Hecla Mining Company (NYSE:HL) today announced third quarter net

loss applicable to common shareholders of $10.0 million, or $0.03

per share, and a loss after adjustments applicable to common

shareholders of $20.5 million, or $0.05 per share.1

THIRD QUARTER HIGHLIGHTS AND SIGNIFICANT ITEMS

- Sales of $104.9 million.

- Adjusted EBITDA of $17.8 million.2

- Operating cash flow of $26.8

million.

- Total silver production of 2.6 million

ounces at a cash cost, after by-product credits, per silver ounce,

of $7.52.3

- Gold production of 43,635 ounces, of

which Casa Berardi produced 29,259 ounces at a cash cost, after

by-product credits, per gold ounce of $793.3

- Cash and cash equivalents of $174.5

million at September 30, 2015.

- San Sebastian, Hecla's fourth operating

mine, expected to produce ore by year end. Stripping has started

exposing the Middle Vein.

- Strong exploration success at San

Sebastian and Casa Berardi.

"During the third quarter we delivered solid production

performance, with Greens Creek continuing to lead the way. Cash

costs, after by-product credits, were higher because of the weak

price of our by-product metals," said Phillips S. Baker Jr.,

Hecla's President and CEO. "Hecla's cash flow and balance sheet

have allowed continued investment in capital improvements, growth

and exploration initiatives; the benefits of which are just

beginning to be realized. We expect San Sebastian to start

processing ore by year end, Casa Berardi is accessing a newly

discovered, high-grade stope and the Lucky Friday has returned to

full production after replacing the main ventilation booster

fans."

(1) Loss after adjustments applicable to

common shareholders represents a non-US Generally Accepted

Accounting Principles (GAAP) measurement, a reconciliation of which

to net income (loss) applicable to common shareholders (GAAP), the

most comparable GAAP measure, can be found at the end of the

release. (2) Adjusted EBITDA is a non-GAAP measurement, a

reconciliation of which to net income (loss), the most comparable

GAAP measure, can be found at the end of the release. (3)

Cash cost, after by-product credits, per silver and gold ounce

represents a non-GAAP measurement, a reconciliation of which to

cost of sales and other direct production costs and depreciation,

depletion and amortization, the most comparable GAAP measures, can

be found at the end of the release.

FINANCIAL OVERVIEW

Net loss applicable to common shareholders for the third quarter

was $10.0 million, or $0.03 per share, compared to net gain

applicable to common shareholders of $3.5 million, or $0.01 per

share, for the same period a year ago, and was impacted by the

following items:

- Cash cost, after by-product credits,

per gold ounce decreased to $793 from $898, or 12%, from third

quarter 2014 principally due to the weaker Canadian dollar relative

to the US dollar.1

- Cash cost, after by-product credits,

per silver ounce increased to $7.52 from $5.43, or 38%, mainly due

to lower by-product credits resulting from lower gold, lead and

zinc prices than in the same period in 2014.1

- Net mark-to-market gain on base metal

derivative contracts of $3.3 million as a result of lower base

metals prices, compared to a net loss of $0.4 million in the third

quarter of 2014.

- Increased pre-development spending on

San Sebastian in preparation for mining.

- A $9.1 million foreign exchange gain on

Canadian assets due to a weaker Canadian dollar compared to the US

dollar.

Third Quarter Ended

Nine Months Ended September 30,

September 30,

September 30, September 30,

HIGHLIGHTS

2015 2014

2015 2014

FINANCIAL DATA

Sales (000)

$104,941 $135,507

$328,230

$378,796 Gross profit (000)

($2,561 ) $22,023

$26,776 $62,994 Income (loss) applicable to common

shareholders (000)

($10,028 ) $3,538

($24,419

) $505 Basic and diluted loss per common share

($0.03

) $0.01

($0.07 ) $— Net income (loss) (000)

($9,890 ) $3,676

($24,005 ) $919 Cash

provided by operating activities (000)

$26,795 $1,739

$78,968 $58,768

Operating cash flow of $26.8 million was approximately $25

million higher for the third quarter of 2015 compared to the prior

year period. While lower prices in the third quarter of 2015

resulted in lower net income, 2014's comparative results were

driven lower by satisfying the remainder of the Coeur d'Alene Basin

litigation settlement.

Capital expenditures (excluding capitalized interest) at the

operations totaled $39.0 million for the third quarter.

Expenditures were $16.5 million at Lucky Friday, $13.6 million at

Greens Creek and $8.9 million at Casa Berardi.2

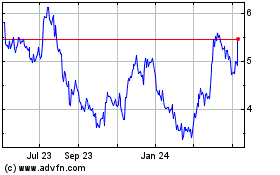

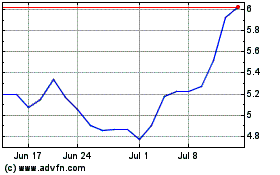

Metals Prices

The average realized silver price in the third quarter was

$14.54 per ounce, 22% lower than the $18.53 price realized in the

third quarter of 2014. Realized gold, lead and zinc prices also

decreased by 12%, 24%, and 22% respectively, from the third quarter

of 2014.

(1) Cash cost, after by-product credits, per

silver and gold ounce represents a non-GAAP measurement, a

reconciliation of which to cost of sales and other direct

production costs and depreciation, depletion and amortization, the

most comparable GAAP measures, can be found at the end of the

release. (2) Numbers may not add due to rounding.

Third Quarter Ended

Nine Months Ended September 30,

September 30,

September 30, September 30,

2015

2014

2015 2014

AVERAGE METAL

PRICES

Silver - London PM Fix ($/oz)

$14.91 $19.74

$16.01 $19.95 Realized price per ounce

$14.54 $18.53

$16.08 $19.35 Gold - London PM Fix

($/oz)

$1,124 $1,282

$1,179 $1,288 Realized price per

ounce

$1,121 $1,275

$1,177 $1,288 Lead - LME Cash

($/pound)

$0.78 $0.99

$0.83 $0.96 Realized price per

pound

$0.78 $1.02

$0.85 $1.00 Zinc - LME Cash

($/pound)

$0.84 $1.05

$0.93 $0.97 Realized price per

pound

$0.83 $1.07

$0.91 $0.98

Base Metals Forward Sales Contracts

The following table summarizes the quantities of base metals

committed under financially settled forward sales contracts at

September 30, 2015:

Pounds Under Contract

Average Price (in thousands) per Pound

Zinc Lead

Zinc Lead CONTRACTS ON

PROVISIONAL SALES

2015 settlements 18,684

6,283 $ 0.85 $ 0.76

With the advanced settlement of remaining financially settled

base metal forward contracts, other than contracts on provisional

sales, the Company recognized $4.4 million in additional proceeds

during the quarter. Settlements have provided net proceeds of $16.5

million year to date.

OPERATIONS OVERVIEW

Summary

- Greens Creek production of 2.0 million

ounces of silver is 5% higher than the 1.9 million ounces in the

same period of 2014 due to higher recovery and tonnage.

- Lucky Friday silver production of 0.6

million ounces is a decrease from 1.0 million ounces from the same

period of 2014 due to the impact on tonnage and grade of the

ventilation booster fan failure during the third quarter.

- Casa Berardi gold production of 29,259

ounces is a slight increase over 28,977 ounces in the same period

of 2014.

- San Sebastian is progressing rapidly

towards producing ore by year end.

The following table provides the production and cash cost, after

by-product credits, per silver and gold ounce summary for the third

quarters ended September 30, 2015 and 2014:

Third Quarter and Nine Months

Ended Third Quarter and Nine Months Ended

September 30, 2015 September 30, 2014

Production (ounces)

Increase/(decrease)over 2014

Cash costs, afterby-product credits,per

silver or goldounce1,2

Production (ounces)

Cash costs, afterby-product credits,per

silver or goldounce1,2

Q3 9 Mos Q3

9 Mos Q3 9 Mos

Q3 9 Mos Q3 9 Mos

Silver

2,591,546

7,947,293 (10)% 1%

$ 7.52 $

5.98 2,869,722 7,877,410

$ 5.43 $ 4.90 Gold

43,635 128,977 3%

(3)% $ 793

$ 861 42,501

132,323 $ 898 $ 911 Greens Creek:

Silver

1,992,037 5,884,128 5% 10% $

4.82 $ 3.79 1,890,929 5,367,249 $ 3.75 $ 2.95

Gold

14,376 43,368 6% 0% N/A

N/A 13,524 43,464 N/A N/A Lucky Friday

592,243

2,042,436 (39)% (18)% $ 16.60

$ 12.30 972,994 2,493,385 $ 8.71 $ 9.08 Casa Berardi3

29,259 85,609 1% (4)% $

793 $ 861 28,977 88,859 $ 898 $ 911 (1)

Cash cost, after by-product credits, per

silver or gold ounce represent a non-GAAP measurement, a

reconciliation of which to cost of sales and other direct

production costs and depreciation, depletion and amortization, the

most comparative GAAP measures, can be found at the end of the

release. (2) Cash cost, after by-product credits, per gold

ounce is only applicable to Casa Berardi production. Gold produced

from Greens Creek is treated as a by-product credit against the

silver cash cost. (3) Casa Berardi also produced 7,266

ounces of silver in the third quarter of 2015, which is treated as

a by-product credit against the gold cash cost.

The following table provides the production summary on a

consolidated basis for the third quarter and nine months ended

September 30, 2015 and 2014:

Third Quarter

Ended Nine Months Ended

September 30, 2015 September 30,

2014

September 30, 2015

September 30, 2014

PRODUCTION SUMMARY

Silver - Ounces produced

2,591,546

2,869,722

7,947,293 7,877,410 Payable ounces

sold

2,392,798 2,562,171

7,305,740 6,968,138 Gold -

Ounces produced

43,635 42,501

128,977 132,323 Payable

ounces sold

44,937 43,637

124,969 128,115 Lead - Tons

produced

9,123 10,604

28,526 30,468 Payable tons sold

8,315 8,976

24,068 25,210 Zinc - Tons produced

17,435 16,276

51,037 50,750 Payable tons sold

13,487 14,383

36,821 37,653

Greens Creek Mine - Alaska

Greens Creek's third quarter production of 2.0 million ounces of

silver exceeded the third quarter of 2014 by 5%, while gold

production of 14,376 ounces was up 6% over the same period last

year. The higher silver and gold production were a result of higher

recoveries and increased tonnage, partially offset by lower grades.

Silver recoveries increased to 76.5%, up from 71.0% in the prior

year period as a result of a change implemented in late 2014 to the

flotation circuit to more efficiently scalp additional lead

concentrate directly to final concentrate, and by introducing CO2

for pH control in the lead flotation circuit. The increased

recoveries positively impacted the operation's revenues by

$1.8 million in the third quarter. Recoveries for the other

three metals also increased period over period. The mill operated

at an average of 2,233 tons per day (tpd) in the third quarter.

The cash cost, after by-product credits, per silver ounce of

$4.82 increased from $3.75 in the third quarter 2014. The per ounce

cost was impacted by lower by-product credits and slightly lower

operating costs. Power costs were similar to the 2014 period due to

higher precipitation levels in southeast Alaska in both cases

resulting in availability of less expensive hydroelectric power, a

condition that is expected to last through the next quarter.

Treatment costs were lower as a result of lower prices.

Lucky Friday Mine - Idaho

Lucky Friday’s third quarter silver production of 592,243 ounces

was 39% lower than the third quarter of 2014 due to lower tonnage

and grade. A failure of the underground booster fan reduced the

ventilation capacity of the mine, leading to the temporary closure

of a higher-grade production stope. Replacement fans are now in

operation and Lucky Friday has returned to normal production. In

addition, there were 16 days of downtime in the third quarter for

planned hoist mechanical maintenance. The mill operated at an

average of 792 tpd in the third quarter.

The cash cost, after by-product credits, per silver ounce of

$16.60, increased from $8.71 per ounce in the third quarter of

2014. This increase was principally due to lower production and

realized metals grades relating to downtime from the ventilation

fan replacement, as well as lower by-product credits relating to

lower base metals prices.

#4 Shaft, a key growth project, has been excavated to the 8,244

level. The project is more than 89% complete and is expected to be

finished in the fourth quarter of 2016. The final depth of the

shaft has been slightly reduced to 8600 from the earlier target of

8800 feet. A shaft station and operating level will be established

at 8300 feet, the depth of the known resource. The total completion

cost estimate remains at approximately $225 million, with

$193.8 million already spent through the third quarter of

2015. As of September 30, 2015, the #4 Shaft team has

worked 1,413 days without a lost-time accident.

Casa Berardi Mine - Quebec

Casa Berardi’s third quarter gold production of 29,259 ounces

was 1% higher than the third quarter of 2014. The mill operated at

an average of 2,262 tpd in the third quarter.

The cash cost, after by-product credits, per gold ounce of $793,

decreased from $898 in the third quarter of 2014 mainly due to the

weaker Canadian dollar relative to the USD.

Casa Berardi started the fourth quarter very strongly, with

production of approximately 15,000 ounces of gold in October. The

mine is expected to produce approximately 40,000 ounces of gold in

the fourth quarter.

San Sebastian Mine - Mexico

Hecla is quickly advancing the San Sebastian mine in the State

of Durango, Mexico with the goal of producing ore from small open

pits by year end. Updates to the third-party owned processing plant

are proceeding well, the hiring of supervisory staff is nearing

completion, and stripping has begun on the East Francine and Middle

veins.

A Preliminary Economic Assessment (PEA) of the San Sebastian

project was recently completed and shows this is a robust project

and a potential significant cash contributor for Hecla in 2016 and

2017. Notably, the PEA does not include results of the recent

exploration and in-fill drilling programs described in the

Exploration section below that have expanded the resource and

improved the confidence of the resource in the open pit areas.

Hecla has filed in Canada a National Instrument 43-101 technical

report for the San Sebastian project entitled "Technical Report for

the San Sebastian Ag-Au Property, Durango, Mexico" dated effective

September 8, 2015. The report has been filed under the

Company's profile on SEDAR at www.sedar.com, the website maintained

by the Canadian Securities Administrators.

The following is a summary of the high-level life of mine

economic assumptions of surface mining operations, as outlined in

the PEA.1,2

Unit Value Total

Projected Mill Feed tons 273,352

Mill Throughput tons per day 440

Gold Grade oz/ton 0.14 Silver

Grade oz/ton 23.9 Gold Recovery

% 90.8% Silver Recovery

% 85.5% Gold Produced (recovered)

ounces 35,959 Silver Produced

(recovered) ounces 5,585,098

Silver Equivalent Production ounces

8,138,740 Capital (mining and milling)

$ million 5.8 Cash cost, after by-product credits,

per silver ounce3 $/ounce 5.49

Total After Tax Cash Flow (5% discount) $

million 43.0 IRR %

404 (1) The

PEA is preliminary in nature, and is based on a mineral resource

estimate that includes inferred mineral resources (approximately

10% of projected production) that are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves, and

there is no certainty that the PEA will be realized. Mineral

resources that are not mineral reserves do not have demonstrated

economic viability. (2) Results in this table assume

$1,103/oz gold and $15.53/oz silver prices and a 12.5 Peso/Dollar

exchange rate. (3) Cash cost, after by-product credits, per

silver ounce represents a non-GAAP measurement, and the most

comparable GAAP measures are cost of sales and other direct

production costs and depreciation, depletion and amortization.

EXPLORATION AND PRE-DEVELOPMENT

Expenditures

Exploration and pre-development expenses were $5.5 million and

$1.7 million, respectively, in the third quarter of 2015. This is a

decrease of $0.3 million in exploration and an increase $1.3

million in pre-development compared to the third quarter 2014 as a

result of increased spending at the San Sebastian property. Full

year exploration and pre-development expenses are expected to be

about $24 million.

Casa Berardi - Quebec

At Casa Berardi, up to seven drills have been operating

underground in an effort to refine current stope designs and expand

reserves and resources in the 118, 123, 124 and Lower Inter zones.

Other exploration drilling has extended mineralization on the 124

Zone and newly discovered 117 Zone. In-stope and definition

drilling of the upper 118 Zone from the 530 level intersected a 15

to 55-foot wide shear zone that includes mineralized intervals of

0.74 oz/ton gold over 42.3 feet and 0.18 oz/ton gold over 55.4

feet. Mineralization is open and deeper drilling suggests the zone

continues to plunge to the west. Drilling from the 910 level on the

lower 118 Zone intersected 0.46 oz/ton gold over 18.7 feet and 0.36

oz/ton gold over 28.8 feet. This drilling has extended the resource

to the east and also remains open to depth.

Drilling from the 550, 770, and 850 levels in the mine has

identified multiple, stacked high-grade lenses of the 123 Zone that

represent at least 1,800 feet of semi-continuous down-dip

mineralization with an average strike length of 425 feet.

Definition and step-out drilling at the bottom of the 123 Zone

resource has defined a series of high-grade mineralized structures

with intervals including 0.81 oz/ton gold over 23.6 feet and 0.73

oz/ton gold over 11.8 feet below the 850 level that are open at

depth and to the west. Future drilling is expected to continue to

expand the resource, and the close proximity of these new lenses to

mine infrastructure is expected to allow near-term production from

these areas.

Underground drilling on the 124 Zone east of the Principal Zone

area defined a 15 to 60-foot thick, quartz-bearing zone with over

300 feet of strike length that is expected to define a resource

close to the 250 level. Within this zone are high-grade lenses,

including intervals of 1.50 oz/ton gold over 9.2 feet and 0.71

oz/ton gold over 11.8 feet at the 290 level. Drilling from the same

level of the 124-81 lens includes intersections of 0.40 oz/ton gold

over 8.2 feet. Deeper drilling of the 124 Principal Zone

intersected broad mineralization at the 500 level including 0.26

oz/ton gold over 36.1 feet and 0.25 oz/ton gold over 16.1 feet.

Exploration drilling from the 810 level of the newly defined 117

Zone has extended gold mineralization both north and south of the

Casa Berardi Fault for over 325 feet down-plunge. Recent drill

results include an interval of 0.13 oz/ton gold over 17.1 feet in

iron formation north of the Casa Berardi Fault and 0.15 oz/ton gold

over 21.8 feet in sheared veins to the south of the Casa Berardi

Fault.

At the west end of the mine, drilling of the Lower Inter Zone

intersected 1.04 oz/ton gold over 19.7 feet and 1.37 oz/ton gold

over 9.8 feet and these intersections represent the upper extension

of a multiple vein system that is open. Exploration drilling on the

157 Zone at the East Mine has better defined the geometry and

continuity intersected narrow, high-grade zones including an

intersection of 1.26 oz/ton gold over 3.3 feet.

The recent successes in both surface and underground drilling

are expanding reserves and resources with considerable increases in

overall grade and are also identifying new resource trends

throughout the West Mine of Casa Berardi. When the acquisition of

Casa Berardi was made, there was an expectation of finding

significant mineralization that would prolong gold production for

many years to come, and this expectation is being realized.

San Sebastian - Mexico

There has been significant drilling success over the past two

and a half years on the near-surface East Francine, Middle and

North veins at the San Sebastian project, and the project is

quickly advancing to open pit mine production. The East Francine,

Andrea, Middle and North veins now define nearly 5.0 miles of

mineralized strike length and are open along strike and at

depth.

The East Francine Vein has currently been traced for over 1,600

feet along strike and to 500 feet of depth. The near-surface,

high-grade zones are characterized as being silver and gold

dominant, supergene enriched and oxidized (cyanide soluble). An

in-fill drill program of the main mineralized shoot has

demonstrated the continuity of the vein structure and increased

resource confidence to measured and indicated categories in the

proposed open pit areas. The drilling also appears to extend the

high-grade area further along strike, potentially expanding the

open pit resource. Assay results from drilling at the east extent

of the East Francine Vein resource include 0.17 oz/ton gold and 8.2

oz/ton silver over 23.9 feet. About 550 feet east of the resource a

1 foot-wide vein grading 0.07 oz/ton gold and 10.5 oz/ton silver

was intersected in recent exploration drilling suggesting

mineralized veins are present well away from the current

resource.

The Middle Vein has been traced for nearly 7,000 feet along

strike and to a depth of over 1,000 feet. Shallow in-fill drilling

of the Middle Vein confirmed the continuity of the vein

mineralization and includes intercepts of 0.20 oz/ton gold and 54.2

oz/ton silver over 5.9 feet and 0.11 oz/ton gold and 38.4 oz/ton

silver over 6.5 feet. This in-fill program improved the continuity

and grade over previous drilling and has defined strong

mineralization beyond the original pit outline. Exploration

drilling continues to define a new zone of near-surface

mineralization to the southeast, past the San Ricardo Fault. The

zone is slightly deeper and shallower dipping than the Middle Vein

to the west of the fault, and assay intervals include 0.10 oz/ton

gold and 13.2 oz/ton silver over 7.0 feet, and 0.01 oz/ton gold and

11.1 oz/ton silver over 8.9 feet.

The North Vein has a mineralized trend that extends over 3,500

feet along strike and 700 feet to depth and remains open along

strike in both directions and at depth. The North Vein in-fill

drilling intercepts have returned grade results that are consistent

with the initial drilling completed prior to this year. These assay

intervals include 1.74 oz/ton gold and 15.9 oz/ton silver over 4.3

feet, and 0.29 oz/ton gold and 7.6 oz/ton silver over 4.8

feet. On the North Vein, some of exploration intercepts to the

southeast include 0.12 oz/ton gold and 3.7 oz/ton silver over 10.4

feet and 0.04 oz/ton gold and 11.7 oz/ton silver over 5.0 feet.

Exploration and in-fill drilling at San Sebastian over the last

two quarters has expanded the resources and improved the confidence

in near-surface resources to measured and indicated category. All

of the resource models are in the process of being updated. Updated

mining models of each vein are expected to be finalized by the end

of the year and are expected to provide upside to production

defined in the PEA study.

Greens Creek - Alaska

At Greens Creek, definition drilling made progress in refining

the resources of the lower NWW, Deep 200 South, Upper Southwest,

and West Wall zones. Exploration drilling of the 9A Zone expanded

the resource along the projected trend and mineralization has been

intersected on the margins of Southwest Bench and East Ore zones.

Recent drilling of the lower NWW Zone has generally confirmed and

upgraded the resource model of the shared and upper limbs and assay

results include 71.6 oz/ton silver, 0.16 oz/ton gold, 8.2% zinc,

and 4.6% lead over 5.4 feet and 36.2 oz/ton silver, 1.0 oz/ton

gold, 5.6% zinc, and 2.6% lead over 12.2 feet. Drilling has defined

additional West Wall mineralization up to 240 feet down-dip from

the current resource model. More base metal-rich intersections of

the West Wall include 5.8 oz/ton silver, 0.07 oz/ton gold, 27.9%

zinc, and 7.7% lead over 9.4 feet.

Drilling to follow up historic high-grade intersections of the

9A Zone has defined continuous mineralization within the Maki Fault

and above the southern end of the current resource. This drilling

has defined an 8 to 10-foot wide mineralized zone over an area

stretching about 260 feet along strike and 130 feet along dip.

Drilling of the Upper Southwest Zone has defined good continuity of

multiple, flat-lying mineralized zones toward the northern end of

Upper Southwest mineralization. Recent assay results include 25.4

oz/ton silver, 0.11 oz/ton gold, 8.8% zinc, and 4.5% lead over 18.2

feet and 24.0 oz/ton silver, 0.12 oz/ton gold, 13.2% zinc, and 7.4%

lead over 13.5 feet.

Drilling of the Deep 200 South Zone in the past few years has

defined three stacked folds of high-grade mineralization that

represent up to 600 feet of down-dip continuity. Recent drilling of

the folded upper bench mineralization has stepped systematically to

the south and has defined mineralization of similar extent,

thickness, and geometry compared to the resource model.

Intersections of Deep 200 South include 35.5 oz/ton silver, 0.09

oz/ton gold, 1.2% zinc, and 0.7% lead over 16.1 feet and 34.5

oz/ton silver, 0.05 oz/ton gold, 1.0% zinc and 0.4% lead over 9.8

feet along the upper limb. The mineralization remains open to the

south and exploration drilling recently identified mineralization

above and to the east of the bench mineralization.

More complete drill assay highlights from Casa Berardi, San

Sebastian and Greens Creek can be found in Table A at the end of

the release.

Other Properties

Summer fieldwork on the Opinaca-Wildcat project near the

Eleonore Mine in northern Quebec identified gold mineralization in

trenches at the Manuel occurrence including 0.35 oz/ton gold over

15.4 feet. Prospecting and sampling of the areas covered by an

Induced Polarization geophysical survey in April identified gold

mineralization in the Brad, Mousson and Emma grids.

At the recently acquired Rock Creek project in Montana, work

included integration and upgrading of the resource model and

exploration data into the Hecla database and modeling software.

MANAGEMENT CHANGE

James A. Sabala, Senior Vice President and CFO, has announced

that he intends to retire immediately after the Company's Annual

Shareholder Meeting in 2016. The Company has begun a search for his

replacement and will be considering both internal and external

candidates.

"Jim started his career at Hecla in 1972 working as a miner at

the Lucky Friday, and it is only fitting that he has spent the last

eight years of his management career at Hecla," said Phillips S.

Baker, Jr. "He has been a leader, a mentor and my partner in

transforming Hecla. Jim will be missed but his legacy is a stronger

Hecla positioned to grow and prosper in the future."

2015 GUIDANCE

For the full year 2015, the Company expects:

Mine

2015E¹

SilverProduction(Moz)

2015E GoldProduction

(oz)

Cash cost, after by-product

credits, persilver/gold ounce2,3

Greens Creek 7.7-8.0

59,000 $3.75 per silver ounce

Lucky Friday

2.8-3.0 n/a $10.75 per silver ounce

Casa Berardi n/a 126,000

$825 per gold ounce High end

Company-wide 10.5-11.0 185,000

$6.00 per silver ounce

Silver Equivalent Production:

Including all metals 35

2015E capital expenditures (excluding

capitalized interest)

$150 million

2015E pre-development and exploration

expenditures

$24 million

(1)

2015E refers to the Company's estimates for

2015.

(2)

Cash cost, after by-product credits, per silver and gold ounce

represents a non-GAAP measurement. A reconciliation of historical

cash cost, after by-product credits, per ounce of silver and gold

to cost of sales and other direct production costs and

depreciation, depletion and amortization, the most comparable GAAP

measures, can be found at the end of the release.

(3)

All metal equivalent production of 35 million silver oz includes

silver, gold, lead and zinc production from Lucky Friday, Greens

Creek and Casa Berardi converted using the following conversion

ratios: 60:1 gold to silver, 80:1 zinc to silver and 90:1 lead to

silver.

DIVIDENDS

Common

The Board of Directors declared a quarterly cash dividend of

$0.0025 per share of common stock, payable on or about December 1,

2015, to shareholders of record on November 19, 2015.

Preferred

The Board of Directors also declared the regular quarterly cash

dividend of $0.875 per share on the outstanding Series B Cumulative

Convertible Preferred Stock, on a total of 157,816 shares

outstanding. This represents a total amount to be paid of

approximately $138,000. The cash dividend is payable on January 4,

2016, to shareholders of record on December 15, 2015.

CONFERENCE CALL AND WEBCAST

A conference call and webcast will be held Wednesday, November

4, at 10:00 a.m. Eastern Time to discuss these results. You may

join the conference call by dialing toll-free 1-855-760-8158 or for

international by dialing 1-720-634-2922. The participant passcode

is HECLA. Hecla's live and archived webcast can be accessed at

www.hecla-mining.com under Investors

or via Thomson StreetEvents Network.

ABOUT HECLA

Hecla Mining Company (NYSE:HL) is a leading low-cost U.S. silver

producer with operating mines in Alaska and Idaho, and is a growing

gold producer with an operating mine in Quebec, Canada. The Company

also has exploration and pre-development properties in six

world-class silver and gold mining districts in the U.S., Canada

and Mexico, and an exploration office and investments in

early-stage silver exploration projects in Canada.

Cautionary Statements to Investors on Forward-Looking

Statements, including 2015 Outlook

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws, including

Canadian securities laws. Such forward-looking statements may

include, without limitation: (i) estimates of future production and

sales; (ii) estimates of the costs and completion date of the #4

Shaft project; (iii) guidance for 2015 for silver and gold

production, cash cost, after by-product credits, capital

expenditures and pre-development and exploration expenditures

(which assumes metal prices of gold at $1,225/oz., silver at

$17.25/oz., zinc at $0.90/lb. and lead at $0.95/lb. and USD/CAD at

$0.91); (iv) expectations regarding the development, growth and

exploration potential of the Company’s projects (including the San

Sebastian property); (v) expectations of growth; (vi) expected

availability of hydroelectric power at Greens Creek, and extensions

of mineralization of various zones; (vii) the possibility of

increasing production at Casa Berardi due to accessing higher grade

material, and strike and dip extensions of various zones; (viii)

possible strike extensions of veins at the San Sebastian project

and estimates of mining, grade, recovery, free cash flow

generation, mine life, IRR, ability to reactivate existing mill

permits, production of silver, gold and silver equivalent ounces,

ability to begin mining by year end, and the ability to mine the

high-grade ore; and (ix) expected completion of #4 Shaft by Q4 2016

with a budget of $225 million and to a depth of 8600 feet.

Estimates or expectations of future events or results are based

upon certain assumptions, which may prove to be incorrect. Such

assumptions, include, but are not limited to: (i) there being no

significant change to current geotechnical, metallurgical,

hydrological and other physical conditions; (ii) permitting,

development, operations and expansion of the Company’s projects

being consistent with current expectations and mine plans; (iii)

political/regulatory developments in any jurisdiction in which the

Company operates being consistent with its current expectations;

(iv) the exchange rate for the Canadian dollar to the U.S. dollar,

being approximately consistent with current levels; (v) certain

price assumptions for gold, silver, lead and zinc; (vi) prices for

key supplies being approximately consistent with current levels;

(vii) the accuracy of our current mineral reserve and mineral

resource estimates; and (viii) the Company’s plans for development

and production will proceed as expected and will not require

revision as a result of risks or uncertainties, whether known,

unknown or unanticipated. Where the Company expresses or implies an

expectation or belief as to future events or results, such

expectation or belief is expressed in good faith and believed to

have a reasonable basis. However, such statements are subject to

risks, uncertainties and other factors, which could cause actual

results to differ materially from future results expressed,

projected or implied by the “forward-looking statements.” Such

risks include, but are not limited to gold, silver and other metals

price volatility, operating risks, currency fluctuations, increased

production costs and variances in ore grade or recovery rates from

those assumed in mining plans, community relations, conflict

resolution and outcome of projects or oppositions, litigation,

political, regulatory, labor and environmental risks, and

exploration risks and results, including that mineral resources are

not mineral reserves, they do not have demonstrated economic

viability and there is no certainty that they can be upgraded to

mineral reserves through continued exploration. For a more detailed

discussion of such risks and other factors, see the Company’s 2014

Form 10-K, filed on February 18, 2015 with the Securities and

Exchange Commission (SEC), as well as the Company’s other SEC

filings. The Company does not undertake any obligation to release

publicly revisions to any “forward-looking statement,” including,

without limitation, outlook, to reflect events or circumstances

after the date of this news release, or to reflect the occurrence

of unanticipated events, except as may be required under applicable

securities laws. Investors should not assume that any lack of

update to a previously issued “forward-looking statement”

constitutes a reaffirmation of that statement. Continued reliance

on “forward-looking statements” is at investors’ own risk.

Qualified Person (QP) Pursuant to Canadian National

Instrument 43-101

Dean McDonald, PhD. P.Geo., Senior Vice President - Exploration

of Hecla Mining Company, who serves as a Qualified Person under

National Instrument 43-101, supervised the preparation of the

scientific and technical information concerning Hecla’s mineral

projects in this news release. Information regarding data

verification, surveys and investigations, quality assurance program

and quality control measures and a summary of sample, analytical or

testing procedures for the Greens Creek Mine are contained in a

technical report prepared for Hecla and Aurizon Mines Ltd. titled

“Technical Report for the Greens Creek Mine, Juneau, Alaska, USA”

effective date March 28, 2013, for the Lucky Friday Mine are

contained in a technical report prepared for Hecla titled

“Technical Report on the Lucky Friday Mine Shoshone County, Idaho,

USA” effective date April 2, 2014, and for the Casa Berardi Mine

are contained in a technical report prepared for Hecla titled

"Technical Report on the Mineral Resource and Mineral Reserve

Estimate for the Casa Berardi Mine, Northwestern Quebec, Canada"

effective date March 31, 2014 (the "Casa Berardi Technical

Report"), and for the San Sebastian Mine are contained in a

technical report prepared for Hecla titled “Technical Report for

the San Sebastian Ag-Au Property, Durango, Mexico" effective date

September 8, 2015. Also included in these four technical reports is

a description of the key assumptions, parameters and methods used

to estimate mineral reserves and resources and a general discussion

of the extent to which the estimates may be affected by any known

environmental, permitting, legal, title, taxation, socio-political,

marketing or other relevant factors. Copies of these technical

reports are available under Hecla's profile on SEDAR at

www.sedar.com.

Cautionary Statements to Investors on Reserves and

Resources

Reporting requirements in the United States for disclosure of

mineral properties are governed by the SEC and included in the

SEC's Securities Act Industry Guide 7, entitled “Description of

Property by Issuers Engaged or to be Engaged in Significant Mining

Operations” (“Guide 7”). However, the Company is also a "reporting

issuer" under Canadian securities laws, which require estimates of

mineral resources and reserves to be prepared in accordance with

Canadian National Instrument 43-101 (“NI 43-101”). NI 43-101

requires all disclosure of estimates of potential mineral resources

and reserves to be disclosed in accordance with its requirements.

Such Canadian information is being included here to satisfy the

Company's “public disclosure” obligations under Regulation FD of

the SEC and to provide U.S. holders with ready access to

information publicly available in Canada.

Reporting requirements in the United States for disclosure of

mineral properties under Guide 7 and the requirements in Canada

under NI 43-101 standards are substantially different. This

document contains a summary of certain estimates of the Company,

not only of proven and probable reserves within the meaning of

Guide 7, which requires the preparation of a “final” or “bankable”

feasibility study demonstrating the economic feasibility of mining

and processing the mineralization using the three-year historical

average price for any reserve or cash flow analysis to designate

reserves and that the primary environmental analysis or report be

filed with the appropriate governmental authority, but also of

mineral resource and mineral reserve estimates estimated in

accordance with the definitional standards of the Canadian

Institute of Mining, Metallurgy and Petroleum referred to in NI

43-101. The terms “measured resources,” "indicated resources," and

"inferred resources" are Canadian mining terms as defined in

accordance with NI 43-101. These terms are not defined under Guide

7 and are not normally permitted to be used in reports and

registration statements filed with the SEC in the United States,

except where required to be disclosed by foreign law.

Investors are cautioned not to assume that any part or all of the

mineral deposits in such categories will ever be converted into

proven or probable reserves. “Resources” have a great amount of

uncertainty as to their existence, and great uncertainty as to

their economic and legal feasibility. It cannot be assumed that all

or any part of such a "resource” will ever be upgraded to a higher

category or will ever be economically extracted. Investors are

cautioned not to assume that all or any part of a "resource” exists

or is economically or legally mineable. Investors are also

especially cautioned that the mere fact that such resources may be

referred to in ounces of silver and/or gold, rather than in tons of

mineralization and grades of silver and/or gold estimated per ton,

is not an indication that such material will ever result in mined

ore which is processed into commercial silver or gold.

HECLA MINING COMPANY

Condensed Consolidated Statements of

Income (Loss)

(dollars and shares in thousands, except

per share amounts - unaudited)

Third Quarter Ended Nine

Months Ended

September 30, September 30,

September 30, September 30,

2015 2014

2015 2014 Sales of products

$ 104,941 $

135,507

$ 328,230 $ 378,796 Cost

of sales and other direct production costs

79,273 86,680

220,805 235,460 Depreciation, depletion and amortization

28,229 26,804

80,649 80,342

107,502 113,484

301,454

315,802 Gross profit

(2,561 ) 22,023

26,776 62,994 Other operating expenses:

General and administrative

9,461 7,884

26,477 23,984

Exploration

5,540 5,797

14,748 13,086 Pre-development

1,696 391

3,834 1,247 Other operating expense

743 442

2,137 1,853 Provision or closed operations

and reclamation

1,181 1,238

10,983 3,609 Aurizon

acquisition costs

15 —

2,162 —

18,636 15,752

60,341

43,779 Income (loss) from operations

(21,197 )

6,271

(33,565 ) 19,215 Other

income (expense): Gain (loss) on derivative contracts

3,347

(411 )

8,252 (2,560 ) Gain on sale of investments

— —

— — Unrealized loss on investments

(100 )

(2,830 )

(3,226 ) (2,750 ) Foreign exchange gain

(loss)

9,077 7,299

19,518 6,051 Interest and other

income

100 32

173 208 Interest expense, net of amount

capitalized

(6,617 ) (6,505 )

(19,350 )

(20,307 )

5,807 (2,415 )

5,367 (19,358

) Income (loss) before income taxes

(15,390 ) 3,856

(28,198 ) (143 ) Income tax benefit (provision)

5,500 (180 )

4,193 1,062 Net

income (loss)

(9,890 ) 3,676

(24,005 )

919 Preferred stock dividends

(138 ) (138 )

(414 ) (414 ) Income (loss) applicable to common

shareholders

$ (10,028 ) $ 3,538

$ (24,419 ) $ 505 Basic income (loss)

per common share after preferred dividends

$ (0.03

) $ 0.01

$ (0.07 ) $ —

Diluted income (loss) per common share after preferred dividends

$ (0.03 ) $ 0.01

$ (0.07

) $ — Weighted average number of common shares

outstanding - basic

377,508 359,472

372,555 348,801 Weighted average number of

common shares outstanding - diluted

377,508 362,262

372,555 354,673

HECLA

MINING COMPANY

Condensed Consolidated Balance Sheets

(dollars and share in thousands -

unaudited)

September 30, 2015

December 31, 2014

ASSETS

Current assets:

Cash and cash equivalents

$ 174,454 $ 209,665

Accounts receivable: Trade

10,384 17,696 Other, net

27,189 17,184 Inventories

43,606 47,473 Current

deferred income taxes

19,573 12,029 Other current assets

15,957 12,312 Total current assets

291,163 316,359 Non-current investments

2,003 4,920

Non-current restricted cash and investments

999 883

Properties, plants, equipment and mineral interests, net

1,878,177 1,831,564 Non-current deferred income taxes

93,037 98,923 Reclamation insurance asset

16,800 —

Other non-current assets and deferred charges

3,034

9,415

Total assets $ 2,285,213 $

2,262,064

LIABILITIES

Current liabilities: Accounts payable and accrued

liabilities

$ 47,724 $ 41,869 Accrued payroll and

related benefits

23,497 27,956 Accrued taxes

7,078

4,241 Current portion of capital leases

9,492 9,491 Current

portion of debt

1,981 — Current portion of accrued

reclamation and closure costs

20,788 1,631 Other current

liabilities

15,056 5,797 Total current

liabilities

125,616 90,985 Capital leases

9,485

13,650 Accrued reclamation and closure costs

70,822 55,619

Long-term debt

501,281 498,479 Non-current deferred tax

liability

125,753 153,300 Other non-current liabilities

50,485 53,057

Total liabilities

883,442 865,090

SHAREHOLDERS’ EQUITY

Preferred stock

39

39 Common stock

95,114 92,382 Capital surplus

1,517,514 1,486,750 Accumulated deficit

(168,522

) (141,306 ) Accumulated other comprehensive loss

(31,640 ) (32,031 ) Treasury stock

(10,734

) (8,860 )

Total shareholders’ equity

1,401,771 1,396,974

Total liabilities and

shareholders’ equity $ 2,285,213 $

2,262,064 Common shares outstanding

377,697

367,377

HECLA MINING COMPANY

Condensed Consolidated Statements of Cash

Flows

(dollars in thousands - unaudited)

Nine Months Ended

September 30,

September 30,

2015

2014

OPERATING ACTIVITIES

Net income (loss)

$

(24,005 ) $ 919 Non-cash elements included in net

income (loss): Depreciation, depletion and amortization

81,475 81,116 Gain on sale of investments

— — Gain on

disposition of properties, plants, equipment and mineral interests

175 (49 ) Unrealized loss (gain) on investments

3,060

2,750 Provision for reclamation and closure costs

11,028

3,646 Stock compensation

4,036 3,826 Deferred income taxes

(1,781 ) (5,859 ) Amortization of loan origination

fees

1,365 1,703 (Gain) loss on derivative contracts

9,561 6,458 Foreign exchange gain

(17,566 )

(5,932 ) Other non-cash items, net

45 (914 ) Change in

assets and liabilities: Accounts receivable

(2,951 )

10,952 Inventories

4,382 7,125 Other current and non-current

assets

(6,779 ) (1,097 ) Accounts payable and accrued

liabilities

3,986 (4,446 ) Accrued payroll and related

benefits

2,221 10,205 Accrued taxes

2,782 (1,541 )

Accrued reclamation and closure costs and other non-current

liabilities

7,934 (50,094 )

Cash

provided by operating activities 78,968

58,768

INVESTING ACTIVITIES

Additions to properties, plants,

equipment and mineral interests

(95,399 ) (90,697 )

Acquisition of Revett, net of cash acquired

(809 ) —

Proceeds from sale of investments — Proceeds from disposition of

properties, plants and equipment

277 447 Purchases of

investments

(947 ) (580 ) Changes in restricted cash

and investment balances

— 4,334

Net cash used in investing activities (96,878

) (86,496 )

FINANCING ACTIVITIES

Proceeds from

exercise of warrants

— 54,418 Acquisition of treasury shares

(1,875 ) (3,740 ) Dividends paid to common

shareholders

(2,796 ) (2,629 ) Dividends paid to

preferred shareholders

(414 ) (414 ) Credit facility

and debt issuance fees paid

(123 ) (705 ) Payments on

debt

(216 ) — Borrowings on debt

— — Payments

on capital leases

(7,833 ) (6,893 )

Net cash provided by financing activities (13,257

) 40,037 Effect of exchange

rates on cash

(4,044 ) (2,124

) Net increase in cash and cash equivalents

(35,211

) 10,185 Cash and cash equivalents at beginning of period

209,665 212,175 Cash and cash

equivalents at end of period

$ 174,454

$ 222,360

HECLA MINING COMPANY

Production Data

Three Months Ended Nine

Months Ended

September 30, September 30,

September 30, September 30,

2015 2014

2015 2014

GREENS CREEK UNIT

Tons of ore milled

205,437

204,295

600,600 608,156 Mining cost per ton

$

71.95 $ 69.29

$ 73.06 $ 69.75 Milling cost per

ton

$ 30.55 $ 32.88

$ 29.88 $ 30.49 Ore

grade milled - Silver (oz./ton)

12.68 13.04

12.92

12.51 Ore grade milled - Gold (oz./ton)

0.10 0.11

0.11 0.12 Ore grade milled - Lead (%)

3.25 3.22

3.29 3.21 Ore grade milled - Zinc (%)

8.91 7.91

8.73 8.35 Silver produced (oz.)

1,992,037 1,890,929

5,884,128 5,367,249 Gold produced (oz.)

14,376 13,524

43,368 43,464 Lead produced (tons)

5,394 5,033

15,717 14,902 Zinc produced (tons)

16,024 14,149

45,406 44,478 Cash cost, after by-product credits, per

silver ounce (1)

$ 4.82 $ 3.75

$ 3.79 $

2.95 Capital additions (in thousands)

$

13,584 $ 6,696

$

31,984 $ 19,545

LUCKY FRIDAY UNIT

Tons of ore milled

65,817 78,979

212,121 238,447 Mining cost per ton

$ 95.98 $

90.21

$ 93.1 $ 86.35 Milling cost per ton

$

28.05 $ 22.96

$ 22.77 $ 21.79 Ore grade milled

- Silver (oz./ton)

9.48 12.90

10.10 11.00 Ore grade

milled - Lead (%)

6.06 7.41

6.40 6.91 Ore grade

milled - Zinc (%)

2.33 2.93

2.89 2.94 Silver produced

(oz.)

592,243 972,994

2,042,436 2,493,385 Lead

produced (tons)

3,729 5,571

12,809 15,566 Zinc

produced (tons)

1,411 2,127

5,631 6,272 Cash cost,

after by-product credits, per silver ounce (1)

$

16.60 $ 8.71

$ 12.30 $ 9.08 Capital additions

(in thousands)

$ 16,459

$ 13,729

$ 41,519

$ 36,516

CASA BERARDI UNIT

Tons

of ore milled

208,074 206,237

615,171 604,869 Mining

cost per ton

$ 89.76 $ 102.33

$ 96.75 $

108.68 Milling cost per ton

$ 19.09 $ 20.81

$

19.91 $ 20.86 Ore grade milled - Gold (oz./ton)

0.16

0.16

0.16 0.16 Ore grade milled - Silver (oz./ton)

0.040 0.031

0.040 0.031 Silver produced (oz.)

7,266 5,799

20,729 16,776 Gold produced (oz.)

29,259 28,977

85,609 88,859 Cash cost, after

by-product credits, per gold ounce (1)

$ 793 $ 898

$ 861 $ 911 Capital additions (in thousands)

$ 8,941 $ 13,980

$ 25,139 $ 37,814 (1)

Cash cost, after by-product credits, per ounce represents a

non-U.S. Generally Accepted Accounting Principles (GAAP)

measurement. A reconciliation of cash cost, after by-product

credits to cost of sales and other direct production costs and

depreciation, depletion and amortization (GAAP) can be found in the

cash cost per ounce reconciliation section of this news release.

Gold, lead and zinc produced have been treated as by-product

credits in calculating silver costs per ounce. The primary metal

produced at Casa Berardi is gold, with a by-product credit for the

value of silver production.

Non-GAAP Measures(Unaudited)

Reconciliation of Cash Cost, Before By-product Credits, per

Ounce and Cash Cost, After By-product Credits, per Ounce to

Generally Accepted Accounting Principles (GAAP)

This release contains references to a non-GAAP measure of cash

cost, before by-product credits, per ounce and cash cost, after

by-product credits, per ounce. Cash cost, before by-product

credits, per ounce and cash cost, after by-product credits, per

ounce represent non-U.S. Generally Accepted Accounting Principles

(GAAP) measurements that the Company believes provide management

and investors an indication of net cash flow. Management also uses

this measurement for the comparative monitoring of performance of

mining operations period-to-period from a cash flow perspective.

Cash cost, before by-product credits, per ounce and cash cost,

after by-product credits, per ounce are measures developed by gold

companies and used by silver companies in an effort to provide a

comparable standard; however, there can be no assurance that our

reporting of these non-GAAP measures is similar to those reported

by other mining companies. Cost of sales and other direct

production costs and depreciation, depletion and amortization are

the most comparable financial measures calculated in accordance

with GAAP to cash cost, before by-product credits cash cost, after

by-product credits.

As depicted in the Greens Creek Unit and the Lucky Friday Unit

tables below, by-product credits comprise an essential element of

our silver unit cost structure. By-product credits constitute an

important competitive distinction for our silver operations due to

the polymetallic nature of their orebodies. By-product credits

included in our presentation of cash cost, after by-product

credits, per silver ounce include:

Total, Greens Creek and Lucky Friday Three

Months Ended Nine Months Ended September 30,

September 30, 2015 2014 2015 2014

By-product value, all silver properties:

Zinc

$ 20,850 $ 24,029

$ 67,764

$ 70,638 Gold

13,299 14,315

42,294 46,573 Lead

12,251 18,179

40,616 50,933 Total by-product credits

$ 46,400 $ 56,523

$ 150,674 $ 168,144

By-product credits per silver ounce, all silver properties

Zinc

$ 8.07 $ 8.39

$ 8.55 $ 8.99 Gold

5.15 5.00

5.34 5.93 Lead

4.74 6.35

5.11

6.47 Total by-product credits

$ 17.96 $ 19.74

$ 19 $ 21.39

By-product credits included in our presentation of Cash Cost,

After By-product Credits, per Gold Ounce for our Casa Berardi Unit

include:

Casa Berardi (1) Three Months Ended

Nine Months Ended September 30, September 30,

2015 2014 2015 2014

Silver by-product value

$ 107 $ 112

$ 327 $ 330 Silver by-product credits

per gold ounce

$ 4 $ 4

$ 4 $ 4

The following table calculates cash cost, before by-product

credits, per ounce and cash cost, after by-product credits, per

ounce (in thousands, except per-ounce amounts):

Total, Greens Creek and Lucky Friday Three

Months Ended Nine Months Ended September 30,

September 30, 2015 2014 2015 2014 Cash

cost, before by-product credits (1)

$ 65,823 $ 72,083

$ 198,103 $ 206,653 By-product credits

(46,401

) (56,523 )

(150,674 ) (168,144 ) Cash cost, after

by-product credits

19,422 15,560

47,429 38,509

Divided by silver ounces produced

2,584 2,864

7,926

7,860 Cash cost, before by-product credits, per silver ounce

$ 25.47 $ 25.17

$ 24.99 $ 26.29

By-product credits per silver ounce

$ (17.96 ) $

(19.74 )

$ (19.01 ) $ (21.39 ) Cash cost, after

by-product credits, per silver ounce

$ 7.52 $

5.43

$ 5.98 $ 4.90

Reconciliation to GAAP: Cash cost, after by-product credits

$ 19,422 $ 15,560

$ 47,429 $ 38,509

Depreciation, depletion and amortization

16,669 17,204

49,732 53,706 Treatment costs

(18,518 ) (21,430 )

(57,744 ) (61,346 ) By-product credits

46,401 56,523

150,674 168,144 Change in product inventory

5,445

6,384

5,044 3,968 Reclamation and other costs

624

959

921 1,870 Cost of sales and

other direct production costs and depreciation, depletion and

amortization (GAAP)

$ 70,043 $ 75,200

$ 196,056 $ 204,851

Greens Creek Unit Three Months Ended

Nine Months Ended September 30, September 30, 2015

2014 2015 2014 Cash cost, before by-product credits

(1)

$ 49,030 $ 50,415

$ 145,683 $

147,419 By-product credits

(39,436 ) (43,326 )

(123,376 ) (131,562 ) Cash cost, after by-product credits

9,594 7,089

22,307 15,857 Divided by silver ounces

produced

1,992 1,891

5,884 5,367 Cash cost, before

by-product credits, per silver ounce

$ 24.62 $ 26.66

$ 24.76 $ 27.46 By-product credits per silver ounce

$ (19.80 ) $ (22.91 )

$ (20.97 ) $

(24.51 ) Cash cost, after by-product credits, per silver ounce

$ 4.82 $ 3.75

$ 3.79

$ 2.95 Reconciliation to GAAP: Cash cost,

after by-product credits

$ 9,594 $ 7,089

$

22,307 $ 15,857 Depreciation, depletion and amortization

13,868 14,716

41,389 46,702 Treatment costs

(15,231 ) (15,676 )

(46,103 ) (46,058 ) By-product

credits

39,436 43,326

123,376 131,562 Change in

product inventory

4,003 5,966

4,922 3,589 Reclamation

and other costs

568 909

870

1,779 Cost of sales and other direct production costs and

depreciation, depletion and amortization (GAAP)

$

52,238 $ 56,330

$ 146,761

$ 153,431 Lucky Friday Unit

Three Months Ended Nine Months Ended September 30,

September 30, 2015 2014 2015 2014 Cash

cost, before by-product credits (1)

$ 16,793 $ 21,668

$ 52,420 $ 59,234 By-product credits

(6,965 )

(13,197 )

(27,298 ) (36,582 ) Cash cost, after by-product

credits

9,828 8,471

25,122 22,652 Divided by silver

ounces produced

592 973

2,042 2,493 Cash cost, before

by-product credits, per silver ounce

$ 28.36 $ 22.27

$ 25.67 $ 23.75 By-product credits per silver ounce

$ (11.76 ) $ (13.56 )

$ (13.37 ) $

(14.67 ) Cash cost, after by-product credits, per silver ounce

$ 16.60 $ 8.71

$ 12.30

$ 9.08 Reconciliation to GAAP: Cash cost,

after by-product credits

$ 9,828 $ 8,471

$

25,122 $ 22,652 Depreciation, depletion and amortization

2,801 2,488

8,343 7,004 Treatment costs

(3,287

) (5,754 )

(11,641 ) (15,288 ) By-product credits

6,965 13,197

27,298 36,582 Change in product

inventory

1,442 418

122 379 Reclamation and other

costs

57 51

51 91 Cost of

sales and other direct production costs and depreciation, depletion

and amortization (GAAP)

$ 17,806 $ 18,871

$ 49,295 $ 51,420

Casa Berardi Unit Three Months Ended

Nine Months Ended September 30, September 30, 2015

2014 2015 2014 Cash cost, before by-product credits

(1)

$ 23,311 $ 26,134

$ 74,022 $ 81,293

By-product credits

(107 ) (112 )

(327 ) (330 ) Cash

cost, after by-product credits

23,204 26,022

73,695

80,963 Divided by gold ounces produced

29,259 28,977

85,609 88,859 Cash cost, before by-product credits, per gold

ounce

$ 797 $ 902

$ 865 $ 915

By-product credits per gold ounce

$ (4 ) $ (4 )

$ (4 ) $ (4 ) Cash cost, after by-product credits,

per gold ounce

$ 793 $ 898

$

861 $ 911 Reconciliation to GAAP: Cash

cost, after by-product credits

$ 23,204 $ 26,022

$ 73,695 $ 80,963 Depreciation, depletion and

amortization

11,561 9,600

30,917 26,636 Treatment

costs

(152 ) (108 )

(449 ) (337 ) By-product credits

107 112

327 330 Change in product inventory

2,628 2,450

562 2,738 Reclamation and other costs

111 208

346 621 Cost of

sales and other direct production costs and depreciation, depletion

and amortization (GAAP)

$ 37,459 $ 38,284

$ 105,398 $ 110,951

Total, All Locations Three Months Ended

Nine Months Ended September 30, September 30, 2015

2014 2015 2014 Reconciliation to GAAP:

Cash cost, after by-product credits

$ 42,626 $ 41,582

$ 121,124 $ 119,472 Depreciation, depletion and

amortization

28,230 26,804

80,649 80,342 Treatment

costs

(18,670 ) (21,538 )

(58,193 ) (61,683 )

By-product credits

46,508 56,635

151,001 168,474

Change in product inventory

8,073 8,834

5,606 6,706

Reclamation and other costs

735 1,167

1,267 2,491 Cost of sales and other direct

production costs and depreciation, depletion and amortization

(GAAP)

$ 107,502 $ 113,484

$

301,454 $ 315,802 (1)

Includes all direct and indirect operating cash costs

related directly to the physical activities of producing metals,

including mining, processing and other plant costs, third-party

refining and marketing expense, on-site general and administrative

costs, royalties and mining production taxes, before by-product

revenues earned from all metals other than the primary metal

produced at each unit.

Reconciliation of Net Income (Loss) Applicable to Common

Shareholders (GAAP) to Adjusted Net Income (Loss) Applicable to

Common Stockholders

This release refers to a non-GAAP measure of adjusted net income

(loss) applicable to common stockholders and adjusted net income

(loss) per share, which are indicators of our performance. They

exclude certain impacts which are of a nature which we believe are

not reflective of our underlying performance. Management believes

that adjusted net income (loss) per common share provides investors

with the ability to better evaluate our underlying operating

performance.

Three Months Ended Nine Months

Ended

Dollars are in thousands (except per share

amounts)

September 30, September 30,

2015

2014

2015 2014 Net income (loss)

applicable to common shareholders (GAAP)

$

(10,028

) $ 3,538

$ (24,419 )

$ 505 Adjusting items: (Gains) losses on derivatives

contracts

(3,347 ) 411

(8,252 ) 2,560

Provisional price losses (gains)

963 1,116

(561

) 2,064 Environmental accruals

— 128

8,700 983

Foreign exchange (gain) loss

(9,077 ) (7,299 )

(19,518 ) (6,051 ) Acquisition costs

15 —

2,162 — Income tax effect of above adjustments

948 (662 )

(820 ) (2,243 ) Adjusted net income (loss) applicable

to common shareholders

$ (20,526 ) $

(2,768 ) $ (42,708 ) $

(2,182 ) Weighted average shares - basic

377,508 359,472

372,555 348,801 Weighted average

shares - diluted

377,508 362,262

372,555 354,673

Basic adjusted net income (loss) per common share

$

(0.05 ) $ (0.01 )

$ (0.11 ) $

(0.01 ) Diluted adjusted net income (loss) per common share

$ (0.05 ) $ (0.01 )

$ (0.11

) $ (0.01 )

Reconciliation of Net Income (Loss) (GAAP) to Adjusted

EBITDA

This release refers to a non-GAAP measure of adjusted earnings

before interest, taxes, depreciation and amortization ("Adjusted

EBITDA"), which is a measure of our operating performance. Adjusted

EBITDA is calculated as net income before the following items:

interest expense, income tax provision, depreciation, depletion,

and amortization expense, exploration expense, pre-development

expense, Aurizon acquisition costs, Lucky Friday suspension-related

costs, interest and other income (expense), foreign exchange gains

and losses, gains and losses on derivative contracts, unrealized

gains on investments, provisions for environmental matters,

stock-based compensation, and provisional price gains and losses .

Management believes that, when presented in conjunction with

comparable GAAP measures, Adjusted EBITDA is useful to investors in

evaluating our operating performance. The following table

reconciles net income (loss) to Adjusted EBITDA:

Dollars are in thousands

Three Months Ended Nine Months Ended

September

30, September 30,

September 30,

September 30,

2015 2014

2015 2014 Net income (loss)

$

(9,890 ) $ 3,676

$ (24,005 ) $ 919 Plus:

Interest expense, net of amount capitalized

6,617 6,505

19,350 20,307 Plus/(Less): Income taxes

(5,500 ) 180

(4,193 ) (1,062 ) Plus: Depreciation, depletion and

amortization

28,229 26,804

80,649 80,342 Plus:

Exploration expense

5,540 5,797

14,748 13,086 Plus:

Pre-development expense

1,696 391

3,834 1,247 Plus:

Acquisition costs

15 —

2,162 — Plus/(Less): Foreign

exchange (gain) loss

(9,077 ) (7,299 )

(19,518 )

(6,051 ) Less: (Gains) losses on derivative contracts

(3,347

) 411

(8,252 ) 2,560 Plus/(Less): Provisional price

(gains)/losses

963 1,116

(561 ) 2,064 Plus: Other

2,547 4,997

18,117 14,544

Adjusted EBITDA

$ 17,793 $ 42,578

$ 82,331 $ 127,956

Table A – Assay Results – Q3 2015

Casa Berardi (Quebec) Zone

Drill HoleNumber

Drill HoleSection

Drill HoleAzm/Dip

SampleFrom

SampleTo

TrueWidth(feet)

Gold(oz/ton)

DepthFrom

MineSurface(feet)

Lower-Inter Upper CBW-1071 10782

325/-48 549.2 562.0

12.8 0.26 -1374.7

CBW-1072 10794 335/-50

609.3 623.4 14.1

0.55 -1431.8 CBW-1077

10759 360/-40 570.9

590.6 19.7 1.04

-1353.0 CBW-1078 10764

360/-42 577.4 587.3

9.8 1.37 -1357.6 South-West

(107) CBW-0365-036 10738

360/-8 132.5 142.4 9.8

0.20 -1205.4 (107)

CBW-0365-038 10724 001/3

170.6 180.4 8.2 0.24

-1165.0 Upper 118 (118-61) CBP-0530-214

12307 360/3 246.4

288.7 42.3 0.74

-1760.2 (118-61) CBP-0530-220 12304

360/-3 186.4 199.1

12.8 0.30 -1789.7 (118-06)

CBP-0530-228 12240

331/-60 290.4 345.8 55.4

0.18 -2039.7 (118-06)

CBP-0530-229 12235 331/-52

298.9 326.4 20.7

0.23 -2018.4 Lower 118 (118-27)

CBP-0910-053 12045 180/19

82.0 98.4 15.7 0.32

-2950.1 (118-27) CBP-0910-055

12037 180/2 144.7

163.7 18.7 0.46 -2976.0

(118-22) CBP-0910-057 12022

180/-12 59.1 72.8

13.1 0.29 -3000.3 (118-27)

CBP-0910-058 12021 180/2

124.7 136.2 11.5

0.51 -2978.3 (118-27) CBP-0910-059

12021 180/18 150.9

172.9 21.0 0.38

-2930.4 (118-27) CBP-0910-060 11991

180/19 85.0 118.4

31.8 0.24 -2951.1 (118-27)

CBP-0910-061 11991 180/7

91.5 109.6 14.4

0.33 -2985.6 (118-27)

CBP-0910-062 12007 180/8

58.7 83.7 24.9 0.33

-2975.4 (118-27) CBP-0910-063

12006 180/19 64.6

93.5 28.8 0.36 -2959.0

Upper 123 (123-05) CBP-0550-099 12559

126/33 265.1 282.2

13.5 0.27 -1658.8 (123-08)

CBP-0550-109 12362

180/-21 297.2 329.4 22.6

0.92 -1868.4 Lower 123 (123-11)

CBP-0810-039 12431 153/-29

318.2 341.5 17.1

0.18 -2746.4 (123-04)

CBP-0850-061 12377 146/14

236.9 249.3 8.2 0.57

-2667.7 (123-02) CBP-0850-071

12339 178/-37 412.7

436.4 23.6 0.81

-2991.5 (123-03) CBP-0850-074 12315

195/-30 265.7 287.4

9.5 0.62 -2990.8 (123-02)

CBP-0850-075 12308

195/-39 412.1 430.8 11.8

0.73 -2844.8 (123-02)

CBP-0850-079 12392 166/-41

500.3 529.5 10.2

0.35 -3062.7 U Principal (124-81)

CBP-0250-071 12564 156/64

145.0 157.5 8.2 0.40

-661.7 (124-22) CBP-0290-252

12494 029/16 246.7

257.9 9.2 1.50 -871.7

(124-22) CBP-0290-254 12491

029/-3 229.3 246.7

15.4 0.28 -949.8 (124-22)

CBP-0290-259 12505 041/-27

246.1 260.5 11.8

0.71 -1056.1 L Principal (124-32)

CBP-0530-215 12303 360/16

117.5 138.5 21.0 0.15

-1736.2 (124-32) CBP-0530-220

12303 360/-3 140.1

176.8 36.7 0.20 -1786.1

(124-31) CBP-0530-221 12258

357/-3 42.7 65.6

16.1 0.25 -1767.7 (124-31)

CBP-0530-222 12258 357/8

33.5 69.6 36.1

0.26 -1757.2 (124-31) CBP-0530-226

12261 007/4 25.6

50.5 7.5 0.22

-1762.1 (124-31) CBP-0530-227 12270

007/-30 223.1 294.6

71.5 0.23 -1917.0

(124-22) CBP-0550-099 12555

126/33 242.8 254.9

12.1 0.20 -1673.2 UG 117

CBW-1069 11,700 010/-77

4068.2 4104.3 21.8 0.15

-4501.6 UG 117 CBW-1070

11700 010/-74 1636.5

1653.5 17.1 0.13 -3901.9

Surf 100 CBW-1071 11850

0.10/-70 1235.5 1264.7

29.2 21.80 -3791.0 Surf 100

CBS-15-627 10400 360/-70

3666.3 3710.6 44.3

0.05 -2920.3 Surf 100 CBS-15-627A

10400 360/-72 3553.1

3720.5 167.3 0.05

-2769.4 Surf 157 CBS-15-632

15500 360/-85 1304.1

1353.3 49.2 0.07 -1274.6

Surf 157 CBS-15-633 15650

360/-70 1366.8 1370.1 3.3

1.26 -1245.4

San Sebastian (Mexico)

Zone

Drill HoleNumber

Sample From(ft)

Sample To(ft)

Width(feet)

True Width(feet)

Gold(oz/ton)

Silver(oz/ton)

East Francine Vein SS-935 106.3

130.3 24.1 23.9

0.17 8.16 East Francine Vein SS-936

163.0 164.2 1.2

1.2 0.30 13.34 East Francine

Vein SS-937 228.5 229.6

1.1 1.0 0.07

10.50 Middle Vein SS-790 764.7

773.7 9.0 8.9

0.02 11.06 Middle Vein SS-799

322.7 330.2 7.5

7.0 0.10 13.19 Middle Vein

SS-902 713.7 721.7

7.9 5.9 0.20 54.24

Middle Vein SS-904 835.7

841.7 6.1 5.0 0.02

4.67 Middle Vein SS-907 249.3

251.2 1.9 1.8

0.10 15.34 Middle Vein SS-908

586.4 593.6 7.2

6.5 0.11 38.37 Middle Vein

SS-913 531.2 533.8

2.6 2.5 0.02 6.56

Middle Vein SS-914 638.2

640.7 2.5 2.1 0.07

14.37 Middle Vein SS-917 496.3

503.7 7.4 6.8

0.02 6.92 Middle Vein SS-918

726.2 734.7 8.4

7.3 0.05 15.12 Middle Vein

SS-919 396.5 400.0

3.5 3.4 0.09 16.67

Middle Vein SS-922 290.6

294.8 4.1 4.0 0.03

8.91 Middle Vein SS-924 510.3

516.5 6.2 5.6

0.07 27.90 Middle Vein SS-924 A

510.3 514.0 3.6

3.3 0.02 10.56 Middle Vein

SS-926 378.2 382.9

4.7 4.6 0.06 9.01

Middle Vein SS-927 614.1

618.3 4.2 3.9 0.15

33.15 Middle Vein SS-932 590.6

600.9 10.3 9.9

0.01 8.16 Middle Vein SS-933

409.1 411.0 1.9

1.9 0.05 15.72 North Vein

SS-899 773.0 778.0

5.0 5.0 0.04 11.72 North

Vein SS-943 143.0 151.2

8.2 8.1 0.10

3.04 North Vein SS-948 138.4

140.4 2.0 2.0

0.50 8.25 North Vein SS-950

170.3 172.7 2.4

2.4 0.14 1.70 North Vein

SS-952 111.2 122.7

11.5 11.0 0.20 2.02 North

Vein SS-954 107.1 115.6

8.5 8.1 0.11

1.61 North Vein SS-955 94.1

99.4 5.3 5.3

0.51 7.23 North Vein SS-956

82.6 86.9 4.3

4.3 1.74 15.87 North Vein

SS-958 A 62.1 66.2

4.1 3.7 0.11 4.30 North

Vein SS-959 95.6 115.8

20.2 20.1 0.14

2.98 North Vein SS-965 31.1

36.1 5.0 4.9

0.06 8.94 North Vein SS-966 A

45.9 56.9 10.9

10.4 0.12 3.68 North Vein

SS-967 23.1 36.7

13.6 13.0 0.06 1.83 North

Vein SS-970 100.5 103.9

3.4 3.4 0.06

6.58 North Vein SS-973 138.5

143.3 4.8 4.8

0.29 7.59 North Vein SS-979

70.3 74.5 4.3

4.2 0.10 6.99 North Vein

SS-980 80.2 83.9

3.6 2.2 0.08 6.45 North

Vein SS-990 78.3 80.2

2.0 1.9 0.22

4.61

Greens Creek (Alaska)

Zone

Drill HoleNumber

Drill HoleAzm/Dip

SampleFrom

SampleTo

HorizontalWidth1(feet)

Silver(oz/ton)

Gold(oz/ton)

Zinc(%)

Lead(%)

DepthFromMinePortal(feet)

Northwest West GC4023 063/-28

92.00 101.60 7.9

13.64 0.07 2.25 1.11

-439 GC4050

063/-63 124.90 134.50 9.5

19.03 0.14 6.73

2.98 -516

140.80 145.20

4.4 12.15 0.14

12.96 3.32 -530

GC4068 063/-34 144.00

148.00 3.4 23.46 0.08

3.87 1.72 -482

277.20

282.20 2.6 23.13

0.06 1.22 0.38

-557

307.90 312.90 2.6 15.43

0.03 0.09 0.11

-574 GC4071 063/-61

115.60 119.20 3.4

80.71 0.08 10.82

5.47 -524

127.50 129.40 1.9

49.34 0.23 6.04

2.81 -515 GC4073

063/-78 177.50 180.20

2.2 25.75 0.23

17.28 4.84 -579

GC4076 063/19 178.10

182.90 4.3 16.95 0.03

8.62 4.35 -616

320.10

323.00 1.7 34.11

0.04 13.34 7.76

-298 GC4079 063/37

195.40 197.40 1.9 14.37

0.07 0.68 0.33

-278

204.00 207.90 3.4

8.33 0.14 0.67 0.26

-272

240.40 251.40 10.6

14.43 0.05 13.31

6.38 -249

261.40 269.70 5.6

47.10 0.13 8.96

4.79 -239 GC4088

243/-69 242.70 252.70

6.2 32.98 0.39

12.78 5.62 -630

GC4089 243/-80 199.20

205.80 5.4 40.93 0.15

2.56 1.59 -601

GC4091 063/-23 438.30

441.00 2.7 5.38

0.09 24.86 3.52

-571 GC4093 063/-32

145.30 148.40 2.4

32.69 0.14 6.59 3.09

-481 GC4097

063/-64 122.00 131.10 8.0

35.14 0.20 7.29

3.03 -514 GC4098

063/-82 168.30 170.70

1.5 52.95 0.36

14.84 5.64 -572

GC4102 063/24 192.80

199.60 5.6 58.04 0.19

8.97 4.96 -312

247.80

252.00 2.0 36.52

0.40 5.37 2.41

-288

264.30 279.20 10.2 19.91

0.04 6.99 3.62

-281 GC4105 063/17

132.70 134.70 1.9

36.58 0.00 0.24 0.10

-356

227.60 230.60 1.9

151.21 0.32 6.66

3.93 -327 GC4108

243/-64 212.90 225.20

10.9 34.86 0.28 11.87

5.37 -598 GC4110

243/-28 515.10 517.30

2.2 11.02 0.02

16.89 9.22 -627

121.30

122.30 0.8 29.69

0.70 8.22 3.47 -485

GC4122 063/-83

102.10 104.10 1.7 25.69

0.15 2.26 1.17

-508

157.30 159.90 2.1

21.98 0.10 5.88 2.71

-564 GC4123 063/28

278.20 280.20 1.5

14.09 0.17 1.20

0.47 -277

293.00 296.70 2.8

12.26 0.06 0.14

0.11 -271

303.20 309.90

5.4 71.55 0.16

8.25 4.61 -268

GC4132 57/-34.5 151.90

157.70 5.6 19.71 0.07

8.40 4.03 -498

GC4136 261/-77.5 180.00

184.30 4.1 39.17

0.33 5.58 2.13

-584 GC4159 063/-27

154.30 158.10 3.8

20.79 0.13 8.18 3.50

-364

183.80 187.50 3.7

14.01 0.11 0.96

0.37 -377

189.50 205.20 12.2

36.20 1.04 5.59

2.65 -375 GC4161

063/-35 144.30 147.00

2.6 18.68 0.09

11.08 5.21 -376

179.20

185.40 6.2 21.82 0.37

8.73 3.89 -395

GC4163 063/-44 135.90

138.90 2.5 11.42

0.03 2.21 1.07

-388

170.50 172.20 1.7 18.28

0.05 14.32 5.88

-412 GC4165 063/-18

163.50 168.00 4.3

31.39 0.30 13.45

6.92 -344

225.80 230.80 3.3

19.14 0.16 2.94

1.57 -365 West Wall GC4023

063/-28 515.10 517.30

2.2 11.02 0.02

16.89 9.22 -628

GC4093 063/-32 532.60

543.40 9.4 5.86

0.07 27.94 7.68 -674 Deep

200 South GC3968 243/-79

269.80 278.00 8.1 19.77

0.12 0.89 0.56

-1531

459.50 463.50 4.0

12.19 0.06 12.59