Hartford Financial Profit Drops on Asbestos Hit, Catastrophe Claims

July 28 2016 - 6:03PM

Dow Jones News

By Lisa Beilfuss

Hartford Financial Services Group Inc. reported second-quarter

earnings that fell far more than expected as it took an

asbestos-related hit in its property and casualty business,

catastrophe claims climbed, and investment income dropped.

Connecticut-based Hartford sells commercial and personal

insurance as well as financial products, including property and

casualty insurance, group benefits and mutual funds.

Analysts have cautioned that higher catastrophe costs stemming

from wildfires in Canada and hail storms across part of the U.S.

would hurt second-quarter results across the spectrum, and Hartford

joins Travelers Cos. and Chubb Ltd. in confirming that this month.

At the same time, still-low interest rates continue to pressure

insurers' earnings, as many of them bring in a significant slice of

income by investing customers' premiums until the money is needed

to pay claims.

But for Hartford, weakness went beyond the anticipated net

income and catastrophe headwinds.

"The second quarter bottom line was disappointing," said Chief

Executive Christopher Swift, pointing to particular weakness in the

company's property and casualty and auto businesses.

Hartford said greater-than-expected mesothelioma claim filings

for certain defendants in asbestos cases helped push its loss in

its property and casualty "other" category to $154 million from

$111 million a year earlier. In the overall property and casualty

unit, net income fell to $33 million from $189 million in last

year's quarter.

Meanwhile, Hartford's auto business continued to deteriorate,

with new business premiums there sliding 14% from a year earlier.

Total written premiums declined 2%.

During the June quarter, Hartford's net investment income slid

8% to $735 million, dragged by private equity and real estate

partnerships.

Over all, Hartford reported a profit of $216 million, or 54

cents, down from $413 million, or 96 cents, a year earlier.

Excluding certain tax benefits and capital gains, per-share

earnings fell to 31 cents from 91 cents.

Analysts projected 80 cents in adjusted per-share profit,

according to Thomson Reuters.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

July 28, 2016 17:48 ET (21:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

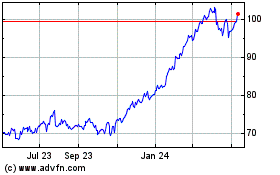

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

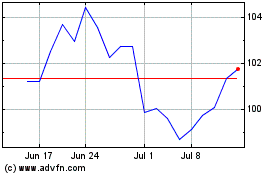

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Apr 2023 to Apr 2024