Car Dealers Dangle Offers as Sales Slow -- WSJ

October 04 2016 - 3:04AM

Dow Jones News

Traffic cools after six years of steady growth; spending

increases on rebates and discounts

By Anne Steele and John D. Stoll

Light-vehicle sales sputtered in the U.S. last month despite

generous Labor Day holiday deals, with most of the market's biggest

sellers reporting declines from the prior September.

While the pace of sales remains historically strong, dealership

traffic is cooling after more than six years of steady growth.

General Motors Co., Ford Motor Co., Fiat Chrysler Automobiles NV

and Honda Motor Co. posted declines. Toyota Motor Corp. and Nissan

Motor Co. notched gains.

Retail demand has eased from a robust clip set in the final six

months of 2015. To keep North American factories running at full

steam and on pace for a record, auto makers have cranked up

spending on rebates and discounts and relied more heavily on fleet

customers, including rental-car companies, government agencies and

commercial clients.

Industry competitors spent nearly $400 more on incentives per

vehicle on average in September compared with a year earlier, and

incentives of $3,888 per-unit sold on average topped the prior

incentive-spending record for a single month set in December 2008,

according to J.D. Power. The last time incentives-per-unit were

this high, GM and Chrysler were appealing to Congress for bailouts

and sales across the industry were sinking.

The industry is in better shape seven years later, particularly

as buyers opt for heavier models that typically deliver bigger

margins. The incentive-spending increase, however, wipes out the

premium that auto makers are collecting as customers take advantage

of low gasoline prices and shift toward pricier trucks and

sport-utility vehicles.

In an interview, Nissan's U.S. sales chief, Judy Wheeler, said

there is room to run on the truck side of the business as vehicles

from big pickups to small crossovers remain hot. The Japanese brand

launched its October "Truck Month" advertising during American

football broadcasts last weekend. Ms. Wheeler credits a healthy

real-estate market and favorable economic conditions, in addition

to cheap fuel, for truck popularity.

In a conference call, Ford U.S. sales chief Mark LaNeve noted

"very aggressive" activity around Labor Day throughout the

industry. The average vehicle was marked down more than 10% during

the month, TrueCar Inc. estimates, which exceeds what it typically

has been and reflects ample inventory sitting on dealer lots.

Bill Fay, the chief of the Toyota brand in the U.S., said Monday

that some of the incentive spending comes as car companies slash

prices on 2016 model-year vehicles to make room for 2017 models. He

expects the industry volume to flirt with a record as customers

appear to be interested in making a deal.

"I would hope for a strong fourth quarter where there are a lot

of reasons for people to buy," he said. GM, for instance, is

offering to finance Chevrolets for 72 months with a 0% interest

rate through Oct. 10.

Brad Sowers, owner of Chevrolet dealerships near St. Louis and

Jefferson City, Mo., said: "We're feeling pretty good about the

finish to the year, as long as the election doesn't screw it up too

much."

Ford's Mr. LaNeve said retail sales, which strip out fleet

deliveries and reflect activity among individual consumers, fell 1%

compared with the same period a year earlier. He added that

September 2015 was among the best performances in the industry's

history, making it tough to top.

Including fleet sales, September volume slipped below 1.5

million for the first time since February, declining 0.5% compared

with the prior year, according to Autodata Corp. The firm said the

rate for seasonally adjusted annual sales was 17.76 million, among

the highest for 2016 but far behind the SAAR of 18 million notched

in September 2015.

GM's sales slipped 0.6% to 249,795 vehicles amid a continued

reduction in fleet sales and falling pickup sales; its

once-dominant market share is now below 17%. Ford, also pulling

back from fleet sales during the month, skidded 8.1% to 203,444

vehicles.

Fiat Chrysler edged down 0.9% to 192,883 vehicles as the Jeep

brand posted a 3% decline. Toyota's overall sales rose 1.5% to

197,260 vehicles amid solid truck sales, a trend that Nissan rode

to a 4.9% increase to 127,797 vehicle sales. Honda, meanwhile,

reported a 0.1% decline to 133,655 vehicles sold.

Mike Colias contributed to this article.

Write to Anne Steele at Anne.Steele@wsj.com and John D. Stoll at

john.stoll@wsj.com

(END) Dow Jones Newswires

October 04, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

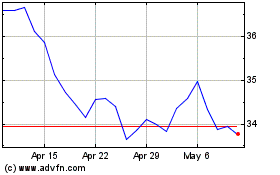

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

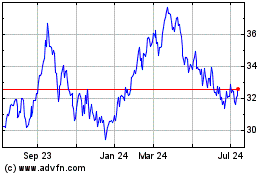

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024