By Adrienne Roberts and John D. Stoll

U.S. light-vehicle sales hit a second consecutive annual high,

aided by a fourth-quarter surge in demand that exceeded

expectations and bolstered the outlook for an industry that has

been a key engine for economic growth.

Such gains, however, are coming with a steep price tag.

December's sales pace, one of the strongest monthly performances in

the industry's history, was fueled by discounts of $3,542 per

vehicle on average, according to J.D. Power, an independent

research firm.

That represents a 10% discount off the original asking price and

is an incentive level not seen since the beginning of the financial

crisis.

Auto makers are dishing out incentives to spark demand for

passenger cars, including sedans, which aren't popular when

gasoline prices are low. Such giveaways also are necessary to keep

drawing buyers to dealerships after seven consecutive years of

growth. Even with brisk sales, Detroit's three auto makers are

closing some factories in January to lower inventories or even

laying workers off at car plants.

Still, President-elect Donald Trump's administration will

inherit a far healthier auto industry compared with what President

Barack Obama encountered eight years ago. In 2009, auto sales were

collapsing amid a wider financial crisis and the Obama

administration spent considerable time crafting bailouts for

Detroit car companies and figuring out how to goose sales.

Judy Wheeler, Nissan Motor Co.'s head of U.S. sales, said in an

interview that with "consumers settling down after the election"

and reasonably low gas prices, she sees the industry maintaining

its stability into 2017.

Bill Fay, an executive with Toyota Motor Corp., said he thinks

the incentive spending that carried 2016 to a record will moderate

and 2017 will get off to a strong start.

But some dealers are unsure if the momentum will last.

Phil Maguire, owner of Maguire Family Dealerships based in

Ithaca, N.Y., is expecting a strong year ahead and investing in

internal operations. He acknowledges low gasoline prices and strong

demand for light trucks are supporting sales. "It will be

interesting to see how long the market can hold out."

Auto makers sold 1.69 million vehicles in December, 3.1% more

than the same period in 2015 despite one fewer sales day. The

seasonally adjusted selling pace of 18.43 million was the highest

since July 2005, when General Motors Co. and other auto makers

stoked demand with a new campaign that offered employee pricing to

all customers. A total of 17.55 million vehicles were sold in 2016,

roughly 60% of which were classified as light trucks.

That compares with 17.48 sales million a year earlier and a mix

of 56% light trucks. Growth in demand for pricier pickups,

sport-utility vehicles and crossover wagons has helped pad auto

maker profits as executives invest to speed development of

autonomous cars and spend heavily to meet stricter emissions

standards.

Shares of GM shot up 5.5% to close at $37.09 as of 4 p.m.

trading on Wednesday, just shy of a 52-week high set last month.

Ford Motor Co. closed up 4.6% at $13.17.

Audi AG's U.S. chief, Scott Keough, said it is unclear what role

the election or response to Mr. Trump's policies had in December's

boost, but noted there was a change in momentum for the

industry.

"We had the most amount of traffic at our stores that we've ever

seen," he said, acknowledging the role incentives played for the

German luxury brand and the wider market. "December was an

incredible month."

"The country was tangled up in knots for six to seven months not

knowing what was going to happen," Mr. Keough said. The certainty

after the election, he said, is "a good thing."

Mr. Keough said December is historically a strong month and

noted there are still pockets of weakness in the overall market,

including certain luxury players.

"We are nearing a peak," Mr. Keough said regarding the luxury

market. "We need to manage and behave accordingly."

Dealers are planning for continued good times, with many

committing to store upgrades or other facility improvements. Joe

Eberhardt, Jaguar Land Rover's North America chief, said Wednesday

that 250 of the company's North American dealers have committed to

spend a total of $1.5 billion on improvements, including moving to

new design elements in showrooms.

"The investments will take time," Mr. Eberhardt said, adding

that retailers will spend that money over the next half-decade or

so. "A big part of the story line over the next couple years is

that sales will remain strong," he said.

Among individual players, GM logged a 10% increase compared with

December 2015, selling 319,108 vehicles, while Ford sales edged up

0.1% to 237,785 as F-series pickups posted their best month in 11

years.

Fiat Chrysler Automobiles NV, meanwhile, reported sales slipped

10% to 192,519 vehicles, as it cut back on daily rental sales and

continued to rely on Jeep and Ram pickups for an increasing amount

of its volume.

Toyota sales rose 2.1%, Nissan sales climbed 9.7% and Honda

Motor Co. booked a 6.4% increase to 160,477 vehicles, as a 4% slip

in cars sales was lifted by an 18% jump in truck sales.

--Anne Steele contributed to this article.

Write to John D. Stoll at john.stoll@wsj.com

(END) Dow Jones Newswires

January 05, 2017 02:48 ET (07:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

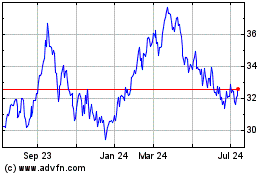

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

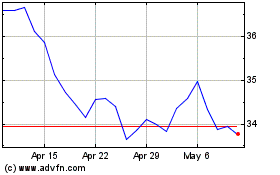

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024