Asian Shares Widely Lower as Strong Yen Drags on Japan

June 02 2016 - 1:00AM

Dow Jones News

Japanese stocks slumped as yen strength persisted, while shares

elsewhere in Asia were choppy.

Japan's Nikkei Stock Average was off 2.3% Thursday, Australia's

S&P/ASX 200 was down 0.9% and the Shanghai Composite Index

slipped 0.2%. Korea's Kospi and Hong Kong's Hang Seng Index were

both up 0.1%.

Stocks in Japan fell as the yen extended gains against the U.S.

dollar. The currency had strengthened late Wednesday after Prime

Minister Shinzo Abe put off a national sales-tax increase,

scheduled for next year, until October 2019.

"People are pessimistic regarding this delayed tax," said

Margaret Yang, market analyst for CMC Markets. "Japan has a

relatively high GDP-to-debt ratio. If they can't increase [the] tax

rate, they may not be able to reduce debt burden further."

The yen was as strong as 108.93 to the U.S. dollar during early

Asian trading hours. A stronger currency makes Japanese exports

less competitive and erodes the repatriated earnings of Japanese

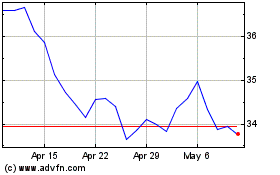

exporters. Shares of Toyota Motor Corp. were down 1.1%, Nissan

Motor Corp. was 1.9% lower and Honda Motor Co. was off 3%.

"I think the postponement of the sales tax hike may have led to

less expectations of more monetary easing" at the Bank of Japan's

policy meeting mid-June, said Qi Gao, a currency strategist for

Scotiabank.

Easing policies are designed in part to weaken the yen and boost

the economy, so the delay triggered an unwinding of bearish yen

bets, analysts said.

In China, the main stock benchmark in Shanghai looked on track

to book a fourth consecutive day of gains. Analysts said it was

partly due to continuing hopes that global index provider MSCI will

soon add mainland-listed stocks to an influential index.

"In the short-term, MSCI hopes will provide some buffer, some

cushion to equity markets in Hong Kong and Shanghai," Ms. Yang

said.

After U.S. stocks closed little changed overnight in thin

trading, analysts said markets in Asia had little direction to move

higher. An improvement in U.S. manufacturing activity data

overnight offset pessimism over a fall in U.S. construction

spending, but signs that the U.S. economy is recovering didn't

boost stocks.

On Thursday, traders in Asia were also waiting for an

Organization of the Petroleum Exporting Countries meeting later

Thursday in Vienna, where an oil production ceiling could be on the

table.

In other markets, most Asian currencies were, like the yen,

strengthening against the dollar, including the Korean won and

Singapore dollar. The ringgit, though, weakened as more funds

increased the size of their hedges against the risk of currency

depreciation and holdings of Malaysian government bonds, traders

said.

Hiroyuki Kachi and Ewen Chew contributed to this article.

Write to Dominique Fong at Dominique.Fong@wsj.com

(END) Dow Jones Newswires

June 02, 2016 00:45 ET (04:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

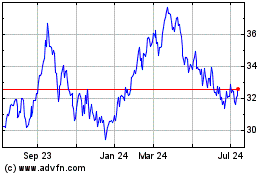

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024