Oil-Field Services Company Keane Group Prices Upsized IPO at High End of Range

January 19 2017 - 8:20PM

Dow Jones News

By Josh Beckerman

Oil-field services company Keane Group Inc., which increased the

size of its initial public offering at least twice, said the IPO

priced at the high end of its estimated range Thursday.

The Houston provider of hydraulic fracturing and other well

completion services said the offering of 26.76 million shares

priced at $19 each.

Keane is selling 15.7 million of the shares, while the rest are

being sold by an entity that includes private-equity firm Cerberus

Capital Management LP. Cerberus bought a majority of Keane in

2011.

In November, Keane filed confidential IPO paperwork, and the

next month it revealed its plans to go public.

Regulatory filings this month mentioned an estimated price of

$17 to $19, with the size projected at 16.7 million shares and then

22.3 million shares.

A severe energy downturn in recent years has led to net losses

and job cuts at oil-field services providers like Halliburton Co.

and Baker Hughes Inc.

For the nine months ended Sept. 30, Keane's revenue fell to

$269.5 million from $312.2 million in the comparable 2015 period.

Net loss widened to $148.6 million from $38.9 million.

In December, Keane said it believes it "well positioned to

capitalize efficiently on an industry recovery." The company

pointed to its active role in North American shale areas and said

its strong balance sheet will help it expand.

Keane will trade on the New York Stock Exchange under the symbol

FRAC. The company will use the proceeds to repay debt.

Citigroup, Morgan Stanley, BofA Merrill Lynch, and J.P. Morgan

are joint book-running managers.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

January 19, 2017 20:05 ET (01:05 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

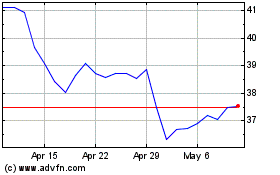

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

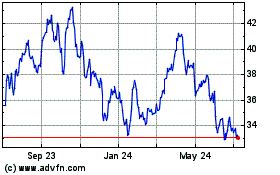

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024