2014 annual report,

can be accessed through the "Investor Relations" section of the

Hovnanian Enterprises' website at http://www.khov.com. To be added

to Hovnanian's investor e-mail list please send an e-mail to

IR@khov.com or sign up at http://www.khov.com.

ABOUT GSO CAPITAL PARTNERS LP:

GSO Capital Partners LP is the global credit investment platform

of Blackstone. With approximately $81 billion of assets under

management, GSO is one of the largest alternative managers in the

world focused on the leveraged-finance, or non-investment grade

related, marketplace. GSO seeks to generate attractive

risk-adjusted returns in its business by investing in a broad array

of strategies including mezzanine debt, distressed investing,

leveraged loans and other special-situation strategies. Its funds

are major providers of credit for small and middle-market companies

and they also advance rescue financing to help distressed

companies.

FORWARD-LOOKING STATEMENTS

All statements in this press release that are not

historical facts should be considered as "forward-looking

statements." Such statements involve known and unknown risks,

uncertainties and other factors that may cause actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Although we

believe that our plans, intentions and expectations reflected in,

or suggested by, such forward looking statements are reasonable, we

can give no assurance that such plans, intentions, or expectations

will be achieved. Such risks, uncertainties and other factors

include, but are not limited to, (1) changes in general and local

economic and industry and business conditions and impacts of the

sustained homebuilding downturn, (2) adverse weather and other

environmental conditions and natural disasters, (3) changes in

market conditions and seasonality of the Company's business, (4)

changes in home prices and sales activity in the markets where the

Company builds homes, (5) government regulation, including

regulations concerning development of land, the home building,

sales and customer financing processes, tax laws, and the

environment, (6) fluctuations in interest rates and the

availability of mortgage financing, (7) shortages in, and price

fluctuations of, raw materials and labor, (8) the availability and

cost of suitable land and improved lots, (9) levels of competition,

(10) availability of financing to the Company, (11) utility

shortages and outages or rate fluctuations, (12) levels of

indebtedness and restrictions on the Company's operations and

activities imposed by the agreements governing the Company's

outstanding indebtedness, (13) the Company's sources of liquidity,

(14) changes in credit ratings, (15) availability of net operating

loss carryforwards, (16) operations through joint ventures with

third parties, (17) product liability litigation, warranty claims

and claims by mortgage investors, (18) successful identification

and integration of acquisitions, (19) significant influence of the

Company's controlling stockholders, (20) changes in tax laws

affecting the after-tax costs of owning a home, (21) geopolitical

risks, terrorist acts and other acts of war, and (22) other factors

described in detail in the Company's Annual Report on Form 10-K for

the year ended October 31, 2012. Except as otherwise required by

applicable securities laws, we undertake no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events, changed circumstances or

any other reason.

CONTACT: J. Larry Sorsby

Hovnanian Enterprises, Inc.

Executive Vice President & CFO

Jeffrey T. O'Keefe

Hovnanian Enterprises, Inc.

Vice President, Investor Relations

732-747-7800

Peter Rose

Blackstone

Senior Managing Director, Global Public Affairs

212-583-5871

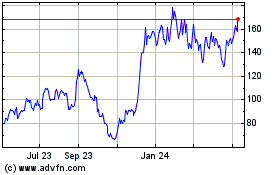

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

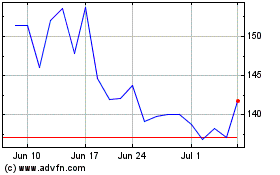

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Apr 2023 to Apr 2024