UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 4, 2016

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

(Exact name of registrant as specified in its charter)

|

| | | |

| | | |

Delaware | | 001-13958 | 13-3317783 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | (IRS Employer Identification No.) |

| |

The Hartford Financial Services Group, Inc. One Hartford Plaza Hartford, Connecticut | 06155 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (860) 547-5000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| |

Item 2.02 | Results of Operations and Financial Condition |

On February 4, 2016, The Hartford Financial Services Group, Inc. (the "Company") issued (i) a press release announcing its financial results for the quarterly period ended December 31, 2015, and (ii) its Investor Financial Supplement (“IFS”) relating to its financial results for the quarterly period ended December 31, 2015. Copies of the press release and the IFS are furnished herewith as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

The information furnished pursuant to this Item 2.02, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

|

| |

Item 9.01 | Financial Statements and Exhibits |

|

| | | |

Exhibit No. | | |

| | |

99.1 |

| Press Release of The Hartford Financial Services Group, Inc. dated February 4, 2016 | |

| | |

99.2 |

| Investor Financial Supplement of The Hartford Financial Services Group, Inc. for the quarterly period ended December 31, 2015 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

Date: | February 4, 2016 | By: | /s/ Scott R. Lewis |

| | Name: | Scott R. Lewis |

| | Title: | Senior Vice President and Controller |

NEWS RELEASE

The Hartford Reports Fourth Quarter 2015 Core Earnings Of $1.07 Per Diluted Share And Net Income Of $1.01 Per Diluted Share

| |

• | Fourth quarter 2015 core earnings* increased 4% from fourth quarter 2014 principally due to improved Commercial Lines underwriting results; fourth quarter 2015 core earnings per diluted share* increased 11% |

| |

• | Fourth quarter 2015 net income increased 10% from fourth quarter 2014; fourth quarter net income per diluted share increased 17% |

| |

• | Commercial Lines fourth quarter 2015 combined ratio before catastrophes and prior accident year development (PYD)* was 88.2, a 3.0 point improvement over fourth quarter 2014 |

| |

• | Personal Lines fourth quarter 2015 combined ratio before catastrophes and PYD was 93.5, a 1.7 point deterioration over fourth quarter 2014 |

| |

• | Book value per diluted share, excluding accumulated other comprehensive income (AOCI)*, was $43.76, a 7% increase from Dec. 31, 2014 |

| |

• | During fourth quarter 2015, the company repurchased 9.8 million common shares for a total of $450 million |

HARTFORD, Conn., Feb. 4, 2016 – The Hartford (NYSE:HIG) reported core earnings for the three months ended Dec. 31, 2015 (fourth quarter 2015) of $445 million, a 4% increase over fourth quarter 2014, principally due to improved Commercial Lines, Property & Casualty (P&C) Other and Corporate results, which were partially offset by lower core earnings from Personal Lines, Group Benefits, Mutual Funds and Talcott Resolution. Fourth quarter 2015 core earnings per diluted share increased 11% to $1.07 compared with $0.96 in fourth quarter 2014 due to the increase in core earnings and the 6% decrease in weighted average diluted common shares outstanding as a result of the company's equity repurchase program.

Fourth quarter 2015 net income totaled $421 million, a 10% increase from fourth quarter 2014. Fourth quarter 2015 net income included net realized capital losses of $90 million, after-tax and deferred acquisition costs (DAC), compared with $9 million, after-tax and DAC, in fourth quarter 2014. The increase in net realized capital losses compared with fourth quarter 2014 was principally related to Talcott Resolution variable annuity (VA) hedging program losses and the annual VA assumptions study, which in 2014 was completed in the third quarter. Fourth quarter 2015 net

*Denotes financial measure not calculated in accordance with generally accepted accounting principles (non-GAAP).

income also included a $35 million, after-tax, unlock benefit, an increase from $13 million, after-tax, in fourth quarter 2014. Fourth quarter 2015 net income included a $34 million income tax benefit related to a reduction in the deferred tax asset valuation reserve on capital loss carryovers; a $37 million benefit from reduction in valuation allowance was included in loss from discontinued operations in fourth quarter 2014. Fourth quarter 2015 net income per diluted share was $1.01, an increase of 17% compared with net income of $0.86 per diluted share in fourth quarter 2014.

"2015 was a successful year for The Hartford," said The Hartford's Chairman and CEO Christopher Swift. "Core earnings per diluted share increased 15%, core earnings ROE rose to 9.2% from 8.4%, book value per diluted share, excluding AOCI, grew 7%, and we returned $1.6 billion of capital to shareholders. We achieved these financial results while investing in operating capabilities and talent that are making us a broader, deeper risk player and a more efficient and customer-focused company. We enter 2016 with a strong foundation and, despite facing increased competition, we are confident that we can continue to maintain our underwriting discipline, expense control and capital flexibility.”

The Hartford's President Doug Elliot said, "The Hartford achieved strong financial results in a competitive market in 2015. Group Benefits had a very strong year, with an increase in the core earnings margin to 5.6%. Our P&C business also performed well, with the Commercial Lines combined ratio improving 1.5 points to 90.0, excluding catastrophes and prior accident year development. However, Personal Lines results were challenged in the second half, experiencing higher than expected auto frequency. In 2016, we are focused on maintaining our margins in Commercial Lines and Group Benefits, and improving Personal Lines results, while continuing to invest in our businesses to drive long-term success.”

For the year ended Dec. 31, 2015 (full year 2015), core earnings were $1,650 million, up 7% from full year 2014 due to improved results from Commercial Lines, P&C Other, Group Benefits, Talcott Resolution and Corporate, partially offset by lower core earnings from Personal Lines and Mutual Funds. Full year 2015 core earnings per diluted share were $3.88, a 15% increase from full year 2014 due to higher core earnings and an 8% decrease in weighted average diluted shares outstanding.

Full year 2015 net income totaled $1,682 million compared with $798 million in full year 2014, which included a $551 million, after-tax, loss from discontinued operations associated largely with the Japan annuity business that was sold in June 2014. Full year 2015 net income included net realized capital losses, after-tax and DAC, excluded from core earnings, of $114 million compared with full year 2014 net realized capital losses, after-tax and DAC, excluded from core earnings, of $20 million. In addition, full year 2015 had a income tax benefit from reduction in valuation allowance totaling $94 million while full year 2014 included an $83 million, after-tax, pension settlement charge.

Full year 2015 net income per diluted share was $3.96, a significant increase from $1.73 in full year 2014, reflecting the growth in net income and the accretive impact of share repurchases.

CONSOLIDATED FINANCIAL RESULTS |

| | | | | | |

($ in millions except per share data) | Three Months Ended | Years Ended |

Dec 31 2015 | Dec 31 2014 | Change2 | Dec 31 2015 | Dec 31 2014 | Change2 |

Core earnings (loss): | | |

| | | |

Commercial Lines | $289 | $251 | 15% | $1,003 | $996 | 1% |

Personal Lines | $51 | $65 | (22)% | $185 | $210 | (12)% |

P&C Other Operations | $18 | $— | NM | ($57) | ($111) | 49% |

Property & Casualty | $358 | $316 | 13% | $1,131 | $1,095 | 3% |

Group Benefits | $40 | $45 | (11)% | $195 | $180 | 8% |

Mutual Funds | $20 | $27 | (26)% | $86 | $91 | (5)% |

Sub-total | $418 | $388 | 8% | $1,412 | $1,366 | 3% |

Talcott Resolution | $83 | $98 | (15)% | $472 | $433 | 9% |

Corporate | $(56) | $(60) | 7% | ($234) | ($251) | 7% |

Core earnings | $445 | $426 | 4% | $1,650 | $1,548 | 7% |

Net income | $421 | $382 | 10% | $1,682 | $798 | 111% |

Weighted average diluted common shares outstanding | 415.9 | 442.6 | (6)% | 425.2 | 460.2 | (8)% |

Core earnings available to common shareholders per diluted share¹ | $1.07 | $0.96 | 11% | $3.88 | $3.36 | 15% |

Net income available to common shareholders per diluted share¹ | $1.01 | $0.86 | 17% | $3.96 | $1.73 | 129% |

| |

[1] | Includes dilutive potential common shares |

| |

[2] | The Hartford defines increases or decreases greater than or equal to 200%, or changes from a net gain to a net loss position, or vice versa, as "NM" or not meaningful |

2016 OUTLOOK

The Hartford announced that the company's full year 2016 core earnings outlook range is $1,575 million to $1,675 million and includes an expected decline in Talcott Resolution core earnings to a range of $320 million to $340 million.

The Hartford's outlook is a management estimate based on business, competitive, capital market, catastrophe loads and other assumptions. Key business and market assumptions included in this outlook are set forth in the table below. This outlook is subject to change for many reasons, including unusual or unpredictable items, such as catastrophe losses, tax benefits or charges, PYD, investment results and other items. The company has frequently experienced unusual or unpredictable benefits and charges that were not anticipated in previously provided guidance.

2016 OUTLOOK

|

| | |

($ in millions) | 2015 Actual | 2016 Outlook |

Consolidated core earnings | $1,650 | $1,575 - $1,675 |

Key Metrics and Market Assumptions: | | |

Commercial Lines combined ratio1 | 90.0 | 89.0 - 91.0 |

Personal Lines combined ratio1 | 92.0 | 90.0 - 92.0 |

P&C catastrophe loss ratio2 | 3.2 | 3.9 |

Group Benefits core earnings margin* | 5.6% | 5.5% - 6.0% |

Talcott Resolution core earnings | $472 | $320 - $340 |

P&C net investment income, before tax, excluding limited partnerships and other alternative income (LP)3 | $1,065 | $1,005 - $1,055 |

Share repurchases | $1,250 | $1,330 |

[1] Excludes catastrophes and PYD and is a financial measure not calculated based on generally accepted accounting principles

[2] 2016 outlook includes P&C catastrophe ratio of 2.3 points in Commercial Lines and 6.6 points in Personal Lines

[3] Excludes P&C LP investment income yield of 6% in 2016 outlook.

The 2016 outlook includes several items that differ from 2015 results. In particular, the 2016 outlook includes:

| |

• | P&C catastrophe loss ratio of 3.9 points compared with a 3.2 point catastrophe loss ratio in 2015; |

| |

• | Unfavorable PYD of $22 million, after-tax, for the accretion of the discount on workers' compensation reserves, whereas full year 2015 core earnings included total unfavorable PYD of $168 million, after-tax, comprised of $19 million for accretion of discount on workers' compensation reserves, $134 million, after-tax for asbestos and environmental (A&E) reserves and $15 million, after-tax, net, for other lines; |

| |

• | Significantly lower core earnings from Talcott Resolution of $320 million to $340 million compared with $472 million in 2015, which included favorable LP returns and non-routine net investment income from make-whole premiums and other non-routine items; |

| |

• | Common share repurchases of approximately $1.3 billion, which are expected to be accretive to core earnings per diluted share but the amount of accretion will depend on the price and timing of the share repurchases; and |

| |

• | Does not include a favorable litigation resolution in P&C of $13 million, after-tax, in 2015. |

The table below provides a reconciliation of these items between full year 2015 core earnings and the 2016 outlook.

|

| | | | | |

2015 Core Earnings Reconciliation To 2016 Outlook |

| | | | | |

($ in millions) | 2015 | | 2016 Outlook |

Core earnings | $1,650 | | $1,575 | - | $1,675 |

Less: | | | | | |

Catastrophes favorable to outlook | 77 | | - | | - |

Unfavorable PYD | (168) | | (22) | - | (22) |

Favorable litigation resolution | 13 | | - | | - |

Core earnings excluding items | $1,728 | | $1,597 | - | $1,697 |

Less: Talcott Resolution core earnings | 472 | | 320 | - | 340 |

Adjusted core earnings, excluding Talcott Resolution | $1,256 | | $1,277 | - | $1,357 |

Adjusted core earnings growth rate, excl. Talcott Resolution | | | 2% | - | 8% |

COMMERCIAL LINES

Fourth Quarter 2015 Highlights:

| |

• | Core earnings increased 15% over fourth quarter 2014 due to improved underwriting results partially offset by lower net investment income |

| |

• | Combined ratio before catastrophes and PYD of 88.2 improved 3.0 points over fourth quarter 2014 |

| |

• | Standard Commercial renewal written pricing increases averaged 2% |

|

| | | |

($ in millions) | Three Months Ended |

| Dec 31 2015 | Dec 31 2014 | Change |

Core earnings | $289 | $251 | 15% |

Net income | $293 | $262 | 12% |

Underwriting gain* | $198 | $123 | 61% |

Net investment income | $206 | $222 | (7)% |

Combined ratio | 88.1 | 92.4 | 4.3 |

Catastrophes and PYD | (0.2) | 1.2 | 1.4 |

Combined ratio before catastrophes and PYD | 88.2 | 91.2 | 3.0 |

Small Commercial: | | | |

Combined ratio before catastrophes and PYD | 85.1 | 86.8 | 1.7 |

New business premium | $133 | $122 | 9% |

Policy count retention | 85% | 85% | — |

Middle Market: | | | |

Combined ratio before catastrophes and PYD | 89.0 | 94.7 | 5.7 |

New business premium | $114 | $131 | (13)% |

Policy count retention | 81% | 80% | 1.0 |

Written premiums | $1,609 | $1,558 | 3% |

Standard Commercial renewal written pricing increases | 2% | 3% | (1.0) |

Fourth quarter 2015 core earnings in Commercial Lines was $289 million, an increase of $38 million, or 15%, from fourth quarter 2014 due to improved underwriting results that were partially offset by lower net investment income.

Commercial Lines underwriting results were a gain of $198 million, before tax, in fourth quarter 2015 for an 88.1 combined ratio compared with a fourth quarter 2014 underwriting gain of $123 million, before tax, for a 92.4 combined ratio. The increase in underwriting gain reflects improved current accident year results, despite a modest increase in catastrophe losses, and favorable PYD versus unfavorable PYD in fourth quarter 2014. Excluding the impact of PYD on both periods, fourth quarter 2015 underwriting results improved by $46 million, before tax, compared with fourth quarter 2014, including a $7 million, before tax, increase in catastrophe losses.

Fourth quarter 2015 combined ratio before catastrophes and PYD improved 3.0 points over fourth quarter 2014 to 88.2, reflecting improvements in all three business lines within Commercial Lines. The Small Commercial combined ratio before catastrophes and PYD was 85.1 in fourth quarter 2015, 1.7 points better than fourth quarter 2014, principally due to workers’ compensation results, lower non-catastrophe property losses and a lower expense ratio. The

Middle Market combined ratio before catastrophes and PYD improved 5.7 points to 89.0, reflecting lower non-catastrophe property losses and better workers' compensation and general liability results compared with fourth quarter 2014. The Specialty Commercial combined ratio before catastrophes and PYD improved 1.0 point compared with fourth quarter 2014 to 98.1 due to better underwriting results in financial products and bond.

Fourth quarter 2015 written premiums in Commercial Lines grew 3% over fourth quarter 2014 to $1,609 million, reflecting renewal written price increases and strong retention in Small Commercial and Middle Market, which together comprise about 87% of Commercial Lines written premiums. Fourth quarter 2015 renewal written price increases averaged 2% in Standard Commercial, resulting from a 3% increase in Small Commercial and a 1% increase in Middle Market, exclusive of the specialty programs and livestock lines. Policy count retention remained strong in both businesses at 85% in Small Commercial and 81% in Middle Market.

PERSONAL LINES

Fourth Quarter 2015 Highlights:

| |

• | Combined ratio before catastrophes and PYD of 93.5, up 1.7 points compared with fourth quarter 2014 |

| |

• | Automobile combined ratio before catastrophes and PYD increased 0.5 point compared with fourth quarter 2014 due to higher physical damage and liability frequency |

| |

• | Homeowners combined ratio before catastrophes and PYD increased 4.3 points over fourth quarter 2014, which was lower than normal |

|

| | | |

($ in millions) | Three Months Ended |

| Dec 31 2015 | Dec 31 2014 | Change |

Core earnings | $51 | $65 | (22)% |

Net income | $51 | $65 | (22)% |

Underwriting gain | $46 | $60 | (23)% |

Net investment income | $30 | $30 | —% |

Combined ratio | 95.3 | 93.8 | (1.5) |

Catastrophes and PYD | 1.8 | 1.9 | 0.1 |

Combined ratio before catastrophes and PYD | 93.5 | 91.8 | (1.7) |

Automobile | 102.9 | 102.4 | (0.5) |

Homeowners | 72.4 | 68.1 | (4.3) |

Written premiums | $936 | $912 | 3% |

Fourth quarter 2015 core earnings in Personal Lines decreased to $51 million from $65 million in fourth quarter 2014 due to a decrease in the underwriting gain as a result of lower current accident year results for automobile and homeowners, including higher catastrophe losses.

Personal Lines underwriting gain totaled $46 million, before tax, for a combined ratio of 95.3 in fourth quarter 2015 compared with fourth quarter 2014 underwriting gain of $60 million for a combined ratio of 93.8. Catastrophes increased from $13 million, before tax, in fourth quarter 2014 to $21 million, before tax, in fourth quarter 2015. The increase in catastrophes, however, was more than offset by PYD, which was a favorable $3 million, before tax, in fourth quarter 2015 compared with an unfavorable $6 million, before tax, in fourth quarter 2014. In total, catastrophes and PYD added 1.8 points to the fourth quarter 2015 combined ratio versus 1.9 points in fourth quarter 2014.

Excluding catastrophes and PYD, fourth quarter 2015 underwriting results deteriorated from fourth quarter 2014 due to higher automobile losses as a result of increased physical damage and liability frequency and increased homeowner losses. Fourth quarter 2015 combined ratio before catastrophes and PYD was 93.5, up 1.7 points compared with fourth quarter 2014.

The automobile combined ratio before catastrophes and PYD rose from 102.4 in fourth quarter 2014 to 102.9 in fourth quarter 2015 due to higher frequency compared with fourth quarter 2014, although largely consistent with third quarter 2015 experience. Frequency was unfavorably impacted by increased economic activity, resulting in more miles driven and congested roadways, coupled with adverse weather conditions in parts of the country.

The homeowners combined ratio before catastrophes and PYD increased from 68.1 in fourth quarter 2014 to 72.4 in fourth quarter 2015. Fourth quarter 2014 had a low level of non-weather related losses compared with a more normal level in fourth quarter 2015.

Fourth quarter 2015 Personal Lines written premiums rose 3% over fourth quarter 2014 reflecting strong automobile new business growth and stable retention, partially offset by lower premium in Other Agency. Premium retention continued to be strong and stable with third quarter 2015 and fourth quarter 2014 at 87% for automobile and 90% for homeowners. Total automobile new business premium increased 14%, while homeowners declined 14% compared with fourth quarter 2014. Renewal written price increases in fourth quarter 2015 averaged 6% in automobile and 8% in homeowners, consistent with the past several quarters.

GROUP BENEFITS

Fourth Quarter 2015 Highlights:

| |

• | Core earnings of $40 million decreased 11% over fourth quarter 2014 principally due to less favorable group life results |

| |

• | Core earnings margin* of 4.6% compared with 5.3% in fourth quarter 2014 |

| |

• | Fully insured ongoing premiums grew 5% over fourth quarter 2014, excluding Association-Financial Institutions |

|

| | | |

($ in millions) | Three Months Ended |

| Dec 31 2015 | Dec 31 2014 | Change |

Core earnings | $40 | $45 | (11%) |

Net income | $37 | $48 | (23%) |

Fully insured ongoing premiums, excluding A-FI1 | $774 | $737 | 5% |

Loss ratio, excluding A-FI | 78.4% | 76.0% | (2.4) |

Expense ratio, excluding A-FI | 26.0% | 27.9% | 1.9 |

Net investment income | $88 | $90 | (2%) |

Core earnings margin* | 4.6% | 5.3% | (0.7) |

| |

[1] | Fully insured ongoing premiums exclude buyout premiums and premium equivalents; excludes A-FI premiums of $0 million and $2 million in fourth quarter 2015 and 2014, respectively. |

Fourth quarter 2015 core earnings in Group Benefits declined $5 million, after-tax, to $40 million, an 11% decrease from $45 million in fourth quarter 2014, reflecting higher loss ratios in group life and group disability partially offset by a lower expense ratio. As a result, the core earnings margin declined to 4.6% in fourth quarter 2015 from 5.3% in fourth quarter 2014.

Fourth quarter 2015 total loss ratio was 78.4%, an increase of 2.4 points compared with

fourth quarter 2014, excluding the impact of the Association-Financial Institutions (A-FI) book. The A-FI book, which was in the group life line, was fully run off as of Dec. 31, 2014 and does not impact 2015 results, although it did affect the group life loss ratio and Group Benefits expense ratios in 2014. The increase in the loss ratio in fourth quarter 2015 was due to a 4.2 point increase in the group life loss ratio, excluding A-FI, and a 1.0 point increase in the group disability loss ratio compared with fourth quarter 2014. The increase in group life was due to higher mortality and claim severity while the increase in disability was due to higher claims severity including slightly lower recoveries, partially offset by improved incidence and pricing. The fourth quarter 2015 expense ratio, excluding A-FI, improved 1.9 points to 26.0% due to higher earned premiums and lower insurance operating costs and other expenses compared with fourth quarter 2014.

Fourth quarter 2015 fully insured ongoing premiums were $774 million, up 5%, excluding A-FI, from fourth quarter 2014, reflecting increased sales, improved persistency and improved pricing during 2015. Group life premiums, which comprise 48% of segment premiums, rose 5% from fourth quarter 2014, excluding A-FI, while group disability premiums, which comprise approximately 46%, were up 4%. Fourth quarter 2015 fully insured ongoing sales rose 9% over fourth quarter 2014 to $48 million, principally reflecting 10% growth in group disability sales to $22 million and stable group life sales at $20 million.

MUTUAL FUNDS

Fourth Quarter 2015 Highlights:

| |

• | Core earnings of $20 million compared with $27 million in fourth quarter 2014, which included a favorable state tax benefit |

| |

• | Mutual Fund net flows, which exclude Talcott Resolution assets under management (AUM), were $0.4 billion in the quarter and $1.5 billion for full year 2015, marking four consecutive quarters of positive net flows |

| |

• | Solid overall fund performance, with 61%, 55% and 58% of Hartford Mutual Funds outperforming peers on a 1-, 3- and 5-year basis, respectively1 |

|

| | | |

($ in millions) | Three Months Ended |

| Dec 31 2015 | Dec 31 2014 | Change |

Core earnings | $20 | $27 | (26%) |

Net income | $20 | $23 | (13%) |

Mutual Fund sales | $4,636 | $3,894 | 19% |

Mutual Fund net flows | $405 | $(1,060) | NM |

Mutual Fund AUM | $74,413 | $73,035 | 2% |

Talcott AUM | $17,549 | $20,584 | (15)% |

Total Mutual Funds segment AUM | $91,962 | $93,619 | (2)% |

Mutual Funds fourth quarter 2015 core earnings were $20 million, down from $27 million in fourth quarter 2014, which included a favorable state tax benefit. Excluding this benefit, fourth quarter 2015 core earnings decreased due to a decrease in fees as a result of a lower average AUM and higher marketing expenses compared with fourth quarter 2014.

Total AUM declined 2% from fourth quarter 2014 due to the expected decrease in Talcott Resolution AUM, partially offset by $1.5 billion of net flows into Mutual Fund AUM during 2015. Talcott Resolution AUM decreased 15% over the past twelve months to $17.5 billion due to continued runoff of variable annuity contract counts. Excluding Talcott Resolution, Mutual Fund AUM increased to $74.4 billion from $73.0 billion due to positive net flows during 2015.

During the quarter, Mutual Fund net flows were $405 million, benefiting from higher sales compared with fourth quarter 2014 and stable redemption levels. Overall Mutual Fund performance remained solid, with 61%, 55% and 58% of funds outperforming peers on a 1-, 3- and 5-year basis, respectively.

| |

[1] | Hartford Mutual Funds only on Morningstar net of fee basis |

TALCOTT RESOLUTION

|

| | | |

($ in millions) | Three Months Ended |

| Dec 31 2015 | Dec 31 2014 | Change |

Core earnings | $83 | $98 | (15)% |

Net income | $28 | $144 | (81)% |

Variable annuity contract count (in thousands) | 603 | 674 | (11)% |

Fixed annuity and other contract count (in thousands) | 128 | 139 | (8)% |

Fourth quarter 2015 core earnings in Talcott Resolution were $83 million, a $15 million, or 15%, decrease from fourth quarter 2014 due to lower net investment income, including lower income on LPs, and lower fees due to the continued runoff of the annuity business. Investment income on LPs was $1 million, before tax, in fourth quarter 2015 compared with $24 million, before tax, in fourth quarter 2014.

Variable annuity (VA) and fixed annuity contract counts as of Dec. 31, 2015 each declined 2% from Sept. 30, 2015 and declined 11% and 8%, respectively, from Dec. 31, 2014. The decline in contract counts since Dec. 31, 2014 includes normal surrender activity and the impact of the company's contractholder initiatives in both VA and fixed annuity, which ended in April and November 2015, respectively.

In the fourth quarter of 2015, the company completed its annual study of non-market related policyholder behavior assumptions and incorporated the results of those studies into its projection of future gross profits. In 2014, the annual assumptions study was completed in the third quarter. As a result of the fourth quarter assumptions study in 2015, the company recognized an unlock benefit of $9 million, after-tax. In addition, annual assumption study updates were included in the valuation of the liability for non-lifetime guaranteed minimum withdrawal benefit (GMWB). This resulted in a charge of $27 million, after-tax, included in net realized capital losses, after-tax and DAC. The charge was largely due to lower assumed lapses and higher withdrawal utilization.

INVESTMENTS

|

| | | | |

($ in millions) | Three Months Ended |

Amounts presented before tax | Dec 31 2015 | Dec 31 2014 | Change |

Total investments | $72,728 | $76,278 | (5 | )% |

Net investment income on LPs | $12 | $44 | (73 | )% |

Net investment income | $695 | $752 | (8 | )% |

Net impairment losses, including mortgage loan loss reserves | $42 | $17 | 147 | % |

Annualized investment yield1 | 3.9% | 4.2% | (0.3 | ) |

Annualized investment yield on LPs | 1.5% | 6.0% | (4.5 | ) |

Annualized investment yield, excluding LPs | 4.1% | 4.1% | — |

|

| |

[1] | Yields, before tax, calculated using annualized net investment income divided by the monthly average invested assets at cost, amortized cost, or adjusted carrying value, as applicable, excluding repurchase agreement and securities lending collateral, if any, and derivatives book value. |

Fourth quarter 2015 net investment income totaled $695 million, before tax, an 8% decrease from fourth quarter 2014 principally due to lower investment income on LPs and the continued runoff of Talcott Resolution. Fourth quarter 2015 annualized investment yield declined to 3.9%, before tax, from 4.2%, before tax, in fourth quarter 2014 due to lower investment income on LPs, which totaled $12 million, before tax, in fourth quarter 2015 compared with $44 million, before tax, in fourth quarter 2014. The decrease in investment income on LPs was largely due to losses on hedge funds and real-estate partnerships but also includes lower income on private equity funds compared with fourth quarter 2014. Fourth quarter 2015 annualized investment yield on LPs was 1.5%, before tax, compared with 6.0%, before tax, in fourth quarter 2014.

Excluding the impact of LPs, net investment income decreased 4% compared with fourth quarter 2014 due to lower investment income in Talcott Resolution as a result of the runoff of the business. Fourth quarter 2015 annualized investment yield excluding LPs was 4.1%, before tax, consistent with fourth quarter 2014 although lower reinvestment rates continue to pressure the total portfolio yield.

The credit performance of the company's portfolio remained strong in fourth quarter 2015, although net impairment losses, including mortgage loan loss reserves, increased from $17 million, before tax, in fourth quarter 2014 to $42 million, before tax, in fourth quarter 2015. Similar to third quarter 2015, the increase in net impairment losses includes impairments on securities the company intends to sell, as well as credit impairments for securities that the company expects to continue to own. The impairments included securities in the energy and minerals and mining sectors.

The carrying value of total investments declined to $72.7 billion at Dec. 31, 2015 compared with $76.3 billion at Dec. 31, 2014. The decline in total investments reflects stable invested assets in the P&C and Group Benefits businesses, partially offset by a reduction in Corporate invested assets due to dividends, share repurchases and debt reduction over the past 12 months and by a 9% decrease in invested assets in Talcott Resolution during 2015.

STOCKHOLDERS’ EQUITY

|

| | | |

($ in millions) | As of |

| Dec 31, 2015 | Dec 31 2014 | Change |

Stockholders' equity | $17,642 | $18,720 | (6)% |

Stockholders' equity (ex. AOCI) | $17,971 | $17,792 | 1% |

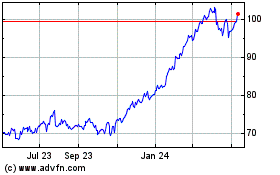

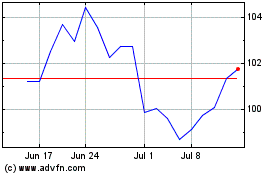

Book value per diluted share | $42.96 | $42.84 | —% |

Book value per diluted share (ex. AOCI) | $43.76 | $40.71 | 7% |

Common shares outstanding | 401.8 | 424.4 | (5)% |

Common shares outstanding and dilutive potential common shares | 410.7 | 437.0 | (6)% |

The Hartford’s stockholders’ equity was $17.6 billion as of Dec. 31, 2015, a 6% decrease from $18.7 billion as of Dec. 31, 2014. The decrease was largely due to the $1.3 billion reduction in accumulated other comprehensive income (AOCI) from Dec. 31, 2014 mostly due to the impact of higher interest rates on the company's fixed income portfolios. Excluding AOCI, stockholders' equity was $18.0 billion as of Dec. 31, 2015, a 1% increase compared with Dec. 31, 2014, as the company's common share repurchases of $1,250 million and common dividends of $323 million during 2015 almost entirely offset 2015 net income of $1,682 million.

Common shares outstanding at Dec. 31, 2015 decreased to 401.8 million, or 5%, since Dec. 31, 2014, due to the company's repurchase of 28.4 million common shares, slightly offset by conversion of warrants into common equity. Common shares outstanding and dilutive potential common shares as of Dec. 31, 2015 decreased 6% from Dec. 31, 2014 to 410.7 million, also as a result of the company's common share repurchases.

The company's current capital management plan authorized $4.375 billion for equity repurchases from Jan. 1, 2014 through Dec. 31, 2016. As of Feb. 3, 2016, the company has repurchased $3.173 billion of common shares and warrants, including $128 million of common equity since Dec. 31, 2015, leaving approximately $1.2 billion for equity repurchases through Dec. 31, 2016.

Book value per diluted common share was $42.96 as of Dec. 31, 2015, roughly flat with Dec. 31, 2014, as the 6% decline in stockholders' equity, due principally to a decline in AOCI during 2015, was offset by the effect of a 6% decrease in common shares outstanding and dilutive potential common shares as a result of the company's equity repurchases. Excluding AOCI, book value per diluted common share rose 7% to $43.76 as of Dec. 31, 2015 from $40.71 as of Dec. 31, 2014. The increase in book value per diluted common share, excluding AOCI, was due to a 1% increase in stockholders' equity, excluding AOCI, and a 6% decrease in common shares outstanding and dilutive potential common shares.

CONFERENCE CALL

The Hartford will discuss its fourth quarter and full year 2015 financial results and its 2016 outlook in a webcast on Friday, Feb. 5, 2016, at 9 a.m. EST. The webcast can be accessed live or as a replay through the investor relations section of The Hartford's website at http://ir.thehartford.com.

More detailed financial information can be found in The Hartford's Investor Financial Supplement for Dec. 31, 2015 and the Fourth Quarter 2015 Financial Results Presentation, both of which are available at http://ir.thehartford.com.

ABOUT THE HARTFORD

With more than 200 years of expertise, The Hartford (NYSE:HIG) is a leader in property and casualty insurance, group benefits and mutual funds. The company is widely recognized for its service excellence, sustainability practices, trust and integrity. More information on the company and its financial performance is available at www.thehartford.com.

From time to time, The Hartford uses its website to disseminate material company information. Financial and other important information regarding The Hartford is routinely accessible through and posted on our website at http://ir.thehartford.com. In addition, you may automatically receive email alerts and other information about The Hartford when you enroll your email address by visiting the “Email Alerts” section at http://ir.thehartford.com.

HIG-F

Media Contacts Investor Contacts

Michelle Loxton Sabra Purtill, CFA

860-547-7413 860-547-8691

michelle.loxton@thehartford.com sabra.purtill@thehartford.com

Matthew Sturdevant Sean Rourke

860-547-8664 860-547-5688

matthew.sturdevant@thehartford.com sean.rourke@thehartford.com

|

| | | | | | | | | | | | | | | | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

CONSOLIDATING INCOME STATEMENTS |

Three Months Ended December 31, 2015 |

($ in millions) |

| Property & Casualty | Group Benefits | Mutual Funds | Talcott Resolution | Corporate | Consolidated |

Earned premiums | $ | 2,667 |

| $ | 774 |

| $ | — |

| $ | 19 |

| $ | — |

| $ | 3,460 |

|

Fee income | — |

| 17 |

| 178 |

| 266 |

| 2 |

| 463 |

|

Net investment income | 270 |

| 88 |

| 1 |

| 331 |

| 5 |

| 695 |

|

Other revenues | 21 |

| — |

| — |

| — |

| — |

| 21 |

|

Net realized capital gains (losses) | 10 |

| (6 | ) | — |

| (128 | ) | (2 | ) | (126 | ) |

Total revenues | 2,968 |

| 873 |

| 179 |

| 488 |

| 5 |

| 4,513 |

|

Benefits, losses, and loss adjustment expenses | 1,639 |

| 620 |

| — |

| 431 |

| — |

| 2,690 |

|

Amortization of deferred policy acquisition costs | 330 |

| 7 |

| 6 |

| (53 | ) | — |

| 290 |

|

Insurance operating costs and other expenses | 487 |

| 199 |

| 141 |

| 106 |

| 6 |

| 939 |

|

Interest expense | — |

| — |

| — |

| — |

| 86 |

| 86 |

|

Restructuring and other costs | — |

| — |

| — |

| — |

| 4 |

| 4 |

|

Total benefits and expenses | 2,456 |

| 826 |

| 147 |

| 484 |

| 96 |

| 4,009 |

|

Income (loss) from continuing operations, before income taxes | 512 |

| 47 |

| 32 |

| 4 |

| (91 | ) | 504 |

|

Income tax expense (benefit) | 149 |

| 10 |

| 12 |

| (24 | ) | (64 | ) | 83 |

|

Net income (loss) | 363 |

| 37 |

| 20 |

| 28 |

| (27 | ) | 421 |

|

Less: Unlock benefit, after-tax | — |

| — |

| — |

| 35 |

| — |

| 35 |

|

Less: Net realized capital gains (losses), after-tax and DAC, excluded from core earnings | 5 |

| (3 | ) | — |

| (90 | ) | (2 | ) | (90 | ) |

Less: Restructuring and other costs, after-tax | — |

| — |

| — |

| — |

| (3 | ) | (3 | ) |

Less: Income tax benefit from reduction in valuation allowance | — |

| — |

| — |

| — |

| 34 |

| 34 |

|

Core earnings (losses) | $ | 358 |

| $ | 40 |

| $ | 20 |

| $ | 83 |

| $ | (56 | ) | $ | 445 |

|

|

| | | | | | | | | | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

PROPERTY & CASUALTY |

CONSOLIDATING INCOME STATEMENTS |

Three Months Ended December 31, 2015 |

($ in millions) |

| Commercial Lines | Personal Lines | P&C Other | Property & Casualty |

Written premiums | $ | 1,609 |

| $ | 936 |

| $ | 31 |

| $ | 2,576 |

|

Change in unearned premium reserve | (49 | ) | (42 | ) | — |

| (91 | ) |

Earned premiums | 1,658 |

| 978 |

| 31 |

| 2,667 |

|

Losses and loss adjustment expenses |

|

|

|

|

|

Current accident year before catastrophes | 923 |

| 662 |

| 25 |

| 1,610 |

|

Current accident year catastrophes | 13 |

| 21 |

| — |

| 34 |

|

Prior accident year development | (16 | ) | (3 | ) | 14 |

| (5 | ) |

Total losses and loss adjustment expenses | 920 |

| 680 |

| 39 |

| 1,639 |

|

Amortization of DAC | 241 |

| 89 |

| — |

| 330 |

|

Underwriting expenses | 295 |

| 163 |

| 11 |

| 469 |

|

Dividends to policyholders | 4 |

| — |

| — |

| 4 |

|

Underwriting gain (loss) | 198 |

| 46 |

| (19 | ) | 225 |

|

Net investment income | 206 |

| 30 |

| 34 |

| 270 |

|

Net realized capital gains (losses) | 11 |

| — |

| (1 | ) | 10 |

|

Net servicing and other income | 4 |

| — |

| 3 |

| 7 |

|

Income from continuing operations before income taxes | 419 |

| 76 |

| 17 |

| 512 |

|

Income tax expense (benefit) | 126 |

| 25 |

| (2 | ) | 149 |

|

Net income | 293 |

| 51 |

| 19 |

| 363 |

|

Less: Net realized capital gains, after-tax and DAC, excluded from core earnings | 4 |

| — |

| 1 |

| 5 |

|

Core earnings | $ | 289 |

| $ | 51 |

| $ | 18 |

| $ | 358 |

|

|

| | | | | | | | | | | | | | | | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

CONSOLIDATING INCOME STATEMENTS |

Three Months Ended December 31, 2014 |

($ in millions) |

| Property & Casualty | Group Benefits | Mutual Funds | Talcott Resolution | Corporate | Consolidated |

Earned premiums | $ | 2,580 |

| $ | 751 |

| $ | — |

| $ | 47 |

| $ | — |

| $ | 3,378 |

|

Fee income | — |

| 15 |

| 181 |

| 276 |

| 1 |

| 473 |

|

Net investment income | 282 |

| 90 |

| — |

| 370 |

| 10 |

| 752 |

|

Other revenues | 28 |

| — |

| — |

| — |

| — |

| 28 |

|

Net realized capital gains (losses) | 6 |

| 4 |

| — |

| (15 | ) | (9 | ) | (14 | ) |

Total revenues | 2,896 |

| 860 |

| 181 |

| 678 |

| 2 |

| 4,617 |

|

Benefits, losses, and loss adjustment expenses | 1,622 |

| 580 |

| — |

| 380 |

| — |

| 2,582 |

|

Amortization of deferred policy acquisition costs | 322 |

| 8 |

| 6 |

| 45 |

| — |

| 381 |

|

Insurance operating costs and other expenses | 491 |

| 208 |

| 134 |

| 144 |

| 8 |

| 985 |

|

Interest expense | — |

| — |

| — |

| — |

| 94 |

| 94 |

|

Net reinsurance gain on dispositions | — |

| — |

| — |

| (23 | ) | — |

| (23 | ) |

Pension settlement | — |

| — |

| — |

| — |

| 128 |

| 128 |

|

Restructuring and other costs | — |

| — |

| 6 |

| — |

| 20 |

| 26 |

|

Total benefits and expenses | 2,435 |

| 796 |

| 146 |

| 546 |

| 250 |

| 4,173 |

|

Income (loss) from continuing operations before income taxes | 461 |

| 64 |

| 35 |

| 132 |

| (248 | ) | 444 |

|

Income tax expense (benefit) | 140 |

| 16 |

| 12 |

| 19 |

| (88 | ) | 99 |

|

Income (loss) from continuing operations, after tax | 321 |

| 48 |

| 23 |

| 113 |

| (160 | ) | 345 |

|

Income from discontinued operations, after-tax | 6 |

| — |

| — |

| 31 |

| — |

| 37 |

|

Net income (loss) | 327 |

| 48 |

| 23 |

| 144 |

| (160 | ) | 382 |

|

Less: Unlock benefit, after-tax | — |

| — |

| — |

| 13 |

| — |

| 13 |

|

Less: Net realized capital gains (losses) and other, after-tax and DAC, excluded from core earnings | 5 |

| 3 |

| — |

| (13 | ) | (4 | ) | (9 | ) |

Less: Restructuring and other costs, after-tax | — |

| — |

| (4 | ) | — |

| (13 | ) | (17 | ) |

Less: Pension settlement, after-tax | — |

| — |

| — |

| — |

| (83 | ) | (83 | ) |

Less: Net reinsurance gain on dispositions, after-tax | — |

| — |

| — |

| 15 |

| — |

| 15 |

|

Less: Income from discontinued operations, after-tax | 6 |

| — |

| — |

| 31 |

| — |

| 37 |

|

Core earnings (losses) | $ | 316 |

| $ | 45 |

| $ | 27 |

| $ | 98 |

| $ | (60 | ) | $ | 426 |

|

|

| | | | | | | | | | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

PROPERTY & CASUALTY |

CONSOLIDATING INCOME STATEMENTS |

Three Months Ended December 31, 2014 |

($ in millions) |

| Commercial Lines | Personal Lines | P&C Other | Property & Casualty |

Written premiums | $ | 1,558 |

| $ | 912 |

| $ | — |

| $ | 2,470 |

|

Change in unearned premium reserve | (53 | ) | (56 | ) | (1 | ) | (110 | ) |

Earned premiums | 1,611 |

| 968 |

| 1 |

| 2,580 |

|

Losses and loss adjustment expenses | | | | |

Current accident year before catastrophes | 934 |

| 640 |

| — |

| 1,574 |

|

Current accident year catastrophes | 6 |

| 13 |

| — |

| 19 |

|

Prior accident year development | 13 |

| 6 |

| 10 |

| 29 |

|

Total losses and loss adjustment expenses | 953 |

| 659 |

| 10 |

| 1,622 |

|

Amortization of DAC | 233 |

| 89 |

| — |

| 322 |

|

Underwriting expenses | 298 |

| 160 |

| 15 |

| 473 |

|

Dividends to policyholders | 4 |

| — |

| — |

| 4 |

|

Underwriting gain (loss) | 123 |

| 60 |

| (24 | ) | 159 |

|

Net investment income | 222 |

| 30 |

| 30 |

| 282 |

|

Net realized capital gains (losses) | 8 |

| (1 | ) | (1 | ) | 6 |

|

Net servicing and other income | 5 |

| 6 |

| 3 |

| 14 |

|

Income from continuing operations before income taxes | 358 |

| 95 |

| 8 |

| 461 |

|

Income tax expense | 102 |

| 30 |

| 8 |

| 140 |

|

Income from continuing operations, after-tax | 256 |

| 65 |

| — |

| 321 |

|

Income from discontinued operations, after-tax | 6 |

| — |

| — |

| 6 |

|

Net income | 262 |

| 65 |

| — |

| 327 |

|

Less: Net realized capital gains, after-tax and DAC, excluded from core earnings | 5 |

| — |

| — |

| 5 |

|

Less: Income from discontinued operations, after-tax | 6 |

| — |

| — |

| 6 |

|

Core earnings | $ | 251 |

| $ | 65 |

| $ | — |

| $ | 316 |

|

|

| | | | | | | | | | | | | | | | | | |

| | | | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

CONSOLIDATING INCOME STATEMENTS |

($ in millions) |

Year Ended December 31, 2015 |

| Property & Casualty | Group Benefits | Mutual Funds | Talcott Resolution | Corporate | Consolidated |

Earned premiums | $ | 10,416 |

| $ | 3,069 |

| $ | — |

| $ | 92 |

| $ | — |

| $ | 13,577 |

|

Fee income | — |

| 67 |

| 723 |

| 1,041 |

| 8 |

| 1,839 |

|

Net investment income | 1,171 |

| 371 |

| 1 |

| 1,470 |

| 17 |

| 3,030 |

|

Other revenues | 87 |

| — |

| — |

| — |

| — |

| 87 |

|

Net realized capital gains (losses) | 1 |

| (11 | ) | — |

| (161 | ) | 15 |

| (156 | ) |

Total revenues | 11,675 |

| 3,496 |

| 724 |

| 2,442 |

| 40 |

| 18,377 |

|

Benefits, losses, and loss adjustment expenses | 6,897 |

| 2,427 |

| — |

| 1,451 |

| — |

| 10,775 |

|

Amortization of deferred policy acquisition costs | 1,310 |

| 31 |

| 22 |

| 139 |

| — |

| 1,502 |

|

Insurance operating costs and other expenses | 1,894 |

| 788 |

| 568 |

| 469 |

| 33 |

| 3,752 |

|

Interest expense | — |

| — |

| — |

| — |

| 357 |

| 357 |

|

Net reinsurance gain loss on dispositions | — |

| — |

| — |

| (28 | ) | — |

| (28 | ) |

Loss on extinguishment of debt | — |

| — |

| — |

| — |

| 21 |

| 21 |

|

Restructuring and other costs | — |

| — |

| — |

| — |

| 20 |

| 20 |

|

Total benefits and expenses | 10,101 |

| 3,246 |

| 590 |

| 2,031 |

| 431 |

| 16,399 |

|

Income (loss) from continuing operations, before income taxes | 1,574 |

| 250 |

| 134 |

| 411 |

| (391 | ) | 1,978 |

|

Income tax expense (benefit) | 444 |

| 63 |

| 48 |

| (17 | ) | (233 | ) | 305 |

|

Income (loss) from continuing operations, after tax | 1,130 |

| 187 |

| 86 |

| 428 |

| (158 | ) | 1,673 |

|

Income from discontinued operations, after-tax | 7 |

| — |

| — |

| 2 |

| — |

| 9 |

|

Net income (loss) | 1,137 |

| 187 |

| 86 |

| 430 |

| (158 | ) | 1,682 |

|

Less: Unlock benefit, after-tax | — |

| — |

| — |

| 52 |

| — |

| 52 |

|

Less: Net realized capital gains (losses), after-tax and DAC, excluded from core earnings | (1 | ) | (8 | ) | — |

| (114 | ) | 9 |

| (114 | ) |

Less: Restructuring and other costs, after-tax | — |

| — |

| — |

| — |

| (13 | ) | (13 | ) |

Less: Loss on extinguishment of debt, after-tax | — |

| — |

| — |

| — |

| (14 | ) | (14 | ) |

Less: Net reinsurance gain on dispositions, after-tax | — |

| — |

| — |

| 18 |

| — |

| 18 |

|

Less: Income tax benefit from reduction in valuation allowance | — |

| — |

| — |

| — |

| 94 |

| 94 |

|

Less: Income from discontinued operations, after-tax | 7 |

| — |

| — |

| 2 |

| — |

| 9 |

|

Core earnings (losses) | $ | 1,131 |

| $ | 195 |

| $ | 86 |

| $ | 472 |

| $ | (234 | ) | $ | 1,650 |

|

|

| | | | | | | | | | | | |

| | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

PROPERTY & CASUALTY |

CONSOLIDATING INCOME STATEMENTS |

Year Ended December 31, 2015 |

($ in millions) |

| Commercial Lines | Personal Lines | P&C Other | Property & Casualty (Combined) |

Written premiums | $ | 6,625 |

| $ | 3,918 |

| $ | 35 |

| $ | 10,578 |

|

Change in unearned premium reserve | 114 |

| 45 |

| 3 |

| 162 |

|

Earned premiums | 6,511 |

| 3,873 |

| 32 |

| 10,416 |

|

Losses and loss adjustment expenses | | | | |

Current accident year before catastrophes | 3,712 |

| 2,578 |

| 25 |

| 6,315 |

|

Current accident year catastrophes | 121 |

| 211 |

| — |

| 332 |

|

Prior accident year development | 53 |

| (21 | ) | 218 |

| 250 |

|

Total losses and loss adjustment expenses | 3,886 |

| 2,768 |

| 243 |

| 6,897 |

|

Amortization of DAC | 951 |

| 359 |

| — |

| 1,310 |

|

Underwriting expenses | 1,178 |

| 628 |

| 32 |

| 1,838 |

|

Dividends to policyholders | 17 |

| — |

| — |

| 17 |

|

Underwriting gain (loss) | 479 |

| 118 |

| (243 | ) | 354 |

|

Net investment income | 910 |

| 128 |

| 133 |

| 1,171 |

|

Net realized capital gains (losses) | (6 | ) | 4 |

| 3 |

| 1 |

|

Net servicing and other income | 22 |

| 19 |

| 7 |

| 48 |

|

Income (loss) from continuing operations before income taxes | 1,405 |

| 269 |

| (100 | ) | 1,574 |

|

Income tax expense (benefit) | 409 |

| 82 |

| (47 | ) | 444 |

|

Income (loss) from continuing operations, after-tax | 996 |

| 187 |

| (53 | ) | 1,130 |

|

Income from discontinued operations, after-tax | 7 |

| — |

| — |

| 7 |

|

Net income (loss) | 1,003 |

| 187 |

| (53 | ) | 1,137 |

|

Less: Income from discontinued operations, net of tax | 7 |

| — |

| — |

| 7 |

|

Less: Net realized capital gains (losses), after-tax and DAC, excluded from core earnings | (7 | ) | 2 |

| 4 |

| (1 | ) |

Core earnings (losses) | $ | 1,003 |

| $ | 185 |

| $ | (57 | ) | $ | 1,131 |

|

|

| | | | | | | | | | | | | | | | | | |

| | | | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

CONSOLIDATING INCOME STATEMENTS |

($ in millions) |

Year Ended December 31, 2014 |

| Property & Casualty | Group Benefits | Mutual Funds | Talcott Resolution | Corporate | Consolidated |

Earned premiums | $ | 10,096 |

| $ | 3,034 |

| $ | — |

| $ | 206 |

| $ | — |

| $ | 13,336 |

|

Fee income | — |

| 61 |

| 723 |

| 1,201 |

| 10 |

| 1,995 |

|

Net investment income | 1,216 |

| 374 |

| — |

| 1,542 |

| 22 |

| 3,154 |

|

Other revenues | 113 |

| — |

| — |

| — |

| — |

| 113 |

|

Net realized capital gains (losses) | (32 | ) | 15 |

| — |

| 26 |

| 7 |

| 16 |

|

Total revenues | 11,393 |

| 3,484 |

| 723 |

| 2,975 |

| 39 |

| 18,614 |

|

Benefits, losses, and loss adjustment expenses | 6,800 |

| 2,362 |

| — |

| 1,643 |

| — |

| 10,805 |

|

Amortization of deferred policy acquisition costs | 1,267 |

| 32 |

| 28 |

| 402 |

| — |

| 1,729 |

|

Insurance operating costs and other expenses | 1,824 |

| 836 |

| 553 |

| 567 |

| 44 |

| 3,824 |

|

Interest expense | — |

| — |

| — |

| — |

| 376 |

| 376 |

|

Net reinsurance gain on dispositions | — |

| — |

| — |

| (23 | ) | — |

| (23 | ) |

Pension settlement | — |

| — |

| — |

| — |

| 128 |

| 128 |

|

Restructuring and other costs | — |

| — |

| 6 |

| — |

| 70 |

| 76 |

|

Total benefits and expenses | 9,891 |

| 3,230 |

| 587 |

| 2,589 |

| 618 |

| 16,915 |

|

Income (loss) from continuing operations, before income taxes | 1,502 |

| 254 |

| 136 |

| 386 |

| (579 | ) | 1,699 |

|

Income tax expense (benefit) | 426 |

| 63 |

| 49 |

| 16 |

| (204 | ) | 350 |

|

Income (loss) from continuing operations, after tax | 1,076 |

| 191 |

| 87 |

| 370 |

| (375 | ) | 1,349 |

|

Income (loss) from discontinued operations, after-tax | 6 |

| — |

| — |

| (557 | ) | — |

| (551 | ) |

Net income (loss) | 1,082 |

| 191 |

| 87 |

| (187 | ) | (375 | ) | 798 |

|

Less: Unlock charge, after-tax | — |

| — |

| — |

| (62 | ) | — |

| (62 | ) |

Less: Net realized capital gains (losses), after-tax and DAC, excluded from core earnings | (19 | ) | 11 |

| — |

| (16 | ) | 4 |

| (20 | ) |

Less: Restructuring and other costs, after-tax | — |

| — |

| (4 | ) | — |

| (45 | ) | (49 | ) |

Less: Pension settlement, after-tax | — |

| — |

| — |

| — |

| (83 | ) | (83 | ) |

Less: Reinsurance gain on disposition, after-tax | — |

| — |

| — |

| 15 |

| — |

| 15 |

|

Less: Income (loss) from discontinued operations, after-tax | 6 |

| — |

| — |

| (557 | ) | — |

| (551 | ) |

Core earnings (losses) | $ | 1,095 |

| $ | 180 |

| $ | 91 |

| $ | 433 |

| $ | (251 | ) | $ | 1,548 |

|

|

| | | | | | | | | | | | |

| | | | |

THE HARTFORD FINANCIAL SERVICES GROUP, INC. |

PROPERTY & CASUALTY |

CONSOLIDATING INCOME STATEMENTS |

Year Ended December 31, 2014 |

($ in millions) |

| Commercial Lines | Personal Lines | P&C Other | Property & Casualty (Combined) |

Written premiums | $ | 6,381 |

| $ | 3,861 |

| $ | 2 |

| $ | 10,244 |

|

Change in unearned premium reserve | 92 |

| 55 |

| 1 |

| 148 |

|

Earned premiums | 6,289 |

| 3,806 |

| 1 |

| 10,096 |

|

Losses and loss adjustment expenses | | | | |

Current accident year before catastrophes | 3,733 |

| 2,498 |

| — |

| 6,231 |

|

Current accident year catastrophes | 109 |

| 232 |

| — |

| 341 |

|

Prior accident year development | 13 |

| (46 | ) | 261 |

| 228 |

|

Total losses and loss adjustment expenses | 3,855 |

| 2,684 |

| 261 |

| 6,800 |

|

Amortization of DAC | 919 |

| 348 |

| — |

| 1,267 |

|

Underwriting expenses | 1,086 |

| 604 |

| 37 |

| 1,727 |

|

Dividends to policyholders | 15 |

| — |

| — |

| 15 |

|

Underwriting gain (loss) | 414 |

| 170 |

| (297 | ) | 287 |

|

Net investment income | 958 |

| 129 |

| 129 |

| 1,216 |

|

Net realized capital gains (losses) | (30 | ) | (5 | ) | 3 |

| (32 | ) |

Net servicing and other income | 20 |

| 5 |

| 6 |

| 31 |

|

Income (loss) from continuing operations before income taxes | 1,362 |

| 299 |

| (159 | ) | 1,502 |

|

Income tax expense (benefit) | 385 |

| 92 |

| (51 | ) | 426 |

|

Income (loss) from continuing operations, after-tax | 977 |

| 207 |

| (108 | ) | 1,076 |

|

Income from discontinued operations, after-tax | 6 |

| — |

| — |

| 6 |

|

Net income (loss) | 983 |

| 207 |

| (108 | ) | 1,082 |

|

Less: Net realized capital gains (losses), after-tax and DAC, excluded from core earnings | (19 | ) | (3 | ) | 3 |

| (19 | ) |

Less: Income from discontinued operations, after-tax | 6 |

| — |

| — |

| 6 |

|

Core earnings (losses) | $ | 996 |

| $ | 210 |

| $ | (111 | ) | $ | 1,095 |

|

DISCUSSION OF NON-GAAP FINANCIAL MEASURES

The Hartford uses non-GAAP financial measures in this press release to assist investors in analyzing the company's operating performance for the periods presented herein. Because The Hartford's calculation of these measures may differ from similar measures used by other companies, investors should be careful when comparing The Hartford's non-GAAP financial measures to those of other companies. Definitions and calculations of other financial measures used in this press release can be found below and in The Hartford's Investor Financial Supplement for fourth quarter 2015, which is available on The Hartford's website, http://ir.thehartford.com.

Book value per diluted common share excluding accumulated other comprehensive income ("AOCI”): Book value per diluted common share excluding AOCI is a non-GAAP financial measure based on a GAAP financial measure. It is calculated by dividing (a) common stockholders' equity excluding AOCI, after-tax, by (b) common shares outstanding and dilutive potential common shares. The Hartford provides book value per diluted common share excluding AOCI to enable investors to analyze the company’s stockholders’ equity excluding the effect of changes in the value of the company’s investment portfolio and other assets due to interest rates, currency and other factors. The Hartford believes book value per diluted common share excluding AOCI is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period, primarily based on changes in market value. Book value per diluted common share is the most directly comparable GAAP measure. A reconciliation of book value per diluted common share, including AOCI to book value per diluted common share, excluding AOCI is set forth below.

|

| | | |

| As of |

| Dec 31 2015 | Dec 31 2014 | Change |

Book value per diluted common share, including AOCI | $42.96 | $42.84 | —% |

Less: Per diluted share impact of AOCI | $(0.80) | $2.13 | NM |

Book value per diluted common share, excluding AOCI | $43.76 | $40.71 | 7% |

Core Earnings: The Hartford uses the non-GAAP measure core earnings as an important measure of the company’s operating performance. The Hartford believes that the measure core earnings provides investors with a valuable measure of the performance of the company’s ongoing businesses because it reveals trends in our insurance and financial services businesses that may be obscured by including the net effect of certain realized capital gains and losses, certain restructuring charges, pension settlements, loss on extinguishment of debt, reinsurance gains and losses on business disposition transactions, income tax benefit from reduction in valuation allowance, discontinued operations, and the impact of Unlocks to deferred policy acquisition costs ("DAC"), sales inducement assets ("SIA"), unearned revenue reserves ("URR") and death and other insurance benefit reserve balances. Some realized capital gains and losses are primarily driven by investment decisions and external economic developments, the nature and timing of which are unrelated to the insurance and underwriting aspects of our business.

Accordingly, core earnings excludes the effect of all realized gains and losses (net of tax and the effects of DAC) that tend to be highly variable from period to period based on capital market conditions. The Hartford believes, however, that some realized capital gains and losses are integrally related to our insurance operations, so core earnings includes net realized gains and losses such as net periodic settlements on credit derivatives and net periodic settlements on the Japan fixed annuity cross-currency swap. These net realized gains and losses are directly related

to an offsetting item included in the income statement such as net investment income. Net income (loss) is the most directly comparable U.S. GAAP measure. Core earnings should not be considered as a substitute for net income (loss) and does not reflect the overall profitability of the company’s business. Therefore, The Hartford believes that it is useful for investors to evaluate both net income (loss) and core earnings when reviewing the company’s performance.

A reconciliation of core earnings to net income (loss) for the quarterly periods ended Dec. 31, 2015 and 2014, is included in this press release. A reconciliation of core earnings to net income (loss) for individual reporting segments can be found in this press release under the heading "The Hartford Financial Services Group, Inc. Consolidating Income Statements" and in The Hartford's Investor Financial Supplement for the quarter ended Dec. 31, 2015.

Core earnings available to common shareholders per diluted share: Core earnings available to common shareholders per diluted share is calculated based on the non-GAAP financial measure core earnings. It is calculated by dividing (a) core earnings, by (b) diluted common shares outstanding. The Hartford believes that the measure core earnings available to common shareholders per diluted share provides investors with a valuable measure of the company's operating performance for the same reasons applicable to its underlying measure, core earnings. Net income (loss) per diluted common share is the most directly comparable GAAP measure. Core earnings available to common shareholders per diluted share should not be considered as a substitute for net income (loss) per diluted share and does not reflect the overall profitability of the company's business.

Therefore, The Hartford believes that it is useful for investors to evaluate both net income (loss) per diluted share and core earnings available to common shareholders per diluted share when reviewing the company's performance. A reconciliation of core earnings available to common shareholders per diluted share to net income (loss) per diluted common share for the quarterly periods and years ended Dec. 31, 2015 and 2014 is provided in the table below.

|

| | | | | | | | | | |

| Three Months Ended | Years Ended |

| Dec 31 2015 | Dec 31 2014 | Change | Dec 31 2015 | Dec 31 2014 | Change |

PER SHARE DATA | | | | | | |

Diluted earnings (losses) per common share: | | | | | | |

Core earnings available to common shareholders | $1.07 | $0.96 | 11% | $ | 3.88 |

| $ | 3.36 |

| 15% |

Add: Unlock (charge) benefit, after-tax | 0.08 | 0.03 | 167% | 0.12 |

| (0.13 | ) | NM |

Add: Net realized capital losses, after-tax and DAC, excluded from core earnings | (0.21) | (0.02) | NM | (0.27 | ) | (0.04 | ) | NM |

Add: Restructuring and other costs, after-tax | (0.01) | (0.04) | 75% | (0.03 | ) | (0.11 | ) | 73% |

Add: Pension settlement, after-tax | — | (0.18) | NM | — |

| (0.18 | ) | NM |

Add: Loss on extinguishment of debt, after-tax | — | — | —% | (0.03 | ) | — |

| NM |

Add: Net reinsurance gain on dispositions, after-tax | — | 0.03 | NM | 0.04 |

| 0.03 |

| 33% |

Add: Income tax benefit from reduction in valuation allowance | 0.08 | — | NM | 0.22 |

| — |

| NM |

Add: Income (loss) from discontinued operations, after-tax | — | 0.08 | NM | 0.03 |

| (1.20 | ) | NM |

Net income available to common shareholders | $1.01 | $0.86 | 17% | $ | 3.96 |

| $ | 1.73 |

| 129% |

Core earnings margin: The Hartford uses the non-GAAP measure core earnings margin to evaluate, and believes it is an important measure of, the Group Benefits segment's operating performance. Core earnings margin is calculated by dividing core earnings by revenues, excluding buyouts and realized gains (losses). Net income margin is the most directly comparable U.S. GAAP measure. The Company believes that core earnings margin provides investors with a valuable measure of the performance of Group Benefits because it reveals trends in the business that may be obscured by the effect of buyouts and realized gains (losses). Core earnings margin should not be considered as a substitute for net income margin and does not reflect the overall profitability of Group Benefits. Therefore, the Company believes it is important for investors to evaluate both core earnings margin and net income margin when reviewing performance. A reconciliation of net income margin to core earnings margin for the quarterly periods and years ended Dec. 31, 2015 and 2014, is set forth below.

|

| | | | | | | | | |

| Three Months Ended | Years Ended |

Margin | 12/31/2015 | 12/31/2014 | Change | 12/31/2015 | 12/31/2014 | Change |

Net income margin | 4.2% | 5.7% | (1.5) | 5.4 | % | 5.5 | % | (0.1 | ) |

Less: Effect of net capital realized gains (losses), net of tax on after-tax margin | (0.4)% | 0.4% | (0.8) | (0.2 | )% | 0.3 | % | (0.5 | ) |

Core earnings margin | 4.6% | 5.3% | (0.7) | 5.6 | % | 5.2 | % | 0.4 |

|

Underwriting gain (loss): The Hartford's management evaluates profitability of the Commercial and Personal Lines segments primarily on the basis of underwriting gain or loss. Underwriting gain (loss) is a before-tax measure that represents earned premiums less incurred losses, loss adjustment expenses and underwriting expenses. Net income (loss) is the most directly comparable GAAP measure. Underwriting gain (loss) is influenced significantly by earned premium growth and the adequacy of The Hartford's pricing. Underwriting profitability over time is also greatly influenced by The Hartford's underwriting discipline, as management strives to manage exposure to loss through favorable risk selection and diversification, effective management of claims, use of reinsurance and its ability to manage its expenses. The Hartford believes that the measure underwriting gain (loss) provides investors with a valuable measure of profitability, before tax, derived from underwriting activities, which are managed separately from the company's investing activities. A reconciliation of underwriting results to net income for the quarterly periods and years ended Dec. 31, 2015 and 2014, is set forth below.

|

| | | | |

| Three Months Ended | Years Ended |

| Dec 31 2015 | Dec 31 2014 | Dec 31 2015 | Dec 31 2014 |

Commercial Lines | | | | |

Net income | $293 | $262 | $1,003 | $983 |

Less: Income from discontinued operations | — | 6 | 7 | 6 |

Add: Income tax expense | 126 | 102 | 409 | 385 |

Less: Other income (expense) | (2) | (4) | 2 | (3) |

Less: Net realized capital gains (losses) | 11 | 8 | (6) | (30) |

Less: Net investment income | 206 | 222 | 910 | 958 |

Less: Net servicing income | 6 | 9 | 20 | 23 |

Underwriting gain | $198 | $123 | $479 | $414 |

| |

| | |

Personal Lines | | | | |

Net income | $51 | $65 | $187 | $207 |

Add: Income tax expense | 25 | 30 | 82 | 92 |

Less: Other expenses | (1) | 5 | 15 | 2 |

Less: Net realized capital gains (losses) | — | (1) | 4 | (5) |

Less: Net investment income | 30 | 30 | 128 | 129 |

Less: Net servicing income | 1 | 1 | 4 | 3 |

Underwriting gain | $46 | $60 | $118 | $170 |

Combined ratio before catastrophes and prior accident year development: Combined ratio before catastrophes and prior year development (PYD) (also referred to as Current Accident Year (CAY) combined ratio before catastrophes) is a non-GAAP financial measure. Combined ratio is the most directly comparable GAAP measure. The combined ratio is the sum of the loss and loss adjustment expense ratio, the expense ratio and the policyholder dividend ratio. This ratio measures the cost of losses and expenses for every $100 of earned premiums. A combined ratio below 100 demonstrates a positive underwriting result. A combined ratio above 100 indicates a negative underwriting result. The combined ratio before catastrophes and PYD represents the combined ratio for the current accident year, excluding the impact of current accident year catastrophes. The company believes this ratio is an important measure of the trend in profitability since it removes the impact of volatile and unpredictable catastrophe losses and prior accident year loss and loss adjustment expense reserve. A reconciliation of the combined ratio to the combined ratio before catastrophes and PYD for individual reporting segments can be found in this press release under the headings Commercial Lines and Personal Lines.

SAFE HARBOR STATEMENT

Some of the statements in this release should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “projects” and similar references to the future. Examples of forward-looking statements include, but are not limited to, statements the company makes regarding future results of operations. The Hartford cautions investors that these forward-looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ. These important risks and uncertainties include the risks and uncertainties identified below, as well as

factors described in such forward-looking statements or in The Hartford's 2014 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings The Hartford makes with the Securities and Exchange Commission.

Risks Relating to Economic, Market and Political Conditions: challenges related to the Company’s current operating environment, including global political, economic and market conditions, and the effect of financial market disruptions, economic downturns or other potentially adverse macroeconomic developments on the attractiveness of our products, the returns in our investment portfolios and the hedging costs associated with our runoff annuity block; financial risk related to the continued reinvestment of our investment portfolios and performance of our hedge program for our runoff annuity block; market risks associated with our business, including changes in interest rates, credit spreads, equity prices, market volatility and foreign exchange rates, commodities prices and implied volatility levels, as well as continuing uncertainty in key sectors such as the global real estate market; the impact on our investment portfolio if our investment portfolio is concentrated in any particular segment of the economy;

Risks Relating to Estimates, Assumptions and Valuations: risk associated with the use of analytical models in making decisions in key areas such as underwriting, capital, hedging, reserving, and catastrophe risk management; the potential for differing interpretations of the methodologies, estimations and assumptions that underlie the valuation of the Company’s financial instruments that could result in changes to investment valuations; the subjective determinations that underlie the Company’s evaluation of other-than-temporary impairments on available-for-sale securities; the potential for further acceleration of deferred policy acquisition cost amortization; the potential for further impairments of our goodwill or the potential for changes in valuation allowances against deferred tax assets; the difficulty in predicting the Company’s potential exposure for asbestos and environmental claims;

Financial Strength, Credit and Counterparty Risks: the impact on our statutory capital of various factors, including many that are outside the Company’s control, which can in turn affect our credit and financial strength ratings, cost of capital, regulatory compliance and other aspects of our business and results; risks to our business, financial position, prospects and results associated with negative rating actions or downgrades in the Company’s financial strength and credit ratings or negative rating actions or downgrades relating to our investments; losses due to nonperformance or defaults by others, including reinsurers, sourcing partners, derivative counterparties and other third parties; the potential for losses due to our reinsurers' unwillingness or inability to meet their obligations under reinsurance contracts and the availability, pricing and adequacy of reinsurance to protect us against losses;

Insurance Industry and Product-Related Risks: the possibility of unfavorable loss development including with respect to long-tailed exposures; the possibility of a pandemic, earthquake, or other natural or man-made disaster that may adversely affect our businesses; weather and other natural physical events, including the severity and frequency of storms, hail, winter storms, hurricanes and tropical storms, as well as climate change and its potential impact on weather patterns; the possible occurrence of terrorist attacks and the Company’s ability to contain its exposure, including limitations on coverage from the federal government under applicable reinsurance terrorism laws; the uncertain effects of emerging claim and coverage issues; actions by competitors that may be larger or have greater financial resources than we do; technological changes, such as usage-based methods of determining premiums, advancements in automotive safety features, the development of autonomous vehicles, and platforms that facilitate ride sharing, which may alter demand for the Company's products, impact the frequency or severity of losses, and/or impact the way the Company markets, distributes and underwrites its products; the Company's ability to market, distribute and provide insurance

products and investment advisory services through current and future distribution channels and advisory firms; the Company’s ability to effectively price its property and casualty policies, including its ability to obtain regulatory consents to pricing actions or to non-renewal or withdrawal of certain product lines; volatility in our statutory and United States ("U.S.") GAAP earnings and potential material changes to our results resulting from our adjustment of our risk management program to emphasize protection of economic value;