Liquidation of MF Global Comes to an End

February 09 2016 - 4:20PM

Dow Jones News

Marking the conclusion of MF Global Inc.'s bankruptcy case, a

judge Tuesday officially closed the estate of the defunct brokerage

firm and discharged the federally appointed trustee, James Giddens,

who clawed back a 95% recovery for the commodity broker's unsecured

creditors and repaid its customers in full.

The end of the case was "a day we could dimly foresee when this

case began four years ago on Halloween," said James Kobak, a lawyer

for the trustee during the hearing in U.S. Bankruptcy Court in New

York. Over that time the trustee has returned some $7 billion worth

of property to customers.

MF Global imploded in the fall of 2011 with a $1.6 billion

shortfall in segregated accounts. The end came after Chief

Executive Jon S. Corzine's bets on European sovereign debt came to

light, raising questions about the firm's risk management.

Mr. Kobak also noted that at the beginning of the case some had

expressed doubt as to whether the Securities Investor Protection

Act, the law covering the liquidation failed brokerages, could

handle the liquidation of a firm as complex as MF Global.

Having been tested in two of the most complex brokerage

liquidation cases in history, MF Global and Lehman Brothers, "the

statute has more than vindicated itself," Mr. Kobak said.

Stephen Harbeck, the president of the Securities Investor

Protection Corp., the agency formed under SIPA, also appeared

during the hearing to thank the court on behalf of the investors it

serves.

Bankruptcy Judge Martin Glenn recalled during the hearing the

importance of those investors particularly in this case.

"What made this case somewhat unique was that many of the MF

Global Inc. customers were farmers in the Midwest, who used

commodity trading as a way of protecting their financial interest,"

Judge Glenn said.

The flood of letters he received from irate farmers at the

beginning of the case added "a very human dimension," to the

proceedings, he said.

Although the liquidation of MF Global Inc. is over, litigation

involving holding company parent MF Global Holdings is pending.

Claims in litigation seeking to hold accountable Mr. Corz ine,

the former New Jersey governor and onetime Goldman Sachs Group Inc.

chairman, and other former officers, directors and employees of MF

Global for the brokerage's 2011 collapse were transferred to the MF

Global Holdings parent company, allowing the brokerage's

liquidation to conclude. Parties in that case are near reaching a

conclusion in that case as well.

A lawyer for Mr. Corzine, who has denied wrongdoing with respect

to MF Global's demise, wasn't immediately available for

comment.

Write to Stephanie Gleason at stephanie.gleason@wsj.com

(END) Dow Jones Newswires

February 09, 2016 16:05 ET (21:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

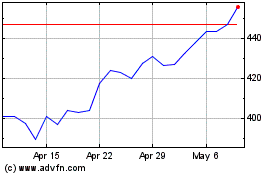

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Mar 2024 to Apr 2024

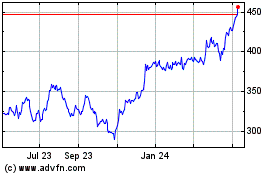

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Apr 2023 to Apr 2024