Blackstone to Back JDA Software

August 19 2016 - 10:20AM

Dow Jones News

Blackstone Group LP on Friday said it took up a proposal from

New Mountain Capital to pump $570 million into JDA Software Group

Inc. in a deal that gives the firm a minority stake in the

supply-chain management software provider that was close to a sale

to Honeywell International Inc.

The Wall Street Journal on Thursday reported New Mountain last

week reached out to fellow New York firm Blackstone, proposing a

structured financing deal in exchange for preferred stock and

equity warrants in JDA that would entitle the private-equity giant

to a 40% stake in the company and guarantee a return of 7.5%.

New Mountain, the company's majority shareholder since JDA's

merger with RedPrairie in 2012, will remain so.

JDA said the new capital will be used to fuel product

innovation, including cloud-based development. The equity

investment is expected to be completed by early in the fourth

quarter. It will have no cash interest costs for JDA and will be

used to retire existing debt and reduce its interest expense by $70

million a year.

JDA has about $2 billion in outstanding debt, representing about

nine times its earnings before interest, taxes, depreciation and

amortization, according to people familiar with the matter.

The deal was contingent on the outcome of JDA's negotiations

with Honeywell, an industrial conglomerate that makes products

ranging from air conditioners and commercial boilers to

airplane-cockpit controls and industrial gloves. Honeywell had been

close to sealing a deal to acquire JDA for about $3 billion,

including debt.

Write to Anne Steele at Anne.Steele@wsj.com and Amy Or at

amy.or@wsj.com

(END) Dow Jones Newswires

August 19, 2016 10:05 ET (14:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

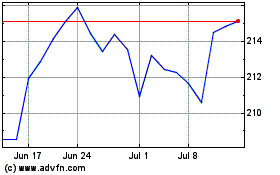

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

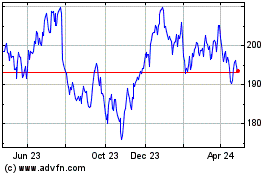

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024