Justice Department Files Lawsuit to Block Halliburton-Baker Hughes Deal -- Update

April 06 2016 - 11:42AM

Dow Jones News

By Brent Kendall and Alison Sider

WASHINGTON -- The Justice Department Wednesday filed an

antitrust lawsuit challenging Halliburton Co.'s planned acquisition

of rival Baker Hughes Inc., alleging that the deal would threaten

higher prices and reduced innovation in the oil-field services

industry.

The lawsuit, filed in a Delaware federal court, asserts that the

transaction would eliminate important head-to-head competition in

markets for 23 products and services used for U.S. oil exploration

and production, from drill bits to offshore cementing services.

"The proposed deal between Halliburton and Baker Hughes would

eliminate vital competition, skew energy markets and harm American

consumers," Attorney General Loretta Lynch said in a statement.

The companies pledged to fight the Justice Department lawsuit

vigorously. In a joint statement, they said they "believe that the

DOJ has reached the wrong conclusion in its assessment of the

transaction and that its action is counterproductive, especially in

the context of the challenges the U.S. and global energy industry

are currently experiencing."

The Wall Street Journal reported Tuesday that a government

lawsuit challenging the transaction was imminent.

The nearly $35 billion deal, originally announced in November

2014, proposed to combine the world's second- and third-largest

oil-field services firms, behind only Schlumberger Ltd. The

transaction has faced antitrust resistance around the globe,

including in Europe. The U.S. lawsuit Wednesday is the biggest

hurdle yet for the merger.

Since the deal was struck, the oil-field services industry has

faced severe setbacks, as persistently low oil prices have slashed

demand for the business of drilling wells and pumping oil and

natural gas.

Halliburton and Baker Hughes have been seeking to ease concerns

that their merger would slash competition by offering to sell off,

or divest, assets worth billions of dollars to other firms.

Halliburton and Baker Hughes said Wednesday their proposal would

"facilitate the entry of new competition in markets in which

products and services are being divested." They added, "Both

companies strongly believe that the proposed divestiture package,

which was significantly enhanced, is more than sufficient to

address the DOJ's specific competitive concerns."

The companies said their combination would create a more

flexible, innovative and efficient company that could reduce costs

for customers.

But the Justice Department has been highly critical of the

companies' divestiture proposal, saying the merged firm would

retain more valuable assets while selling less-significant ones to

third parties.

"Although the terms of Halliburton's proposed remedy continue to

change, it appears to be among the most complex and riskiest

remedies ever contemplated in an antitrust case," the department

said in its lawsuit.

While most mergers continue to receive government approval, the

legal challenge is the latest evidence that U.S. antitrust

enforcers in the Obama administration are pushing back against

transactions they believe raise significant threats to

competition.

Last year, the Justice Department sank several deals, including

General Electric Co.'s planned sale of its appliance business to

Electrolux AB and Comcast Corp.'s planned acquisition of Time

Warner Cable Inc. Both of those deals were eventually

abandoned.

The Federal Trade Commission, meanwhile, is in the midst of

court proceedings against a proposed merger of Staples Inc. and

Office Depot Inc.

Write to Brent Kendall at brent.kendall@wsj.com and Alison Sider

at alison.sider@wsj.com

(END) Dow Jones Newswires

April 06, 2016 11:27 ET (15:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

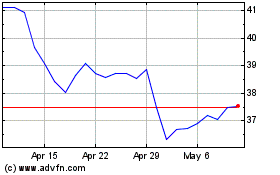

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

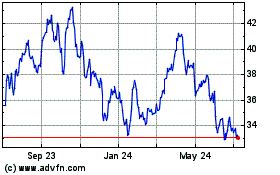

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024