By Tatyana Shumsky

More companies are giving investors the bad news first, in

response to heavier regulatory scrutiny of their financial

reporting.

More than a quarter of the companies in the S&P 500 index

have shifted results that conform with Generally Accepted

Accounting Principles to the top of news releases outlining their

most recent financial performance.

Among the S&P 500 companies reporting results since July,

81% have given prominence to GAAP figures, a sharp rise from the

52% that did so when reporting first-quarter results, according to

an Audit Analytics analysis conducted for The Wall Street

Journal.

Companies that have made the transition include Halliburton Co.,

Walgreens Boots Alliance Inc. and videogame maker Electronic Arts

Inc.

The uptick comes in response to new guidance issued by the

Securities and Exchange Commission in May that requires companies

to give GAAP figures greater weight. It reflects concerns that

adjusted or non-GAAP figures make companies look healthier.

The SEC's timing offered some breathing room, giving companies a

chance to comply with the guidance for subsequent reporting

periods, officials said.

"There's little appetite at the SEC for companies who don't

assess the guidance and self-correct," said Paula Hamric, a partner

in accounting firm BDO USA's national SEC practice.

Halliburton highlighted $64 million in "income from continuing

operations excluding special items" in its first-quarter press

release. But when reconciled to standard accounting principles, the

company had a loss of $2.4 billion.

By contrast, the Houston oil-field services company led its

second-quarter earnings release with a standard-accounting loss of

$3.73 per share, or $3.2 billion.

A Halliburton spokeswoman confirmed that the change was made to

comply with the SEC's new instructions.

The guidance leaves little room for flexibility. If a paragraph

or table contains standard and adjusted figures, companies must

make sure sentences or columns with the standard, or GAAP,

information precedes everything else.

Numbers must be also be presented in the same style, meaning

customized metrics can't be bolded or printed in a larger-size

font, nor can they be described as "record" or "exceptional" unless

GAAP results are characterized in a similar way.

Over the past two quarters, drugstore operator Walgreens has

switched around the sentences atop its earnings press release. The

company led its fiscal second-quarter earnings release with an 11%

increase in "adjusted net earnings," adding that standard per-share

results had plunged 56%. The following quarter, Walgreens put

standard results first, reporting a 14% drop in per-share

earnings.

"We did make some small changes to our most recent quarterly

earnings announcement based on the new SEC guidance and to further

enhance our disclosure to investors," said a spokesman for

Walgreens.

Some companies haven't yet made the shift. Software provider

Ellie Mae Inc. said in its second-quarter earnings release in July

that it hadn't yet modified "adjusted net income" to reflect

certain tax impacts -- a change now required by the SEC.

In a statement recently, Ellie Mae said it plans to comply with

SEC guidelines and modify the "adjusted" benchmark, but is

currently considering timing of the change. "Our measured approach

to transitioning the reporting of this financial metric will

balance our investors' expectations with the concerns of the SEC

staff," the company said.

Companies that don't make the necessary changes run the risk of

additional regulatory scrutiny in the form of letters and forced

revisions. in letters made public through Aug. 5, the SEC

questioned 166 companies this year regarding their use of non-GAAP

figures, up 13% from a year earlier, according to Audit

Analytics.

The SEC makes such written exchanges public 20 days after the

matter is resolved. The letters that have become public so far

concern financial reports from before the new guidance was

announced.

Accountants expect such correspondence to surge as the SEC

evaluates how companies handle the new requirement.

"It's an evolutionary process," said Jeffrey Jones, a partner in

KPMG's SEC practice. "The preparer community, the audit community,

the legal community as well as the SEC will be learning over the

next couple of months where the lines are."

Corporate chief financial officer may face a steep learning

curve. The SEC's new guidelines banned a number of metrics

previously considered acceptable. Regulators said that adjusting

results inconsistently or for recurring expenses could be

misleading.

Complying with the new parameters is more challenging and time

consuming than simply putting GAAP results at the front of the

press release. CFOs must re-evaluate whether the numbers they have

been reporting for years could be considered misleading in light of

the new guidance.

"You have investors and analysts that are used to seeing certain

metrics, so in order to change the presentation, [CFOs] have to

rethink what's meaningful going forward," said BDO USA's Ms.

Hamric.

In July, Electronic Arts Inc. became the first of three

videogame makers to announce it would drop non-GAAP information

from its reporting to comply with the guidance. Rivals Activision

Blizzard Inc. and Take-Two Interactive Software Inc. followed

suit.

"We're trying to do exactly what we have been asked to do by the

SEC, and we feel like we're doing that in a very proactive way,"

CFO Blake Jorgensen said in advance of EA's Aug. 2 earnings report,

which said revenue rose 6% during the fiscal first quarter.

Visa Inc., which typically reports GAAP results first, made more

nuanced changes. The company included more adjusted figures to show

investors how the business would have fared without a recent

acquisition. The goal was for investors to "make up their own minds

about our performance," said James Hoffmeister, the company's chief

accounting officer.

"It's not like we were afraid the SEC was going to come back and

slap us on the wrist and tell us we were not doing a good job," he

said. "We looked at it as more of an opportunity."

--Michael Rapoport contributed to this article.

(END) Dow Jones Newswires

August 29, 2016 14:54 ET (18:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

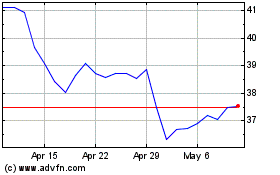

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

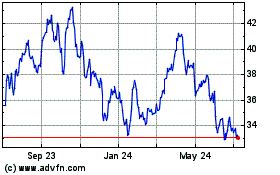

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024