Honeywell Cuts Sales Projections

October 06 2016 - 8:13PM

Dow Jones News

By Maria Armental

Honeywell International Inc. on Thursday cut its sales

projections, citing a business slowdown and delays.

The Morris Plains, N.J.-based conglomerate now projects adjusted

profit of $6.60 to $6.64 a share with sales down 1% to 2% from the

year ago. It previously projected $6.60 to $6.70 a share in profit

with sales declining about 1%.

Honeywell said sales would fall 3% in the third quarter and that

segment margin would narrow to a range of 17.3% to 17.5%. In July,

Honeywell had projected sales in the quarter to remaining flat or

increase 1% from the year-ago period with segment margin in the

18.7% to 18.9% range.

Shares, up 12% this year, fell 4.5% to $110.39 in after-hours

trading.

Best known as a maker of aircraft parts and climate control

systems, Honeywell has been expanding its industrial software

business, adding privately held Intelligrated this year in a $1.5

billion cash deal and spinning off its resins and chemical business

as a separately traded public company.

A Wall Street darling the stock of which has surged since the

financial crisis, Honeywell unsuccessfully sought to merge with

United Technologies Corp., a deal that largely died over antitrust

concerns as it would have brought together two of the largest

players in the aerospace and commercial-building equipment

businesses.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

October 06, 2016 19:58 ET (23:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

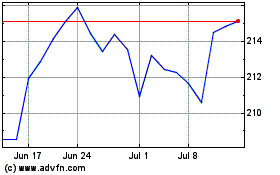

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

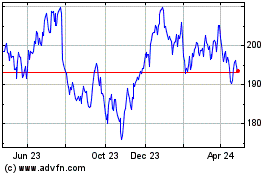

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024