GE Rides the Coattails of China's Global Dream

October 14 2016 - 9:16AM

Dow Jones News

By Brian Spegele

BEIJING-- General Electric Co. is targeting billions of dollars

in new sales in risky markets from Pakistan to Egypt as it and

other U.S. industrial giants seek to piggyback on Beijing's push to

open more markets to Chinese companies.

As China's economy slows and shifts away from the heavy industry

that long drove growth, multinationals are being driven to follow

China's state giants deep into the developing world. In the

process, many--including Honeywell International Inc. and Siemens

AG--are throwing their support behind China's bid to build roads,

ports and other infrastructure across a wide swath of

geography.

GE has been among the U.S. companies most aggressively seeking

to capitalize on President Xi Jinping's initiative, known as " One

Belt, One Road." By partnering with Chinese companies in emerging

markets, GE said, it can boost sales of its equipment such as

boilers for coal plants and wind turbines.

The aviation-to-health-care conglomerate thinks it can attract

annual orders of more than $5 billion in the coming decade in the

roughly 65 countries targeted under One Belt, One Road, said John

Rice, GE's vice chairman who leads global operations, That is more

than five times as much as in recent years in those countries. Much

of the growth will come from supplying power infrastructure in

underdeveloped markets, Mr. Rice said.

"We have to recognize that markets like China's have evolved,"

he said. The Chinese government is saying that "companies can't

just rely on the domestic market to be successful. They have to go

global."

Take Pakistan, one market that has been aggressively targeted by

Chinese engineering companies and GE. Beijing has committed to

spending at least $35 billion on financing and building power

plants in Pakistan by 2030. GE said its orders in the country have

risen to more than $1 billion today compared with less than $100

million five years ago.

The company is joining other U.S. and global industrial giants

saying they are eager to do more business with Chinese companies as

they go global. Top executives at heavy-machinery maker Caterpillar

Inc., shipping giant A.P. Møller-Mærsk A/S and others have also

publicly supported the One Belt, One Road plan.

"Everybody is figuring out that this is a serious effort," Mr.

Rice said. "It is going to happen with us or without us."

GE executives say the company is already supplying Chinese firms

with natural-gas turbines in Pakistan and Bangladesh, wind turbines

in Kenya, and hydropower equipment in Laos, among other deals.

GE has done business in China in one form or another for more

than a century, setting up a lightbulb factory in the northern city

of Shenyang as early as 1908. It employs around 22,000 people in

China, though its revenue was near flat last year, compared with

double-digit growth in recent years, reflecting China's

slowdown.

Underlining its support for China's global expansion, GE hosted

on Friday nearly 1,000 industry players at a lavish compound the

Chinese government frequently uses to receive foreign dignitaries.

A former Chinese vice foreign minister was in attendance.

For China's companies, the international ambition is born out of

necessity. Left with vast oversupply of everything from steel to

advanced industrial parts as the economy slows, they must look for

growth outside China's borders.

The push comes with massive challenges, including a shortfall of

financing for infrastructure in frontier markets. Even the launch

of the Beijing-backed Asian Infrastructure Investment Bank, which

has been called China's answer to the World Bank, hasn't been

enough to close the gap, Mr. Rice said.

Yet, seeking out new business across frontier markets will be

key for GE's growth, analysts said. The company's power segment is

already one of its biggest business lines, and increasing revenue

will be tough in developed markets such as the U.S.

"All the new capacity is happening in the fast-growth markets,"

said Deane Dray, an analyst at RBC Capital Markets, which said it

has done business with GE in the past year. "And that's where GE is

focused."

Saeed Shah in Islamabad, Pakistan, contributed to this

article.

Write to Brian Spegele at brian.spegele@wsj.com

(END) Dow Jones Newswires

October 14, 2016 09:01 ET (13:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

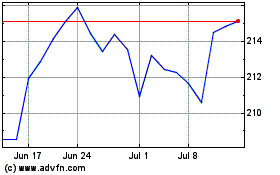

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

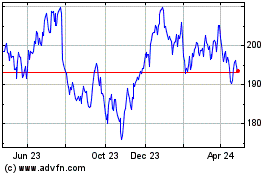

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024