Halliburton-Baker Hughes Deal: What Has Been Gained and Lost -- Heard on the Street

May 02 2016 - 1:10PM

Dow Jones News

By Spencer Jakab

If there is one economic concept an oil man intuitively grasps,

it is sunk costs.

Just as Halliburton boss David Lesar would advise clients to

walk away from a likely dry hole rather than pour good money after

bad, he pushed only as hard as was prudent to complete a merger

with rival Baker Hughes, a deal that ultimately fell apart. The

result: This week he will be writing that company a $3.5 billion

check.

The stock market doesn't seem to mind. On a weak day for

oil-field-service stocks, shares of both Halliburton, the intended

acquirer, and Baker Hughes, the target, gained in early

trading.

The fact that Halliburton didn't sink reflects that investors

long ago assigned scant odds to a successful deal. That was due to

given regulatory objections on both sides of the Atlantic.

Halliburton has the cash and, while the fee stings, it isn't facing

distress. Its shares actually did far better than the recipient of

its huge check.

Meanwhile, Baker Hughes may be awaiting a sum equal to about 16%

of its market value, but the failed merger took a hefty toll on it.

That highlights another economic concept: opportunity costs matter

just as much as direct ones.

During its first-quarter results last week, the company said it

was carrying $110 million of costs during the period that it might

have otherwise shed. The anticipated deal was the reason it didn't

do so. It also incurred some $306 million in after-tax

merger-related expenses in 2015 and the first quarter of 2016.

Finally, Baker Hughes has allowed potential investment

opportunities in a distressed industry to pass it by. The $2.5

billion or so in after-tax value it will realize from the break fee

it will get from Halliburton shouldn't really be viewed as an

outright windfall.

Granted, it does help. Rather than a complicated cost-benefit

analysis, the stock market's verdict on the failed merger's impact

on Baker Hughes shareholders is telling. The stock is just 6% lower

than just before the deal's announcement in November 2014. An

exchange-traded fund tracking the sector has shed 31% of its value

since then.

Baker Hughes wasted no time in telling investors how it would

deploy the cash after paying Uncle Sam: $1.5 billion in share

buybacks and $1 billion in debt reduction. It might have been able

to buy a smaller competitor such as an offshore driller with little

overlap and few regulatory complications. Instead, it is putting

its cash into something it knows best: itself.

Investors seeking one of the few companies in the industry with

fat left to trim and a healthy balance sheet could do worse than to

follow management's lead.

(END) Dow Jones Newswires

May 02, 2016 12:55 ET (16:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

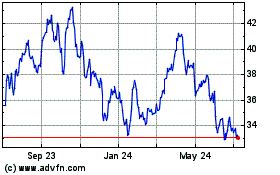

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

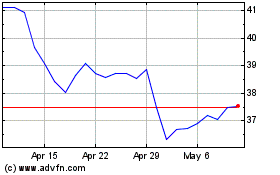

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024