The following references to the above matters are revised effective as of July 22, 2015:

This Prospectus Supplement revises Question 3 of the Prospectus, found on page 2 thereof, under the heading “Administration,” to read as follows:

3. Who administers the Plan for participants?

The transfer agent and registrar for Honeywell International Inc. common stock is Wells Fargo Shareowner Services, a division of Wells Fargo Bank, N.A. (the “Agent”).

The Agent is responsible for administering the Plan, receiving all cash investments made by participants, forwarding funds to be used to purchase common stock, holding shares of stock acquired under the Plan, maintaining records, sending statements of account to participants and performing other duties related to the

Plan.

Contact information

Online:

shareowneronline.com

To obtain information and perform certain transactions on your account online, including investments via electronic funds transfer (“EFT”), share withdrawals and sale of shares, you may use the Administrator’s website at: shareowneronline.com.

Click on “Sign Up Now!” under “I am a Current Shareowner”. You will need your 10-digit account number, your 12-digit Authentication ID and a valid email address. Your account number can be found on your dividend check, dividend deposit notice or account statement. If you do not have your Authentication ID,

you may request one online or by phone. Your Authentication ID will be sent to your mailing address on file.

Telephone:

Toll free at 1- 800-647-7147 between 8:00 a.m. and 8:00 p.m. Monday through Friday, Eastern Time.

International Calls: 1-651-450-4064

Written correspondence:

Wells Fargo Shareowner Services

P.O. Box 64856

St. Paul, MN 55164-0856

Certified/Overnight Mail:

Wells Fargo Shareowner Services

1110 Centre Pointe Curve, Suite 101

Mendota Heights, MN 55120-4100

This Prospectus Supplement revises the last sentence of Question 6 of the Prospectus, found on page 3 thereof, under the heading “Participation” to read as follows:

An Authorization Form may be obtained at any time by calling the Agent at the number set forth in Question 3, or you may enroll online at shareowneronline.com.

This Prospectus Supplement revises Question 12 of the Prospectus, found on page 4 thereof, under the heading “Optional Cash Purchases” to read as follows:

12. How are optional cash payments made?

You can make additional cash investments in the Plan at any time either by check or by authorizing one-time or recurring automatic bank withdrawals from a U.S. or Canadian financial institution.

Check – To make an investment by check, complete and return a Transaction Request Form (attached to your account statement) together with your payment. The check must be made payable to “Shareowner Services” in U.S. dollars.

2

One-time automatic withdrawal – You can make a one-time automatic withdrawal from a designated checking or savings account at a qualified financial institution by signing on to shareowneronline.com.

Recurring automatic withdrawals – You can make regular investments with automatic monthly withdrawals from a designated checking or savings account at a qualified financial institution. You can authorize automatic investments by signing on to shareowneronline.com.

No third-party checks will be accepted by the Agent. Optional cash payments received from foreign shareowners must be in U.S. dollars and will be invested in the same manner as payments from other participants.

This Prospectus Supplement strikes all references in the Prospectus to “www.amstock.com” and replaces such references with “shareowneronline.com,” including, without limitation, as follows:

|

| |

• |

|

in the second paragraph of Question 21 under the heading “Certificates for Shares,” found on page 7; and |

|

| |

• |

|

in the first paragraph of Question 23 under the heading “Termination of Participation in the Plan,” found on page 7.

|

This Prospectus Supplement revises the first sentence of the second paragraph of Question 25 of the Prospectus under the heading “Safekeeping,” found on page 8, to read as follows:

Participants who wish to deposit certificates should send their certificates (which should not be endorsed) to the Agent at the address set forth in Question 3, along with a written request that the certificates be deposited by the Agent for safekeeping under the Plan.

This Prospectus Supplement revises the Prospectus to insert the following question under the heading “Sale or Transfer of Shares,” immediately subsequent to Question 26 of the Prospectus, found on page 8:

26A. How can a participant sell shares?

You can sell your Plan shares at any time by submitting a request to sell either online, by telephone or through the mail (see Contact Information). A check will be issued for your sale proceeds, unless you elect to receive the funds by direct deposit into your bank account.

You may instruct the Agent to sell shares under the Plan through a Batch Order, Market Order, Day Limit Order, Good-‘Til Date/Canceled Limit Order, or Stop Order.

Batch Order (online, telephone, mail) – Requests to sell shares are aggregated and the total of all shares are sold on the open market. Batch Order sale requests will be completed by the Agent within five business days. The price per share sold will not be known until the sales are completed and will always be the

weighted-average price for all shares sold for the Plan on the trade date.

Market Order (online or telephone) – During market hours, sale requests will be promptly submitted by the Agent to a broker. The sale will be at the prevailing market price when the trade is executed. Once entered, a Market Order request cannot be canceled. Sale requests submitted near the close of the market

may be executed on the next trading day, along with other requests received after market close.

Day Limit Order (online or telephone) – Sale requests for a Day Limit Order will be promptly submitted by the Agent to a broker. The sale will be executed when and if the stock reaches, or exceeds the specified price on the day the order was placed. The request will be automatically canceled if the price is not

met by the end of the trading day.

Good-‘Til-Date/Canceled (GTD/GTC) Limit Order (online or telephone) – Requests to sell shares with a GTD and GTC Limit Order will be promptly submitted by the Agent to a broker. The sale will be executed when and if the stock reaches, or exceeds the specified price at any time while the order remains open

(up to the date requested or 90 days for GTC). The request is automatically canceled if the price is not met by the end of the order period.

3

Stop Order (online or telephone) – Requests to sell shares will be promptly submitted by the Agent to a broker for a Stop Order. The sale will be executed when the stock reaches a specified price, at which time the order becomes a Market Order and the sale will be at the prevailing market price when the trade is

executed. The price specified in the order must be below the current market price (generally used to limit a market loss).

This Prospectus Supplement revises the Prospectus to insert the following section immediately preceding the heading “Additional Information About the Plan,” found on page 10:

|

|

|

Investment Summary and Fees |

|

|

Summary |

|

|

|

Minimum cash investments |

|

|

|

Minimum one-time optional cash purchase |

|

$25.00 |

|

Minimum recurring automatic investments |

|

$25.00 |

|

Maximum cash investments |

|

|

|

Maximum annual investment |

|

$120,000.00 |

|

Dividend reinvestment options |

|

|

|

Reinvest options |

|

Full, Partial |

Fees |

|

|

|

Investment fees |

|

|

|

Dividend reinvestment |

|

Company Paid |

|

Check investment |

|

Company Paid |

|

One-time automatic investment |

|

Company Paid |

|

Recurring automatic investment |

|

Company Paid |

|

Dividend purchase trading commission per share |

|

Company Paid |

|

Optional cash purchase trading commission per share |

|

Company Paid |

|

Sales fees |

|

|

|

Batch Order |

|

$15.00 |

|

Market Order |

|

$25.00 |

|

Limit Order per transaction (Day/GTD/GTC) |

|

$30.00 |

|

Stop Order |

|

$30.00 |

|

Sale trading commission per share |

|

$0.12 |

|

Direct deposit of sale proceeds |

|

$5.00 |

|

Other fees |

|

|

|

Certificate issuance |

|

Company Paid |

|

Certificate deposit |

|

Company Paid |

|

Returned check / Rejected automatic bank withdrawals |

|

$35.00 per item |

|

Prior year duplicate statements |

|

$15.00 per year |

This Prospectus Supplement revises the first paragraph under the heading “Additional Information About the Plan,” found on page 10 of the Prospectus to read as follows:

The Agent has advised us that sales are usually made through an affiliated broker, who will receive brokerage commissions in connection with such transactions. Commission and sales fees are set forth under the heading “Investment Summary and Fees – Fees – Sales fees” above.

This Prospectus Supplement revises the third sentence of the first paragraph of the section titled “General,” under the heading “Description of Common Stock,” on page 11 of the Prospectus to read as follows:

Wells Fargo Shareowner Services, a division of Wells Fargo Bank, N.A., is the transfer agent and registrar for our common stock.

4

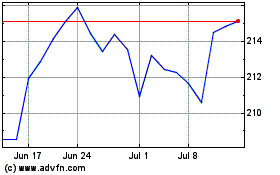

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

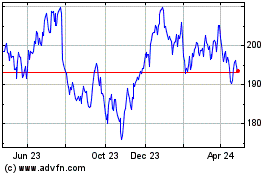

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024