Halliburton Swings to Profit -- Update

October 19 2016 - 12:09PM

Dow Jones News

By Anne Steele

Halliburton Co. posted a surprise small profit for the third

quarter after a year of losses during a protracted energy

downturn.

Executives for the oil-field services provider said Halliburton

was able to eke out a $6 million profit because its U.S. energy

company customers started to return to drilling this summer as

crude prices marched back toward $50 a barrel.

Dave Lesar, chief executive of the Houston-based company, said

he was pleased with the results "given the devastation our industry

has faced over the last two years."

The slow but steady return to oil patches across the U.S. will

continue as long as crude prices hover around $50 a barrel or

higher, a trend Mr. Lesar expects to hold.

"Our customers are smart and they see 2017 as getting better,"

he said.

Over all for the quarter ending in September, Halliburton posted

a profit of $6 million, or a penny a share, compared with a

year-earlier loss of $54 million, or 6 cents a share. Total revenue

plunged 31% to $3.83 billion. Analysts polled by Thomson Reuters

had projected a loss of 6 cents a share on $3.9 billion in

revenue.

Shares in the company, which are up 38% so far this year, rose

4.8% to $49.33 in midmorning trade.

While North American business is generally improving, the

company said international drilling efforts are still stymied. The

rig count outside of the U.S. is expected to bottom out during the

first half of next year, Halliburton President Jeff Miller told

investors and analysts Wednesday on a conference call.

The third quarter was particularly bad for energy companies

operating in Mexico, Venezuela, Australia and Indonesia, Mr. Miller

said, citing a 15-year low for the rig count in Latin America.

It was also the first period during which Halliburton has been

relieved of hefty charges related to its failed tie-up with rival

Baker Hughes Inc., another Houston-based oil-field services

company. That merger, initially valued at $35 billion when it was

first proposed in 2014, failed last May amid intense global

regulatory scrutiny.

When oil was trading around $100 -- double what it is today --

significant inefficiencies were covered up across the industry,

executives said. For instance, demand for labor and equipment was

so great that truck drivers hauling oil-field equipment regularly

made six-figure salaries, and rates to rent drilling rigs

skyrocketed.

But two years of plunging then languishing oil prices forced

Halliburton to slash the price tags of its goods and services to

energy companies. Now Halliburton wants to claw back some of those

price concessions.

Despite its failed merger attempt, Halliburton has the largest

market share of any oil-field services company in the U.S., a

position it is willing to cede in favor of getting paid the higher

prices it needs to operate profitably. Negotiating higher prices

for its services is like being in a "barroom brawl" with customers,

Mr. Miller said.

But he argued that Halliburton has been able to help shale

drillers boost output from wells using fewer chemicals, which is

making fields across the Permian Basin in West Texas economic at

lower oil prices. Even American oil companies that don't hold

leases in core areas considered to have the best geology and

prospects for oil are finding more.

"Our job is to help extend the definition of core," he said.

North America results -- which have dragged lately amid

energy-market volatility -- improved in the third quarter, but

sustained meaningful recovery depends on oil prices staying over

$50. The business, which is the contributor to Halliburton's top

line, rose 9% sequentially, and operating results improved by $58

million, representing margin improvement.

"This is a step in the right direction as we work to regain

profitability in North America," Mr. Lesar said.

In all, revenue in North American operations was down 33% from a

year ago.

Last quarter Halliburton predicted a U.S. oil patch turnaround

was on the horizon, but Wednesday executives sounded a note of

caution that the fourth quarter could slow down due to holiday and

seasonal weather-related downtime before activity picks back up in

early 2017.

"We remain cautious around fourth quarter customer activity,"

Mr. Lesar said. "However, it does not change our view that things

are getting better for us and our customers."

Anne Steele contributed to this article.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

October 19, 2016 11:54 ET (15:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

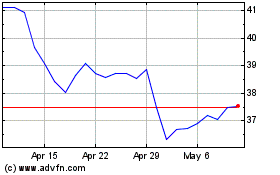

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

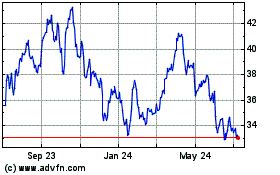

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024