SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

--------------------

Form

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

DATE OF REPORT – September 30, 2015

(Date of earliest event reported)

honeywell

international inc.

(Exact name of Registrant as specified in its

Charter)

|

DELAWARE

(State or other jurisdiction of incorporation) |

1-8974

(Commission File Number) |

22-2640650

(I.R.S. Employer Identification Number) |

| 115

Tabor Road, Morris Plains, New Jersey |

07950 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area

code: (973) 455-2000

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

[ ] Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 |

Entry into a Material Definitive Agreement. |

| |

|

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation Under

an Off-Balance Sheet Arrangement of a Registrant.

|

On September 30, 2015, Honeywell International

Inc. (“Honeywell”) amended its $4.0 billion Amended and Restated Five Year Credit Agreement (the

“Credit Agreement”) dated as of July 10, 2015, with the banks, financial institutions and other institutional

lenders party to the Credit Agreement, Citibank, N.A., as administrative agent, Citibank International Limited, as swing line

agent, JPMorgan Chase Bank, N.A., as syndication agent, Bank of America, N.A., Barclays Bank PLC, Deutsche Bank Securities

Inc., Goldman Sachs Bank USA, Morgan Stanley MUFG Loan Partners, LLC and Wells Fargo Bank, National Association, as

documentation agents, and Citigroup Global Markets Inc. and J.P. Morgan Securities LLC, as joint lead arrangers and co-book

managers. The amendment eliminates the $500 million sublimit for revolving credit borrowings and competitive bid borrowings

in foreign currencies. The description of the amendment to the Credit Agreement contained herein is qualified in its entirety

by reference to the Amendment to the Credit Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated

herein by reference.

| Item 9.01 |

Financial Statements and Exhibits |

The following exhibit is filed as part

of this report:

| Exhibit # |

|

Description |

| |

|

|

| 10.1 |

|

Amendment No. 1, dated as of September 30, 2015, to the

$4.0 billion Amended and Restated Five Year Credit Agreement dated as of July 10, 2015 among Honeywell

International Inc., the banks, financial institutions and other institutional lenders parties thereto,

Citibank, N.A., as administrative agent, Citibank International Limited, as swing line agent, JPMorgan Chase

Bank, N.A., as syndication agent, Bank of America, N.A., Barclays Bank PLC, Deutsche Bank Securities Inc.,

Goldman Sachs Bank USA, Morgan Stanley MUFG Loan Partners, LLC and Wells Fargo Bank, National Association, as

documentation agents, and Citigroup Global Markets Inc. and J.P. Morgan Securities LLC, as joint lead

arrangers and co-book managers.

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Date: October 1, 2015 |

Honeywell International Inc. |

|

| |

|

|

|

| |

By: |

/s/ Jeffrey N. Neuman |

|

| |

|

Jeffrey N. Neuman

Vice President, Corporate Secretary and Deputy General Counsel |

|

Exhibit 10.1

EXECUTION COPY

AMENDMENT NO. 1 TO THE

CREDIT AGREEMENT

Dated as of September 30, 2015

AMENDMENT NO. 1 TO THE CREDIT AGREEMENT

among Honeywell International Inc. (the “Company”), the other borrowers parties to the Credit Agreement referred

to below, the banks, financial institutions and other institutional lenders parties to the Credit Agreement referred to below (collectively,

the “Lenders”) and CITIBANK, N.A., as agent (the “Agent”) for the Lenders.

PRELIMINARY STATEMENTS:

(1) The Company, the Lenders and the Agent

have entered into an Amended and Restated Five Year Credit Agreement dated as of July 10, 2015 (the “Credit Agreement”).

Capitalized terms not otherwise defined in this Amendment have the same meanings as specified in the Credit Agreement.

(2) The Company and the Majority Lenders

have agreed to amend the Credit Agreement as hereinafter set forth.

SECTION

1. Amendments to Credit Agreement. The Credit Agreement is, effective as

of the date hereof and subject to the satisfaction of the conditions precedent set forth in Section 2, hereby amended as follows:

(a) Section 2.01(a) is amended

by deleting in full the following sentence:

Notwithstanding anything herein

to the contrary, no Revolving Credit Borrowing may be made in a Major Currency if, after giving effect to the making of such Revolving

Credit Borrowing, the Equivalent in Dollars of the aggregate amount of outstanding Revolving Credit Advances denominated in Major

Currencies, together with the Equivalent in Dollars of the aggregate amount of outstanding Competitive Bid Advances denominated

in Foreign Currencies, would exceed $500,000,000.

(b) Section 2.03(a) is amended

by deleting in full the following sentence.

Notwithstanding anything herein

to the contrary, no Competitive Bid Borrowing may be made in a Foreign Currency if, after giving effect to the making of such Competitive

Bid Borrowing, the Equivalent in Dollars of the aggregate amount of outstanding Competitive Bid Advances denominated in Foreign

Currencies, together with the Equivalent in Dollars of the aggregate amount of outstanding Revolving Credit Advances denominated

in Major Currencies, would exceed $500,000,000.

(c) Section 2.10(b)(ii) is

deleted in full.

SECTION

2. Conditions of Effectiveness. This Amendment shall become effective as

of the date first above written when, and only when, the Administrative Agent shall have received counterparts of this Amendment

executed by the Company and the Majority Lenders.

SECTION

3. Representations and Warranties of the Company. The Company represents

and warrants that (i) the representations and warranties of the Company set forth in Article 4 of the Credit Agreement are true

and correct on and as of the date hereof and (ii) no Default has occurred and is continuing.

SECTION

4. Reference to and Effect on the Loan Documents. (a) On and after the effectiveness

of this Amendment, each reference in the Credit Agreement to “this Agreement”, “hereunder”, “hereof”

or words of like import referring to the Credit Agreement, and each reference in the Notes and each of the other Loan Documents

to “the Credit Agreement”, “thereunder”, “thereof” or words of like import referring to the

Credit Agreement, shall mean and be a reference to the Credit Agreement, as amended by this Amendment.

(b) The Credit Agreement, the Notes and each

of the other Loan Documents, as specifically amended by this Amendment, are and shall continue to be in full force and effect and

are hereby in all respects ratified and confirmed.

(c) The execution, delivery and effectiveness

of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender

or the Agent under any of the Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents.

(d) This Amendment is subject to the provisions

of Section 9.01 of the Credit Agreement and constitutes a Loan Document.

SECTION

5. Costs and Expenses. The Company agrees to pay on demand all costs and

expenses of the Administrative Agent in connection with the preparation, execution, delivery and administration, modification and

amendment of this Amendment (including, without limitation, the reasonable fees and expenses of counsel for the Administrative

Agent) in accordance with the terms of Section 9.04 of the Credit Agreement.

SECTION

6. Execution in Counterparts. This Amendment may be executed in any number

of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be

an original and all of which taken together shall constitute but one and the same agreement. Delivery of an executed counterpart

of a signature page to this Amendment by telecopier shall be effective as delivery of a manually executed counterpart of this Amendment.

SECTION

7. Governing Law. This Amendment shall be governed by, and construed in

accordance with, the law of the State of New York.

IN WITNESS WHEREOF, the parties hereto have

caused this Amendment to be executed by their respective officers thereunto duly authorized, as of the date first above written.

| |

HONEYWELL INTERNATIONAL INC. |

| |

|

|

|

| |

By: |

/s/ John J. Tus |

|

| |

Name: |

John J. Tus |

|

| |

Title: |

Vice President and Treasurer |

|

| |

|

|

|

| |

CITIBANK, N.A., as Administrative Agent and as a Lender |

| |

|

|

|

| |

By: |

/s/ Susan M. Olsen |

|

| |

Name: |

Susan M. Olsen |

|

| |

Title: |

Vice President |

|

| |

|

|

|

| |

JPMORGAN CHASE BANK, N.A. |

| |

|

|

|

| |

By: |

/s/ Richard W. Duker |

|

| |

Name: |

Richard W. Duker |

|

| |

Title: |

Managing Director |

|

| |

|

|

|

| |

BANK OF AMERICA, N.A. |

| |

|

|

|

| |

By: |

/s/ Lindsay Kim |

|

| |

Name: |

Lindsay Kim |

|

| |

Title: |

Vice President |

|

| |

|

|

|

| |

BARCLAYS BANK PLC |

| |

|

|

|

| |

By: |

/s/ Christopher R. Lee |

|

| |

Name: |

Christopher R. Lee |

|

| |

Title: |

Vice President |

|

| |

|

|

|

| |

DEUTSCHE BANK AG NEW YORK BRANCH |

| |

|

|

|

| |

By: |

/s/ Ming K. Chu |

|

| |

Name: |

Ming K. Chu |

|

| |

Title: |

Vice President |

|

| |

|

|

|

| |

By: |

/s/ Heidi Sandquist |

|

| |

Name: |

Heidi Sandquist |

|

| |

Title: |

Director |

|

| |

GOLDMAN SACHS BANK USA |

| |

|

|

|

| |

By: |

/s/ Jamie Minieri |

|

| |

Name: |

Jamie Minieri |

|

| |

Title: |

Authorized Signatory |

|

| |

|

|

|

| |

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD. |

| |

|

|

|

| |

By: |

/s/ Maria Iarriccio |

|

| |

Name: |

Maria Iarriccio |

|

| |

Title: |

Director |

|

| |

|

|

|

| |

MORGAN STANLEY BANK, N.A. |

| |

|

|

|

| |

By: |

/s/ Jason Lipschitz |

|

| |

Name: |

Jason Lipschitz |

|

| |

Title: |

Authorized Signatory |

|

| |

|

|

|

| |

WELLS FARGO BANK, NATIONAL ASSOCIATION |

| |

|

|

|

| |

By: |

/s/ James Travagline |

|

| |

Name: |

James Travagline |

|

| |

Title: |

Director |

|

| |

|

|

|

| |

BANCO BILBAO VIZCAYA ARGENTARIA S.A., NEW YORK BRANCH |

| |

|

|

|

| |

By: |

/s/ Brian Crowley |

|

| |

Name: |

Brian Crowley |

|

| |

Title: |

Managing Director |

|

| |

|

|

|

| |

By: |

/s/ Luca Sacchi |

|

| |

Name: |

Luca Sacchi |

|

| |

Title: |

Managing Director |

|

| |

|

|

|

| |

BNP PARIBAS |

| |

|

|

|

| |

By: |

/s/ Angela Bentley Arnold |

|

| |

Name: |

Angela Bentley Arnold |

|

| |

Title: |

Managing Director |

|

| |

|

|

|

| |

By: |

/s/ Kwang Kyun Choi |

|

| |

Name: |

Kwang Kyun Choi |

|

| |

Title: |

Vice President |

|

| |

HSBC BANK USA, NATIONAL ASSOCIATION |

| |

|

|

|

| |

By: |

/s/ Patrick Mueller |

|

| |

Name: |

Patrick Mueller |

|

| |

Title: |

Director |

|

| |

|

|

|

| |

INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED, NEW YORK BRANCH |

| |

|

|

|

| |

By: |

/s/ Peitao Chen |

|

| |

Name: |

Peitao Chen |

|

| |

Title: |

Deputy General Manager |

|

| |

|

|

|

| |

INTESA SANPAOLO S.P.A., NEW YORK BRANCH |

| |

|

|

|

| |

By: |

/s/ Jordan Schweon |

|

| |

Name: |

Jordan Schweon |

|

| |

Title: |

Global Relationship Manager |

|

| |

|

|

|

| |

By: |

/s/ Francesco Di Mario |

|

| |

Name: |

Francesco Di Mario |

|

| |

Title: |

FVP, Credit Manager |

|

| |

|

|

|

| |

MIZUHO BANK, LTD. |

| |

|

|

|

| |

By: |

/s/ Donna DeMagistris |

|

| |

Name: |

Donna DeMagistris |

|

| |

Title: |

Authorized Signatory |

|

| |

|

|

|

| |

ROYAL BANK OF CANADA |

| |

|

|

|

| |

By: |

/s/ Kevin Flynn |

|

| |

Name: |

Kevin Flynn |

|

| |

Title: |

Authorized Signatory |

|

| |

|

|

|

| |

SOCIETE GENERALE |

| |

|

|

|

| |

By: |

/s/ Linda Tam |

|

| |

Name: |

Linda Tam |

|

| |

Title: |

Director |

|

| |

STANDARD CHARTERED BANK |

| |

|

|

|

| |

By: |

/s/ Felipe Macia |

|

| |

Name: |

Felipe Macia |

|

| |

Title: |

Managing Director |

|

| |

|

|

|

| |

By: |

/s/ Hsing H. Huang |

|

| |

Name: |

Hsing H. Huang |

|

| |

Title: |

Associate Director |

|

| |

|

|

|

| |

SUMITOMO MITSUI BANKING CORPORATION |

| |

|

|

|

| |

By: |

/s/ David W. Kee |

|

| |

Name: |

David W. Kee |

|

| |

Title: |

Managing Director |

|

| |

|

|

|

| |

THE NORTHERN TRUST COMPANY |

| |

|

|

|

| |

By: |

/s/ Andrew Holtz |

|

| |

Name: |

Andrew Holtz |

|

| |

Title: |

Senior Vice President |

|

| |

|

|

|

| |

THE ROYAL BANK OF SCOTLAND PLC |

| |

|

|

|

| |

By: |

/s/ Jeannine Pascal |

|

| |

Name: |

Jeannine Pascal |

|

| |

Title: |

Vice President |

|

| |

|

|

|

| |

TORONTO DOMINION (TEXAS) LLC |

| |

|

|

|

| |

By: |

/s/ Rayan Karim |

|

| |

Name: |

Rayan Karim |

|

| |

Title: |

Authorized Signatory |

|

| |

|

|

|

| |

U.S. BANK NATIONAL ASSOCIATION |

| |

|

|

|

| |

By: |

/s/ Mark Irey |

|

| |

Name: |

Mark Irey |

|

| |

Title: |

Vice President |

|

| |

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED |

| |

|

|

|

| |

By: |

/s/ Robert Grillo |

|

| |

Name: |

Robert Grillo |

|

| |

Title: |

Director |

|

| |

|

|

|

| |

BANK OF CHINA, NEW YORK BRANCH |

| |

|

|

|

| |

By: |

/s/ Haifeng Xu |

|

| |

Name: |

Haifeng Xu |

|

| |

Title: |

Executive Vice President |

|

| |

|

|

|

| |

BAYERISCHE LANDESBANK, NEW YORK BRANCH |

| |

|

|

|

| |

By: |

/s/ Matthew DeCarlo |

|

| |

Name: |

Matthew DeCarlo |

|

| |

Title: |

Senior Director |

|

| |

|

|

|

| |

By: |

/s/ Elke Videgain |

|

| |

Name: |

Elke Videgain |

|

| |

Title: |

Vice President |

|

| |

|

|

|

| |

CREDIT AGRICOLE CORPORATE & INVESTMENT BANK |

| |

|

|

|

| |

By: |

/s/ Mark Koneval |

|

| |

Name: |

Mark Koneval |

|

| |

Title: |

Managing Director |

|

| |

|

|

|

| |

By: |

/s/ Gordon Yip |

|

| |

Name: |

Gordon Yip |

|

| |

Title: |

Director |

|

| |

|

|

|

| |

DANSKE BANK A/S |

| |

|

|

|

| |

By: |

/s/ Bjarne Madsen |

|

| |

Name: |

Bjarne Madsen |

|

| |

Title: |

Senior Loan Manager |

|

| |

|

|

|

| |

By: |

/s/ Gert Carstens |

|

| |

Name: |

Gert Carstens |

|

| |

Title: |

Senior Loan Manager |

|

| |

DBS BANK LTD. |

| |

|

|

|

| |

By: |

/s/ Jacqueline Tan |

|

| |

Name: |

Jacqueline Tan |

|

| |

Title: |

Senior Vice President |

|

| |

|

|

|

| |

LLOYDS BANK PLC |

| |

|

|

|

| |

By: |

/s/ Erin Doherty |

|

| |

Name: |

Erin Doherty |

|

| |

Title: |

Assistant Vice President |

|

| |

|

|

|

| |

By: |

/s/ Julia R. Franklin |

|

| |

Name: |

Julia R. Franklin |

|

| |

Title: |

Vice President |

|

| |

|

|

|

| |

SANTANDER BANK, N.A. |

| |

|

|

|

| |

By: |

/s/ William Maag |

|

| |

Name: |

William Maag |

|

| |

Title: |

Managing Director |

|

| |

|

|

|

| |

THE BANK OF NEW YORK MELLON |

| |

|

|

|

| |

By: |

/s/ David Wirl |

|

| |

Name: |

David Wirl |

|

| |

Title: |

Managing Director |

|

| |

|

|

|

| |

THE BANK OF NOVA SCOTIA |

| |

|

|

|

| |

By: |

/s/ Michelle Phillips |

|

| |

Name: |

Michelle Phillips |

|

| |

Title: |

Director |

|

| |

|

|

|

| |

UNICREDIT BANK AG, NEW YORK BRANCH |

| |

|

|

|

| |

By: |

/s/ Ken Hamilton |

|

| |

Name: |

Ken Hamilton |

|

| |

Title: |

Managing Director |

|

| |

|

|

|

| |

By: |

/s/ Betsy Hudson |

|

| |

Name: |

Betsy Hudson |

|

| |

Title: |

Associate Director |

|

| |

WESTPAC BANKING CORPORATION |

| |

|

|

|

| |

By: |

/s/ Richard Yarnold |

|

| |

Name: |

Richard Yarnold |

|

| |

Title: |

Senior Relationship Manager |

|

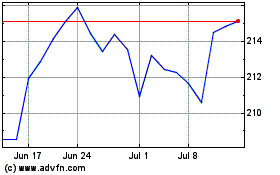

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

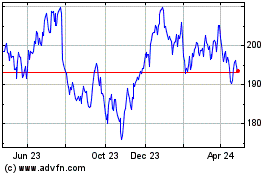

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024