Nissan Tries Mega-Warranty on Titan

August 15 2016 - 1:10PM

Dow Jones News

Nissan Motor Co. is rolling out the Titan of truck

warranties.

Long a laggard in the U.S. full-size truck market, the Japanese

auto maker is offering its new 2017 Titan pickup with a five-year,

100,000-mile bumper-to-bumper warranty this year—coverage that far

exceeds what rival truck makers are offering. The average

comparable truck warranty stands at around three years and 36,000

miles.

The move comes as Nissan tries to reboot its image with truck

buyers and put a dent in the Detroit car makers' long-running

dominance of the U.S. full-size truck market at time when low

gasoline prices are fueling demand for brawny pickups.

The diesel version of the redesigned Titan hit dealer lots late

last year and a higher-volume crew cab is expected to arrive this

month.

Nissan believes the new truck could easily triple or quadruple

sales of the previous-generation model, but so far, the Titan has

gotten off to a slow start.

The company has sold only 7,242 trucks in the first seven months

of the year, up 0.9% from the same year-ago period, according to

Autodata Corp. Ford Motor Co., the market leader in trucks, sold

65,657 F-series pickups in July alone.

Phil O'Connor, marketing director for Nissan, says the company

is hoping the new warranty offer will help the Titan stand out. He

stressed the offer isn't a response to the truck's sluggish sales

this year but rather a way to highlight reliability.

"What we have found is that advertising is only so effective,"

Mr. O'Connor said in an interview. A five-year, 100,000-mile

warranty offer on Nissan's cargo vans in 2014 helped it to boost

sales.

Dave Sullivan, an analyst with consulting firm AutoPacific,

Inc., said the warranty could help boost potential buyers'

confidence in the truck's quality. But Nissan is likely to face

steep challenges poaching customers from rival truck makers, he

said.

"It is an absolute bloodbath to try and get converts right at

the moment," Mr. Sullivan said.

Spokespeople for rival truck brands Ford, Chevy and Fiat

Chrysler Automobiles NV's Ram declined to comment on Nissan's

warranty offer but defended the quality and coverage of their own

trucks.

Nissan has largely sat on the sidelines of the U.S.'s

highly-profitable truck market since launching the full-size Titan

in 2004 during the last pickup-truck boom. Delays redesigning the

current Titan have left dealers struggling with an aging pickup

model that has sold poorly against the more-established brands.

While Nissan doesn't expect sales of the new Titan to match

rivals Ford and General Motors Co. in sales, it is relying on the

pickup to move it closer to meeting Chief Executive Carlos Ghosn's

goal of 10% U.S. market share in early 2017. Nissan's U.S. market

share was 8.7% in July.

Nissan, along with Japanese rivals Toyota Motor Corp. and Honda

Motor Co., have long trailed the U.S. car makers in truck sales,

putting them at a disadvantage when gasoline prices fall and demand

for full-size pickups rises.

Truck buyers tend to be fiercely loyal and winning over

defectors is even difficult for leading brands like Chevy and

Ram.

Christina Rogers contributed to this article.

Write to Jonathan Bach at jonathan.bach@wsj.com

(END) Dow Jones Newswires

August 15, 2016 12:55 ET (16:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

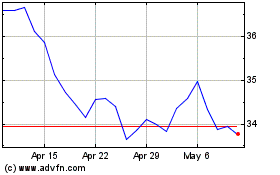

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

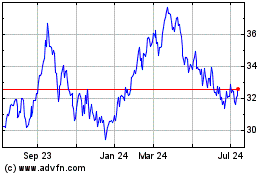

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024