By Thomas M. Burton

The Trump administration's nominee to lead the Food and Drug

Administration plans to recuse himself for a year from FDA

decisions on more than 20 companies, including some drug

giants.

Scott Gottlieb in recent years has held positions and received

millions of dollars in income as adviser, executive, paid speaker

or consultant to the companies, according to financial-disclosure

documents he has filed with government ethics officials.

Among the companies are cancer-therapy startups, such as Cell

Biotherapy Inc., and large concerns, such as GlaxoSmithKline PLC

and Bristol-Myers Squibb Inc.

Much of that work involved assessing the prospects of fledgling

companies, investing in some and advising them on medical and

regulatory matters.

Dr. Gottlieb, a physician, has provided some of that seed money

himself. Other venture capital came from New Enterprise Associates,

where he has been a venture partner, and from T.R. Winston &

Co., where he has been a managing partner and investment

consultant.

The consulting work for GlaxoSmithKline, for which he was paid

$87,153 in 2016 through the first two months of 2017, involved

helping the company make decisions about drugs in its research

pipeline.

In all cases, Dr. Gottlieb pledged to ethics officials at the

Office of Government Ethics to recuse himself from involvement with

the medical companies at the FDA for a year after resigning

positions and divesting his interests.

An FDA commissioner rarely is required to get involved in

company-specific decisions, instead directing policy covering

entire industries.

Dr. Gottlieb's work with such a wide range of drug firms could

provide fodder for Senate Democrats to attack his nomination in

hearings scheduled for next week. Unlike some other Trump cabinet

members who are relative novices to federal government, Dr.

Gottlieb previously served in government, as a deputy FDA

commissioner under President George W. Bush.

According to the documents, during 2016 and through March 1,

2017, when the disclosure period ends, Dr. Gottlieb made more than

$3 million in gross income. The income included a retainer and

bonus of $1.85 million from T.R. Winston, as well as $280,000 as a

consulting retainer from New Enterprise and salary of $210,916 from

the American Enterprise Institute, a conservative think tank.

Earlier data in a federal database, covering 2013 through 2015,

show that Dr. Gottlieb had collected $413,000 from medical

companies, mostly in consulting and speaking fees.

Dr. Gottlieb's ties to 19 of the companies in the newer

disclosure forms stem from his position with New Enterprise and

T.R. Winston.

At New Enterprise, he invested in six early-stage companies

specializing in areas such as kidney disease, pathology and

radiology. They include American Pathology Partners, Radiology

Partners and U.S. Renal Care. He plans to divest interests in all

the companies, according to decisions reached with the Office of

Government Ethics and ethics officials with the Department of

Health and Human Services.

Some critics of Mr. Gottlieb say their concerns focus on his

views of FDA regulation -- not his finances.

Jerome Avorn, a Harvard Medical School professor who has

extensively studied the drug industry, said, "You can't recuse

yourself from your ideology. Scott has been very candid that he

would like a lighter regulatory touch" at the FDA.

Dr. Gottlieb has generally advocated for quicker and simpler FDA

approvals, a view that aligns him in some ways with President

Donald Trump.

Dr. Gottlieb's attorney, Leslie Kiernan of the Washington firm

Akin Gump Strauss Hauer & Feld, said, "Every nominee who goes

into government from private industry will have some recusals. But

Scott brings a unique combination of experience. He understands how

startups work, and it's valuable for a regulator to understand

this."

At T.R. Winston, Dr. Gottlieb has recently held financial

interests in 13 companies, such as Cell Biotherapy, a

cancer-research company; Kure, a retailer of vaping products; and

Tivorsan Pharmaceuticals, a maker of an early-stage

muscular-dystrophy drug.

T.R. Winston often put its own money into such companies and

raises other funds from investors.

Dr. Gottlieb also agreed to resign his consultancy relationship

with Glaxo, in which he served as a drug-research adviser. He has

said he won't be involved in any Glaxo decisions for a year after

ending the relationship.

In the case of Bristol-Myers, his disclosures say he "previously

provided" consulting services to the company, without stating a

dollar figure for income or giving detail. But he pledged to have

no official dealings with the company for a year.

Another issue that could raise possible issues concerns 24

speaking honoraria totaling more than $200,000 during 2016 and the

first two months of 2017. These include $10,000 from Merck &

Co., $11,250 from the Generic Pharmaceutical Association and

$11,250 from Biogen Inc.

Write to Thomas M. Burton at tom.burton@wsj.com

(END) Dow Jones Newswires

March 29, 2017 00:15 ET (04:15 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

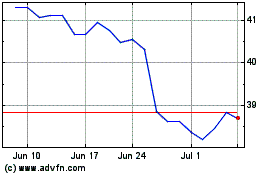

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

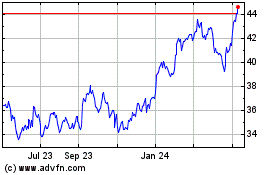

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024