GlaxoSmithKline Names Emma Walmsley as Next Chief Executive -- 2nd Update

September 20 2016 - 9:49AM

Dow Jones News

By Denise Roland

LONDON-- GlaxoSmithKline PLC said its head of consumer health

care, Emma Walmsley, will succeed Andrew Witty as chief executive,

in a move that cements the company's shift away from its dominant

prescription-medicine business.

Ms. Walmsley, 47 years old, will take up the post when Mr. Witty

steps down on March 31, making Glaxo the only top-tier

pharmaceutical company to be led by a woman. The consumer

health-care division, which she has run since 2010, sells drugstore

staples such as toothpaste and painkillers.

Her appointment is likely to draw a mixed response from

investors given her lack of direct pharmaceutical experience. Ms.

Walmsley spent most of her career at cosmetics giant L'Oréal SA

before joining Glaxo six years ago.

Some investors were eager to see an executive with experience in

managing the development of innovative drugs take up the role, to

breathe new life into the company's drug pipeline, which has

suffered some setbacks in recent years.

Still, it won't have come as a big surprise: Ms. Walmsley was

widely touted as a strong internal contender for the job.

The decision was uncontroversial within Glaxo's management: The

board voted unanimously that she should succeed Mr. Witty,

according to a person familiar with the situation. Ms. Walmsley is

well respected within the company, having presided over a period of

rapid expansion of Glaxo's consumer-health-care unit following the

formation of a joint venture with Novartis AG.

"She has been very clear with the board that an absolute

priority will be fostering and boosting innovative drugs," the

person said. "She recognizes the potential that has for the

company's performance in the near and medium term."

The person added that Ms. Walmsley regularly weighs in on other

parts of the business during executive board meetings. "Just

because they're not talking about consumer" doesn't mean she lacks

a point of view, the person said.

Andrew Baum, an analyst at Citi, said Ms. Walmsley could improve

Glaxo's research productivity despite her lack of experience in

that area as long as she undertook a critical assessment of the

company's research outcomes and made some senior hires in the

pharmaceuticals business.

Ms. Walmsley won't have the luxury of focusing squarely on the

pharmaceuticals business. She will take the reins in the middle of

a strategic shift engineered by her predecessor. While other major

drug companies increasingly focus on expensive new therapies for

cancer and other diseases, Mr. Witty, 52, has put increasing

emphasis on low-margin, high-volume consumer-health-care products

and vaccines.

He achieved that largely through a three-part, $20 billion deal

with Novartis that involved swapping Glaxo's cancer-drug portfolio

for the Swiss company's vaccines business and pooling their

consumer-health-care businesses into a joint venture controlled by

the U.K. company.

Mr. Witty engineered the transaction to reduce Glaxo's

dependence on the risk-laden drug-discovery part of the business,

which succeeds or fails on the outcomes of lengthy and expensive

clinical trials, patent life cycles and the willingness of

governments and health insurers to spend ever-tighter budgets on

medicines. By contrast, vaccines and consumer health care are

considered more stable businesses.

Since that deal closed last year, the consumer-health-care

business has been a key source of growth for the company as its

huge prescription-drug business struggles with the decline of its

old blockbuster drug Advair.

Ms. Walmsley's strategy: to champion a selection of "power

brands," such as toothpaste Sensodyne, where she believes the

consumer-health-care division can achieve the strongest growth.

The deal is also starting to bear fruit across the company as a

whole. Glaxo has posted solid revenue and earnings growth for the

past few quarters.

Joe Walters, senior portfolio manager at Royal London Asset

Management, said the appointment "suggests a strategy of evolution

rather than revolution" and meant the company was unlikely to

undergo any big structural changes. Neil Woodford, a prominent U.K.

fund manager and one of Glaxo's biggest investors, is pushing for

breaking up the company into its pharmaceutical, vaccines and

consumer-health-care constituents.

After trading down earlier in Tuesday's session, Glaxo shares

were lately up 0.3% to GBP16.50 ($21.53) in London.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

September 20, 2016 09:34 ET (13:34 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

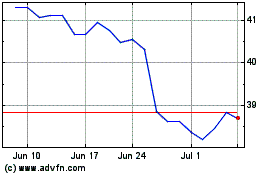

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

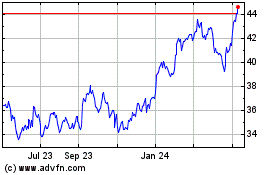

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024