Halliburton-Baker Hughes Merger Under EU Antitrust Review

January 12 2016 - 2:11PM

Dow Jones News

By Tom Fairless

BRUSSELS-- Halliburton Co. faces a fresh hurdle toward its $35

billion acquisition of rival Baker Hughes Inc. after European Union

regulators opened a full-blown antitrust investigation into the

deal, warning it raised "serious potential competition

concerns."

The merger, which would unite the second and third largest

oil-field services firms, already faces a growing list of antitrust

concerns in the U.S., while the slump in oil prices complicates the

firms' efforts to find buyers of any assets.

The European Commission, the EU's top antitrust authority, said

Tuesday it would open an in-depth probe into the merger after its

initial inquiry showed the firms were close competitors.

Such inquiries are common in large mergers and don't indicate a

deal will be blocked. If the concerns are confirmed, the companies

can decide to make concessions, such as selling assets, to assuage

the regulator. If those aren't deemed sufficient, Brussels can also

block the deal.

EU antitrust chief Margrethe Vestager said her agency would have

to "look closely" at the merger. The initial probe found serious

potential concerns in more than 30 product and service lines, the

regulator said.

The EU now has until May 26 to review the deal.

Write to Tom Fairless at tom.fairless@wsj.com

(END) Dow Jones Newswires

January 12, 2016 13:56 ET (18:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

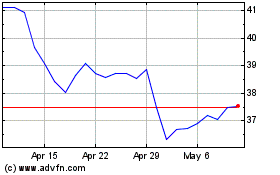

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

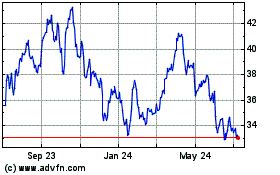

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024