Baker Hughes Reports Loss, Sees Further Decline in Rigs

January 28 2016 - 9:30AM

Dow Jones News

Baker Hughes Inc. swung to a fourth-quarter loss and reported a

49% decline in revenue as the oil-field services company continues

to feel the impact from the downturn in energy prices.

The company, which is in agreement to be acquired by Halliburton

Co., said Thursday that it sees current market conditions causing

further declines this year in the number of rigs being

operated.

In the fourth quarter, Baker was hurt by weakness in its North

America business, where revenue slid by two-thirds to $1.1 billion.

The company cited a steep drop in activity and the deterioration of

industry pricing conditions since early 2015.

Chief Executive Martin Craigshead said in prepared remarks on

Thursday that "since the fourth quarter of 2014, the global rig

count has declined 46% as our customers adjusted their spending to

align with declining commodity prices."

Mr. Craigshead said revenue in the December quarter dropped 10%

from the third quarter on a "sharp decrease in activity and ongoing

pricing pressure as [exploration and production] companies further

adjust their spending to the continued drop in commodity

prices."

Looking ahead, he said that "at current commodity prices, the

global rig count could decline as much as 30% in 2016, as our

customers' challenges of maximizing production, lowering their

overall costs, and protecting cash flows are now more acute."

Overall, Baker Hughes reported a loss of $1.3 billion, or $2.35

a share, compared with a year-earlier profit of $663 million, or

$1.52 a share. Excluding one-time items—which included a write-down

of its pressure-pumping product line in North America,

restructuring charges and expenses related to the Halliburton

deal—the adjusted per-share loss was 21 cents, compared with

year-earlier adjusted per-share earnings of $1.44.

Revenue slumped to $3.39 billion from $6.64 billion.

Analysts polled by Thomson Reuters expected a per-share loss of

10 cents and revenue of $3.47 billion.

The pending $35 billion acquisition of Baker Hughes by

Halliburton is facing more regulatory hurdles since European Union

regulators opened a full-blown antitrust investigation into the

deal earlier this month, warning it raised "serious potential

competition concerns."

The pending merger, which would unite the second- and

third-largest oil-field services suppliers, already has been facing

a growing list of antitrust concerns in the U.S., even as the slump

in oil prices complicates the firms' efforts to find buyers for any

assets that might need to be sold to ease regulators' concerns.

Oil-field services company have been cutting costs as customers

slash their spending plans to cope with a prolonged downturn in

energy prices. On Monday, Halliburton laid off an additional 4,000

workers at the end of last year as it lost money in the fourth

quarter on its oil-field drilling and services businesses.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

January 28, 2016 09:15 ET (14:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

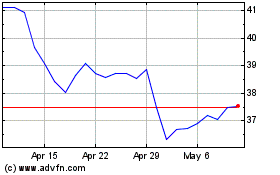

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

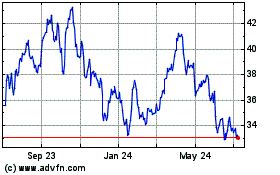

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024