By Ellie Ismailidou and Victor Reklaitis, MarketWatch

Oil jumps to 7-month high, helping energy shares

U.S. stocks rallied sharply Wednesday for the second straight

session after logging their best daily gains in nearly three months

on Tuesday.

A jump in oil prices near $50 a barrel following a Tuesday

report showing a decline in crude inventories

(http://www.marketwatch.com/story/crude-oil-rockets-to-near-50-a-barrel-as-data-hints-at-us-supply-drop-2016-05-25),

lifted energy and materials stocks. Oil futures held on to their

gains Wednesday, trading near a seven-month high after the U.S.

Energy Information Administration reported

(http://www.marketwatch.com/story/oil-holds-gains-after-eia-reports-42-million-barrel-fall-in-us-crude-supplies-2016-05-25)

that U.S. crude supplies declined by 4.2 million barrels in the

week ended May 20.

Meanwhile, growing expectations that the Federal Reserve might

raise interest rates as early as next month buoyed financial

companies' shares, as higher interest rates tend to boost banks'

balance sheets.

The S&P 500 was up 16 points, or 0.8%, to 2,092, led by

strong gains in financial stocks, up 1.2%, followed by a 1.1% rise

in energy stocks. The utilities sector was the only sector in

negative territory, down 0.4%.

The Dow Jones Industrial Average added 174 points, or 1%, to

17,878, led by a 2.6% jump in Goldman Sachs Group Inc.(GS),

followed by 2.2% rise in J.P. Morgan Chase & Co.(JPM) shares. A

0.5% drop in shares of Nike Inc. (NKE) weighed on the blue-chip

gauge.

Meanwhile, the Nasdaq Composite was up 36 points, or 0.7%, at

4,897.

" A big part of this rally is central-bank induced," said Quincy

Krosby, market strategist at Prudential Financial. The fact that

financials are leading the advance implies, according to Krosby,

that investors are betting that a potential rate hike will push the

10-year benchmark Treasury yield higher, boosting bank

profitability.

But overall, it is typically thought that "the market always

prefers a rate cut to a rate hike," Krosby said, so in order for

this rally to continue in a sustainable way, there needs to be

"broad market participation."

Some analysts pointed to nascent signs of such broad

participation. For instance, the recent rally in the technology

sector has been "much more broad based than what we saw during most

of the last two years," said Tim Anderson, managing director at MND

Partners, in emailed comments.

A rally in financial and tech stocks underpinned Tuesday's sharp

advance. The main difference from past rallies, according to

Anderson, is that dozens of technology stocks have been part of the

Nasdaq rally since last Thursday, including many sub groups that

have been languishing for many quarters.

Other strategists pointed to a shift in broader investor

sentiment.

"Traders continue to view the [Federal Reserve] moving toward an

interest-rate increase as a positive sign that the U.S. economy is

strong and overseas economic risks are fading, setting up a

positive environment for corporate earnings growth," said Colin

Cieszynski, chief market strategist at CMC Markets, in emailed

comments.

The surge in risk appetite, according to Cieszynski, weighed on

gold futures as capital continued to leave defensive havens, like

gold and U.S. Treasurys for more aggressive positions.

Still, some analysts appeared worried at the market's strong

gains ahead of a potential interest-rate hike that could come as

soon as June.

"I really am trying to get my head around the newfound

euphoria," said David Buik, market commentator for Panmure Gordon

& Co. "Yes, I get the learning to live with a 25-basis-point

U.S. Fed rate hike in June or July ... but I wonder!"

Other markets: European stocks were advancing, while Asian

markets mostly closed higher

(http://www.marketwatch.com/story/asian-stocks-boosted-by-strong-oil-prices-upbeat-us-data-2016-05-25).

Gold futures were losing ground, and the ICE U.S. Dollar Index

inched lower.

Read:Citi expects Brent crude to reach $50 a barrel in the third

quarter

(http://www.marketwatch.com/story/new-age-for-oil-prompts-citi-to-raise-2017-forecast-to-65-2016-05-24)

Economic news: Investors shrugged off a report that showed the

nation's trade deficit widened in April

(http://www.marketwatch.com/story/us-goods-deficit-shows-higher-trade-gap-in-april-2016-05-25),

as imports increased faster than exports.

Minneapolis Fed President Neel Kashkari is expected to talk at

11:40 a.m. about the energy sector and monetary policy. At 1:30

p.m. Eastern, Dallas Fed President Steven Kaplan has been slated to

take part in a moderated question-and-answer session. None of the

speakers is currently a voting member of the Fed.

Individual movers: Shares in Hewlett Packard Enterprise Co.(HPE)

surged 10.7%, on track for their best daily gain in 11 weeks. The

company late Tuesday said it will spin off its enterprise services

business and merge it

(http://www.marketwatch.com/story/hp-enterprise-to-spin-off-merge-services-business-2016-05-24-164855124)

with Computer Sciences Corp.(CSC)

Read:Hewlett Packard Enterprise -- another day, another spinoff?

(http://www.marketwatch.com/story/hewlett-packard-enterprise-another-day-another-spinoff-2016-05-24)

Microsoft Corp. shares (MSFT) gained 1% after the tech giant

early Wednesday said it will lay off 1,850 workers

(http://www.marketwatch.com/story/microsoft-to-layoff-1850-from-smartphone-business-2016-05-25)

from its ailing smartphone business.

Alibaba Group Holding Ltd.'s (BABA) stock dropped 3.9% after the

China-based ecommerce giant disclosed in a filing that it was being

investigated by the U.S. Securities and Exchange Commission.

(http://www.marketwatch.com/story/alibabas-stock-slumps-after-disclosure-of-sec-probe-into-singles-day-data-consolidation-practices-2016-05-25)

Jewelry seller Tiffany & Co.(TIF) fell 1.6% after its

quarterly revenue and outlook disappointed

(http://www.marketwatch.com/story/tiffanys-stock-rocked-by-sales-miss-downbeat-outlook-2016-05-25),

and clothing retailer Express Inc.(EXPR) tumbled 14.4% following

its quarterly report

(http://www.marketwatch.com/story/express-cuts-outlook-after-revenue-flattens-2016-05-25).

(END) Dow Jones Newswires

May 25, 2016 11:15 ET (15:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

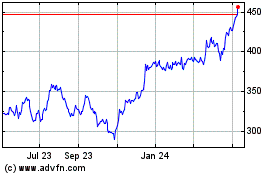

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Mar 2024 to Apr 2024

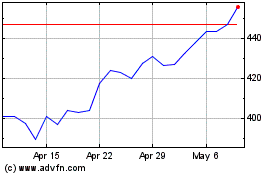

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Apr 2023 to Apr 2024