Current Report Filing (8-k)

February 15 2017 - 4:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

February 15, 2017

|

The Hartford Financial Services Group, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-13958

|

13-3317783

|

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

One Hartford Plaza, Hartford, Connecticut

|

|

06155

|

|

________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

860-547-5000

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

As previously reported, on February 8, 2017, The Hartford Financial Services Group, Inc. (the “Company”) delivered an exercise notice (the “Put Notice”) under Section 3.1 of the put option agreement dated as of February 12, 2007 (the “Put Option Agreement”) among the Company, Glen Meadow ABC Trust, a Delaware statutory trust (the “ABC Trust”), and Wilmington Trust Company (as successor to LaSalle Bank National Association) (“Wilmington”), as put option calculation agent. Pursuant to the Put Notice, the Company required the ABC Trust to purchase the Company’s junior subordinated notes (the “Notes”) for the designated amount of $500,000,000 on the terms set forth in the junior subordinated indenture, dated as of February 12, 2007, between the Company and Wilmington, as trustee. The settlement of the issuance of the Notes occurred on February 15, 2017.

In connection with the settlement of the transaction described above, the Company entered into a replacement capital covenant (the “RCC”), whereby the Company agreed for the benefit of certain of its debtholders named therein that it will not repay, redeem, defease or repurchase and will cause its subsidiaries not to purchase, as applicable, all or any portion of the Notes at any time prior to February 12, 2047 (or such earlier date on which the RCC terminates by its terms), except to the extent that the principal amount repaid or defeased or the applicable redemption or purchase price does not exceed the applicable percentage set forth in the RCC of the qualifying proceeds from the sale of certain replacement capital securities as set forth in the RCC. The RCC also prohibits the Company from redeeming all or any portion of the Notes on or prior to February 15, 2022. The foregoing description of the material terms of the RCC is qualified in its entirety by reference to the RCC, which is incorporated by reference herein and attached as Exhibit 4.1 to this report.

SAFE HARBOR STATEMENT

Certain information included in this Current Report on Form 8-K may be deemed to be “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, including statements that involve risks, uncertainties and assumptions. We caution you not to place undue reliance on these forward-looking statements, and we do not undertake any obligation to update these forward-looking statements, except as may be required by law.

Item 9.01 Financial Statements and Exhibits

(d)

Exhibits

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

4.1

|

|

Replacement Capital Covenant dated as of February 15, 2017

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Hartford Financial Services Group, Inc.

|

|

|

|

|

|

|

|

February 15, 2017

|

|

By:

|

|

/s/ Beth Bombara

|

|

|

|

|

|

|

|

|

|

|

|

Name: Beth Bombara

|

|

|

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

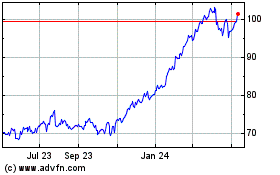

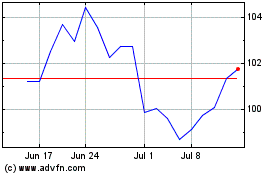

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Apr 2023 to Apr 2024