Honeywell Profit Rises; Lower Expenses Offset Sales Drop -- Update

January 29 2016 - 3:12PM

Dow Jones News

By Lisa Beilfuss and Ted Mann

Honeywell International Inc. said profit rose 24% in its latest

quarter as the conglomerate reined in expenses to offset a decline

in sales driven by the stronger dollar.

The New Jersey-based company last month offered upbeat sales

forecasts for the year, despite emerging concerns about global

growth, a view it backed Friday. Honeywell makes products ranging

from thermostats and turbochargers to airplane-cockpit controls and

industrial gloves. As it is diversified across business lines, the

company has also spread itself widely across geographies and now

generates about half of its revenue outside the U.S.

Chief Executive Dave Cote on Friday noted a tough operating

environment and said Honeywell is expecting another year of slow

global economic growth. "We are planning conservatively in 2016,"

Mr. Cote said, but added he sees margin expansion this year.

Honeywell has been cutting costs to maintain profitability after

the stronger dollar pushed sales down 3%. Chief Financial Officer

Tom Szlosek said in an interview the company is squeezing more

efficiency out of its 250 manufacturing plants, and in some cases

closing and combining facilities to improve margins, moves that

reduced overhead expenses by 8.8%.

Nonetheless, Honeywell is maintaining spending levels on

research and development at a range of 6% to 7% of sales, Mr.

Szlosek said, and investing in plant expansions to boost capacity

in businesses where orders have been strong, such as for products

and services used in the oil-refining and petrochemical

industry.

Honeywell customers tend to be downstream, like oil refineries,

and are less affected by the long-term slump in crude-oil prices

because their facilities keep running even as some oil exploration

and production operations shut down. "Those plants have to run and

that's where our customers are," Mr. Szlosek said.

Honeywell is "heading into the peak year" in a program of

capital investment, and is planning $1.1 billion in capital

investment in 2016, up from a typical annual amount of around $800

million.

Overall, Honeywell reported a profit of $1.19 billion, up from

$956 million. Revenue declined 2.8% to $9.98 billion. All of

Honeywell's three divisions reported sales declines in 2015, while

profit in all three rose. For the year, Honeywell forecasts sales

of $39.9 billion to $40.9 billion, up from $38.6 billion in

2015.

Shares in the company, down 5.4% since the start of the year

through Friday's close, and were up 4% in recent trading.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com and Ted Mann at

ted.mann@wsj.com

(END) Dow Jones Newswires

January 29, 2016 14:57 ET (19:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

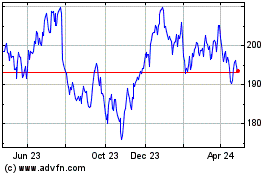

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

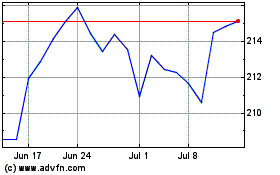

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024