Nissan Keeps Full-Year View Despite Currency Woes -- WSJ

November 08 2016 - 3:05AM

Dow Jones News

By Sean McLain

TOKYO -- Nissan Motor Co. maintained its full year sales

guidance for the year on Monday despite the corrosive effect of a

stronger yen on earnings, betting that a stable of new models would

help it outrun a broader decline among Japanese car makers in the

U.S.

Japanese car makers, such as Honda Motor Co. and Mitsubishi

Motor Corp., have reduced sales projections for the year on the

back of a strong yen. But Nissan expects sales in the second half

to be strong enough to overcome the adverse exchange rate.

"We have a strong product lineup in the second half to help us

reach this target, said Hiroto Saikawa, Nissan's co-chief

executive. The company maintained its guidance for the full year

ending March of Yen11.8 trillion ($113 billion) in revenue and

Yen525 billion in net profit, despite currency headwinds.

Nissan has already missed the goal set by Chief Executive Carlos

Ghosn in 2011 to have 8% of the global automotive market and an 8%

profit margin by the end of this financial year. The company now

projects a 6% operating profit margin for the year, and global

market share is currently 5.8%, down from 6.1% a year ago.

Blame it on the yen, said Mr. Saikawa. A stronger yen ate away

179.9 billion yen in the company's profit for the fiscal first

half.

Nissan said it earned 154.7 billion yen for the July-September

quarter, down 13% from a year prior.

In Japan, the company's business was hammered by halted sales of

popular car models manufactured by Mitsubishi Motors, which

admitted in April to tampering with fuel economy data on the

vehicles. Nissan's Japan sales volume fell 20% in the first half of

the year, in part because of the halted sales.

Nissan is betting that the resumption of those car models and

the popularity of a minivan with self-driving features will help

stem the bleeding in its home market.

Nissan bought a controlling stake in Mitsubishi Motors,

incorporating it into the broader alliance with Renault SA. Mr.

Ghosn will head Mitsubishi's board, a role he said is to help

accelerate a turnaround at the company.

But much depends on Nissan's ability to keep up the pace in the

U.S.

Nissan has been better than its peers at reading market demand

outside of Japan, particularly in the U.S.

The company's U.S. sales rose 4.7% in the first 10 months of the

year, while Toyota Motor Corp.'s declined and Honda Motor Co. grew

a more tepid 2.6%.

Some of that growth has been due to Nissan offering more cash

incentives on its vehicles compared with rivals, something that

gets customers in the door, but isn't great for the bottom

line.

Nissan says it has to cut back on those enticements as U.S.

consumers take advantage of low gas prices by flocking to trucks

and SUVs, at the expense of sedans. It said it hopes updated pickup

truck and SUV models will help wean the company off sedan sales,

which represent more than half of its total U.S. sales.

Nissan last month said it would press ahead with the manufacture

of its Qashqai sport-utility vehicle and a second model in

Sunderland, England, a move widely seen as a vote of confidence in

the U.K. amid uncertainty following the Brexit vote.

Write to Sean McLain at sean.mclain@wsj.com

(END) Dow Jones Newswires

November 08, 2016 02:50 ET (07:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

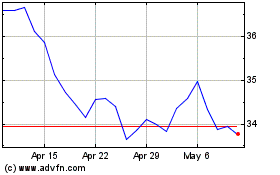

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

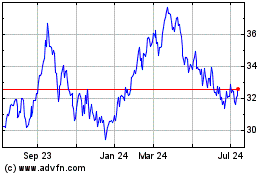

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024