GlaxoSmithKline Swung to Profit in Fourth Quarter, Helped by Weak Pound -- 2nd Update

February 08 2017 - 11:19AM

Dow Jones News

By Denise Roland

LONDON-- GlaxoSmithKline PLC braced investors for the likely

launch of a cheap copycat of its blockbuster respiratory drug

Advair in the U.S., saying such competition would scuttle any

profit growth in 2017.

Core earnings per share would be flat or decline slightly in

2017 if a cheap competitor to Advair entered the U.S. market in the

middle of the year, the U.K.-based drugmaker said Wednesday.

Glaxo shares were down 0.3% at GBP15.58 ($19.47) on Wednesday

afternoon, after falling by as much as 2.9%.

Advair lost patent protection in 2010, but the complexities of

mimicking the action of an inhaled drug has delayed the arrival of

generic versions. Mylan NV and Hikma Pharmaceuticals PLC are likely

to launch competing products this year.

Sales of Advair are already suffering from competition but the

introduction of a direct substitute would sharply accelerate that

decline. Glaxo said the arrival of a generic competitor would slash

U.S. Advair revenue to around GBP1 billion in 2017, compared with

GBP1.8 billion in 2016.

Glaxo said that should those products fail to win approval from

U.S. regulators, or be delayed, core earnings per share would

increase 5%-7% at constant exchange rates.

"Clearly, this year we face some uncertainty as to the level of

our earnings performance given the possibility of substitutable

generic competition to Advair in the U.S.," said Chief Executive

Andrew Witty.

Those alternative outlooks came as the company posted soaring

profit and sales for the three months to Dec. 31, thanks to

increased revenue from newer drugs and a boost from the weakness of

the pound.

The company said core operating profit, a measure that strips

out one-time items, climbed 52% to GBP2.1 billion, while revenue

rose 21% to GBP7.6 billion. Net profit was GBP257 million, compared

with a GBP354 million loss in the same period a year earlier, when

restructuring costs related to Glaxo's $20 billion asset-swap deal

with Novartis AG ate into earnings.

Glaxo, which reports in sterling but makes most of its revenue

in other currencies, is benefiting from the weakness of the pound

as politicians lay the groundwork for exiting the European Union.

Stripping out the currency effect, core operating profit rose 16%

and revenue increased 3%.

The company's solid performance was largely thanks to a rise in

sales from its newer drugs. Glaxo said revenue from a string of

medicines launched in the last few years, such as Tivicay for HIV

and Advair-successor Breo, grew 71% at constant exchange rates to

GBP1.4 billion of sales in the fourth quarter.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

February 08, 2017 11:04 ET (16:04 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

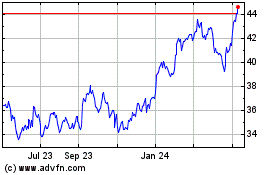

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

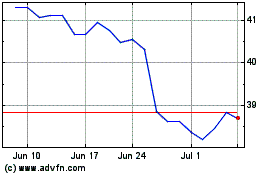

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024