UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 12, 2015

HECLA MINING COMPANY

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

1-8491 |

77-0664171 |

|

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

6500 North Mineral Drive, Suite 200

Coeur d'Alene, Idaho 83815-9408

(Address of Principal Executive Offices) (Zip Code)

(208) 769-4100

(Registrant's Telephone Number, Including Area Code)

N/A

(Former name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12(b))

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On April 12, 2015, Hecla Mining Company (the “Company”) issued a news release announcing preliminary production results for the quarter ended March 31, 2015. All measures of the Company's first quarter 2015 operating results and conditions contained in the news release, including cash on hand and production, are preliminary and reflect the Company’s expected first quarter 2015 results as of the date of the news release. Actual reported first quarter 2015 results are subject to management's final review as well as review by the Company's independent registered accounting firm and may vary significantly from those expectations because of a number of factors, including, without limitation, additional or revised information and changes in accounting standards or policies or in how those standards are applied. A copy of the news release is attached as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any of the Company’s filings or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit Number |

|

Description |

| |

|

|

|

99.1

|

|

News Release, dated April 12, 2015.*

* Furnished herewith |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: April 13, 2015

| |

Hecla Mining Company |

| |

|

|

| |

|

|

| |

By: |

/s/ David C. Sienko |

| |

|

David C. Sienko |

| |

|

Vice President & General Counsel |

3

Exhibit 99.1

NEWS RELEASE

HECLA REPORTS PRELIMINARY FIRST QUARTER 2015 PRODUCTION RESULTS OF 2.9 MILLION OUNCES

OF SILVER AND 40,651 OUNCES OF GOLD

FOR IMMEDIATE RELEASE

April 12, 2015

COEUR D'ALENE, IDAHO -- Hecla Mining Company (NYSE:HL) today announced preliminary production results¹ for the first quarter 2015.

FIRST QUARTER 2015 HIGHLIGHTS (Comparisons to Q1 2014)

| |

● |

Silver production of 2.9 million ounces, a 16% increase. |

| |

● |

Gold production of 40,651 ounces, a 12% decrease. |

| |

● |

Silver equivalent production of 8.7 million ounces, a 1% decrease.2 |

| |

● |

Lead production increased 3% and zinc production decreased 6%. |

| |

● |

Cash and cash equivalents of approximately $194 million as of March 31, 2015. |

“Greens Creek, with higher grades and recoveries, led another strong operating quarter for Hecla – silver production is among the highest in our history,” said Phillips S. Baker, Jr., Hecla’s President and CEO. “In March we celebrated 50 years on the NYSE, and I see our current mix of three operating mines to be the strongest in our history. We believe that our portfolio of mines, particularly Greens Creek which is recognized as a world-class silver mine, provides operating stability to weather current market conditions.”

Greens Creek

Greens Creek’s first quarter production of 2.0 million ounces of silver and 15,239 ounces of gold exceeded the first quarter 2014 production of silver and gold by 14% and 2%, respectively. The increase was principally due to mine sequencing, higher silver grades and higher silver and gold recoveries. Changes made to the flotation circuit in the fourth quarter of 2014 continue to result in higher silver recovery, the value of which has outweighed a slight loss in zinc recovery. The mill operated at an average of 2,172 tons per day (tpd) in the first quarter.

|

(1) |

See cautionary statement regarding preliminary statements at the end of this release. |

|

(2) |

Silver equivalent calculations based on the following prices: $17.25 for Ag, $1,225 for Au, $0.90 for Pb, and $1.00 for Zn. |

Lucky Friday

Lucky Friday’s first quarter silver production of 836,719 ounces was 20% higher than the first quarter 2014 production on higher silver grades and recoveries. The mill operated at an average of 825 tpd in the first quarter.

Casa Berardi

Casa Berardi’s first quarter gold production of 25,412 ounces was 19% lower than the first quarter 2014 production because of lower grades and recovery. The mine experienced lower grades as a result of mine sequencing. Recoveries are lower due to new metallurgical characteristics of the ore from the 118 Zone requiring adjustments to the plant which are expected to improve recoveries in the second quarter. The mill operated at an average of 2,090 tpd in the first quarter.

| |

First Quarter Ended |

|

| |

March 31, 2015 |

March 31, 2014 |

|

|

PRODUCTION |

|

|

Increase (Decrease) |

|

Silver |

2,878,597 oz. |

2,491,853 oz. |

16% |

|

Gold |

40,651 oz. |

46,268 oz. |

(12)% |

|

Lead |

9,878 tons |

9,635 tons |

3% |

|

Zinc |

16,086 tons |

17,091 tons |

(6)% |

|

Greens Creek (Silver) |

2,035,966 oz. |

1,787,137 oz. |

14% |

|

Greens Creek (Gold) |

15,239 oz. |

15,009 oz. |

2% |

|

Lucky Friday |

836,719 oz. |

699,605 oz. |

20% |

|

Casa Berardi |

25,412 oz. |

31,259 oz. |

(19)% |

Hecla expects to report first quarter 2015 financial results on May 7, 2015.

About Hecla

Hecla Mining Company (NYSE:HL) is a leading low-cost U.S. silver producer with operating mines in Alaska and Idaho, and is a gold producer with an operating mine in Quebec, Canada. The Company also has exploration and pre-development properties in five world-class silver and gold mining districts in the U.S., Canada, and Mexico, and an exploration office and investments in early-stage silver exploration projects in Canada.

Cautionary Statements Regarding Preliminary Results

All measures of the Company's first quarter 2015 operational results and the Company’s cash on hand, are preliminary and reflect the Company’s expected first quarter 2015 results as of the date of this news release. Actual reported first quarter results are subject to management's final review as well as review by the Company's independent registered public accounting firm and may vary significantly from those expectations because of a number of factors, including, without limitation, additional or revised information and changes in accounting standards or policies or in how those standards are applied.

Cautionary Statements Regarding Forward Looking Statements

Statements made or information provided in this news release that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of Canadian securities laws. Words such as “may”, “will”, “should”, “expects”, “intends”, “projects”, “believes”, “estimates”, “targets”, “anticipates” and similar expressions are used to identify these forward-looking statements. Such forward-looking statements or forward-looking information include statements or information regarding estimates of annual silver production for the first quarter of 2015 on a consolidated basis and at each of the Greens Creek and Lucky Friday mines, first quarter 2015 gold production at Casa Berardi, first quarter 2015 production and cash on hand. The material factors or assumptions used to develop such forward-looking statements or forward-looking information include that the Company’s plans for development and production will proceed as expected and will not require revision as a result of risks or uncertainties, whether known, unknown or unanticipated, to which the Company’s operations are subject.

Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, expected or implied. These risks and uncertainties include, but are not limited to, metals price volatility, volatility of metals production and costs, litigation, regulatory and environmental risks, operating risks, project development risks, political risks, labor issues, ability to raise financing and exploration risks and results. Refer to the Company's Form 10-K and 10-Q reports for a more detailed discussion of factors that may impact expected future results. The Company undertakes no obligation and has no intention of updating forward-looking statements other than as may be required by law.

For further information, please contact:

Mike Westerlund

Vice President - Investor Relations

800-HECLA91 (800-432-5291)

Email: hmc-info@hecla-mining.com

Website: www.hecla-mining.com

3

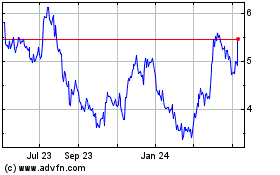

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Mar 2024 to Apr 2024

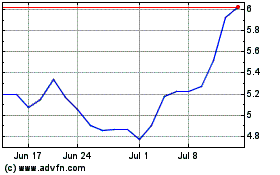

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Apr 2023 to Apr 2024