Venezuela Oil Production Drops Sharply in May

June 13 2016 - 10:09PM

Dow Jones News

By Kejal Vyas and Timothy Puko

Venezuela registered its biggest monthly oil-production decline

in a decade in May, according to data released Monday by the

Organization of the Petroleum Exporting Countries, signaling

further trouble for a country already enduring severe economic

hardship.

The decline of 120,000 barrels a day, to 2.37 million barrels a

day, underscores the inability of state energy company Petróleos de

Venezuela SA to maintain oil-industry investments, as the region's

largest petroleum exporter suffers from a debilitating cash crunch,

widespread food shortages and civil unrest.

In recent months, major oil services companies, including

Halliburton Co. and Schlumberger Ltd., said they were cutting back

on operations in Venezuela as the country struggles to pay

multibillion-dollar debts with partners.

"This is very surprising," said Francisco Monaldi, a Latin

American energy policy fellow at Rice University in Houston, who

closely tracks Venezuela's oil industry. "If you want to point to

the biggest problem, it is cash flow, which for PdVSA now looks

worse than we had imagined."

Venezuela, which relies on oil for nearly all of its income, is

facing severe dollar shortages due to low oil prices as well as

more than a decade of profligate spending under the ruling

socialist government, which used oil-sector money to fund social

programs. The country's oil output is far from the 6 million

barrels a day that its officials have long targeted.

Monthly oil production has fallen this much only once since

2003, when the country's oil industry came to a standstill during a

devastating strike led by PdVSA workers seeking the ouster of

then-President Hugo Chávez.

The last time was in 2006, said Gary Ross, head of global oil at

the consulting firm PIRA Energy Group, who added that the drop-off

may give leverage to oil-field services companies that are now in

payment negotiations with Venezuela. "There's an urgency there now

that wasn't there before this happened, because of the lost

production," Mr. Ross said.

Venezuela, which boasts the world's largest crude reserves,

needs significant investment in its Orinoco basin, a massive oil

patch in the country's east, as part of its long-term plans to

double oil output. The region's tar-like, heavy crude is costly to

process and requires PdVSA to import light crude oil as a blending

agent to extract the Orinoco crude and make it transportable.

While the break-even price for Venezuelan oil is around $21 a

barrel, Orinoco crude requires a price above $28 a barrel for PdVSA

and its partners to make a profit on it, according to Eurasia Group

analyst Risa Grais-Targow.

Venezuelan oil fetched around $25 a barrel during the first

three months of 2016. While the price has risen to nearly $40 a

barrel over the last month, the production decline has eaten into

PdVSA's revenues.

--Juan Forero contributed to this article.

(END) Dow Jones Newswires

June 13, 2016 21:54 ET (01:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

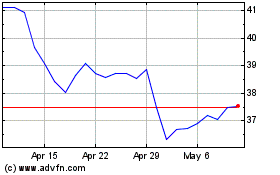

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

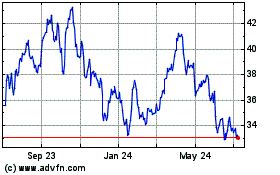

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024