By Denise Roland and Joann S. Lublin

As GlaxoSmithKline PLC's search for a new boss gets under way,

one requirement ranks high on investors' wish lists: someone who

can breathe new life into its drug-development machine.

The company's pharmaceuticals arm, which develops prescription

medicines and accounts for around two-thirds of its GBP23.9 billion

($34 billion) annual revenue, has lagged behind many of its peers

in recent years, according to investors. Glaxo has notched a total

shareholder return of 60% over the past five years, compared with

107% for the S&P Global 1200 Health Care Index. For many,

fixing this is seen as the top priority for the successor to Chief

Executive Andrew Witty, who recently announced plans to retire next

March.

The U.K. company has made recent efforts to highlight promising

medicines in its labs, which it says could yield 20 new drugs by

2020. In November, Mr. Witty and other executives walked investors

through Glaxo's pipeline of new drugs at the company's first

so-called R&D day for more than a decade. The company is also

upbeat about the prospects for some recently launched medicines in

HIV and respiratory conditions.

But a number of high-profile failures in recent years, including

darapladib, a heart drug it hoped would become a

multibillion-dollar blockbuster, and MAGE-A3, an experimental

treatment for lung cancer, have hurt the company's credibility in

research and development, according to some investors.

"The research and development organization of Glaxo is

recovering from several painful and high-profile historic

failures," said Andrew Baum, an analyst at Citi. "It needs someone

to inject a note of confidence and smart risk-taking."

At the same time, Mr. Witty's strategy of reducing Glaxo's

exposure to drug development by bulking up in vaccines and

drugstore staples, from over-the-counter remedies to toothpaste,

has raised concerns that the company is moving away from its

historic core.

Neil Woodford, a prominent U.K. fund manager and one of Glaxo's

biggest investors, is one shareholder pressing for the company to

focus squarely on developing and selling drugs. "He wants it to be

a pharmaceuticals company," said a spokesman for the fund manager.

"He's not in the consumer health-care camp."

Joe Walters, manager of Royal London Asset Management's UK

Income With Growth Trust, which holds 0.8% of Glaxo, said it is

important the new boss "comes with a strong scientific background"

because a new blockbuster drug is the company's best chance for

increasing its share price. "Science is still the largest part of

the group and will determine its success or failure," he added.

"I would prefer somebody who has had some experience of R&D

and who can make good long-term calls," said another institutional

investor. "Those calls don't show up in yearly earnings but help

sustain the business over time."

Another issue confronting Glaxo's new boss: deciding whether to

break up the group, which was formed in 2000 by the merger of

crosstown London rivals. Some shareholders, led by Mr. Woodford,

have said spinning off the GBP6 billion consumer health-care arm

could release value for shareholders.

For Mr. Woodford, that means hiring "a fresh pair of eyes" from

outside Glaxo, a move which that would be a departure from the

company's tendency to promote insiders to top jobs. The company's

12 executive team members have an average tenure of 16 years, and

eight were promoted from inside.

Mr. Witty has said that while the consumer health-care unit is

large enough to constitute a stand-alone company, it would be

"unwise" to consider breaking it off until Glaxo finishes

integrating a recent deal with Novartis AG, a process that he said

would take another two years.

Some shareholders pointed to Glaxo's U.K. rival AstraZeneca PLC

as an example of how a research culture can be overhauled from the

top. Pascal Soriot, who was hired from Roche Holding AG in 2012,

has "reinvigorated the R&D engine and brought in new talent,"

said Dani Saurymper, manager of the AXA Framlington Health

fund.

The Glaxo board last month said it would consider internal and

external candidates to succeed Mr. Witty, who has spent more than

30 years at the company and is leaving at the age of 52. Under the

company's remuneration policy, the board may offer external

candidates a bonus of up to nine times' base salary for long-term

performance as a joining incentive.

One outsider in the running is Geno Germano, a departing Pfizer

Inc. executive, according to several people close to the situation.

A spokesman for Glaxo declined to comment on the matter.

In early February, Pfizer said Mr. Germano, group president of

its global innovative pharmaceuticals business, would leave the

giant drugmaker. His exit was announced along with the leadership

plans for Pfizer's now-abandoned merger with Allergan PLC. Mr.

Germano will depart despite the deal's collapse, according to

people familiar with the matter.

Some internal candidates highlighted by investors as strong

contenders were Abbas Hussain, head of global pharmaceuticals; Jack

Bailey, head of the company's U.S. pharmaceuticals arm; and Roger

Connor, head of global manufacturing and supply.

Glaxo "needs someone who can walk into one of the most

challenging jobs in the U.K. at the moment, and can deliver," said

Ashley Hamilton Claxton, corporate governance manager at Royal

London Asset Management.

--Helen Thomas contributed to this article.

Write to Denise Roland at Denise.Roland@wsj.com and Joann S.

Lublin at joann.lublin@wsj.com

(END) Dow Jones Newswires

April 21, 2016 05:44 ET (09:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

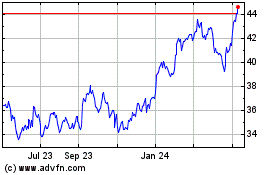

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

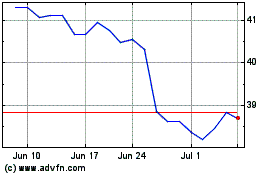

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024