Stocks in Asia Fall After Comments From Fed

August 29 2016 - 12:30AM

Dow Jones News

A rally in the U.S. dollar weakened the Japanese yen, sending

the Nikkei sharply higher on Monday amid broader equities weakness

elsewhere in Asia.

The Nikkei Stock Average was up 2.2% as the dollar gained after

Federal Reserve Chairwoman Janet Yellen signaled growing conviction

that the central bank will raise short-term interest rates in the

weeks or months ahead. A weaker yen helps Japanese exports.

Shares in major Japanese exporters rose sharply, with Toyota

Motor Corp. adding 4%, Honda Motor Co. gaining 3.5%, and Nissan

Motor Co. rising 2.6%.

The market expected hawkish commentary from the Fed and

investors were cautious leading up to last week's central banking

summit in Jackson Hole, Wyo., analysts said.

"All of the concerns and worries were addressed in [Ms.

Yellen's] speech," said Alex Wijaya, a senior sales trader at CMC

Markets.

Any doubt the markets had about the Fed's intentions were put to

rest by subsequent comments from Fed Vice Chairman Stanley

Fischer.

"I thought what Fischer said was a driver" of the currency

moves, said Naoki Fujiwara, a fund manager at Shinkin Asset

Management.

"He didn't rule out the possibility of a rate increase in

September," said Mr. Fujiwara.

The comments sent stocks in the U.S. lower on Friday, helping

the market there notch its largest weekly decline since the U.K.'s

vote to leave the European Union in June.

In morning Asian trade, the U.S. dollar was broadly higher

against most local currencies. The yen was last down 0.3% against

the dollar.

Meanwhile, the Malaysian ringgit fell 0.7% against the dollar,

the Indonesian Rupiah was off 0.5%, and the Australian dollar fell

0.3%.

The dollar's strength pushed commodity prices lower. Brent

crude, the global benchmark, was recently trading down US$0.56 at

$49.35 a barrel.

In Australia, the commodity-heavy S&P/ASX 200 fell 1.1%,

with Woodside Petroleum Ltd. falling 1.8% and Oil Search Ltd.

declining 2.3%. Rio Tinto Ltd. and BHP Billiton Ltd. fell 1.2% and

0.4%, respectively.

Elsewhere in Asia, stocks were under pressure as Ms. Yellen's

comments affirmed expectations for higher U.S. rates this year,

which could trigger fund flows into U.S.-dollar assets.

"A move at the September meeting remains less likely but a move

before year-end now looks a distinct possibility should U.S. data

continue to improve," said Lee Ferridge, head of multiasset

strategy at State Street Global Markets.

Hong Kong's Hang Seng Index was recently down 0.4%, while

Singapore's Straits Times Index was off 0.7%.

The Hong Kong-traded shares of China Petroleum & Chemical

Corp., or Sinopec, were down 0.9% after China's biggest refiner

reported a 22% decline in net first-half profit from a year earlier

to 19.92 billion yuan (US$2.98 billion).

In South Korea, the Kospi was down 0.2% with shares of Hyundai

Motor Co. falling to their lowest level in a week, after its

workers rejected a wage deal agreed to by their leaders and

management, a rare move that could signal more industrial action

and production losses at South Korea's largest auto maker. Shares

of the auto company were recently down 1.1%.

Gold prices retreated to a month's low after the Fed's comments,

even though the broad outlook for the commodity remains bullish,

due to demand for haven assets on debt worries in Italy and the

coming U.S. elections.

Gold was last trading 0.2% higher at $1,317.36 per ounce.

Ese Erheriene, Kosaku Narioka, In-Soo Nam and Biman Mukherji

contributed to the article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

August 29, 2016 00:15 ET (04:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

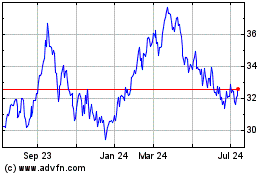

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

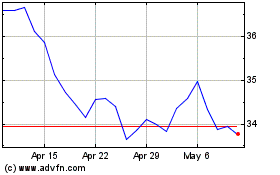

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024