By Brent Kendall and Alison Sider

WASHINGTON -- The Justice Department on Wednesday filed an

antitrust lawsuit challenging Halliburton Co.'s planned acquisition

of rival Baker Hughes Inc., alleging that the deal would threaten

higher prices and reduce innovation in the oil-field services

industry.

The lawsuit, filed in a Delaware federal court, asserts that the

transaction would eliminate important head-to-head competition in

markets for 23 products and services used for U.S. oil exploration

and production, from drill bits to offshore cementing services. The

effect would be to skew energy markets and harm American consumers,

the department said.

Bill Baer, the Justice Department's antitrust chief, pulled no

punches in his criticisms of the merger and made clear the

government's decision to sue wasn't a close call.

"I have seen a lot of problematic mergers in my time. But I have

never seen one that poses so many antitrust problems in so many

markets," Mr. Baer said. Some deal proposals should never leave the

corporate boardroom, he said, and "this deal falls squarely in that

category."

The companies pledged to fight the Justice Department lawsuit.

In a joint statement, they said they "believe that the DOJ has

reached the wrong conclusion in its assessment of the transaction

and that its action is counterproductive, especially in the context

of the challenges the U.S. and global energy industry are currently

experiencing."

The Wall Street Journal reported Tuesday that a government

lawsuit challenging the transaction was imminent.

The nearly $35 billion deal, originally announced in November

2014, proposed to combine the world's second- and third-largest

oil-field services firms, behind only Schlumberger Ltd.

The transaction has faced antitrust resistance around the globe,

including in Europe. The U.S. lawsuit Wednesday is the biggest

hurdle yet for the merger.

Since the deal was struck, the oil-field services industry has

faced severe setbacks, as persistently low oil prices have slashed

demand for the business of drilling wells and pumping oil and

natural gas.

Mr. Baer said the government was "certainly aware" of what has

happened to oil prices. But he said the companies operate in a

cyclical business and the downturn "is not a justification for an

anticompetitive merger."

Halliburton and Baker Hughes have been trying to ease concerns

that their merger would slash competition by offering to sell off

assets worth billions of dollars to other firms, an action called

divestiture.

The companies said Wednesday their proposal would "facilitate

the entry of new competition in markets in which products and

services are being divested." Halliburton said it strongly believed

"that the proposed divestiture package, which was significantly

enhanced in response to concerns that the DOJ expressed during the

course of its 15-month investigation, is more than sufficient to

address the DOJ's specific competitive concerns."

The companies said their combination would create a more

flexible, innovative and efficient company that could reduce costs

for customers.

Baker Hughes Chief Executive Martin Craighead told employees in

a letter the company believed it had a strong case. Mr. Craighead

said he couldn't predict how long the litigation would take.

The companies previously set a deadline of April 30 for

obtaining all the regulatory approvals for the merger agreement,

after which either company could terminate the deal, though they

could also choose to stay the course.

The Justice Department was highly critical of the companies'

divestiture proposal, saying the merged firm would retain more

valuable assets while selling less-significant ones to third

parties.

The department's Mr. Baer said the government had held off on

filing a lawsuit to give a full hearing to the companies' offer.

But he said Halliburton's proposal for fixing the transaction's

competitive problems "changes by the day" and is "so complicated

and convoluted" that it could never work to preserve a competitive

marketplace.

Baker Hughes stands to collect a steep $3.5 billion breakup fee

from Halliburton if the deal doesn't pass antitrust muster. But

some analysts said Baker Hughes might struggle to regain its

footing as an independent company if the deal falls through.

"We believe the biggest risk with a suddenly stand-alone BHI is

the state of the company's operational capabilities after a wave of

departures and, according to multiple industry sources, the

apparent unorganized and disengaged nature of the rest of the

organization," Wells Fargo analysts wrote.

But, they noted, the company would have as much as $5 billion on

its balance sheet and a lot more freedom to cut costs and improve

margins than it has had in the past year. Baker Hughes shares shot

up almost 9% to $42.83 Wednesday. Halliburton shares rose almost 6%

to $36.44.

In addition to the breakup fee it would owe Baker Hughes,

Halliburton would be on the hook to redeem $2.5 billion worth of

bonds if the merger isn't consummated by November. Still, analysts

said the company could likely handle the cash outflow.

"With Halliburton, the balance sheet becomes a little less

flexible, but it doesn't fundamentally redefine the company," said

Bill Herbert, an analyst at Simmons & Co., a division of Piper

Jaffray Cos.

While most mergers continue to receive government approval, the

legal challenge is the latest evidence that U.S. antitrust

enforcers in the Obama administration are pushing back against

transactions they believe raise significant threats to

competition.

Last year, the Justice Department challenged several major

deals, including General Electric Co.'s planned sale of its

appliance business to Electrolux AB and Comcast Corp.'s planned

acquisition of Time Warner Cable Inc.

Both of those deals were eventually abandoned.

The Federal Trade Commission, meanwhile, is in the midst of

court proceedings against a proposed merger of Staples Inc. and

Office Depot Inc.

Write to Brent Kendall at brent.kendall@wsj.com and Alison Sider

at alison.sider@wsj.com

(END) Dow Jones Newswires

April 07, 2016 02:16 ET (06:16 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

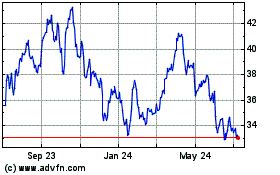

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

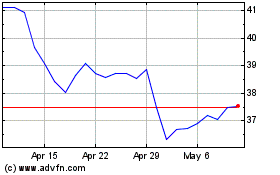

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024