Survey: Most Midsize Businesses Have Continuity Plans But Few Have Tested Them

July 29 2015 - 9:05AM

Business Wire

- More than one-third unable to meet

client need due to interruption

Most midsize businesses have business continuity plans but few

have tested them, according to The Hartford’s survey of midsize

business owners and C-level executives. This shortcoming presents

potential risk for businesses, which may be unable to meet client

needs due to an interruption in their operation or lose revenue due

to a supplier issue.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20150729005913/en/

While the majority of midsize businesses (59 percent) surveyed

had a formal, documented continuity plan, one-third (33 percent)

had an informal, verbal plan, and 8 percent reported having no plan

at all. Just 19 percent of businesses had tested their plan.

“Weather-related events, fires, thefts and supplier

interruptions are just a few of the issues that can impact a

business,” said Eric Cannon, assistant vice president of property

underwriting at The Hartford. “While many midsize businesses have

taken the important step of developing a formal continuity plan,

testing and updating that plan on a regular basis can mean the

difference between a business’s ability to recover quickly versus

being unable to meet client needs.”

The Hartford survey found that more than one-third (36 percent)

of midsize businesses had been unable to meet a client need due to

an interruption in their operation, putting their relationship with

that client at risk. Of those businesses:

- A majority (57 percent) used an

alternate supplier and avoided any direct impact on their

clients.

- 39 percent lost business to other

suppliers but had clients return once their business resumed

operations.

- 9 percent lost clients that did not

return.

Role of suppliers in continuity planning

Most midsize businesses surveyed (84 percent) rely on suppliers,

vendors or consultants. Four in 10 had suffered a supplier

interruption and almost one-third (32 percent) had lost revenue due

to a supplier problem.

“Even the smallest vendor or that vendor’s supplier can impact a

business’s ability to meet its customers’ needs. The savvy business

owner must take the time to understand the continuity plans of its

suppliers and their suppliers in order to fully know who is at the

table and who can step in when back-ups are needed,” said Cannon.

“It is also important for business owners to speak with their

insurance agent about their continuity plans and business

interruption coverage.”

Cannon discusses business continuity planning and suppliers at

www.thehartford.com/midsizemonitor.

For information about business continuity planning, visit

http://www.thehartford.com/business/disaster-planning-for-businesses.

To download a business continuity plan worksheet, visit

http://www.ready.gov/sites/default/files/documents/files/BusinessContinuityPlan_0.pdf

Survey Methodology

The Hartford’s 2014 Midsize Business Monitor was fielded from

September 16-23, 2014. More than 500 owners and C-level executives

of midsize businesses headquartered in the U.S. with annual sales

or revenues of $10 million to $1 billion participated in the online

survey, which had a margin of error of +/- 4.3 percent at the 95

percent confidence level.

More information about this survey, including an executive

summary and infographics available at

www.thehartford.com/midsizemonitor.

About The Hartford

With more than 200 years of expertise, The Hartford (NYSE: HIG)

is a leader in property and casualty insurance, group benefits and

mutual funds. The company is widely recognized for its service

excellence, sustainability practices, trust and integrity. More

information on the company and its financial performance is

available at www.thehartford.com. Join us on Facebook at

www.facebook.com/TheHartford. Follow us on Twitter at

www.twitter.com/TheHartford.

HIG-M

Some of the statements in this release may be considered

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. We caution investors that these

forward-looking statements are not guarantees of future

performance, and actual results may differ materially. Investors

should consider the important risks and uncertainties that may

cause actual results to differ. These important risks and

uncertainties include those discussed in our 2014 Annual Report on

Form 10-K, subsequent Quarterly Reports on Forms 10-Q, and the

other filings we make with the Securities and Exchange Commission.

We assume no obligation to update this release, which speaks as of

the date issued.

From time to time, The Hartford may use its website to

disseminate material company information. Financial and other

important information regarding The Hartford is routinely

accessible through and posted on our website at

http://ir.thehartford.com. In addition, you may automatically

receive email alerts and other information about The Hartford when

you enroll your email address by visiting the “Email Alerts”

section at http://ir.thehartford.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150729005913/en/

Media Contact:The HartfordPamela Rekow,

860-547-8990pamela.rekow@thehartford.com

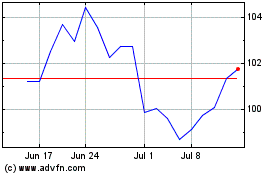

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

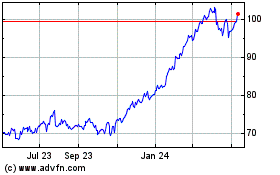

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Apr 2023 to Apr 2024