Ford Boasts Buoyant Chinese Car Sales in 2015

January 08 2016 - 2:40PM

Dow Jones News

Ford Motor Co. is the second Detroit auto maker to say it ended

last year on a high note in China, reporting a 27% increase in

December sales, as automobile demand continues to rebound in the

world's biggest light-vehicle market.

Ford's December performance caps a record year for the No. 2

U.S. auto maker, following a late-year surge by General Motors Co.,

which sells more than three times more vehicles in China than its

smaller crosstown rival.

For the year, Ford's China sales topped 1 million units and

increased 3%, compared with the same period a year ago. The company

said the launch of its Lincoln luxury-car brand in China got off to

a good start in 2015.

The Dearborn, Mich.-based auto maker is a latecomer to China.

GM, Germany's Volkswagen AG and others entered the market with

products decades ago and have been expanding capacity and sales

channels ever since.

Ford will continue to grow its footprint in China, particularly

for a Lincoln premium brand scrambling to catch up to GM's

Cadillac, Daimler AG's Mercedes-Benz, BMW AG and others. Ford's

11,630 Lincoln deliveries in 2015 equaled a fraction of the 79,779

Cadillacs sold over the same period.

Ford aims to have 60 Lincoln dealerships in 50 cities by

year-end, and it will introduce the Continental sedan to the market

this year. The Continental will battle against Cadillac's CT6,

which hits showrooms this year as well.

Outside of the U.S., China is considered one of the most

profitable markets in the world. But China, like a handful of other

emerging markets, provided its share of turbulence to the global

auto industry in 2015.

Long billed as the world's most promising light-vehicle market,

China's rapid auto sales growth slowed, with car companies

reporting sluggish volumes early in the year and rare sales

declines in the summer months. Volumes rebounded in the fourth

quarter of the year, however, as new tax incentives led to what LMC

Automotive calls a "V-shaped rebound."

Local auto makers selling so-called new energy vehicles, such as

electric cars, are benefiting from policies aimed at sparking sales

of more efficient products. SUVs and crossover vehicles—segments

where some non-Chinese auto makers thrive—have also been

strong.

Not every auto maker is enjoying an upswing, however.

Volkswagen, one of the dominant players in China, reported a 2.1%

decline in December and a 3.4% decline over the course of the

year.

VW, rocked by a global diesel-emissions cheating scandal, said

it sold 3.55 million vehicles in China last year, compared with

GM's record 3.61 million. GM reported a 14% increase in December

sales and a 5.2% increase for the year.

Full Chinese light-vehicle sales statistics are due later in

January. Several auto makers posted sales gains in December and the

2015 calendar year, according to a roundup of results published by

WardsAuto.com. Japan's Honda Motor Co. and Nissan Motor Co. were

among the winners in last year's sales chase.

Meanwhile, auto makers and analysts have a muted view on 2016's

prospects. Toyota Motor Co. has led the companies calling for

growth rates this year well below the high-single-digit percentage

increase estimated for 2015. Barclays' auto analyst Brian Johnson

said he expects growth in China to be "at a more tapered level than

earlier in the decade and a lower absolute volume than most would

have expected a year ago."

The sales pace in the final months of last year was sizzling.

Car makers in China shipped about 2.2 million passenger vehicles in

November, a 24% increase over the same period a year earlier. That

jump was largely because of Beijing's halving of the purchase tax

on small cars to 5% from 10%, covering about 70% of the vehicles

sold in China.

Still, analysts are concerned about a glut of capacity. Credit

Suisse for instance, estimates there was a sharper increase in

production than sales in November, helping drive up sales

incentives and stoking fears that a price war in China will

accelerate.

"Optimism for sales activity in the Chinese market has increased

dramatically since the government announced measures to reduce the

vehicle purchase tax," IHS Automotive said in a forecast issued on

Friday. "However, continued stock market volatility may intimidate

some buyers." The firm now expects light vehicle sales growth to

increase 5% to 6% in 2016, enough to add more than 1.3 million

units of additional sales.

Write to Anne Steele at Anne.Steele@wsj.com and John D. Stoll at

john.stoll@wsj.com

(END) Dow Jones Newswires

January 08, 2016 14:25 ET (19:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

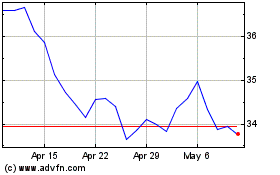

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

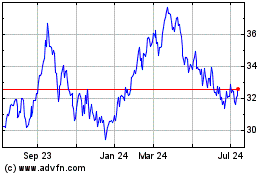

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024