Honeywell International Cuts Revenue Guidance

July 22 2016 - 8:30AM

Dow Jones News

Honeywell International Inc. posted revenue and profit gains in

its latest quarter but cut its revenue forecast for the year as the

company saw core organic sales fall in its three business

units.

Shares in the company, up 3.9% over the past three months, slid

1% to $117.50 in premarket trading.

Honeywell now expects annual sales of between $40 billion to

$40.6 billion, down from its previous guidance for sales between

$40.3 billion and $40.9 billion. It also increased the low end of

its earnings-per-share guidance for the year by 5 cents, now

expecting between $6.60 to $6.70.

Honeywell makes products ranging from air conditioners and

commercial boilers to airplane-cockpit controls and industrial

gloves. The company also is varied across geographies and generates

about half of its revenue outside the U.S.

Last month, Honeywell said Chief Executive Dave Cote would step

down in March after a 14-year tenure. Mr. Cote, who turns 64 next

month, will be succeeded by Darius Adamczyk, who was named the

company's president and chief operating officer in April. Mr. Cote

will continue as executive chairman through April 2018, and then

start a five-year consulting and noncompete agreement.

For the quarter, Honeywell reported a profit of $1.28 billion,

or $1.66 a share, up from $1.19 billion, or $1.51 a share, a year

prior.

Revenue grew 2.2% to $9.99 billion. Core organic sales fell

overall by 2%.

Analysts polled by Thomson Reuters projected $1.64 in per-share

profit on $10.13 billion in sales.

Honeywell also announced that its automation and control

solutions segment would be split into two smaller units—home and

building technologies, and safety and productivity solutions.

"Having two more nimble segments will promote greater customer

intimacy and responsiveness," Mr. Cote said.

Home and building technologies, which had an estimated $9.4

billion in revenue in 2015, will include products that monitor and

control homes and buildings, such as security, fire and air

conditioning systems. It will be led by Terrence Hahn, who

previously ran Honeywell's transportation systems unit.

Safety and productivity solutions, which had an estimated $4.7

billion in revenue in 2015, provides products for workers such as

rugged mobile computers, bar-code scanners, gas sensing

technologies and personal protection equipment. It will be lead by

John Waldron, who had been the president of the sensing and

productivity solutions business unit.

The CEO of the automation and control solutions segment, Alex

Ismail, will leave the company. Honeywell will begin reporting

under the new segments next quarter.

In its automation and control-systems business, Honeywell saw an

acquisition-driven 9.4% jump in revenue to $3.89 billion. Core

organic sales decreased 1% because of lower volume in sensing and

solutions due to a large rollout last year, which was partially

offset by growth in security and fire.

In its performance materials and technologies unit, sales fell

2.9% to $2.33 billion. Core organic sales declined 4%. Lower gas

processing, licensing and equipment sales along with lower market

pricing in resins and chemicals contributed to the decline.

Revenue in the company's aerospace segment fell 1.3% to $3.78

billion on higher repair and overhaul activities and new platform

launches. Core organic sales dropped 2% on program delays in the

international, U.S. and service businesses within defense and

space, on lower shipments to business and general aviation

customers and on higher incentives for original equipment

manufacturers.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 22, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

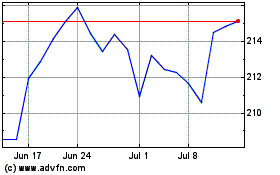

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

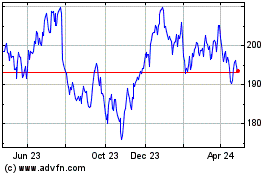

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024