Asian Shares Rebound as Investors See Hope in Trump Win

November 09 2016 - 11:50PM

Dow Jones News

Asian shares rose broadly early Thursday, as global investors

chose to focus on the upsides of a Donald Trump presidency after a

sharp selloff in the region the previous day.

Japan's Nikkei Stock Average gained 5.8%, its biggest single-day

gain in two months, making up for Wednesday's 5.4% fall. Korea's

Kospi added 1.8% and Singapore's Straits Times Index was higher by

1.3%.

"His victory surprised everyone but I think people noticed a

reconciliatory tone in his speech," said Alex Furber, senior client

services executive at CMC Markets. "Analysts are scratching their

heads but I think the key now will be with what Trump actually does

versus what he has said."

In Australia, the S&P/ASX 200 gained 2.7%, led by commodity

stocks as prices recovered, with iron ore surging 4.7% to its

highest level year to date.

Among key Australian resources firms, BHP Billiton rose 7.9%,

while Rio Tinto added 7.8% in morning trade.

Asia's strength on Thursday—with all equity markets headed

higher—came as stocks on Wall Street notched firm gains overnight,

lifted by hopes that Mr. Trump's plan to cut corporate taxes and

ease repatriation of firms' overseas cash will boost the U.S.

economy. Investors also hoped that his fiscal spending plans would

boost a laggard U.S. economy.

Meanwhile, Japanese stocks surged, with analysts noting that Mr.

Trump's possible push on infrastructure spending and other

initiatives could benefit local infrastructure companies, as well

as industrial-robot and electronic-parts makers.

Industrial giant Hitachi Ltd. was up 9.1%, robot maker Fanuc

Corp. was up 5.8%, and Honda Motor Co. surged 8.0%.

"There is a tide of positive assessment of Mr. Trump's economic

policies," said Takashi Ito, a strategist at Nomura Securities. "We

aren't sure if he can do everything he has said he would, but if

some of that materializes, that'd be good news for the U.S.

economy," he said.

In U.S. trading on Wednesday, stock markets reversed earlier

flips to end up with the S&P 500 closing up 1.1% and the Dow

Jones Industrial Average rising 1.4%.

Traders also shrugged off earlier worries over Mr. Trump's tough

rhetoric against China, with the Shanghai Composite Index gaining

1.1%, and Hong Kong's Hang Seng Index rising 1.8%.

But concerns over the outlook of the U.S. market capped gains

among Hong Kong stocks with heavy U.S. exposure. Blue-chip Li &

Fung, which sources goods for key U.S. retailers, recouped just

0.6% from its 4.5% fall on Wednesday.

Analysts say the markets will now refocus on the U.S. Federal

Reserve's action in December. Market expectations of an

interest-rate rise next month has given way to doubts of any

increase at all this year, following the Trump victory.

"I am off the election now," said Stephen Innes, head of trading

for the Asia Pacific region at currency broker Oanda in Singapore.

"I am certainly changing my December Fed hike view from a certainty

to a 50:50 chance."

Saurabh Chaturvedi, Rhiannon Hoyle and Robb M. Stewart

contributed to this article.

Write to Kenan Machado at kenan.machado@wsj.com and Kosaku

Narioka at kosaku.narioka@wsj.com

(END) Dow Jones Newswires

November 09, 2016 23:35 ET (04:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

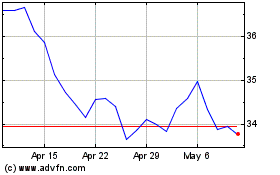

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

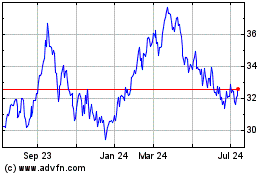

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024