Audi's China Dealers Seek to Block Deal With SAIC Motor

November 22 2016 - 4:00AM

Dow Jones News

SHANGHAI—Audi AG dealers in China have threatened to take action

against an agreement that paves the way for the country's largest

auto maker to build and sell Audi vehicles there, fearing it would

dilute already thinning profits as sales slow.

If the German auto maker doesn't call off its agreement to

explore a tie-up with SAIC Motor Corp., China's largest auto maker

by sales, the dealers said they would demand "hundreds of billions

of yuan" in compensation for potential lost sales. They have also

threatened to not accept new Audi vehicles from December, some of

the dealers told The Wall Street Journal on Tuesday.

Representatives from 15 dealer groups, which have a combined 150

Audi dealerships, met with Audi's top executives in China on

Monday, dealers participating in the talks said. The talks didn't

yield any outcome, they said.

Officials from Audi and SAIC weren't immediately available for

comment. The companies signed a memorandum of understanding on

potential cooperation earlier this month. SAIC is also a partner of

General Motors Co.

Currently, Audi makes and sells cars in China through a

three-party joint venture with Volkswagen AG and FAW Group Corp.

Dealers say an additional joint venture would add more dealerships

to a network already struggling with slower sales and sliding

profits.

"We firmly oppose Audi's tie-up with SAIC because it will

seriously hurt our interests," said one of the Audi dealers.

Audi now has about 460 dealerships in China, with a third having

opened in the past three years, said its dealers. "Our profits have

dropped significantly. I couldn't imagine where we will go if the

company adds another 200 dealers," said another Audi dealer who

participated in the Monday talk.

Chinese regulations require foreign auto companies to team up

with domestic manufacturers to build cars. Some foreign companies

have two car-making partners in the country to tap demand for

owning a car in China. For example, Volkswagen counts both FAW and

SAIC as partners, and Ford Motor Co., Toyota Motor Corp., Nissan

Motor Co. and Honda Motor Co. each have two Chinese partners.

However, analysts say luxury nameplates like Audi are in a

weaker position to follow suit due to lower sales volumes.

"Although Audi has expanded very fast, its volumes are still

small by mass-market brand standards," said Yale Zhang, managing

director of consulting firm Automotive Foresight in Shanghai.

Setting up a second joint venture will likely seriously divert

sales from the current dealers, he said.

Friction between car manufacturers and dealers has risen sharply

in recent years because of slowing sales and rising inventories.

BMW AG last year agreed to appease its dealers by lowering sales

targets and paying 5.1 billion yuan, or $740 million, in

subsidies.

Audi's new agreement with Shanghai-based SAIC comes as its share

of China's luxury-car market is falling as competition grows. Audi,

which arrived in China in the mid-1980s and quickly gained a

reputation as the maker of limousines favored by government

officials, has long been the best-selling premium-car brand

there.

Audi currently sells about 15% more cars annually in China than

rival BMW Group, and nearly 30% more than Daimler AG's Mercedes,

according to data from these companies.

However, the gap has been narrowed amid growing competition from

BMW, Mercedes and new entrants such as GM's Cadillac and Ford's

Lincoln models.

Rose Yu

(END) Dow Jones Newswires

November 22, 2016 03:45 ET (08:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

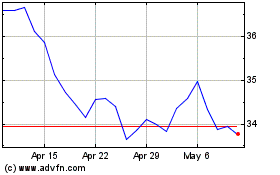

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

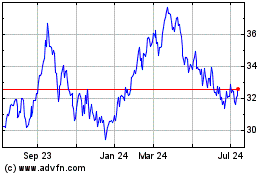

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024