FORM 11-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

| x |

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2014

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

Commission file number 001-13958

| A. |

Full title of the Plan and the address of the Plan, if different from that of the issuer named below: |

THE HARTFORD INVESTMENT AND SAVINGS PLAN

| B. |

Name of issuer of the securities held pursuant to the Plan and the address of its principal executive office: |

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

One Hartford Plaza, Hartford, Connecticut 06155

The Hartford Investment and Savings Plan

TABLE OF CONTENTS

December 31, 2014 and 2013

All other schedules required by Section 2520.103-10 of the Department of Labor’s Rules and

Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Administrator and Members of

The Hartford

Investment and Savings Plan

Hartford, Connecticut

We have

audited the accompanying statements of net assets available for benefits of The Hartford Investment and Savings Plan (the “Plan”) as of December 31, 2014 and 2013, and the related statement of changes in net assets available for

benefits for the year ended December 31, 2014. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan

and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial

reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of

the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the

accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31,

2014 and 2013, and the changes in net assets available for benefits for the year ended December 31, 2014, in conformity with accounting principles generally accepted in the United States of America.

The supplemental schedule of assets (held at end of year) as of December 31, 2014, has been subjected to audit procedures performed in conjunction with

the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule should be reconciled to the financial

statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule,

we evaluated whether the supplemental schedule, including its form and content, is presented in compliance with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of

1974. In our opinion, such schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

DELOITTE &

TOUCHE LLP

Hartford, Connecticut

June 29, 2015

F-1

EIN# 06-0383750

Plan# 100

THE HARTFORD

INVESTMENT AND SAVINGS PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

AS OF DECEMBER 31, 2014 AND 2013

($ IN THOUSANDS)

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Assets |

|

|

|

|

|

|

|

|

| Investments, at fair value: |

|

|

|

|

|

|

|

|

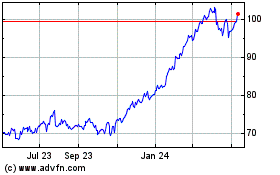

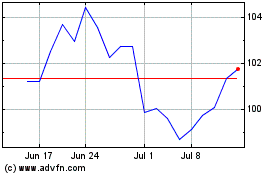

| The Hartford Stock Fund, common stock 5,316,940 and 5,940,444 shares at December 31, 2014 and 2013, respectively |

|

$ |

221,663 |

|

|

$ |

215,222 |

|

| The Hartford Index Fund |

|

|

368,163 |

|

|

|

317,940 |

|

| Separately managed accounts |

|

|

439,180 |

|

|

|

448,541 |

|

| Collective investment trusts |

|

|

849,637 |

|

|

|

748,320 |

|

| Mutual funds |

|

|

899,477 |

|

|

|

902,626 |

|

| Pooled temporary investments |

|

|

17,091 |

|

|

|

21,021 |

|

| Fully benefit-responsive investment contracts with financial institutions, Stable Value Fund |

|

|

695,630 |

|

|

|

706,858 |

|

|

|

|

|

|

|

|

|

|

| Total investments |

|

|

3,490,841 |

|

|

|

3,360,528 |

|

| Receivables: |

|

|

|

|

|

|

|

|

| Notes receivable from participants |

|

|

57,145 |

|

|

|

54,333 |

|

| Dividends and interest receivable |

|

|

5,431 |

|

|

|

4,665 |

|

|

|

|

|

|

|

|

|

|

| Total receivables |

|

|

62,576 |

|

|

|

58,998 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

3,553,417 |

|

|

|

3,419,526 |

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

| Investment management expenses payable |

|

|

613 |

|

|

|

766 |

|

| Administrative expenses payable |

|

|

43 |

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

656 |

|

|

|

816 |

|

|

|

|

| Net assets available for benefits at fair value |

|

|

3,552,761 |

|

|

|

3,418,710 |

|

|

|

|

| Adjustment from fair value to contract value for fully benefit-responsive investment contracts |

|

|

(21,756 |

) |

|

|

(19,299 |

) |

|

|

|

|

|

|

|

|

|

| Net assets available for benefits |

|

$ |

3,531,005 |

|

|

$ |

3,399,411 |

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

F-2

EIN# 06-0383750

Plan# 100

THE HARTFORD

INVESTMENT AND SAVINGS PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

FOR THE YEAR ENDED DECEMBER 31, 2014

($ IN THOUSANDS)

|

|

|

|

|

| |

|

2014 |

|

| Investment gain: |

|

|

|

|

| Net appreciation in fair value of investments |

|

$ |

232,410 |

|

| Dividends |

|

|

6,323 |

|

|

|

|

|

|

| Total investment gain |

|

|

238,733 |

|

|

|

|

|

|

| Interest income on notes receivable from participants |

|

|

2,343 |

|

|

|

|

|

|

| Contributions: |

|

|

|

|

| Employee contributions |

|

|

129,073 |

|

| Employer contributions |

|

|

109,632 |

|

| Rollover contributions |

|

|

14,256 |

|

|

|

|

|

|

| Total contributions |

|

|

252,961 |

|

|

|

|

|

|

| Total additions |

|

|

494,037 |

|

|

|

|

|

|

| Deductions from net assets attributed to: |

|

|

|

|

| Benefits paid to Members |

|

|

358,936 |

|

| Investment management fees |

|

|

3,229 |

|

| Administrative expenses |

|

|

278 |

|

|

|

|

|

|

| Total deductions |

|

|

362,443 |

|

|

|

|

|

|

| Net increase |

|

|

131,594 |

|

|

|

| Net assets available for benefits: |

|

|

|

|

| Beginning of year |

|

|

3,399,411 |

|

|

|

|

|

|

| End of year |

|

$ |

3,531,005 |

|

|

|

|

|

|

See Notes to Financial Statements.

F-3

THE HARTFORD INVESTMENT AND SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2014 AND 2013

AND FOR THE YEAR ENDED DECEMBER 31, 2014

($ IN THOUSANDS)

Note 1. Description

of the Plan

The following description of The Hartford Investment and Savings Plan (the “Plan” or “ISP”) is provided for general

information purposes only. Members should refer to the Plan Document for more complete information. “Members” refers to eligible participants of the Plan.

The Hartford Financial Services Group, Inc. (“HFSG”, together with its subsidiaries, “The Hartford”, the “Company”) is an

insurance and financial services company. The Hartford, headquartered in Connecticut, is among the largest providers of property and casualty insurance and group life and disability products to individual and business customers in the United States

of America. The Hartford is also a provider of mutual funds to investors and additionally, The Hartford continues to manage life and annuity products previously sold. The Plan Sponsor, Hartford Fire Insurance Company, is a wholly owned subsidiary of

The Hartford.

Information with regard to eligibility, contributions, distributions, vesting, trustees, withdrawals, loans, fund redistribution and

certain definitions are contained in the Plan Document. A Summary Plan Description (SPD) setting forth the highlights of the Plan is available to Members on the Fidelity Net Benefits website. Fidelity Workplace Services LLC serves as the record

keeper of the Plan.

Plan Changes

See Note 11 for a

general description of amendments made to the Plan Document during 2014.

General

The Plan is a defined contribution plan covering substantially all full-time and part-time employees of the Company. The Pension Administration Committee of

the Company controls and manages the operation and administration of the Plan, subject to certain exemptions that are specified in the Plan Document. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974

(“ERISA”).

The Trust, as defined in the Plan Document, is the aggregate funds held by the trustee, State Street Bank and Trust Company (the

“Trustee”), under the trust agreement established for the purposes of the Plan. The Investment and Savings Plan Investment Committee (ISPIC) is responsible for the management of Plan assets except with respect to matters that are the

responsibility of Evercore Trust Company as fiduciary with respect to the common stock of HFSG (“Hartford Stock”) held in The Hartford Stock Fund. The ISPIC may from time to time add investment funds to, or eliminate investment funds from,

the group of investment funds available under the Plan, provided, however, that the ISPIC has no authority with respect to the Hartford Stock in The Hartford Stock Fund.

Contributions

Members may elect to save a percentage of

their eligible compensation (including, effective January 1, 2013, overtime and certain annual bonuses and sales incentives) and may designate their savings as before-tax, Roth 401(k), after-tax or a combination thereof. Generally, savings may

be elected based on 1% to 30% of eligible compensation. Members who are highly compensated employees may have contribution limits of less than 30% due to the operation of certain tests required under the Internal Revenue Code of 1986, as amended

(the “Code”).

The Company’s contributions include a non-elective contribution of 2% of eligible compensation and a dollar-for-dollar

matching contribution of up to 6% of eligible compensation contributed by the employee each pay period.

Members’ savings in excess of 6% of the

applicable compensation are Supplemental Savings that are not matched by the Company.

Administrative Costs

The Trust pays certain administrative expenses of the Plan out of the assets of the Trust. Expenses not paid by the Trust are borne by the Company.

F-4

Note 1. Description of the Plan (continued)

Member Accounts

Individual accounts are maintained for

each Member. Each Member’s account is credited with that Member’s contributions and allocations of (a) the Matching Company contributions and non-elective Company contributions and (b) Plan earnings, and is charged with

withdrawals and an allocation of administrative expenses and Plan losses. Allocations are based on Member account balances, as defined in the Plan Document. The benefit to which a Member is entitled is the benefit that can be provided from that

Member’s vested account balance.

Vesting

Members are 100% vested at all times with respect to Member contributions and earnings thereon. Members are 100% vested in Matching Company and non-elective

Company contributions made after January 1, 2013 after two years of service.

Members are vested 20% in Matching Company contributions made prior to

January 1, 2013 for each completed year of service, until five years of service at which time the Members are 100% vested. Members are fully vested in Floor Company contributions (0.5% of highly compensated eligible employees’ base salary

and 1.5% of all other eligible employees’ base salary) made prior to January 1, 2013.

Notwithstanding the foregoing statement, a Member becomes

fully vested in such Member’s Matching Company contribution account upon retirement (for retirement eligible Members), disability, death, reaching age 65, or upon the complete discontinuance of Company contributions or termination of the Plan.

Investment Options

As of December 31, 2014,

contributions of Member savings and Company contributions may be invested in any of the twenty-two investment options of the Plan in multiples of 1%, as elected or deemed elected by the Member (“Member directed investments”).

Certain investment options are parties-in-interest with The Hartford. See Notes 3 and 10 for further discussion.

On June 28, 2013 three multi-manager equity funds were added as investment options to the Plan: a large-cap equity fund, a small/mid-cap equity fund and

an international equity fund. The multi-manager funds are comprised of several underlying funds (mutual funds and separate accounts) which are not available as stand-alone options under the Plan. The large-cap equity fund is made up of the

previously available Hartford Capital Appreciation HLS Fund, Hartford Dividend and Growth HLS Fund and Columbus Circle Large Cap Growth Fund. The small/mid-cap equity fund is made up of the previously available Hartford Small Company HLS Fund and

Hartford Midcap HLS Fund as well as the Chartwell Investment Partners Small Cap Value Fund and LMCG Investments Mid Cap Value Fund. The international equity fund is made up of the previously available Hartford International Opportunities HLS Fund

and the new Dodge & Cox International Stock Fund added during 2014.

Member Loans

Members may borrow from their accounts a minimum of $0.5 to a maximum equal to the lesser of $50 or 50% of their vested account balance. Loan transactions are

treated as transfers between the investment funds and the loan fund. Loan terms range from one to five years, or up to 15 years for the purchase of a primary residence. The loan is secured by the balance in the Member’s account. The interest

rate on a loan in a calendar quarter is set on the last business day of the prior February, May, August or November based on the prime rate provided by Thomson Reuters on that date plus one percentage point and is fixed for the term of the loan.

Principal and interest is paid ratably through payroll deductions.

Payment of Benefits

On termination of service due to death, disability, retirement, or certain other reasons, Members or their designated beneficiaries may elect to receive either

a lump sum amount equal to the value of their vested account balance, annual installments over a period not greater than thirty years (subject to certain conditions), or annual installments over the recipient’s life expectancy.

Distributions may be paid in cash or, with respect to The Hartford Stock Fund, in stock distributions. Members or their designated beneficiaries may also

elect to defer distributions subject to certain conditions.

F-5

Note 1. Description of the Plan (continued)

Forfeitures

At December 31, 2014 and 2013, forfeited

non-vested account balances totaled $131 and $22, respectively.

These forfeitures are applied to reduce future Matching Company contributions. During the

year ended December 31, 2014, Matching Company contributions were reduced by $3,103 from forfeitures.

Note 2. Accounting Policies

Basis of Accounting

The accompanying financial statements

have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and the Department of Labor’s Rules and Regulations for Reporting and Disclosure under ERISA.

Use of Estimates

The preparation of financial statements

in conformity with U.S. GAAP requires management of the Plan to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities as of the date of the

financial statements and the reported amounts of additions and deductions during the reporting period. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

The

Plan’s investments are stated at fair value. Fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date

(See Note 5). The fair value of the common stock of HFSG is based on quoted market prices. The Hartford Index Fund, separately managed accounts, mutual funds, collective investment trusts and pooled temporary investment funds are valued at the net

asset value (NAV) of shares, which represent the fair value of the underlying securities, held by the Plan at year end. The fully benefit-responsive investment contracts with financial institutions (the “Stable Value Fund”) include

synthetic guaranteed investment contracts (“GICs”) whose underlying securities are stated at fair value. The GICs are stated at fair value and then adjusted to contract value as described in Note 4.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the

ex-dividend date.

Investment securities, in general, are exposed to various risks, such as interest rate, credit and overall market volatility. Due to

the level of risk associated with certain investment securities, it is possible that changes in the values of investment securities, which are reflected in the Statement of Changes in Net Assets Available for Benefits, may occur in the near term and

such changes could materially affect the amounts reported in the financial statements.

Investment expenses charged to the Plan for investments in mutual

funds and collective investment trusts are charged directly against the assets of the fund and are not separately reflected. Consequently, investment expenses are reflected as a reduction of investment return for such investments. For investments

other than mutual funds and collective investment trusts, investment expenses are reflected as investment management fees paid out of the assets of the Fund and are recognized as expenses of the Plan. As of December 31, 2014 and 2013 there were

no unfunded commitments or redemption restrictions on collective investment trusts and mutual funds.

Payment of Benefits

Benefits paid to Members are recorded when distributed.

Contributions

Employee and employer contributions are

recorded in the period during which the Company makes payroll deductions from Members’ compensation.

F-6

Note 2. Accounting Policies (continued)

Notes Receivable from Members

Notes receivable from

Members are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent Member loans are recorded as distributions based on the terms of the Plan Document.

New Accounting Standards Not Yet Effective

On

May 1, 2015, the Financial Accounting Standards Board issued Update No. 2015-07, Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent) (“ASU 2014-07”) which removes the

requirement to present certain investments for which the practical expedient is used to measure fair value at net asset value within the fair value hierarchy table. Retrospective application is required upon adoption.

Note 3. Investments

The following investments

represented 5% or more of the Plan’s net assets available for benefits at the end of the Plan year:

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

| * The Hartford Stock Fund, common stock (5,316,940 and 5,940,444 shares at December 31, 2014 and 2013, respectively) |

|

$ |

221,663 |

|

|

$ |

215,222 |

|

| * The Hartford Index Fund |

|

|

368,163 |

|

|

|

317,940 |

|

| Collective investment trusts: |

|

|

|

|

|

|

|

|

| Vanguard Target Retirement 2025 |

|

|

201,146 |

|

|

|

186,411 |

|

| Vanguard Target Retirement 2035 |

|

|

196,230 |

|

|

|

174,745 |

|

| Mutual funds: |

|

|

|

|

|

|

|

|

| * Hartford Capital Appreciation HLS Fund |

|

|

** |

|

|

|

173,372 |

|

| * Hartford Dividend and Growth HLS Fund |

|

|

** |

|

|

|

172,662 |

|

| * Hartford International Opportunity HLS Fund |

|

|

** |

|

|

|

171,545 |

|

| Stable Value Fund: |

|

|

|

|

|

|

|

|

| Transamerica Premier Life, Contract #MDA01097TR |

|

|

238,013 |

|

|

|

** |

|

| * |

Indicates party-in-interest |

| ** |

Investment did not represent 5% or more of the Plan’s net assets available for benefits at December 31, 2014 or December 31, 2013 |

For the year ended December 31, 2014, the Plan’s investments appreciated (depreciated), including gains and losses on investments bought and sold,

as well as held during the year, as follows:

|

|

|

|

|

| |

|

December 31, 2014 |

|

| The Hartford Stock Fund |

|

$ |

29,363 |

|

| The Hartford Index Fund |

|

|

43,582 |

|

| Separately managed accounts |

|

|

39,068 |

|

| Stable Value Fund |

|

|

15,892 |

|

| Mutual funds |

|

|

|

|

| Bond Investments |

|

|

2,606 |

|

| Large-Cap Equities |

|

|

33,798 |

|

| Mid-Cap Equities |

|

|

14,089 |

|

| Small-Cap Equities |

|

|

6,870 |

|

| International Equities |

|

|

(6,872 |

) |

| Collective investment trusts |

|

|

|

|

| Vanguard Target Retirement Funds |

|

|

54,265 |

|

| State Street Global Advisors (SSGA) Real Asset |

|

|

(251 |

) |

|

|

|

|

|

| Net appreciation in fair value of investments |

|

$ |

232,410 |

|

|

|

|

|

|

F-7

Note 4. Fully Benefit-Responsive Investments Contract with Financial Institutions

The Plan’s Stable Value Fund is comprised primarily of synthetic GICs. A synthetic GIC is an investment contract issued by an insurance company or other

financial institution where the contract issuer is contractually obligated to provide a specified interest rate, also known as a wrap contract, backed by a portfolio of financial instruments which are held in a trust that are owned by the Plan.

Standish Mellon Asset Management Company LLC, a wholly owned subsidiary of The Bank of New York Mellon Corporation, provides investment management services to the Stable Value Fund. The fair value of the benefit-responsive wrapper contracts was $(9)

at December 31, 2014 and $149 at December 31, 2013. The wrap contract provides that Members execute Plan transactions at contract value. These contracts are fully benefit-responsive and are included in the financial statements at fair

value (see Note 2). Fully benefit-responsive contracts provide for a stated return on principal invested over a specified period and permit withdrawals at contract value for benefit payments, loans, or transfers. Contract value represents

contributions made under the contract, plus earnings, less Plan withdrawals and administrative expenses. Certain events, such as a Plan termination, divestiture or reduction in force may limit the ability of the Plan to transact at contract value or

may allow for the termination of the wrapper contract at less than contract value. The Plan Sponsor does not believe that it is probable that any such events would limit the ability of the Plan to transact at contract value.

The relationship of future crediting rates and the adjustments to contract value reported on the statements of net assets available for benefits are provided

through the mechanism of the crediting rate formula. The crediting rate is based on the current yield-to-maturity, the duration of the portfolio, and the amortization of gains and losses, defined as the difference between the market value of the

underlying securities and contract value of the wrapper. Key factors that could influence future crediting rates include, but are not limited to, Plan cash flows, changes in interest rates, total return performance of the fair market value of the

underlying securities within each synthetic GIC, default or credit failures of any of the securities, investment contracts, or other investments held in the associated fund and the initiation of an extended termination of one or more synthetic GICs

by the manager or the contract issuer. The rate of return earned on a synthetic GIC is generally reset quarterly by the issuer but the rate cannot be less than zero.

The contract issuer is not allowed to terminate any of the synthetic GICs and settle at an amount different from contract value unless there is a breach of

the contract which is not corrected within the applicable cure period. Actions that will result in a breach include, but are not limited to, material misrepresentation, failure to pay synthetic GIC fees, or any other payment due under the contract,

and failure to adhere to investment guidelines. The Plan did not breach any terms of the synthetic GICs in 2014 or 2013.

During 2014, there were changes

in contracts within the Stable Value Fund. The previous Natixis contract was replaced by an American General Life contract. The previous Blackrock portion of the Monumental contract (MDA01098TR) was moved to RGA to provide wrapper diversification to

the portfolio. The previous Monumental contract (MDA01097TR) was renamed to Transamerica Premier Life when Aegon (the holding company for Monumental and Transamerica Insurance Companies) consolidated its wrap business into its Transamerica business

line.

|

|

|

|

|

|

|

|

|

| Average yields: |

|

2014 |

|

|

2013 |

|

| Based on annualized earnings (1) |

|

|

2.32 |

% |

|

|

2.25 |

% |

| Based on interest rate credited to participants (2) |

|

|

2.41 |

% |

|

|

2.33 |

% |

| (1) |

Calculated based on actual investment income from the underlying investments for the last month of the year, annualized, divided by the fair value of the investment portfolio as of December 31, 2014 and 2013,

respectively. |

| (2) |

Calculated based on the interest rate credited to participants from the underlying investments for the last month of the year, annualized, divided by the fair value of the investment portfolio as of December 31,

2014 and 2013, respectively. |

The following table represents the adjustment from fair value to contract value for each of the contracts as of

December 31, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contract Issuer |

|

Contract

Number |

|

Major

Credit

Ratings |

|

Investments

at Contract

Value |

|

|

Investments

at Fair

Value |

|

|

Adjustment from

Fair Value to

Contract Value |

|

| Transamerica Premier Life |

|

MDA01097TR |

|

AA- / Aa2 |

|

$ |

227,472 |

|

|

$ |

238,013 |

|

|

$ |

(10,541 |

) |

| American General Life |

|

1646368 |

|

AA / Aa2 |

|

|

96,058 |

|

|

|

97,024 |

|

|

|

(976 |

) |

| American General Life |

|

1635582 |

|

AA+ / Aaa |

|

|

63,527 |

|

|

|

63,461 |

|

|

|

66 |

|

| RGA |

|

RGA00058 |

|

AA / Aa2 |

|

|

39,401 |

|

|

|

40,994 |

|

|

|

(1,593 |

) |

| New York Life |

|

GA29021 |

|

AA+ / Aaa |

|

|

88,449 |

|

|

|

91,195 |

|

|

|

(2,746 |

) |

| Prudential |

|

GA62433 |

|

AA / Aa1 |

|

|

158,967 |

|

|

|

164,943 |

|

|

|

(5,976 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

$ |

673,874 |

|

|

$ |

695,630 |

|

|

$ |

(21,756 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F-8

Note 4. Fully Benefit-Responsive Investments Contract with Financial Institutions (continued)

The following table represents the adjustment from fair value to contract value for each of the contracts as of December 31, 2013:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contract Issuer |

|

Contract

Number |

|

Major

Credit

Ratings |

|

Investments

at Contract

Value |

|

|

Investments

at Fair

Value |

|

|

Adjustment from

Fair Value to

Contract Value |

|

| Monumental Life Insurance Company |

|

MDA01097TR |

|

AA- / Aa2 |

|

$ |

127,119 |

|

|

$ |

133,755 |

|

|

$ |

(6,636 |

) |

| Monumental Life Insurance Company |

|

MDA01098TR |

|

AA / Aa2 |

|

|

142,670 |

|

|

|

143,715 |

|

|

|

(1,045 |

) |

| American General Life |

|

1635582 |

|

AA+ / Aaa |

|

|

82,577 |

|

|

|

83,178 |

|

|

|

(601 |

) |

| Natixis Financial Products Inc. |

|

1879-02 |

|

AA-/ Aa2 |

|

|

94,210 |

|

|

|

99,106 |

|

|

|

(4,896 |

) |

| New York Life |

|

GA29021 |

|

AA+ / Aaa |

|

|

86,417 |

|

|

|

88,572 |

|

|

|

(2,155 |

) |

| Prudential |

|

GA62433 |

|

AA / Aa1 |

|

|

154,566 |

|

|

|

158,532 |

|

|

|

(3,966 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

$ |

687,559 |

|

|

$ |

706,858 |

|

|

$ |

(19,299 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note 5. Fair Value Measurements

The Plan estimates of fair value are based on ASC 820, Fair Value Measurements and Disclosures, which provides a framework for

measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value and requires that observable inputs be used in valuations when available.

The disclosure of fair value estimates in the fair value accounting guidance hierarchy is based on whether the significant inputs into the valuation are

observable. In determining the level of the hierarchy in which the estimate is disclosed, the highest priority is given to unadjusted quoted prices in active markets and the lowest priority to unobservable inputs that reflect the Plan’s

significant market assumptions. The level in the fair value hierarchy within which the fair value measurement is reported is based on the lowest level input that is significant to the measurement in its entirety. The three levels of the hierarchy

are as follows:

• Level 1 - Unadjusted quoted market prices for identical assets or liabilities in active markets that the Plan has

the ability to access.

• Level 2 - Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or

similar assets or liabilities in inactive markets; or valuations based on models where the significant inputs are observable (e.g., interest rates, yield curves, prepayment speeds, default rates, loss severities, etc.) or can be corroborated by

observable market data.

• Level 3 - Valuations based on models where significant inputs are not observable. The unobservable inputs

reflect the Plan’s own assumptions about the inputs that market participants would use.

Asset Valuation Techniques — Valuation

techniques maximize the use of relevant observable inputs and minimize the use of unobservable inputs. The following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the

methodologies used at December 31, 2014 and 2013.

Generally, the Plan determines the estimated fair value of its fixed income securities, equity

securities and short-term investments using the market approach. The income approach is used for securities priced using a pricing matrix, as well as for derivative instruments. The collective investment trust assets are measured at fair value using

a NAV as a practical expedient. For Level 1 investments, which are comprised primarily of exchange-traded equity securities, valuations are based on observable inputs that reflect quoted prices for identical assets in active markets that the Plan

has the ability to access at the measurement date.

F-9

Note 5. Fair Value Measurements (continued)

Debt Securities:

For most of the

Plan’s debt securities, the following inputs are typically used in the Plan’s pricing methods: reported trades, benchmark yields, bids and/or estimated cash flows. For securities except U.S. Treasuries, inputs also include issuer spreads,

which may consider credit default swaps.

A description of additional inputs used for Debt Securities is listed below:

Asset-Backed Securities (ABS), Commercial Mortgage-Backed Securities (CMBS) and Residential Mortgage-Backed Securities (RMBS) — Primary

inputs also include monthly payment information, collateral performance, which varies by vintage year and includes delinquency rates, collateral valuation loss severity rates, collateral refinancing assumptions and, for ABS and RMBS, estimated

prepayment rates.

Corporates — Valued using pricing models maximizing the use of observable inputs for similar securities. This

includes basing value on yields currently available on comparable securities of issuers with similar credit ratings. When quoted prices are not available for identical or similar bonds, the bond is valued under a discounted cash flows approach that

maximizes observable inputs, such as current yields of similar instruments, but includes adjustments for certain risks that may not be observable, such as credit and liquidity risks or a broker quote, if available. Inputs also include observations

of credit default swap curves related to the issuer.

Municipals — Primary inputs also include Municipal Securities Rulemaking Board

reported trades and material event notices, and issuer financial statements.

Short-term Investments — Primary inputs also include material

event notices and new issue money market rates.

Mutual Funds — Valued at the daily closing price as reported by the fund. Mutual funds

held by the Plan are open-ended mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily NAV and to transact at that price. The mutual funds held by the Plan are deemed to be

actively traded.

Stable Value Fund —

Fully benefit-responsive investment contracts with financial institutions consist of synthetic GICs which are reported at fair value. Synthetic GICs are valued

at the fair value of the underlying assets derived from the exchange where the securities are primarily traded. The Plan includes the fair value estimates of the Synthetic GICs in Level 2. The fair value of the wrapper contracts associated with the

synthetic GICs are based on the wrap contract fees provided by insurance companies and are disclosed in Level 3 due to the significant inputs being unobservable. The Statements of Net Assets Available for Benefits presents the fair value of the

investment contracts as well as the adjustment of the fully benefit-responsive investment contracts from fair value to contract value.

Fair values for

insurance company separate account GICs are calculated using the market value provided by the insurance companies that manage the underlying assets of the product.

Collective Investment Trusts — The fair value of the collective trust investments are valued at the NAV per unit as reported by the sponsor

of the collective trust funds derived from the exchange where the underlying securities are primarily traded and are redeemable daily.

Common Stocks

– Valued at the closing price reported on the active market on which the individual securities are traded.

F-10

Note 5. Fair Value Measurements (continued)

The following tables set forth by level within the fair value hierarchy a summary of the Plan’s investments measured at fair value on a recurring basis at

December 31, 2014 and 2013.

The tables below include the major categorization for debt and equity securities on the basis of the nature and risk of

the investments at December 31, 2014 and 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Investment Assets at Fair Value as of December 31, 2014 |

|

| |

|

Active Markets

for Identical

Assets

(Level 1) |

|

|

Other

Observable

Inputs

(Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

|

Total |

|

| Invested Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short Term Investments |

|

$ |

— |

|

|

$ |

17,091 |

|

|

$ |

— |

|

|

$ |

17,091 |

|

| Stable Value Fund: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short Term Investments |

|

|

— |

|

|

|

8,089 |

|

|

|

— |

|

|

|

8,089 |

|

| Guaranteed Investment Contract |

|

|

— |

|

|

|

91,195 |

|

|

|

— |

|

|

|

91,195 |

|

| Debt Securities including U.S. Government |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities |

|

|

1,156 |

|

|

|

595,199 |

|

|

|

(9 |

) |

|

|

596,346 |

|

| Debt Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| High-yield |

|

|

— |

|

|

|

58,474 |

|

|

|

1,212 |

|

|

|

59,686 |

|

| Mutual Funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Small-Cap Equities |

|

|

84,792 |

|

|

|

— |

|

|

|

— |

|

|

|

84,792 |

|

| Mid-Cap Equities |

|

|

126,200 |

|

|

|

— |

|

|

|

— |

|

|

|

126,200 |

|

| Large-Cap Equities |

|

|

343,225 |

|

|

|

— |

|

|

|

— |

|

|

|

343,225 |

|

| International Equities |

|

|

181,225 |

|

|

|

— |

|

|

|

— |

|

|

|

181,225 |

|

| Bond Investments |

|

|

102,836 |

|

|

|

— |

|

|

|

— |

|

|

|

102,836 |

|

| Money Market |

|

|

61,199 |

|

|

|

— |

|

|

|

— |

|

|

|

61,199 |

|

| Equity Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Company Stock |

|

|

221,663 |

|

|

|

— |

|

|

|

— |

|

|

|

221,663 |

|

| Large-Cap Equities |

|

|

536,370 |

|

|

|

293 |

|

|

|

— |

|

|

|

536,663 |

|

| Mid-Cap Equities |

|

|

126,402 |

|

|

|

— |

|

|

|

— |

|

|

|

126,402 |

|

| Small-Cap Equities |

|

|

84,592 |

|

|

|

— |

|

|

|

— |

|

|

|

84,592 |

|

| Collective investment trusts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Target funds |

|

|

— |

|

|

|

839,674 |

|

|

|

— |

|

|

|

839,674 |

|

| Blended fund |

|

|

— |

|

|

|

9,963 |

|

|

|

— |

|

|

|

9,963 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investments at fair value [1] |

|

$ |

1,869,660 |

|

|

$ |

1,619,978 |

|

|

$ |

1,203 |

|

|

$ |

3,490,841 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| [1] |

Excludes $1,332 of dividend receivable, $2,545 of interest receivable and $1,554 of other receivables recorded at fair value. |

F-11

Note 5. Fair Value Measurements (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Investment Assets at Fair Value as of December 31, 2013 |

|

| |

|

Active Markets

for Identical

Assets

(Level 1) |

|

|

Other

Observable

Inputs

(Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

|

Total |

|

| Short Term Investments |

|

$ |

66,644 |

|

|

$ |

21,021 |

|

|

$ |

— |

|

|

$ |

87,665 |

|

| Fixed Income Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stable Value Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short Term Investments |

|

|

— |

|

|

|

14,687 |

|

|

|

— |

|

|

|

14,687 |

|

| Guaranteed Investment Contract |

|

|

— |

|

|

|

88,572 |

|

|

|

— |

|

|

|

88,572 |

|

| Debt Securities including U.S. Government |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities |

|

|

— |

|

|

|

603,450 |

|

|

|

149 |

|

|

|

603,599 |

|

| Bond Investments |

|

|

96,914 |

|

|

|

58,951 |

|

|

|

2,374 |

|

|

|

158,239 |

|

| Equity Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Company Stock |

|

|

215,222 |

|

|

|

— |

|

|

|

— |

|

|

|

215,222 |

|

| Large-Cap Equities |

|

|

516,273 |

|

|

|

325,011 |

|

|

|

— |

|

|

|

841,284 |

|

| Mid-Cap Equities |

|

|

263,013 |

|

|

|

— |

|

|

|

— |

|

|

|

263,013 |

|

| Small-Cap Equities |

|

|

175,453 |

|

|

|

— |

|

|

|

— |

|

|

|

175,453 |

|

| International Equities |

|

|

171,545 |

|

|

|

— |

|

|

|

— |

|

|

|

171,545 |

|

| Vanguard Retirement Funds |

|

|

— |

|

|

|

741,249 |

|

|

|

— |

|

|

|

741,249 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investments at fair value [2] |

|

$ |

1,505,064 |

|

|

$ |

1,852,941 |

|

|

$ |

2,523 |

|

|

$ |

3,360,528 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| [2] |

Excludes $1,366 of dividend receivable, $2,376 of interest receivable and $923 of other receivables recorded at fair value. |

Transfers Between Levels — The availability of observable market data is monitored to assess the appropriate classification of financial

instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. In such instances, the transfer is reported at

the beginning of the reporting period.

We evaluate the significance of transfers between levels based upon the nature of the financial instrument and

size of the transfer relative to total net assets available for benefits. For the years ended, December 31, 2014 and 2013 there were no transfers between Levels 1 and Levels 2.

F-12

Note 5. Fair Value Measurements (continued)

Rollforward of Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

The tables below set forth a summary of changes in the fair value of the Plan’s Level 3 investments for the years ended December 31, 2014 and 2013.

As reflected in the table below, the net unrealized gain/(loss) on Level 3 investment assets was $(550) and $(522) as of December 31, 2014 and 2013, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Level 3 Investment Assets and Investment Liabilities

Year Ended December 31, 2014 |

|

| |

|

Stable Value Fund |

|

|

Bond Investments |

|

|

Total |

|

| Balance, beginning of year |

|

$ |

149 |

|

|

$ |

2,374 |

|

|

$ |

2,523 |

|

| Realized gains/(losses), net |

|

|

— |

|

|

|

(567 |

) |

|

|

(567 |

) |

| Change in unrealized gains/(losses), net |

|

|

(158 |

) |

|

|

(392 |

) |

|

|

(550 |

) |

| Purchases |

|

|

— |

|

|

|

1,123 |

|

|

|

1,123 |

|

| Issuances |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Settlements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Sales |

|

|

— |

|

|

|

(1,326 |

) |

|

|

(1,326 |

) |

| Transfers in to Level 3 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Transfers out of Level 3 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, end of year |

|

$ |

(9 |

) |

|

$ |

1,212 |

|

|

$ |

1,203 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Level 3 Investment Assets and Investment Liabilities

Year Ended December 31, 2013 |

|

| |

|

Stable Value Fund |

|

|

Bond Investments |

|

|

Total |

|

| Balance, beginning of year |

|

$ |

570 |

|

|

$ |

1,127 |

|

|

$ |

1,697 |

|

| Realized gains/(losses), net |

|

|

— |

|

|

|

13 |

|

|

|

13 |

|

| Change in unrealized gains/(losses), net |

|

|

119 |

|

|

|

(641 |

) |

|

|

(522 |

) |

| Purchases |

|

|

— |

|

|

|

2,954 |

|

|

|

2,954 |

|

| Issuances |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Settlements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Sales |

|

|

— |

|

|

|

(1,079 |

) |

|

|

(1,079 |

) |

| Transfers in to Level 3 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Transfers out of Level 3 |

|

|

(540 |

) |

|

|

— |

|

|

|

(540 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, end of year |

|

$ |

149 |

|

|

$ |

2,374 |

|

|

$ |

2,523 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The valuation methods described in Note 2 may produce a fair value calculation that may not be indicative of net

realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the

fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

For the year ended

December 31, 2014 there were no transfers in or out of Level 3. During the year ended December 31, 2013 transfers out of Level 3 are primarily attributable to the availability of market observable information and the re-evaluation of the

observability of pricing inputs.

F-13

Note 6. Derivative Financial Instruments

Futures Contracts — The Plan enters into futures contracts as part of the Stable Value Fund in the normal course of its

investing activities to manage market risk associated with the Plan’s fixed-income investments and to achieve overall investment portfolio objectives. These contracts involve elements of market risk in excess of amounts recognized in the

statements of net assets available for benefits. The credit risk associated with these contracts is minimal, as they are traded on organized exchanges and settled daily. The current day’s gains and losses are classified as derivatives

receivable/payable for the investment portfolio, with a value of $2 and $0 at December 31, 2014 and December 31, 2013, respectively.

During

2014 and 2013, the Plan was a party to futures contracts held for trading purposes for U.S. Treasury bonds. Upon entering into a futures contract, the Plan is required to deposit either in cash or securities an amount (“initial margin”)

equal to a certain percentage of the nominal value of the contract. Subsequent payments are then made or received by the Plan, depending on the daily fluctuation in the value of the underlying contracts. Short-term investments owned and included in

the investments of the Plan, with a value of $50 at December 31, 2014 and U.S. Treasury bills owned and included in the investments of the Plan with a value of $377 at December 31, 2013, were held by the Plan’s brokers as performance

security on futures contracts.

At December 31, 2014 and 2013, the Plan had futures contracts to purchase or sell U.S. Treasury bonds contracts.

The fair value of futures contracts in the statements of net assets available for benefits is zero at December 31, 2014 and 2013, as cash settlements are

done daily. Changes in fair value are accounted for as net depreciation in fair value of investments. For the year ended December 31, 2014 the net gain related to future contracts was $121.

Note 7. Federal Income Tax Status

The Internal Revenue Service (IRS) has determined and informed the Company by letter dated September 23, 2013 that the Plan and related

Trust are designed in accordance with applicable sections of the Code. The Plan has been amended since receiving the determination letter. The Company and the Plan Administrator believe that the Plan is designed and is currently being operated in

compliance with the applicable requirements of the Code and the Plan and related Trust continue to be tax-exempt. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

The Plan is subject to audit by the IRS; however there are currently no audits for any tax periods in progress. The Plan administrator believes it is no

longer subject to income tax examinations for years prior to 2011.

Note 8. Plan Termination

Although the Company has not expressed any intent to do so, the Company has the right under the Plan to suspend, reduce, or partially or

completely discontinue its contributions at any time and to terminate the Plan, the Trust agreement and the Trust hereunder, subject to the provisions of ERISA. In the event of termination or partial termination of the Plan or complete

discontinuance of contributions, the interests of affected Members automatically become fully-vested.

Note 9. Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net assets available for benefits between the accompanying financial statements and the amounts

reflected in Form 5500 as of December 31, 2014 and 2013:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Net assets available for benefits per accompanying financial statements |

|

$ |

3,531,005 |

|

|

$ |

3,399,411 |

|

| Adjustment from contract value to fair value for fully benefit-responsive investment

contracts |

|

|

21,756 |

|

|

|

19,299 |

|

|

|

|

|

|

|

|

|

|

| Net assets per Form 5500 |

|

$ |

3,552,761 |

|

|

$ |

3,418,710 |

|

|

|

|

|

|

|

|

|

|

F-14

Note 9. Reconciliation of Financial Statements to Form 5500 (continued)

The following is a reconciliation of total investment gain and contributions on the accompanying financial statements and the amount

reflected in Form 5500 for the year ended December 31, 2014:

|

|

|

|

|

| Total investment gain and contributions per accompanying financial statements |

|

$ |

494,037 |

|

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts at beginning of the year |

|

|

(19,299 |

) |

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts at the end of the year |

|

|

21,756 |

|

|

|

|

|

|

| Total income per Form 5500 |

|

$ |

496,494 |

|

|

|

|

|

|

The following is a reconciliation of benefits paid to Members between the accompanying financial statements and the amount

reflected in Form 5500 for the year ended December 31, 2014:

|

|

|

|

|

| Benefits paid to Members per accompanying financial statements |

|

$ |

358,936 |

|

| Deduct corrective distributions |

|

|

1 |

|

| Deduct amounts allocated to deemed loan distributions |

|

|

78 |

|

|

|

|

|

|

| Benefits paid to Members per Form 5500 |

|

$ |

358,857 |

|

|

|

|

|

|

Note 10. Party-in-Interest Transactions

Certain plan investments are in funds managed by the Trustee and certain subsidiaries of the Company. Fees paid by the Plan for trustee,

custodial and investment management services amounted to $61 for the year ended December 31, 2014. Fees paid by the Plan to a subsidiary of the Company pursuant to a group annuity contract issued by a subsidiary, for The Hartford Index Fund,

amounted to $57 for the year ended December 31, 2014. In addition, certain Plan investments are shares of mutual funds that are sponsored by The Hartford and shares of Hartford Stock. At December 31, 2014 and 2013, the Plan held 5,316,940

shares and 5,940,444 shares of Hartford Stock with a cost basis of $177,210 and $197,973, respectively. During the year ended December 31, 2014, the Plan recorded dividend income from Hartford Stock and The Hartford’s mutual funds of

$6,945.

Note 11. Plan Amendments and Other Changes

Effective June 26, 2013 (executed December 18, 2014), the Plan was amended to reflect changes to the definition of spouse for

federal law purposes as set forth in the Windsor decision.

Effective April 1, 2014, there is no minimum amount for an in-service withdrawal (prior

to April 1, 2014, there was a minimum withdrawal amount of $0.5, other than for hardship withdrawals).

Effective April 1, 2014, monthly

periodic installment payments may be made to a Member, Deferred Member or Beneficiary who has attained age 55 and terminated employment in an amount requested by an investment manager appointed by, and with the consent of, a Member, Deferred Member

or Beneficiary in accordance with Plan rules.

Effective April 1, 2014, the Plan was amended to clarify that the Plan Administrator has the full

discretionary authority to determine all questions and to make all factual determinations regarding the correction of errors that result from the operation of Investment Options.

Note 12. Subsequent Events

For the year ended

December 31, 2014, subsequent events were evaluated through the date the financial statements were issued.

******

F-15

EIN# 06-0383750

Plan# 100

THE HARTFORD

INVESTMENT AND SAVINGS PLAN SUPPLEMENTAL SCHEDULE

FORM 5500, SCHEDULE H, PART IV, LINE 4i – SCHEDULE

OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2014

($ IN THOUSANDS, except for par value)

|

|

|

|

|

|

|

|

|

|

|

| (a) |

|

(b) Identity of issue, borrower, lessor,

or similar party |

|

(c) Description of investment including maturity date, rate of

interest, collateral, par or maturity value |

|

(d) Cost |

|

(e) Current

value |

|

|

|

The Hartford Stock Fund |

|

|

|

|

|

|

|

|

| * |

|

The Hartford |

|

The Hartford Stock Fund, common stock (5,316,940 shares) |

|

*** |

|

$ |

221,663 |

|

|

|

|

|

|

| * |

|

State Street Bank and Trust |

|

State Street Cash Fund – STIF |

|

*** |

|

|

687 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal Stock Fund |

|

|

|

|

222,350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds: |

|

|

|

|

|

|

|

|

|

|

Total Return Bond HLS Fund |

|

|

|

|

|

|

|

|

| * |

|

The Hartford |

|

Hartford Series Fund, Inc. Total Return Bond HLS Fund, Class IA shares |

|

*** |

|

|

102,836 |

|

|

|

|

|

|

|

|

Dividend and Growth HLS Fund |

|

|

|

|

|

|

|

|

| * |

|

The Hartford |

|

Hartford Series Fund, Inc. Dividend and Growth HLS Fund, Class IA shares |

|

*** |

|

|

171,250 |

|

|

|

|

|

|

|

|

International Opportunities HLS Fund |

|

|

|

|

|

|

|

|

| * |

|

The Hartford |

|

Hartford Series Fund, Inc. International Opportunities HLS Fund, Class IA shares |

|

*** |

|

|

90,771 |

|

|

|

|

|

|

|

|

Dodge & Cox International Stock Fund |

|

|

|

|

|

|

|

|

|

|

Dodge & Cox |

|

Dodge & Cox International Stock Fund, Class IA shares |

|

*** |

|

|

90,454 |

|

|

|

|

|

|

|

|

Capital Appreciation HLS Fund |

|

|

|

|

|

|

|

|

| * |

|

The Hartford |

|

Hartford Series Fund, Inc. Capital Appreciation HLS Fund, Class IA shares |

|

*** |

|

|

171,975 |

|

|

|

|

|

|

|

|

Small Company HLS Fund |

|

|

|

|

|

|

|

|

| * |

|

The Hartford |

|

Hartford Series Fund, Inc. Small Company HLS Fund, Class IA shares |

|

*** |

|

|

84,792 |

|

|

|

|

|

|

|

|

MidCap HLS Fund |

|

|

|

|

|

|

|

|

| * |

|

The Hartford |

|

Hartford Series Fund, Inc. MidCap HLS Fund, Class IA shares |

|

*** |

|

|

126,200 |

|

|

|

|

|

|

|

|

Prime Money Market |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Prime Money Market |

|

*** |

|

|

61,199 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal Mutual Funds |

|

|

|

|

899,477 |

|

|

|

|

|

|

|

|

|

|

|

|

| * |

Indicates party-in-interest. |

| ** |

These synthetic portfolios have no final maturity date. Final maturity is based on the underlying assets in the bond portfolios. |

| *** |

Cost information is not required for Member directed investments, and therefore is not included. |

F-16

EIN# 06-0383750

Plan# 100

THE HARTFORD

INVESTMENT AND SAVINGS PLAN SUPPLEMENTAL SCHEDULE

FORM 5500, SCHEDULE H, PART IV, LINE 4i – SCHEDULE OF ASSETS (HELD AT END OF

YEAR)

AS OF DECEMBER 31, 2014 (continued)

($ IN THOUSANDS, except for par value)

|

|

|

|

|

|

|

|

|

|

|

| (a) |

|

(b) Identity of issue, borrower, lessor,

or similar party |

|

(c) Description of investment including maturity date, rate of

interest, collateral, par or maturity value |

|

(d) Cost |

|

(e) Current

value |

|

|

|

Collective Investment Trusts: |

|

|

|

|

|

|

|

|

|

|

Real Asset |

|

|

|

|

|

|

|

|

| * |

|

SSGA |

|

SSGA Real Asset Fund |

|

*** |

|

$ |

9,963 |

|

|

|

|

|

|

|

|

Target Retirement Income Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement Income Fund |

|

*** |

|

|

35,316 |

|

|

|

|

|

|

|

|

Target Retirement 2010 Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement 2010 Fund |

|

*** |

|

|

12,033 |

|

|

|

|

|

|

|

|

Target Retirement 2015 Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement 2015 Fund |

|

*** |

|

|

103,147 |

|

|

|

|

|

|

|

|

Target Retirement 2020 Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement 2020 Fund |

|

*** |

|

|

52,001 |

|

|

|

|

|

|

|

|

Target Retirement 2025 Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement 2025 Fund |

|

*** |

|

|

201,146 |

|

|

|

|

|

|

|

|

Target Retirement 2030 Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement 2030 Fund |

|

*** |

|

|

51,671 |

|

|

|

|

|

|

|

|

Target Retirement 2035 Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement 2035 Fund |

|

*** |

|

|

196,230 |

|

|

|

|

|

|

|

|

Target Retirement 2040 Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement 2040 Fund |

|

*** |

|

|

38,082 |

|

|

|

|

|

|

|

|

Target Retirement 2045 Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement 2045 Fund |

|

*** |

|

|

102,547 |

|

|

|

|

|

|

|

|

Target Retirement 2050 Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement 2050 Fund |

|

*** |

|

|

32,303 |

|

|

|

|

|

|

|

|

Target Retirement 2055 Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement 2055 Fund |

|

*** |

|

|

9,205 |

|

|

|

|

|

|

|

|

Target Retirement 2060 Fund |

|

|

|

|

|

|

|

|

|

|

Vanguard |

|

Vanguard Target Retirement 2060 Fund |

|

*** |

|

|

5,993 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal Collective Investment Trusts |

|

|

|

|

849,637 |

|

|

|

|

|

|

|

|

|

|

|

|

| * |

Indicates party-in-interest. |

| ** |

These synthetic portfolios have no final maturity date. Final maturity is based on the underlying assets in the bond portfolios. |

| *** |

Cost information is not required for Member directed investments, and therefore is not included. |

F-17

EIN# 06-0383750

Plan# 100

THE HARTFORD

INVESTMENT AND SAVINGS PLAN SUPPLEMENTAL SCHEDULE

FORM 5500, SCHEDULE H, PART IV, LINE 4i – SCHEDULE OF ASSETS (HELD AT END OF

YEAR)

AS OF DECEMBER 31, 2014 (continued)

($ IN THOUSANDS, except for par value)

|

|

|

|

|

|

|

|

|

|

|

| (a) |

|

(b) Identity of issue, borrower, lessor,

or similar party |

|

(c) Description of investment including maturity date,

rate of interest, collateral, par or maturity value |

|

(d) Cost |

|

(e) Current

Value |

|

| * |

|

The Hartford |

|