Earnings Watch -- WSJ

July 27 2016 - 3:04AM

Dow Jones News

UNITED TECHNOLOGIES

Otis and Pratt Make Progress

United Technologies Corp. reported higher quarterly sales as the

conglomerate makes progress righting its elevator unit and ramping

jet engine production to historically high levels.

Net sales rose 1.3% to $14.87 billion, with a 1% increase in

organic sales, prompting the company to boost the lower end of its

full-year revenue forecast and raise its adjusted earnings per

share expectation.

The strong quarter comes in a tumultuous period for United

Technologies. Chief Executive Gregory Hayes warded off a $90

billion takeover bid from rival Honeywell International Inc.

earlier in the year. That attempt came amid Mr. Hayes's struggle to

revive growth at Otis, the legacy elevator and escalator maker. At

the same time, Pratt & Whitney is overhauling its manufacturing

operation.

Profit for the period fell to $1.37 billion, down 11% from the

prior year. The company raised its guidance for adjusted earnings

per share of between $6.45 and $6.60, increasing the low end from

$6.30.

It expects revenue of $57 billion to $58 billion, up from $56

billion to $58 billion previously.

--Ted Mann and Austen Hufford

AK STEEL HOLDING

Quarterly Profit Reverses Loss

AK Steel Holding Corp. swung to a second-quarter profit as the

steelmaker reduced its exposure to spot prices and focused on more

profitable coated products.

The West Chester, Ohio, company's shipments declined 14% to

roughly 1.55 million tons for the latest quarter, compared with

1.81 million tons a year earlier. Selling prices per ton improved

2.8% to $957 a ton, compared with $931 a ton a year earlier.

U.S. steelmakers have been starting to benefit from U.S. tariffs

on steel imports.

Over all, AK Steel reported a profit of $17.3 million, or 8

cents a share, compared with a year-earlier loss of $64 million, or

36 cents a share.

The latest period included a tax benefit of $106 million.

Revenue decreased 12% to $1.49 billion, mostly owing to lower

automotive contract pricing as well as a decrease in shipments.

Analysts polled by Thomson Reuters expected per-share loss of 2

cents and revenue of $1.53 billion.

--Tess Stynes

(END) Dow Jones Newswires

July 27, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

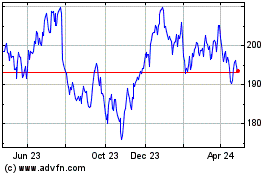

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

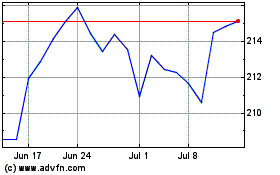

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024