The rally that pushed Shanghai shares into bull market territory

this week singles out China's market from others in Asia, where a

stronger U.S. dollar is pressuring firms.

The Shanghai Composite Index and the Shenzhen Composite Index

are each up roughly 4% for the week as of Thursday's close.

Shanghai entered a bull market on Thursday, rising 20% since Aug.

26, the bottom of what had been a volatile summer selloff for

mainland equities. A bull market is defined as a rise of 20% from a

recent low.

Performance elsewhere has been lackluster, as central banks in

Australia and Japan dashed investors' hopes of adding stimulus for

now, despite an uncertain economic outlook.

Australia's S&P/ASX 200 is on track to shed 0.8% this week

and Japan's Nikkei Stock Average is on track to gain 0.8%. Hong

Kong's Hang Seng Index is up 1.2% for the week so far.

Trading in the region was tepid early Friday. The Hang Seng was

down 0.6% and the Shanghai Composite fell 0.2%.

The Nikkei and Kospi gained fractionally, while the S&P/ASX

200 slipped 0.5%.

In November, investors have focused on country-specific news,

explaining the "divergence between markets," said Ilya Feygin,

managing director at New York-based brokerage WallachBeth Capital.

That's a shift from October, when global central bank moves tended

to drive markets in one direction: up.

Expectations that the dollar will rise more against global

currencies will pressure companies in Asia, Mr. Feygin added, given

Federal Reserve Chairwoman Janet Yellen has kept a December rate

increase on the table.

A stronger dollar makes it more expensive for firms in emerging

markets, in Asia and globally, to pay off dollar-denominated debt,

which has risen in recent years.

The Wall Street Journal Dollar Index, which compares the

greenback against a basket of 16 commonly traded currencies, has

risen 0.8% this week through its close Thursday in the U.S.

The index rose 0.2% to 89.37 overnight, reaching its highest

level in almost 13 years.

Some analysts expect monthly employment data out of the U.S. on

Friday to firm up expectations of a December rate increase. Ms.

Yellen said earlier in the week that the central bank could raise

rates by year-end if the U.S. economy remains on track.

U.S. stocks closed slightly lower overnight, as investors shied

from making broader market bets ahead of the release.

One market benefiting from the dollar's relative strength,

however, has been Japan.

A weakening yen, down roughly 0.9% against the U.S. dollar this

week, helps make Japanese goods more competitive, and has lifted

shares of exporters.

The yen was last at ¥ 121.69 to one U.S. dollar, down 0.1%

compared with its level late Thursday in Asia.

Shares of Japan Post Holdings Co. and its financial units have

gained by double digits since they started trading on Wednesday for

the first time. Analysts said the initial public offering of the

state-owned mail delivery business, the largest privatization for a

Japan firm in decades, signaled investor confidence in Prime

Minister Shinzo Abe's corporate reforms.

Shares of Japan Post Holdings, Japan Post Bank Co. and Japan

Post Insurance Co. are up 27%, 18% and 69% from their respective

premarket IPO prices.

Meanwhile, shares of Takata Corp. fell 13% on Friday, amid

allegations the firm misrepresented and manipulated test data for

its air-bag inflaters.

The stock fell 25% the previous day, as more Japanese auto

makers followed Honda Motor Co.'s footsteps and signaled they may

avoid using certain air-bag inflaters made by Takata in their new

vehicles.

China's stock market was leading gains this week after the

central bank had published an out-of-date statement on Tuesday

about a possible Shenzhen-Hong Kong trading link launching this

year. The comments nevertheless fueled excitement about an influx

of foreign money, pushed up some local brokerage shares up 10% for

two days in a row. The gains were enough to tip the Shanghai

Composite into bull territory, an astounding milestone after a

volatile summer wiped out trillions of dollars in value from

mainland equities and rattled global markets.

Some analysts have said that state-back funds, first tasked to

support the market during the throes of the selloff in July, may

have made another push this week to increase holdings in blue

chips.

Elsewhere, brent crude oil was up 0.3% at $48.12 a barrel in

early Asia trade Friday.

U.S. oil prices slid overnight as a bigger-than-expected

increase in U.S. oil stockpiles, falling product prices and strong

production number out of Russia kept gains in check.

Gold prices were flat at $1,105.10 a troy ounce.

Write to Chao Deng at Chao.Deng@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 05, 2015 21:35 ET (02:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

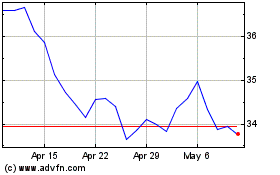

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

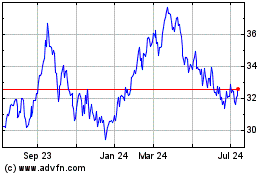

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024