Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-198735

The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer

to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated August 31, 2015.

|

|

|

|

|

|

|

|

The Goldman Sachs Group, Inc.

Fixed Rate Notes

$ |

|

|

We will pay you interest on each tranche of notes on a monthly basis on the 15th of each month. The first such payment will be made

on October 15, 2015. The interest rate per annum and stated maturity date are set forth in the table below.

If requested, we will redeem the notes

prior to their stated maturity date upon the death of a beneficial owner who has owned the notes for at least six months. In any calendar year, this “survivor’s option” is subject to (1) a limit of $250,000 on the permitted

aggregate principal amount exercisable by the estate of the deceased beneficial owner and (2) a limit of two percent of the aggregate principal amount of all notes of The Goldman Sachs Group, Inc. outstanding as of the end of the prior calendar

year that (a) contain a survivor’s option and (b) were registered under the Securities Act of 1933 (as of December 31, 2014, two percent of the aggregate principal amount of such notes outstanding was approximately $110,000,000).

A valid redemption request requires the representative of the deceased beneficial owner to provide information to the Trustee, together with a properly

completed redemption request form. See “Additional Information About the Notes – Survivor’s Option to Request Repayment” and Appendix A.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Initial Price to Public |

|

Underwriting Discount |

|

Proceeds, before

expenses, to Issuer |

| Title of Note: |

|

Per Note |

|

Total |

|

Per Note |

|

Total |

|

Per Note |

|

Total |

| 3.25% Notes due 2024 |

|

% |

|

$ |

|

% |

|

$ |

|

% |

|

$ |

| 4.25% Notes due 2045 |

|

% |

|

$ |

|

% |

|

$ |

|

% |

|

$ |

The initial price to public set forth above does not include accrued interest, if any. Interest on the notes will accrue from the

Original Issue Date and must be paid by the purchaser if the notes are delivered after the Original Issue Date.

In addition to offers and sales at the

initial price to public, the notes may be offered and sold from time to time by the underwriters in one or more transactions at market prices prevailing at the time of sale, at prices related to market prices or at negotiated prices.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or

adequacy of this prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or

guaranteed by, a bank.

Goldman Sachs may use this prospectus in the initial sale of the notes. In addition, Goldman, Sachs & Co. or any

other affiliate of Goldman Sachs may use this prospectus in a market-making transaction in the notes after their initial sale. Unless Goldman Sachs or its agent informs the purchaser otherwise in the confirmation of sale, this prospectus is

being used in a market-making transaction.

|

|

|

| Goldman, Sachs & Co. |

|

Incapital LLC |

Pricing Supplement Nos. 4058 and 4059 dated September , 2015.

|

| About Your Prospectus The notes are part of the Medium-Term Notes, Series D program of The Goldman Sachs Group, Inc. This prospectus includes this pricing supplement and the accompanying documents listed below. This pricing supplement

constitutes a supplement to the documents listed below and should be read in conjunction with such documents:

•

Prospectus supplement dated September 15, 2014

•

Prospectus dated September 15, 2014

The information in this pricing supplement supersedes any conflicting information in the documents listed above. In addition, some of the terms

or features described in the listed documents may not apply to your notes. |

SPECIFIC TERMS OF THE NOTES

Please note that in this section entitled “Specific Terms of the Notes”, references to “The

Goldman Sachs Group, Inc.”, “we”, “our” and “us” mean only The Goldman Sachs Group, Inc. and do not include its consolidated subsidiaries. Also, in this section, references to “holders” mean The

Depository Trust Company (DTC) or its nominee and not indirect owners who own beneficial interests in notes through participants in DTC. Please review the special considerations that apply to indirect owners in the accompanying prospectus, under

“Legal Ownership and Book-Entry Issuance”.

This pricing supplement nos. 4058 and 4059 dated September ,

2015 (pricing supplement) and the accompanying prospectus dated September 15, 2014 (accompanying prospectus), relating to the notes, should be read together. Because the notes are part of a series of our debt securities called Medium-Term

Notes, Series D, this pricing supplement and the accompanying prospectus should also be read with the accompanying prospectus supplement dated September 15, 2014 (accompanying prospectus supplement). Terms used but not defined in this pricing

supplement have the meanings given them in the accompanying prospectus or accompanying prospectus supplement, unless the context requires otherwise.

Each tranche of notes is a separate tranche of our debt securities under our Medium-Term Notes, Series D program governed by our Senior Debt Indenture, dated as of

July 16, 2008 (2008 Indenture), between us and The Bank of New York Mellon, as trustee (Trustee). This pricing supplement summarizes specific terms that will apply to your notes. The terms of the notes described here supplement those described

in the accompanying prospectus supplement and accompanying prospectus and, if the terms described here are inconsistent with those described there, the terms described here are controlling.

Terms of the Fixed Rate Notes

Issuer: The Goldman Sachs Group, Inc.

Specified

currency: U.S. dollars (“$”)

Type of Notes: Fixed rate notes (notes)

Interest Rate: As set forth in the table below

Maturity Date: As set forth in the table below

|

|

|

|

|

|

|

|

|

|

|

| Title of Note: |

|

Interest Rate |

|

Maturity Date |

|

Principal Amount |

|

MTND Number |

|

CUSIP |

| 3.25% Notes due 2024 |

|

3.25% |

|

September 15, 2024 |

|

$ |

|

4058 |

|

38143C4X6 |

| 4.25% Notes due 2045 |

|

4.25% |

|

September 15, 2045 |

|

$ |

|

4059 |

|

38143C4Y4 |

Denominations: $1,000 and integral multiples of $1,000

Trade date:

Original issue date: expected to be the third scheduled business day following the trade

date in respect of all notes

Original issue discount (OID): not applicable

Interest payment dates: the 15th of each month, commencing on October 15, 2015 subject to adjustment under the applicable business day convention

specified below

Regular record dates: for interest due on an interest payment date, the day immediately prior to the day on which

payment is to be made (as such payment day may be adjusted under the applicable business day convention specified below)

Day count

convention: 30/360

Business day: New York

Business day convention: following unadjusted

Redemption at option of issuer before stated

maturity: not applicable

PS-2

Survivor’s option to request repayment: the notes are subject to repayment prior to the stated maturity

upon the death of a beneficial owner who owned the notes for at least six months, if requested, at a price equal to 100% of the principal amount of the note, plus any unpaid interest accrued to (but excluding) the date of repayment, subject to

limitations described under “Additional Information About the Notes – Survivor’s Option to Request Repayment”

Listing: None

ERISA: as described under

“Employee Retirement Income Security Act” on page 118 of the accompanying prospectus

Form of notes: Your notes will be issued

in book-entry form and represented by a master global note.

You should read the section “Legal Ownership and Book-Entry Issuance” in

the accompanying prospectus for more information about notes issued in book-entry form

Defeasance applies as follows:

| • |

|

full defeasance — i.e., our right to be relieved of all our obligations on the note by placing funds in trust for the holder: yes

|

| • |

|

covenant defeasance — i.e., our right to be relieved of specified provisions of the note by placing funds in trust for the holder: yes

|

FDIC: The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other

governmental agency, nor are they obligations of, or guaranteed by, a bank.

Foreign Account Tax Compliance Act (FATCA) Withholding:

Pursuant to Treasury regulations, Foreign Account Tax Compliance Act (FATCA) withholding (as described in “United States Taxation—Taxation of Debt Securities—Foreign Account Tax Compliance Act (FATCA) Withholding” in the

accompanying prospectus) will generally apply to obligations that are issued on or after July 1, 2014; therefore, the notes will generally be subject to FATCA withholding. However, according to final Treasury regulations, the withholding tax

described above will not apply to payments of gross proceeds from the sale, exchange, redemption or other disposition of the notes made before January 1, 2017.

PS-3

ADDITIONAL INFORMATION ABOUT THE NOTES

Book-Entry System

We will issue each tranche of

notes as a master global note registered in the name of DTC, or its nominee. The sale of the notes will settle in immediately available funds through DTC. You will not be permitted to withdraw the notes from DTC except in the limited situations

described in the accompanying prospectus under “Legal Ownership and Book-Entry Issuance — What Is a Global Security? — Holder’s Option to Obtain a Non-Global Security; Special Situations When a Global Security Will Be

Terminated”. Investors may hold interests in a master global note through organizations that participate, directly or indirectly, in the DTC system.

In addition to this pricing supplement, the following provisions are hereby incorporated into the global master note: the description of the 30/360 day count

convention appearing under “Description of Debt Securities We May Offer – Calculations of Interest on Debt Securities – Interest Rates and Interest” in the accompanying prospectus, the description of New York business day

appearing under “Description of Debt Securities We May Offer – Calculations of Interest on Debt Securities – Business Days” in the accompanying prospectus, the description of the following unadjusted business day convention

appearing under “Description of Debt Securities We May Offer – Calculations of Interest on Debt Securities – Business Day Conventions” in the accompanying prospectus and the section “Description of Debt Securities We May

Offer – Defeasance and Covenant Defeasance” in the accompanying prospectus.

Survivor’s Option to Request Repayment

Following the death of the beneficial owner of a note, so long as that note was owned by that beneficial owner or the estate of that beneficial

owner for at least six months prior to the request, if requested by the authorized representative of the beneficial owner of that note (subject to the limitations described below), we agree to redeem any notes prior to the stated maturity unless the

notes:

| • |

|

have been previously redeemed or otherwise repaid, or |

| • |

|

have been declared due and payable before their stated maturity by reason of an event of default under the 2008 Indenture, as more fully described in the

accompanying prospectus under “Description of Debt Securities We May Offer — Default, Remedies and Waiver of Default”. |

Upon the valid exercise of the option to request repayment described in the preceding paragraph (Survivor’s Option) and the proper tender of that note for

repayment (subject to the limitations described below), we will redeem that note, in whole or in part (but in amounts of not less than $1,000), at a price equal to 100% of the principal amount of the note plus any unpaid interest accrued to (but

excluding) the date of repayment.

Incapital LLC has advised that it intends to make a market in the notes. Depending on market conditions,

including changes in interest rates, and our creditworthiness, the value of the notes may be greater than the redemption price. Accordingly, the authorized representative should contact Incapital LLC to determine the market price of the notes and

should otherwise carefully consider whether to sell the notes to Incapital LLC or another market participant rather than redeeming the notes at the redemption price pursuant to a request for redemption.

To be valid, the Survivor’s Option must be exercised by or on behalf of the person who has:

| • |

|

authority to act on behalf of the deceased beneficial owner of the note, including, without limitation, the personal representative or executor of the deceased

beneficial owner or the surviving joint owner with the deceased beneficial owner, under the laws of the applicable jurisdiction, and |

| • |

|

the right to sell, transfer or otherwise dispose of an interest in a note and the right to receive the proceeds from the note, as well as the principal and

interest payable to the holder of the note. |

The following will be deemed the death of a beneficial owner of a note, and the entire

principal amount of the note so held will be subject to redemption by us upon request (with the limitations described below):

| • |

|

death of a person holding a beneficial ownership interest in a note as a joint tenant or tenant by the entirety with another person, a tenant in common with the

deceased holder’s spouse or a tenant in common with a person other than such deceased person’s spouse; |

PS-4

| • |

|

death of a person who at the time of his or her death was a beneficiary of a revocable or irrevocable trust that holds a beneficial ownership interest in a note

may, in the discretion of the Trustee, be deemed the death of a beneficial owner of that note, if such beneficial trust interest can be established to the satisfaction of us and the Trustee; and |

| • |

|

death of a person who, at the time of his or her death, was entitled to substantially all of the beneficial ownership interests in a note regardless of whether

that beneficial owner was the registered holder of that note, if entitlement to those interests can be established to the satisfaction of us and the Trustee. |

In addition, a beneficial ownership interest will be deemed to exist:

| • |

|

in typical cases of nominee ownership, ownership under the Uniform Transfers to Minors Act or Uniform Gifts to Minors Act, community property or other joint

ownership arrangements between a husband and wife; and |

| • |

|

in custodial and trust arrangements where one person has all of the beneficial ownership interests in the applicable note at the time of his or her death.

|

We have the discretionary right to limit the aggregate principal amount of notes as to which exercises of the Survivor’s Option

shall be accepted by us from authorized representatives:

| • |

|

of all deceased beneficial owners in any calendar year to an amount equal to 2% of the aggregate principal amount of all notes of The Goldman Sachs Group,

Inc. outstanding as of the end of the prior calendar year that (a) contain a survivor’s option and (b) were registered under the Securities Act of 1933 (two percent aggregate limitation); and |

| • |

|

of any individual deceased beneficial owner of notes to $250,000 in any calendar year ($250,000 limitation). |

In addition, we will not permit the exercise of the Survivor’s Option except in principal amounts of $1,000 and integral multiples of $1,000 in excess

thereof.

We may, at our option and pursuant to the exercise of the Survivor’s Option, redeem interests of any deceased beneficial owner in the

notes in any calendar year in excess of the $250,000 limitation. Any optional redemption by us of this kind, to the extent it exceeds the $250,000 limitation for any deceased beneficial owner, will not be included in the computation of the two

percent aggregate limitation for redemption of the notes for that or any other calendar year.

We may also, at our option and pursuant to the exercise

of the Survivor’s Option, redeem interests of deceased beneficial owners in the notes in any calendar year in an aggregate principal amount exceeding the two percent aggregate limitation. Any optional redemption by us of this kind, to the

extent it exceeds the two percent aggregate limitation, will not be considered in calculating the two percent aggregate limitation for any other calendar year.

Furthermore, any optional redemption with respect to a deceased beneficial owner’s interest in the notes is inapplicable with respect to any other deceased beneficial owner’s interest in the notes. In

other words, we may waive any applicable limitations with respect to a deceased beneficial owner but not make the same or similar waivers with respect to other deceased beneficial owners.

Each election to exercise the Survivor’s Option will be accepted in the order that elections are received by the Trustee, except for any note the acceptance of which would contravene either the two percent

aggregate limitation or the $250,000 limitation. Upon any determination by us to redeem notes in excess of the $250,000 limitation or the two percent aggregate limitation, notes will be redeemed in the order of receipt of redemption requests by the

Trustee. Each tendered note that is not accepted in any calendar year due to the application of either the two percent aggregate limitation or the $250,000 limitation will be deemed to be tendered in the following calendar year in the order in which

all such notes were originally tendered.

Notes accepted for repayment through the exercise of the Survivor’s Option will be redeemed on the

earlier of the June 15th or December 15th interest payment date that occurs 60 or more calendar days after the date of the acceptance. For example, if the acceptance date of a note tendered through a valid exercise of the Survivor’s

Option is December 1, 2016, and interest on that note is paid monthly on the 15th of every month, we would normally, at our option, repay that note on the interest payment date occurring on June 15, 2017, because the December 15, 2016

interest payment date would occur less

PS-5

than 60 days from the date of acceptance. Any redemption request may be withdrawn by the person(s) presenting the request upon delivery of a written request for withdrawal given by the

participant on behalf of the person(s) to the Trustee not less than 30 days before the redemption date. If a note tendered through a valid exercise of the Survivor’s Option is not accepted, the Trustee will deliver a notice by first-class mail

to the participant through whom the note was tendered that states the reason that note has not been accepted for redemption.

With respect to notes

represented by a master global note (such as these notes), DTC or its nominee is the depositary and is treated as the holder of the notes and the institution that has an account with the depositary of the notes is referred to as the

“participant”.

To obtain redemption pursuant to exercise of the Survivor’s Option for a note, the deceased beneficial owner’s

authorized representative must provide the following items to the participant in DTC through which the beneficial interest in the note is held by the deceased beneficial owner:

| • |

|

a written request for redemption signed by the authorized representative of the deceased beneficial owner with the signature guaranteed by a member firm of a

registered national securities exchange or of the Financial Institution Regulatory Authority, Inc. (FINRA) or a commercial bank or trust company having an office or correspondent in the United States and a written instruction to notify the Trustee

of the authorized representative’s desire to obtain redemption pursuant to exercise of the Survivor’s Option; |

| • |

|

appropriate evidence satisfactory to us and the Trustee: |

| |

(a) |

that the deceased was the beneficial owner of the note at the time of death and his or her interest in the note was owned by the deceased beneficial owner or his or her estate

for at least six months prior to the request for redemption, |

| |

(b) |

of the price paid by the beneficial owner for the note, |

| |

(c) |

that the death of the beneficial owner has occurred, |

| |

(d) |

of the date of death of the beneficial owner, and |

| |

(e) |

that the representative has authority to act on behalf of the beneficial owner; |

| • |

|

if applicable, a properly executed assignment or endorsement; |

| • |

|

tax waivers and any other instruments or documents that we or the Trustee reasonably require in order to establish the validity of the beneficial ownership of

the note and the claimant’s entitlement to payment; |

| • |

|

any additional information we or the Trustee reasonably require to evidence satisfaction of any conditions to the exercise of the Survivor’s Option or to

document beneficial ownership or authority to make the election and to cause the redemption of the note; and |

| • |

|

if the interest in the note is held by a nominee of the deceased beneficial owner, a certificate satisfactory to us and the Trustee from the nominee attesting to

the deceased’s beneficial ownership of such note. |

After the representative provides the information to the participant, the

participant will then deliver each of these items to the Trustee, and to Goldman, Sachs & Co. in its capacity as administrator of the Survivor’s Option on our behalf, together with evidence satisfactory to us and the Trustee from the

participant stating that it represents the deceased beneficial owner. The participant will then need to deliver to the Trustee a request for redemption substantially in the form attached as Appendix A to this pricing supplement.

All questions regarding the eligibility or validity of any exercise of the Survivor’s Option will be determined by us, in our sole discretion, which

determination will be final and binding on all parties.

Subject to arrangements with the depositary, payment for interests in the notes to be redeemed

will be made to the depositary in the aggregate principal amount specified in the redemption requests submitted to the Trustee by the depositary that are to be fulfilled in connection with the payment upon presentation of the notes to the Trustee

for redemption.

Additional redemption request forms for the exercise of the Survivor’s Option may be obtained from the Trustee at The Bank of New

York Mellon at 2001 Bryan Street, 9th Floor, Dallas, TX 75201, Attention: Survivor Options Processing, telephone: (800) 254-2826, fax: (241) 468-6405.

During any time in which the notes are not represented by a master global note and are issued in definitive form:

PS-6

| • |

|

all references in this section of the pricing supplement to participants and the depositary, including the depositary’s governing rules, regulations and

procedures, will be deemed inapplicable; |

| • |

|

all determinations that the participants are required to make as described in this section will be made by us, including, without limitation, determining whether

the applicable decedent is in fact the beneficial owner of the interest in the notes to be redeemed or is in fact deceased and whether the representative is duly authorized to request redemption on behalf of the applicable beneficial owner; and

|

| • |

|

all redemption requests, to be effective, must: |

| |

• |

|

be delivered by the representative to the Trustee, with a copy to us; |

| |

• |

|

if required by the Trustee and us, be in the form of the attached redemption request with appropriate changes mutually agreed to by the Trustee and us to reflect

the fact that the redemption request is being executed by a representative, including provision for signature guarantees; and |

| |

• |

|

be accompanied by the note that is the subject of the redemption request or, if applicable, a properly executed assignment or endorsement, in addition to all

documents that are otherwise required to accompany a redemption request. If the record holder of the note is a nominee of the deceased beneficial owner, a certificate or letter from the nominee attesting to the deceased’s ownership of a

beneficial interest in the note must also be delivered. |

Foreign Account Tax Compliance Act (FATCA) Withholding May Apply to

Payments on Your Notes, Including as a Result of the Failure of the Bank or Broker Through Which You Hold the Notes to Provide Information to Tax Authorities

Please see the discussion under “United States Taxation — Taxation of Debt Securities — Foreign Account Tax Compliance Act (FATCA) Withholding” in the accompanying prospectus for a description

of the applicability of FATCA to payments made on your notes.

PS-7

SUPPLEMENTAL PLAN OF DISTRIBUTION

The Goldman Sachs Group, Inc. and the underwriters for this offering named below have entered into a terms agreement and a distribution agreement with respect to

the notes. Subject to certain conditions, each underwriter named below has severally agreed to purchase the principal amount of notes indicated in the following table.

|

|

|

|

|

|

|

| Title of Note |

|

Goldman, Sachs & Co. |

|

Incapital LLC |

|

Total |

| 3.25% Notes due 2024 |

|

$ |

|

$ |

|

$ |

| 4.25% Notes due 2045 |

|

$ |

|

$ |

|

$ |

Notes sold by the underwriters to the public will initially be offered at the initial price to public set forth on the cover of

this pricing supplement. The underwriters intend to purchase the notes from The Goldman Sachs Group, Inc. at a purchase price equal to the initial price to public less a discount of the percentage of the principal amount of the notes as indicated

below. Any notes sold by the underwriters to securities dealers may be sold at a discount from the initial price to public of up to the percentage of the principal amount of the notes as indicated below. Any such securities dealers may resell any

notes purchased from the underwriters to certain other brokers or dealers at a discount from the initial price to public of up to the percentage of the principal amount of the notes as indicated below. If all of the offered notes are not sold at the

initial price to public, the underwriters may change the offering price and the other selling terms.

|

|

|

|

|

|

|

| Title of Note |

|

Underwriting Discount |

|

Selling Concession |

|

Reallowance |

| 3.25% Notes due 2024 |

|

% |

|

% |

|

% |

| 4.25% Notes due 2045 |

|

% |

|

% |

|

% |

We have agreed to sell to the underwriters, and the underwriters have agreed to purchase from us, the aggregate face amount of

notes specified on the front cover of this pricing supplement. In addition to offers and sales at the initial price to public, the underwriters may offer the notes from time to time for sale in one or more transactions at market prices prevailing at

the time of sale, at prices related to market prices or at negotiated prices.

Please note that the information about the initial price to public and

net proceeds to The Goldman Sachs Group, Inc. on the front cover page relates only to the initial sale of the notes. If you have purchased a note in a market-making transaction by Goldman, Sachs & Co. or any other affiliate of The Goldman

Sachs Group, Inc. after the initial sale, information about the price and date of sale to you will be provided in a separate confirmation of sale.

Each

underwriter has represented and agreed that it will not offer or sell the notes in the United States or to United States persons except if such offers or sales are made by or through FINRA member broker-dealers registered with the U.S. Securities

and Exchange Commission.

The Goldman Sachs Group, Inc. estimates that its share of the total offering expenses, excluding underwriting discounts and

commissions, whether paid to Goldman, Sachs & Co. or any other underwriter, will be approximately $ .

The provision regarding the market-making activities of Goldman, Sachs & Co. described under “Plan of Distribution— Market-Making Resales by Affiliates” on page 116 of the

accompanying prospectus does not apply to the notes. Goldman, Sachs & Co. does not intend to make a market in these notes. However, in the future, Goldman, Sachs & Co. or other affiliates of The Goldman Sachs Group, Inc. may

decide to repurchase and resell the notes in market-making transactions, with resales being made at prices related to prevailing market prices at the time of resale or at negotiated prices. For more information about the plan of distribution and

possible market-making activities, see “Plan of Distribution” in the accompanying prospectus and “Supplemental Plan of Distribution” in the accompanying prospectus supplement.

The notes are a new issue of securities with no established trading market. The Goldman Sachs Group, Inc. has been advised by Incapital LLC that they intend to

make a market in the notes. Incapital LLC is

PS-8

not obligated to do so and may discontinue market-making at any time without notice. No assurance can be given as to the liquidity of the trading market for the notes.

The Goldman Sachs Group, Inc. has agreed to indemnify the several underwriters against certain liabilities, including liabilities under the Securities Act of 1933.

Certain of the underwriters and their affiliates have in the past provided, and may in the future from time to time provide, investment banking and

general financing and banking services to The Goldman Sachs Group, Inc. and its affiliates, for which they have in the past received, and may in the future receive, customary fees. The Goldman Sachs Group, Inc. and its affiliates have in the past

provided, and may in the future from time to time provide, similar services to the underwriters and their affiliates on customary terms and for customary fees. Goldman, Sachs & Co., one of the underwriters, is an affiliate of The Goldman

Sachs Group, Inc. Please see “Plan of Distribution— Conflicts of Interest” on page 117 of the accompanying prospectus.

Conflicts of Interest

GS&Co. is an affiliate of The Goldman Sachs Group, Inc. and, as such, will have a “conflict of interest” in this offering of notes within the meaning of Financial Industry Regulatory Authority, Inc.

(FINRA) Rule 5121. Consequently, this offering of notes will be conducted in compliance with the provisions of FINRA Rule 5121. GS&Co. will not be permitted to sell notes in this offering to an account over which it exercises discretionary

authority without the prior specific written approval of the account holder.

PS-9

APPENDIX A – FORM OF REDEMPTION REQUEST

The Bank of New York Mellon,

Attention: Survivor Options

Processing,

2001 Bryan Street, 9th Floor,

Dallas, TX

75201

Telephone: (800) 254-2826

Fax:

(241) 468-6405

with a copy to:

Goldman,

Sachs & Co.,

PIPG – Americas,

200 West

Street, 4th Floor,

New York, NY 10282-2198

Telephone:

(212) 357-4612

Fax: (212) 428-1577

THE GOLDMAN SACHS GROUP, INC.

MEDIUM-TERM NOTES, SERIES D

Principal Amount to be Redeemed (must be a minimum of $1,000 or integral multiples thereof):

|

|

|

|

|

| Title: |

|

Cusip: |

|

|

| 3.25% Notes due 2024 |

|

38143C4X6 |

|

¨ |

|

|

|

| 4.25% Notes due 2045 |

|

38143C4Y4 |

|

¨ |

The undersigned (the “Participant”) is, or is acting on behalf of, the beneficial owner of a portion of the notes

specified above, which portion has an outstanding face amount equal to the amount set forth at the top of this redemption request notice under “Principal Amount to be Redeemed.” The undersigned hereby elects to exercise the Survivor’s

Option as described under “Additional Information About the Notes – Survivor’s Option to Request Repayment” in the applicable Pricing Supplement dated August , 2015 (the “Pricing Supplement”) to

the accompanying prospectus dated September 15, 2014 and the accompanying prospectus supplement dated September 15, 2014.

The undersigned,

, does hereby certify, pursuant to the provisions set forth in the Pricing Supplement and the Senior Debt Indenture dated as of

July 16, 2008, as amended, modified or supplemented from time to time (the “2008 Indenture”), between The Goldman Sachs Group, Inc. (the “Issuer”) and The Bank of New York Mellon, as trustee (the “Trustee”), to The

Depository Trust Company (the “Depositary”), to the Issuer and to the Trustee that:

| 1. |

[Name of deceased Beneficial Owner] is deceased. |

| 2. |

[Name of deceased Beneficial Owner] had a $ beneficial interest in the above-referenced notes.

|

| 3. |

The beneficial interest of [Name of deceased Beneficial Owner] in the above-referenced notes to be redeemed were acquired at the following price:

$ per $1,000 principal amount. If such notes to be redeemed were acquired at different prices, specify such prices and the principal amount(s) of notes to which such prices are

applicable. |

| 4. |

[Name of Representative] is [Beneficial Owner’s personal representative/other person authorized to represent the estate of the Beneficial Owner/surviving

joint tenant/surviving tenant by the entirety/trustee of a trust] of [Name of deceased Beneficial Owner] and has delivered to the |

PS-10

| |

undersigned a request for redemption in form satisfactory to the undersigned, requesting that $ principal amount of such

notes be redeemed in accordance with the Pricing Supplement and the 2008 Indenture. The documents accompanying such request, all of which are in proper form, are in all respects satisfactory to the undersigned and [Name of Representative] is

entitled to have the notes to which this redemption request notice relates redeemed. |

| 5. |

The Participant holds the beneficial interest in the outstanding face amount of the notes indicated at the top of this redemption request notice with respect to which this

redemption request is being made on behalf of [Name of deceased Beneficial Owner]. |

| 6. |

The Participant hereby certifies that it will indemnify and hold harmless the Depositary, the Trustee and the Issuer (including their respective officers, directors, agents,

attorneys and employees), against all damages, loss, cost, expense (including reasonable attorneys’ and accountants’ fees), obligations, claims or liability incurred by the indemnified party or parties as a result of or in connection with

the redemption of notes to which this redemption request notice relates. The Participant will, at the request of the Issuer, forward to the Issuer a copy of the documents submitted by [Name of Representative] in support of the request for

redemption. |

| 7. |

On the redemption date for the notes to which this redemption request notice relates, the Participant will book a delivery vs. payment trade at a price equal to the applicable

redemption value, facing The Bank of New York Mellon DTC participant code 1541. |

| 8. |

The Participant acknowledges and understands that Incapital LLC has advised that it intends to make a market in the notes and that the value of the notes may be greater than the

redemption price for the notes (with respect to any note, 100% of the principal amount of the note plus any unpaid interest accrued). The Participant has carefully considered and consulted with [name of Representative] as to whether a better

price may be obtained by selling the notes to Incapital LLC or another market participant rather than redeeming the notes at the redemption price. |

The undersigned hereby represents that it has been duly authorized by the Representative to act on behalf of the deceased Beneficial Owner.

Terms used and not defined in this redemption request notice have the meanings given to them in the Pricing Supplement. The redemption of the notes will be governed by the terms of the notes.

IN WITNESS WHEREOF, the undersigned has executed this redemption request as of ,

20 .

|

| [PARTICIPANT NAME]

By: |

| Name: |

|

|

(Title) |

|

|

(Telephone No.) |

|

|

(Fax No.) |

|

|

(DTC participant account number, if any) |

PS-11

We have not authorized anyone to provide any information or to make any representations other than those contained or

incorporated by reference in this pricing supplement, the accompanying prospectus supplement or the accompanying prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may

give you. This pricing supplement, the accompanying prospectus supplement and the accompanying prospectus is an offer to sell only the notes offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The

information contained in this pricing supplement, the accompanying prospectus supplement and the accompanying prospectus is current only as of the respective dates of such documents.

TABLE OF CONTENTS

Pricing Supplement

|

|

|

|

|

| |

|

Page |

|

| Specific Terms of the Notes |

|

|

PS-2 |

|

| Additional Information About the Notes |

|

|

PS-4 |

|

| Supplemental Plan of Distribution |

|

|

PS-8 |

|

| Conflicts of Interest |

|

|

PS-9 |

|

| Appendix A – Form of Redemption Request |

|

|

PS-10 |

|

|

| Prospectus Supplement dated September 15, 2014 |

|

| Use of Proceeds |

|

|

S-2 |

|

| Description of Notes We May Offer |

|

|

S-3 |

|

| Considerations Relating to Indexed Notes |

|

|

S-19 |

|

| United States Taxation |

|

|

S-22 |

|

| Employee Retirement Income Security Act |

|

|

S-23 |

|

| Supplemental Plan of Distribution |

|

|

S-24 |

|

| Validity of the Notes |

|

|

S-26 |

|

|

| Prospectus dated September 15, 2014 |

|

| Available Information |

|

|

2 |

|

| Prospectus Summary |

|

|

4 |

|

| Use of Proceeds |

|

|

8 |

|

| Description of Debt Securities We May Offer |

|

|

9 |

|

| Description of Warrants We May Offer |

|

|

39 |

|

| Description of Purchase Contracts We May Offer |

|

|

56 |

|

| Description of Units We May Offer |

|

|

61 |

|

| Description of Preferred Stock We May Offer |

|

|

67 |

|

| Description of Capital Stock of The Goldman Sachs Group, Inc. |

|

|

75 |

|

| Legal Ownership and Book-Entry Issuance |

|

|

80 |

|

| Considerations Relating to Floating Rate Securities |

|

|

85 |

|

| Considerations Relating to Indexed Securities |

|

|

87 |

|

| Considerations Relating to Securities Denominated or Payable in or Linked to a Non-U.S. Dollar Currency |

|

|

88 |

|

| United States Taxation |

|

|

91 |

|

| Plan of Distribution |

|

|

114 |

|

| Conflicts of Interest |

|

|

117 |

|

| Employee Retirement Income Security Act |

|

|

118 |

|

| Validity of the Securities |

|

|

119 |

|

| Experts |

|

|

119 |

|

| Review of Unaudited Condensed Consolidated Financial Statements by Independent Registered Public Accounting Firm |

|

|

120 |

|

| Cautionary Statement Pursuant to the Private Securities Litigation Reform Act of 1995 |

|

|

120 |

|

$

The Goldman Sachs Group, Inc.

Fixed Rate Notes

Goldman, Sachs & Co.

Incapital LLC

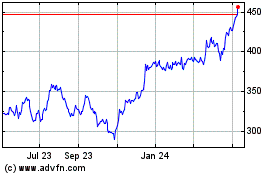

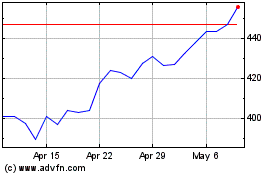

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Apr 2023 to Apr 2024