By John D. Stoll and Christina Rogers

Auto dealerships grew a bit quieter in May as U.S. consumer

demand for new cars continues to ease, forcing manufacturers to

rely more heavily on sales to rental car and other bulk buyers to

keep production lines humming.

In total, Americans purchased 1.54 million cars and light trucks

last month in the U.S., according to data provider Autodata Corp.,

6% fewer than a year earlier. The drop largely is due to two fewer

selling days last month; sales were up modestly when adjusted for

seasonal factors.

But other key measures fell last month compared with a year ago,

including annualized sales pace and consumer purchases at dealers.

That shift is fueling worries that demand in the world's most

profitable vehicle market has peaked.

The nation's largest auto maker, General Motors Co., which

recently has focused more on retail buyers, posted a sharper

decline than rivals. Toyota Motor Corp. also reported a sales drop,

eroding U.S. market shares for two of the biggest auto makers in

the world in 2016.

Overall, sales to individual consumers fell 10.6% in May,

according to GM. Such sales are considered the best indicator of

market demand.

"They're all just cranking up volume and someone is going to

have to blink," said Mike Sullivan, a Los Angeles-area dealer for

Volkswagen AG, Toyota, and other brands. "They're building too many

vehicles and need to pull back," he said of car makers.

A U.S. stall would be worrisome because other international

markets are shrinking or still trying to recover from the 2008-2009

financial crisis. Russia and Brazil remain down significantly.

China has been offering sales-tax discounts to fuel sales gains,

and Europe only returned to precrisis volumes in April.

Thomas King, a vice president at market researcher J.D. Power,

said U.S. retail sales are flagging because, after six years of

industry sales gains, momentum can no longer be sustained by

available buyers. Pent-up demand has been ample since the financial

crisis, mostly because the industry's nadir was so severe. But that

trend now is being pressured by leased vehicles returning to

dealers, boosting the supply of late model used cars.

Another red flag: Sales incentives crept up 11% last month

compared with the prior May, exceeding $3,000 per vehicle on

average, Autodata reports. Incentives include increased use of

subsidized leases that help keep car payments low even as sticker

prices rise.

Bill Fox, co-owner of Fox Dealerships in Auburn, N.Y., said

there are signs of demand plateauing, and last year's 17.5

million-sales mark is "probably not attainable this year at the

rate we're going unless we see some change."

If retail weakness persists, analysts say auto makers will need

to further boost discounts or cut output levels that have

consistently grown since the financial crisis. Some dealers say it

is time for that to happen.

The overall pace of sales has been slowing since auto makers

notched a string of extraordinary gains in late 2015. May's

seasonally-adjusted annual sales rate, or SAAR, was 17.45 million

vehicles, a healthy number by historic standards, but well behind

the pace set in May 2015 and short of the 18 million-plus level set

late last year. That is discouraging for auto makers who already

have been boosting incentives and rely on Memorial Day bonanzas to

spark the summer selling season.

Fiat Chrysler Automobiles NV and Subaru, which have been riding

high on strong positions in sport-utility vehicles, squeezed out

modest increases to extend their monthly increases to 74 months and

54 months, respectively.

Fiat Chrysler's U.S. sales edged 1.1% higher in May, relying on

its Jeep brand's 14% jump for its growth as the Chrysler, Dodge and

Fiat brands fell from a year ago. Toyota reported a 9.6% sales

decline, Honda Motor Co. sales were off nearly 5%, and Nissan Motor

Co. reported a 1% drop.

For now, substantial gains from fleet buyers who purchase

outside the dealer network is propping up industry sales and

keeping volumes near the record pace set in 2015. Fleet sales last

month increased 13% compared with May 2015.

Fleet sales can be harmful to profits because some are sold at a

discount to rental lots, a practice that erodes margins and

potentially undercuts vehicle resale values. A substantial portion

of fleet sales, however, are booked as lucrative deliveries to

fleet owners needing trucks or vans. Ford Motor Co. sells high

volumes of F-series pickups and Transit vans to government agencies

or construction firms, helping it avoid steering too many models to

rental agencies.

Ford posted a 6.1% decline in May, hurt by a 25% slide in

passenger car sales, which are weak across the industry. Sales of

F-series pickups rose 9%, and Ford vans hit their best tally since

1978. Ford retail sales fell 7%, while fleet sales fell 4%, the

company said.

GM's total sales slid 18% in the month. While its sales have

been declining for months due to a pullback in deliveries to fleet

buyers, the company's retail sales also slipped 13%, mostly due to

fewer selling days and "very tight supplies of new launched

products."

GM has been caught short-handed when it comes to key models,

including a new Cadillac crossover SUV called the XT5. Designed to

replace the outdated SRX in Cadillac's market, the XT5 has been

very slow to reach dealer lots even though luxury crossover SUVs

are among the most in-demand vehicles amid gasoline prices that are

at a decade low, according to AAA.

Rich Walicki, vice president of Jim Winter Buick-GMC-Cadillac in

Jackson, Mich., said he is encouraged by GM's plan to boost truck

output and offer bigger discounts on its pickups and SUVs. Messrs

Walicki and Fox both said sedan volumes remain soft, so it makes

sense to shift production to the heavier vehicles that are

considered GM's sweet spot.

Write to John D. Stoll at john.stoll@wsj.com and Christina

Rogers at christina.rogers@wsj.com

(END) Dow Jones Newswires

June 02, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

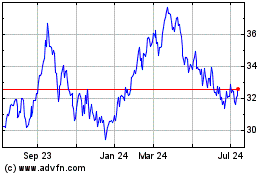

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

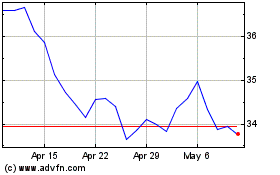

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024